Cheap But Good Auto Insurance

Finding affordable and reliable auto insurance is a top priority for many vehicle owners. With the cost of car insurance often being a significant expense, it's crucial to strike a balance between affordability and adequate coverage. In this comprehensive guide, we will delve into the world of cheap but good auto insurance, exploring the factors that influence rates, the best practices for saving money, and the key considerations to ensure you get the best value for your insurance dollar.

Understanding the Factors that Impact Auto Insurance Rates

The cost of auto insurance is influenced by a multitude of factors, each playing a role in determining the final premium. By understanding these factors, you can make informed decisions to potentially reduce your insurance expenses.

Vehicle Type and Usage

The type of vehicle you own and how you use it are significant determinants of your insurance rates. Sports cars and luxury vehicles, for instance, often come with higher insurance costs due to their increased repair expenses and higher risk profiles. Additionally, the primary purpose of your vehicle—whether it’s for daily commuting, occasional use, or business purposes—can also impact your rates.

Consider the example of Jane, a freelance writer who recently purchased a used Toyota Prius for her daily commute. Since the Prius is known for its safety features and fuel efficiency, it falls into a lower risk category, resulting in relatively affordable insurance rates for Jane.

Driver’s Profile and History

Your driving record and personal details are crucial factors in insurance pricing. Young drivers under the age of 25, especially males, often face higher insurance premiums due to their perceived higher risk of accidents. Similarly, a history of traffic violations or at-fault accidents can lead to increased rates. On the other hand, safe driving habits and a clean record can work in your favor, potentially qualifying you for discounts.

Take the case of John, a 22-year-old student with a history of speeding tickets. Despite driving a standard sedan, his insurance premiums are relatively high due to his driving record. However, by taking a defensive driving course and maintaining a safe driving habit, John was able to gradually lower his insurance costs over time.

Location and Mileage

The area where you reside and the number of miles you drive annually also impact your insurance rates. High-traffic urban areas often have higher insurance costs due to the increased risk of accidents and theft. Furthermore, the more miles you drive, the higher the chances of being involved in an accident, which can lead to increased premiums.

For instance, consider Sarah, a resident of a quiet suburban neighborhood. Due to the lower risk of accidents and theft in her area, her insurance rates are more affordable compared to those living in a busy city center. Additionally, Sarah's annual mileage is relatively low, as she primarily uses her car for short trips, further contributing to her lower insurance costs.

Strategies to Find Affordable and Reliable Auto Insurance

Now that we’ve explored the factors influencing auto insurance rates, let’s delve into the strategies you can employ to find cheap but good auto insurance coverage.

Shop Around and Compare Quotes

One of the most effective ways to save on auto insurance is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three to five insurers can help you identify the most competitive rates.

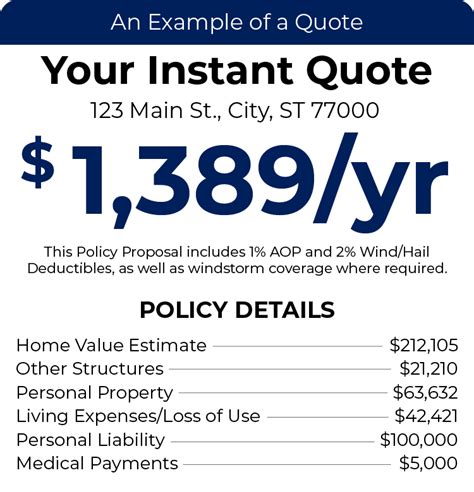

Consider using online quote comparison tools, which allow you to input your details once and receive multiple quotes from different insurers. This streamlined process can save you time and effort, providing a quick overview of the available options in your area.

Consider Bundle Discounts

If you have multiple insurance needs, such as auto, home, or renters’ insurance, bundling your policies with the same insurer can often result in substantial savings. Many insurance companies offer bundle discounts, which can significantly reduce your overall insurance expenses.

For instance, imagine you have an apartment and a car, both of which require insurance. By bundling your auto and renters' insurance policies with the same insurer, you could potentially save up to 25% on your total insurance costs.

Explore Discount Opportunities

Insurance companies often offer a variety of discounts to attract and retain customers. These discounts can be based on factors such as safe driving records, loyalty, educational achievements, or even the safety features of your vehicle. It’s worth inquiring about the discounts available with each insurer to ensure you’re maximizing your savings.

For example, some insurance providers offer discounts for students who maintain a certain GPA, while others provide incentives for installing advanced safety features like lane departure warning systems or automatic emergency braking.

Review Your Coverage Regularly

Insurance needs can change over time, so it’s essential to regularly review your coverage to ensure it aligns with your current situation. As your vehicle ages or your personal circumstances evolve, you may be able to reduce your coverage levels or deductibles, resulting in lower insurance costs.

Consider the scenario of Mike, a recent retiree who no longer commutes to work daily. By reviewing his insurance coverage, Mike realized he could reduce his liability coverage and increase his deductible, leading to a significant decrease in his insurance premiums.

Choosing the Right Coverage for Your Needs

While saving money on auto insurance is important, it’s equally crucial to ensure you have adequate coverage to protect yourself financially in the event of an accident or other unforeseen circumstances.

Understanding Liability Coverage

Liability coverage is a fundamental component of auto insurance, protecting you against claims for bodily injury or property damage caused to others in an accident for which you are at fault. It’s essential to have sufficient liability coverage to protect your assets in case of a serious accident.

The minimum liability coverage requirements vary by state, but it's generally recommended to have higher limits than the state minimums to provide adequate protection. Consider discussing your specific needs with an insurance agent to determine the appropriate liability coverage limits for your situation.

Exploring Additional Coverages

Beyond liability coverage, there are several additional coverages you can consider to enhance your auto insurance protection.

- Collision Coverage: This coverage pays for the repair or replacement of your vehicle if it's damaged in an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects against damage caused by events other than accidents, such as theft, vandalism, natural disasters, or collisions with animals.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Medical Payments Coverage: Medical payments coverage helps cover the medical expenses for you and your passengers in the event of an accident, regardless of fault.

The decision to include these additional coverages in your policy depends on your specific needs and the value of your vehicle. Consult with an insurance professional to determine which coverages are most suitable for your circumstances.

Conclusion: Balancing Cost and Coverage

Finding cheap but good auto insurance requires a careful balance between affordability and adequate coverage. By understanding the factors that influence insurance rates and employing the strategies outlined in this guide, you can make informed decisions to reduce your insurance expenses while ensuring you have the protection you need.

Remember, it's crucial to regularly review your coverage, explore discount opportunities, and consider bundling your insurance policies to maximize your savings. Additionally, don't underestimate the importance of liability coverage and other additional protections to safeguard your financial well-being in the event of an accident.

By staying informed and proactive, you can navigate the world of auto insurance with confidence, securing the best value for your insurance dollar.

FAQ

How often should I review my auto insurance coverage?

+

It’s recommended to review your auto insurance coverage annually or whenever your circumstances change significantly. This ensures your coverage remains aligned with your needs and any potential opportunities for savings.

Can I switch insurance providers to save money?

+

Absolutely! Shopping around for insurance quotes is a great way to potentially save money. Don’t be afraid to switch providers if you find a more competitive rate elsewhere.

What are some common discounts I should look for when shopping for auto insurance?

+

Common discounts include safe driver discounts, multi-policy discounts (for bundling auto and home insurance), student discounts, and discounts for vehicles with advanced safety features. Be sure to inquire about all available discounts when comparing insurance quotes.