Insurance Quote House

The process of obtaining an insurance quote for your house can be a complex journey, filled with important considerations and a myriad of options. As a homeowner, it's crucial to understand the factors that influence insurance rates and the steps to secure the best coverage for your home. This comprehensive guide will walk you through the entire process, providing you with the knowledge and insights to make informed decisions about your home insurance.

Understanding the Basics of Home Insurance Quotes

Home insurance, also known as homeowners insurance, is a form of property insurance that covers a private residence against damages and losses caused by various perils. These perils can range from natural disasters like storms and floods to human-induced incidents such as theft and vandalism. The primary purpose of home insurance is to provide financial protection to homeowners, ensuring they can recover from unexpected events that may cause damage to their property and possessions.

When seeking a quote for your house, it's essential to understand the different components of home insurance and how they contribute to the overall cost. Here's a breakdown of the key elements:

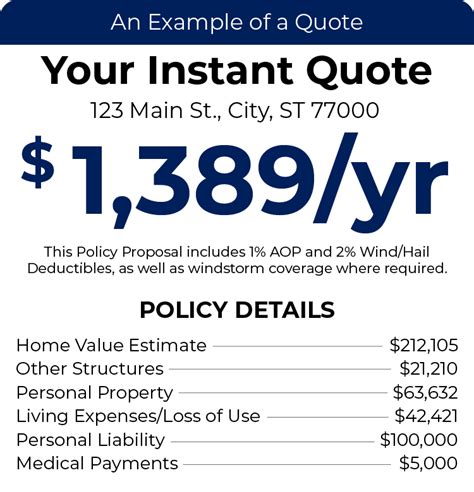

- Dwelling Coverage: This is the primary coverage that protects the physical structure of your home. It covers the cost of repairs or rebuilding in the event of damage or destruction caused by a covered peril.

- Personal Property Coverage: This coverage safeguards your personal belongings, such as furniture, electronics, and clothing, against theft, damage, or loss due to covered perils. It typically provides coverage for a specified percentage of the dwelling coverage amount.

- Liability Coverage: This aspect of home insurance provides protection if someone is injured on your property or if your actions elsewhere result in bodily injury or property damage to others. It covers the costs of legal defense and any resulting judgments or settlements.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered peril, this coverage provides for the additional costs of temporary housing and living expenses until your home is repaired or rebuilt.

- Optional Coverages: Many home insurance policies offer optional add-ons, such as coverage for high-value items (like jewelry or art), identity theft protection, or water backup and sump pump failure. These optional coverages can be tailored to your specific needs.

Factors Influencing Your Insurance Quote

The cost of your home insurance quote is influenced by a multitude of factors, each playing a role in determining the level of risk associated with insuring your property. Here are some key factors that insurance companies consider:

Location and Environment

The geographic location of your home is a significant factor in determining your insurance quote. Areas prone to natural disasters like hurricanes, earthquakes, or floods may carry higher insurance costs. Additionally, the local crime rate and proximity to fire stations can also impact your rates.

Home Characteristics

The size, age, and construction materials of your home are taken into account. Older homes may require more extensive coverage, while newer homes may benefit from modern construction techniques and materials that reduce the risk of damage. The presence of certain features, such as a swimming pool or trampoline, can also impact your insurance quote.

Claims History

Your personal claims history is a crucial factor. If you’ve had multiple claims in the past, it may reflect poorly on your insurance profile, potentially leading to higher premiums or even difficulty in finding coverage. On the other hand, a clean claims history can work in your favor, demonstrating responsible ownership and a reduced risk profile.

Insurance Company and Policy Options

Different insurance companies offer varying levels of coverage and pricing. It’s essential to shop around and compare quotes from multiple providers to find the best fit for your needs. Additionally, the specific policy options you choose, such as deductibles and coverage limits, can significantly impact your premium.

Obtaining an Insurance Quote: A Step-by-Step Guide

Now that we’ve covered the basics and the factors influencing your insurance quote, let’s dive into the process of obtaining a quote for your house. Here’s a step-by-step guide to help you navigate this process seamlessly:

Step 1: Gather Relevant Information

Before you begin the quoting process, it’s essential to have the following information readily available:

- Basic details about your home, including its address, construction type, and square footage.

- The year your home was built and any significant renovations or additions.

- A list of your personal belongings and their approximate value.

- Your previous insurance history, including any claims made.

- Any safety features or improvements you've made to your home, such as security systems or fire suppression systems.

Step 2: Choose Your Insurance Company

Selecting the right insurance company is crucial. Consider factors such as financial stability, customer satisfaction ratings, and the range of coverage options offered. You can start by researching reputable companies online and reading reviews from current and past customers. Additionally, seek recommendations from trusted sources, such as friends, family, or financial advisors.

Step 3: Gather Quotes

Once you’ve narrowed down your options to a few reputable insurance companies, it’s time to gather quotes. You can typically request quotes online, over the phone, or by visiting an insurance agent’s office. Ensure you provide accurate and detailed information to receive an accurate quote.

Step 4: Compare Quotes

After receiving quotes from multiple insurers, it’s essential to compare them side by side. Look at the coverage limits, deductibles, and any additional perks or discounts offered. Consider not only the price but also the reputation and financial stability of the insurance company. A lower premium may be appealing, but it’s important to ensure the coverage meets your needs and provides adequate protection.

Step 5: Review Coverage Options

When reviewing your quotes, pay close attention to the coverage options included. Ensure that the policy provides sufficient coverage for your home’s structure, personal belongings, and liability risks. Consider any optional coverages that may be beneficial, such as flood insurance or coverage for high-value items.

Step 6: Ask Questions and Seek Clarification

If you have any doubts or concerns about the quotes you’ve received, don’t hesitate to reach out to the insurance company or agent. Ask questions about the coverage, exclusions, and any terms or conditions that you don’t fully understand. A clear understanding of your policy is crucial to ensuring you have the right protection for your home.

Step 7: Choose the Right Policy

Based on your research, comparisons, and clarifications, select the insurance policy that best fits your needs and budget. Remember, the cheapest option may not always be the best, as it may lack sufficient coverage. Opt for a policy that provides comprehensive protection without breaking the bank.

Tips for Securing the Best Insurance Quote

To ensure you obtain the most competitive and comprehensive insurance quote for your house, consider the following tips:

- Bundle Your Policies: Many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance. By combining your policies, you can often save money and streamline your insurance management.

- Increase Your Deductible: While it may seem counterintuitive, increasing your deductible can lower your insurance premium. However, ensure you choose a deductible amount that you're comfortable paying out of pocket in the event of a claim.

- Review and Update Your Coverage Regularly: Your home insurance needs may change over time. Regularly review your policy to ensure it aligns with your current circumstances. Update your coverage limits and personal property values as needed to maintain adequate protection.

- Utilize Home Safety Features: Installing security systems, fire alarms, and other safety features can often lead to discounts on your insurance premium. These features not only enhance your home's safety but also demonstrate responsible ownership to insurance providers.

- Shop Around and Negotiate: Don't be afraid to negotiate with insurance companies, especially if you've been a loyal customer for years. Many insurers are willing to match or beat competitor quotes to retain your business. Additionally, shopping around regularly can help you stay informed about the market and potential savings.

Conclusion: Navigating the Home Insurance Landscape

Obtaining an insurance quote for your house is a crucial step in protecting your home and belongings. By understanding the basics of home insurance, the factors influencing your quote, and following the step-by-step guide provided, you can navigate the insurance landscape with confidence. Remember, it’s essential to tailor your coverage to your specific needs and circumstances, ensuring you have the right protection at a competitive price.

Stay informed, compare quotes, and don't hesitate to seek expert advice when needed. With the right home insurance policy, you can rest easy knowing your home is protected against life's unexpected events.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever your circumstances change significantly. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

Can I negotiate my insurance premium?

+Yes, negotiating your insurance premium is possible, especially if you’ve been a loyal customer for an extended period. Don’t hesitate to discuss your options with your insurance provider and inquire about potential discounts or rate adjustments.

What should I do if I’m unsure about my coverage needs?

+If you’re unsure about your coverage needs, it’s best to consult with an insurance professional. They can assess your specific circumstances and provide tailored advice to ensure you have adequate protection without overpaying for unnecessary coverage.

Are there any discounts available for home insurance policies?

+Yes, many insurance companies offer discounts for various reasons. Common discounts include bundling multiple policies, installing safety features, being claim-free for a certain period, or having certain professional affiliations. It’s worth inquiring about these discounts when obtaining quotes.