Idaho Insurance

In the vast and diverse landscape of Idaho, insurance plays a vital role in safeguarding the well-being and financial security of its residents. From the rugged mountains to the fertile farmland, Idahoans rely on insurance policies to protect their homes, businesses, and livelihoods. In this comprehensive article, we delve into the world of Idaho insurance, exploring its unique aspects, regulations, and the impact it has on the lives of Idahoans.

The Importance of Insurance in Idaho

Idaho, known for its natural beauty and outdoor adventures, presents both opportunities and challenges for its residents. With a wide range of industries, including agriculture, tourism, and manufacturing, Idahoans face various risks that insurance helps mitigate. Whether it’s protecting homes from wildfires, safeguarding businesses from natural disasters, or ensuring the financial stability of families, insurance is an essential component of life in the Gem State.

Idaho’s Insurance Market: A Comprehensive Overview

Idaho’s insurance market is diverse and regulated to ensure the protection of consumers. The state’s Department of Insurance plays a crucial role in overseeing insurance companies, agents, and policies to maintain fair practices and consumer rights. Here’s a deeper look into the key aspects of Idaho’s insurance landscape.

Homeowners Insurance

Idaho’s unique geography and climate present specific challenges when it comes to homeowners insurance. With the potential for wildfires, severe weather, and even earthquakes, residents require comprehensive coverage. The state’s insurance providers offer a range of policies tailored to these risks, ensuring homes are protected against natural disasters.

According to a recent study by the Idaho Department of Insurance, the average cost of homeowners insurance in Idaho is $1,350 per year. However, this can vary significantly depending on the location, with areas prone to wildfires or severe storms often facing higher premiums. Despite these challenges, Idaho's insurance market provides affordable coverage options for homeowners.

| County | Average Annual Premium |

|---|---|

| Ada County | $1,500 |

| Canyon County | $1,400 |

| Bonner County | $1,800 |

Auto Insurance

Idaho’s vast network of roads and highways requires comprehensive auto insurance coverage. The state mandates that all drivers carry liability insurance to cover damages and injuries in the event of an accident. Additionally, with the increasing popularity of electric and hybrid vehicles, Idaho’s insurance market has adapted to offer specialized coverage for these eco-friendly options.

The average cost of auto insurance in Idaho is $850 per year, as reported by the National Association of Insurance Commissioners. However, this can vary based on factors such as driving history, age, and the type of vehicle. Idaho's insurance providers offer competitive rates and discounts to encourage safe driving practices.

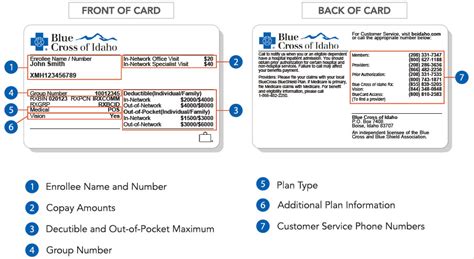

Health Insurance

Health insurance is a critical concern for Idahoans, especially with the state’s growing population and changing healthcare landscape. Idaho’s insurance market offers a variety of health plans, including individual, family, and employer-sponsored policies. The state has also implemented initiatives to increase access to affordable healthcare, such as the Idaho Health Insurance Exchange.

According to a survey by the Kaiser Family Foundation, the average monthly premium for an individual health insurance plan in Idaho is $420, while family plans average at $1,050. These costs can be reduced through subsidies and tax credits, making health insurance more accessible to Idaho residents.

Life Insurance

Life insurance is an essential component of financial planning for Idahoans. With a range of term and permanent life insurance policies available, residents can secure their families’ futures and protect their loved ones from financial burdens in the event of their passing. Idaho’s insurance market provides a variety of options to cater to different needs and budgets.

The average cost of a 20-year term life insurance policy for a healthy 30-year-old in Idaho is $180 per year, as reported by InsuranceQuotes.com. Permanent life insurance policies, such as whole life or universal life, offer more comprehensive coverage but come at a higher cost.

Business Insurance

Idaho’s thriving business community relies on insurance to protect their operations and assets. From small startups to established corporations, businesses in Idaho face unique risks, including natural disasters, cyber threats, and liability issues. The state’s insurance providers offer a wide range of commercial insurance policies to mitigate these risks and ensure business continuity.

According to a study by Insureon, the average cost of general liability insurance for small businesses in Idaho is $450 per year. This coverage protects businesses from claims related to bodily injury, property damage, and personal injury. Other essential policies for Idaho businesses include property insurance, workers' compensation, and professional liability insurance.

Regulations and Consumer Protection

Idaho’s Department of Insurance is dedicated to ensuring a fair and transparent insurance market for consumers. They enforce strict regulations and monitor insurance companies to prevent fraud and ensure policyholders receive the coverage they deserve. Here’s an overview of some of the key regulations and consumer protection measures in Idaho.

Rate Regulation

Idaho’s insurance department carefully reviews and approves insurance rates to prevent excessive premiums. This rate regulation process ensures that insurance companies provide fair and reasonable prices for their policies, protecting consumers from price gouging.

Consumer Complaints

The Department of Insurance provides a platform for consumers to file complaints against insurance companies or agents. This process allows the department to investigate and resolve issues, ensuring fair treatment and prompt action on behalf of consumers.

Agent Licensing and Education

Idaho requires insurance agents to be licensed and undergo rigorous education to ensure they provide accurate and ethical advice to consumers. This licensing process protects consumers from fraudulent or unqualified agents, promoting a professional and trustworthy insurance market.

The Future of Idaho Insurance

As Idaho continues to evolve and grow, its insurance market will adapt to meet the changing needs of its residents. With advancements in technology and an increasing focus on sustainability, Idaho’s insurance providers are likely to offer more innovative and eco-friendly policies. Additionally, with the ongoing pandemic and its impact on healthcare, Idaho’s health insurance market will play a crucial role in ensuring access to quality healthcare for all residents.

In conclusion, Idaho insurance is a vital component of the state's economy and the well-being of its residents. From protecting homes and businesses to ensuring financial security and access to healthcare, insurance plays a multifaceted role in Idaho's society. As the state's insurance market continues to adapt and grow, Idahoans can trust that their insurance policies will provide the necessary coverage and peace of mind.

What are the mandatory insurance requirements in Idaho for drivers?

+

Idaho requires all drivers to carry liability insurance with minimum coverage of 25,000 for bodily injury per person, 50,000 for bodily injury per accident, and $15,000 for property damage.

Are there any discounts available for homeowners insurance in Idaho?

+

Yes, Idaho insurance providers offer various discounts for homeowners. These can include discounts for bundling policies, having safety features in the home, and maintaining a good credit score.

How can I find affordable health insurance in Idaho?

+

Idaho residents can explore affordable health insurance options through the Idaho Health Insurance Exchange. Additionally, they can compare quotes from different providers and consider applying for subsidies or tax credits to reduce their premiums.