Car Insurance Hartford

Car insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the United States. In this comprehensive guide, we will delve into the world of car insurance, specifically focusing on The Hartford, a well-known insurance provider with a rich history and a reputation for comprehensive coverage.

The Hartford, founded in 1810, is one of the oldest and most respected insurance companies in America. With over two centuries of experience, they have established themselves as a trusted partner for millions of policyholders. In this article, we will explore the unique features, coverage options, and benefits that The Hartford offers to its customers, ensuring that you have all the information you need to make informed decisions about your car insurance.

Understanding The Hartford’s Car Insurance Coverage

The Hartford offers a wide range of car insurance coverage options to cater to the diverse needs of its customers. Whether you’re a safe driver, a high-risk driver, or someone with a unique vehicle, The Hartford has tailored plans to fit your specific circumstances.

Standard Coverage Options

Like most insurance providers, The Hartford offers standard coverage options such as:

- Liability Coverage: This is the basic coverage required by law in most states. It covers damages you cause to others in an accident, including their property and medical expenses.

- Collision Coverage: This optional coverage pays for repairs or replacement of your vehicle if you’re involved in a collision, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from non-collision-related incidents like theft, vandalism, weather damage, and natural disasters.

- Personal Injury Protection (PIP): PIP coverage provides medical benefits to the insured and their passengers, regardless of fault, for injuries sustained in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance to cover the damages.

Unique Coverage Features

What sets The Hartford apart is its commitment to providing specialized coverage options that cater to unique situations. Some of these unique coverage features include:

- Classic Car Coverage: The Hartford understands the value of classic and vintage vehicles. Their Classic Car program offers specialized coverage for vehicles that are 25 years or older and driven less than 5,000 miles annually. This coverage includes agreed value settlement, coverage for spare parts, and the option to add a personal articles policy for items like tools and collectibles.

- AARP Auto Insurance Program: In partnership with AARP, The Hartford offers discounted rates and specialized coverage for members aged 50 and above. This program includes additional benefits like diminished value protection, new car replacement, and rental car reimbursement.

- Gap Coverage: If you lease or finance your vehicle, Gap Coverage can be a lifesaver. This coverage pays the difference between what your insurance provider would typically pay for your totaled vehicle and the amount you still owe on your lease or loan.

- Pet Injury Coverage: The Hartford cares about your furry friends too! Their pet injury coverage provides reimbursement for veterinary expenses if your pet is injured in an accident while riding in your insured vehicle.

The Hartford’s Comprehensive Approach to Claims

The Hartford takes pride in its efficient and customer-centric claims process. They understand that accidents can be stressful, so they aim to make the claims process as seamless as possible.

Claims Handling Process

When you need to file a claim with The Hartford, you can expect a prompt and professional response. Here’s a general overview of the claims handling process:

- Report the Claim: You can report a claim online, via their mobile app, or by calling their 24⁄7 claims hotline. Their team will guide you through the process and collect the necessary information.

- Claims Assessment: The Hartford’s claims adjusters will evaluate your claim and determine the scope of the damage. They may request additional documentation or photos to support your claim.

- Repair or Settlement: Depending on the nature of the claim, The Hartford will either arrange for your vehicle to be repaired at a trusted facility or provide a settlement for the total loss of your vehicle.

- Payment: Once the repairs are completed or the settlement amount is agreed upon, The Hartford will process the payment promptly, ensuring you receive the funds you need to get back on the road.

Claims Satisfaction

The Hartford consistently receives high marks for its claims satisfaction. They prioritize timely resolution and fair settlements, ensuring that their customers are satisfied with the outcome. In fact, in a recent J.D. Power study, The Hartford ranked among the top insurance providers for overall customer satisfaction in the auto claims process.

Benefits and Perks of Choosing The Hartford

In addition to its comprehensive coverage options and efficient claims process, The Hartford offers several benefits and perks that make it an attractive choice for car insurance.

Discounts and Savings

The Hartford understands that insurance can be costly, so they offer a variety of discounts to help their customers save:

- Multi-Policy Discount: You can save by bundling your car insurance with other policies, such as homeowners or renters insurance.

- Safe Driver Discount: If you maintain a clean driving record, you may be eligible for a safe driver discount.

- Vehicle Safety Discounts : The Hartford offers discounts for vehicles equipped with certain safety features like anti-lock brakes, air bags, and anti-theft devices.

- Multi-Car Discount: If you insure more than one vehicle with The Hartford, you can take advantage of a multi-car discount.

Customer Service and Convenience

The Hartford places a strong emphasis on customer service and convenience. Their online and mobile platforms are user-friendly, allowing you to manage your policy, make payments, and file claims with ease. Additionally, their 24⁄7 customer service hotline ensures that you can always reach a representative when you need assistance.

Roadside Assistance

With The Hartford’s car insurance, you gain access to their roadside assistance program. This program provides emergency services like towing, flat tire changes, jump starts, and fuel delivery. Having this peace of mind can be invaluable when you’re stranded on the side of the road.

The Hartford’s Commitment to Safety

Beyond just providing insurance coverage, The Hartford is dedicated to promoting road safety. They offer a range of resources and initiatives aimed at preventing accidents and keeping drivers safe.

Safe Driving Programs

The Hartford’s Safe Driving Programs are designed to educate and incentivize safe driving behaviors. These programs include:

- Driver Training Courses: The Hartford partners with reputable driving schools to offer discounts on driver training courses, helping new and experienced drivers refine their skills.

- Teen Driver Programs: Recognizing the importance of safe driving for young drivers, The Hartford offers resources and programs specifically tailored to teens, helping them develop good driving habits.

- Distracted Driving Awareness: The Hartford actively campaigns against distracted driving, providing resources and educational materials to raise awareness about the dangers of distracted behavior behind the wheel.

Accident Forgiveness

In recognition of the fact that accidents can happen to even the safest drivers, The Hartford offers Accident Forgiveness. This optional endorsement allows you to maintain your good driver discount even after your first at-fault accident. It’s a great way to protect your premium from sudden increases after an unexpected mishap.

Conclusion: The Hartford’s Comprehensive Approach to Car Insurance

The Hartford’s car insurance offerings showcase their commitment to providing tailored, comprehensive coverage to meet the diverse needs of their customers. From standard liability coverage to specialized programs for classic car enthusiasts and seniors, they’ve got you covered. Their efficient claims process, impressive customer satisfaction ratings, and array of discounts and perks further enhance their appeal as a trusted insurance provider.

If you're in the market for car insurance, consider The Hartford. With their rich history, comprehensive coverage options, and dedication to safety, they're a top choice for drivers seeking peace of mind and financial protection on the road.

What is The Hartford’s financial strength rating?

+The Hartford holds a strong financial strength rating of A+ (Superior) from AM Best, indicating their financial stability and ability to meet their obligations.

Does The Hartford offer rental car coverage?

+Yes, The Hartford provides rental car reimbursement coverage, which can help cover the cost of a rental vehicle if your insured car is being repaired or replaced due to a covered loss.

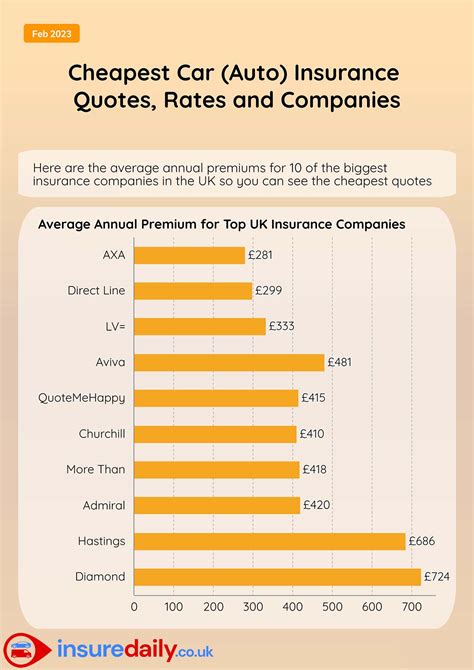

Are The Hartford’s rates competitive?

+The Hartford’s rates are competitive and often offer discounts for various situations. It’s always a good idea to compare quotes from multiple providers to find the best rate for your specific circumstances.