Cheap Online Auto Insurance

Finding affordable and reliable auto insurance is a top priority for many vehicle owners. With the rise of digital technologies, obtaining cheap online auto insurance has become more accessible and convenient than ever before. This article delves into the world of online auto insurance, exploring the factors that influence pricing, the benefits of online platforms, and strategies to secure the best deals. We'll uncover the secrets to navigating the online insurance market, ensuring you get the coverage you need without breaking the bank.

Understanding the Factors Behind Affordable Online Auto Insurance

The landscape of auto insurance is diverse, with numerous factors influencing the cost of coverage. Understanding these elements is crucial for anyone seeking cheap online auto insurance. Online insurance providers utilize sophisticated algorithms to assess risk and determine premiums. Here’s an in-depth look at the key factors that impact pricing:

Demographics and Location

Your age, gender, and residence play a significant role in insurance pricing. For instance, younger drivers often face higher premiums due to their perceived higher risk. Similarly, urban areas with higher accident rates may result in pricier insurance. It’s essential to consider these factors when seeking affordable coverage.

Driving Record and History

A clean driving record is a major advantage when it comes to insurance. Online providers thoroughly examine your history, including any accidents or traffic violations. Maintaining a safe driving record can lead to substantial savings on your insurance premiums.

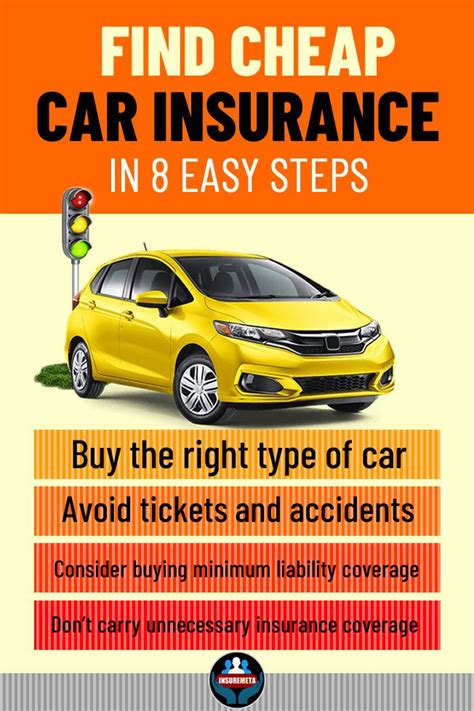

Vehicle Type and Usage

The make and model of your vehicle, as well as its primary purpose, influence insurance costs. Sports cars and luxury vehicles typically require higher coverage, while more economical cars may result in lower premiums. Additionally, frequent long-distance travel may impact your insurance rates.

Coverage and Deductibles

The level of coverage you choose directly affects your insurance costs. Comprehensive coverage plans offer more protection but come with higher premiums. Adjusting your deductibles can also impact pricing; higher deductibles often result in lower premiums.

Discounts and Promotions

Online insurance providers frequently offer discounts and promotions to attract customers. These can include discounts for safe driving, bundling multiple policies, or even paying annually instead of monthly. Being aware of these opportunities can significantly reduce your insurance costs.

| Factor | Impact on Pricing |

|---|---|

| Demographics and Location | Higher premiums for younger drivers and urban areas. |

| Driving Record | Clean records lead to substantial savings. |

| Vehicle Type and Usage | Sports cars and frequent long-distance travel may increase costs. |

| Coverage and Deductibles | Comprehensive coverage and lower deductibles result in higher premiums. |

| Discounts and Promotions | Safe driving, bundling, and annual payments can lead to discounts. |

The Advantages of Online Auto Insurance Platforms

Online auto insurance platforms have revolutionized the way people purchase coverage. These digital platforms offer a range of benefits that make them an attractive option for vehicle owners seeking cheap online auto insurance. Here’s a closer look at the advantages they provide:

Convenience and Accessibility

One of the most significant advantages of online insurance platforms is their convenience. You can easily compare policies, obtain quotes, and purchase coverage from the comfort of your home. This accessibility saves time and effort, especially when compared to traditional insurance agents.

Transparency and Customization

Online platforms provide transparent pricing and coverage options. You can clearly see the costs and benefits of each policy, allowing for informed decisions. Additionally, many platforms offer customization, enabling you to tailor your coverage to your specific needs and budget.

Competitive Pricing and Discounts

The competitive nature of the online insurance market often results in lower premiums. Providers compete for your business, driving down prices. Furthermore, online platforms frequently offer exclusive discounts and promotions that can further reduce your insurance costs.

Paperless and Efficient Processes

Online insurance platforms streamline the entire process, from quote generation to claim management. This paperless approach not only saves time but also reduces environmental impact. Efficient digital processes ensure a smoother experience, from policy purchase to renewal.

Real-Time Updates and Claims Tracking

With online insurance, you can access your policy information and make updates in real-time. This includes adding or removing vehicles, updating personal details, and tracking the progress of claims. The ability to manage your insurance digitally provides convenience and peace of mind.

Strategies for Securing the Best Deals on Cheap Online Auto Insurance

Navigating the online auto insurance market can be daunting, but with the right strategies, you can secure the best deals and cheap online auto insurance. Here are some expert tips to help you find the most affordable coverage:

Compare Multiple Providers

The key to finding the cheapest insurance lies in comparing multiple providers. Online platforms make this process easy, allowing you to quickly obtain quotes from various insurers. By comparing policies, you can identify the most competitive rates and choose the coverage that best fits your needs.

Utilize Comparison Websites

Comparison websites aggregate insurance quotes from various providers, making it even easier to find the best deals. These sites provide a comprehensive overview of the market, allowing you to make informed decisions. By using comparison websites, you can save time and effort while ensuring you get the most value for your money.

Take Advantage of Discounts

Online insurance providers offer a range of discounts to attract customers. These can include safe driving discounts, multi-policy discounts, and loyalty rewards. By understanding the available discounts and meeting the eligibility criteria, you can significantly reduce your insurance costs.

Consider Bundling Policies

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings. Many providers offer discounts when you bundle multiple policies, making it an attractive option for those seeking cheap online auto insurance. It’s a simple way to reduce your overall insurance expenses.

Adjust Your Coverage and Deductibles

The level of coverage you choose directly impacts your insurance costs. If you’re looking for the cheapest option, consider reducing your coverage to the minimum required by your state. Additionally, increasing your deductibles can also result in lower premiums. However, it’s essential to strike a balance between affordability and adequate coverage.

Maintain a Good Driving Record

A clean driving record is a significant factor in determining your insurance premiums. Online providers closely examine your history, so maintaining a safe driving record can lead to substantial savings. Avoid traffic violations and accidents to keep your insurance costs as low as possible.

Shop Around Regularly

Insurance rates can fluctuate over time, so it’s crucial to shop around regularly. Even if you’ve found a great deal initially, it’s worth revisiting the market annually to ensure you’re still getting the best value. Online insurance platforms make this process easy, allowing you to quickly compare and switch providers if necessary.

Understand Your Coverage Needs

Before purchasing insurance, it’s essential to understand your specific coverage needs. Consider your vehicle’s value, your driving habits, and any unique circumstances. This knowledge will help you make informed decisions and avoid overpaying for coverage you don’t need.

Read Reviews and Seek Recommendations

When choosing an online insurance provider, it’s beneficial to read reviews and seek recommendations from trusted sources. This can give you insights into the provider’s customer service, claim handling, and overall reliability. Positive experiences from others can provide peace of mind when selecting an insurer.

The Future of Affordable Online Auto Insurance

The world of cheap online auto insurance is constantly evolving, with new technologies and innovations shaping the industry. As we look ahead, several trends and developments are expected to impact the affordability and accessibility of online insurance:

Advancements in Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining popularity. This data-driven approach allows insurance providers to offer usage-based insurance, where premiums are determined by actual driving habits. This trend is expected to lead to more personalized and affordable insurance options, especially for safe drivers.

Increased Use of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the insurance industry. These technologies enable providers to analyze vast amounts of data, improving risk assessment and claim processing. The efficient use of AI and ML is likely to result in more accurate pricing and better customer experiences, ultimately benefiting those seeking cheap online auto insurance.

Integration of Blockchain Technology

Blockchain technology is poised to transform the insurance sector by enhancing security, transparency, and efficiency. Its implementation can lead to reduced administrative costs and faster claim settlements. The integration of blockchain has the potential to make insurance processes more streamlined and affordable, benefiting both insurers and policyholders.

Growing Focus on Customer Experience and Personalization

Insurance providers are increasingly prioritizing customer experience and personalization. This shift is driven by the understanding that a positive customer journey can lead to higher satisfaction and retention. By offering tailored policies and efficient digital services, insurers can attract and retain customers, ultimately contributing to a more competitive and affordable insurance market.

Regulatory Changes and Industry Innovations

Regulatory changes and industry innovations are expected to shape the future of cheap online auto insurance. New regulations may influence pricing structures, while technological advancements could revolutionize insurance processes. Staying informed about these developments is crucial for making informed decisions and securing the best deals.

Conclusion

Securing cheap online auto insurance is within reach for vehicle owners who understand the factors influencing pricing and leverage the advantages of online platforms. By implementing strategic approaches and staying informed about industry developments, you can navigate the online insurance market with confidence, ensuring you get the coverage you need at the best possible price. The future of affordable auto insurance is bright, and with the right tools and knowledge, you can stay ahead of the curve.

How can I find the cheapest online auto insurance?

+To find the cheapest online auto insurance, compare quotes from multiple providers using comparison websites. Take advantage of discounts, consider bundling policies, and adjust your coverage and deductibles to find the best deal.

What factors influence auto insurance premiums?

+Insurance premiums are influenced by demographics, location, driving record, vehicle type, coverage choices, and deductibles. Understanding these factors can help you make informed decisions when seeking affordable coverage.

Are there any downsides to online auto insurance platforms?

+While online platforms offer numerous advantages, some traditional insurance agents may provide personalized advice and assistance. It’s essential to find a balance between the convenience of online platforms and the expertise of agents to ensure you get the best coverage and service.

What is usage-based insurance, and how can it benefit me?

+Usage-based insurance, also known as pay-as-you-drive insurance, uses telematics technology to track your driving behavior. This data-driven approach can lead to more personalized and affordable insurance options, especially for safe drivers. It’s a promising trend in the industry.