Chaepest Renters Insurance

Finding the cheapest renters insurance can be a priority for many individuals, especially those on a tight budget or new to the world of insurance. Renters insurance provides essential protection for your personal belongings and liability coverage, making it a crucial aspect of financial planning. This comprehensive guide will delve into the world of renters insurance, offering insights on how to secure the most affordable coverage while ensuring you're adequately protected.

Understanding Renters Insurance

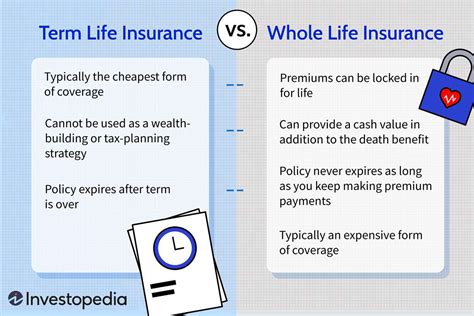

Renters insurance is a form of property insurance specifically designed for tenants. Unlike homeowners insurance, which covers the structure of the home and its contents, renters insurance primarily focuses on protecting your personal possessions and providing liability coverage in case of accidents or injuries that occur on your rented property.

Coverage Options

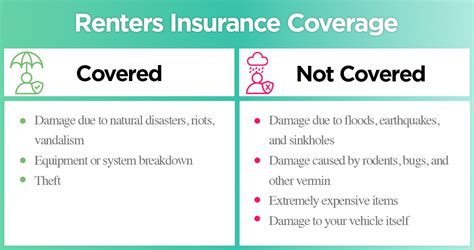

Renters insurance typically includes the following coverage types:

- Personal Property Coverage: This covers your belongings, including furniture, clothing, electronics, and appliances, against losses due to theft, fire, or other perils specified in your policy.

- Liability Coverage: In the event that someone is injured in your rented home or apartment, this coverage can protect you from potential lawsuits and legal fees.

- Additional Living Expenses: If your rental becomes uninhabitable due to a covered incident, this coverage can help cover temporary living expenses while repairs are made.

- Medical Payments to Others: Provides coverage for medical expenses for individuals injured on your rented property, regardless of fault.

Why Renters Insurance Matters

Many renters mistakenly believe that their landlord's insurance will cover their belongings. However, this is not the case. Landlord insurance typically covers the structure of the building, but not the contents inside. Renters insurance fills this gap, providing peace of mind and financial protection in the event of unexpected losses.

Factors Influencing Renters Insurance Costs

The cost of renters insurance can vary significantly based on several factors. Understanding these factors can help you make informed decisions when shopping for the cheapest renters insurance.

Location

The location of your rental property plays a crucial role in determining insurance rates. Areas with higher crime rates or a history of natural disasters tend to have higher insurance premiums. Conversely, safer neighborhoods may offer more affordable rates.

Value of Personal Belongings

The more valuable your possessions, the higher the insurance premium. It's essential to provide accurate information about the value of your belongings to ensure you're adequately covered without overpaying.

Deductibles and Coverage Limits

Like other insurance types, renters insurance policies come with deductibles and coverage limits. Choosing a higher deductible can lower your monthly premium, but it means you'll have to pay more out of pocket if you need to make a claim. Similarly, opting for lower coverage limits can reduce costs, but it may leave you underinsured.

Discounts and Bundling

Many insurance providers offer discounts for various reasons. These can include discounts for having multiple policies with the same insurer (e.g., bundling renters and auto insurance), being a loyal customer, or even for being a non-smoker. Exploring these discounts can help you find the cheapest renters insurance option.

Shopping for the Cheapest Renters Insurance

Now that we've covered the basics, let's dive into the process of finding the cheapest renters insurance that suits your needs.

Compare Multiple Quotes

The insurance market is competitive, and prices can vary significantly between providers. It's essential to compare quotes from multiple insurers to ensure you're getting the best deal. Online quote comparison tools can be a great starting point, but it's also advisable to speak directly with insurance agents to understand the specifics of each policy.

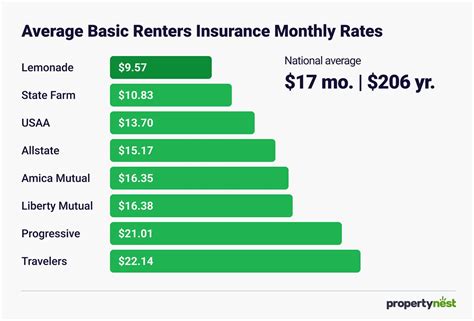

Consider Online Providers

Online insurance providers often offer more affordable rates due to their streamlined business models. These providers may not have the extensive network of agents and physical offices that traditional insurers have, allowing them to pass on these savings to customers.

Review Policy Details

While cost is a significant factor, it's crucial not to sacrifice coverage for affordability. Carefully review the policy details, including coverage limits, deductibles, and any exclusions. Ensure that the policy provides adequate protection for your specific needs.

Assess Your Risk Profile

Your personal risk profile can influence the cost of your renters insurance. Factors such as your credit score, claim history, and the security features of your rental property can impact your premiums. Taking steps to improve your risk profile, such as installing security systems or maintaining a good credit score, can lead to lower insurance costs.

Real-World Examples and Case Studies

Let's look at some real-world examples of renters insurance policies and the factors that influenced their costs.

Case Study 1: John's Experience

John, a recent college graduate, was looking for the cheapest renters insurance for his new apartment in a suburban area. He had a limited budget and wanted to ensure he was getting the best value for his money.

John began by obtaining quotes from various insurance providers. He discovered that online providers offered more competitive rates compared to traditional insurers. By comparing quotes, he found a policy that provided adequate coverage for his belongings and liability concerns at a premium of $150 annually. This policy included a $500 deductible and coverage limits of $20,000 for personal property and $100,000 for liability.

Case Study 2: Sarah's Story

Sarah, a young professional, rented an apartment in an urban area known for its high crime rate. She was concerned about finding affordable renters insurance that would protect her valuable electronics and furniture.

Sarah's research revealed that her location played a significant role in insurance costs. She explored various options and found a policy with a reputable insurer that offered a balance between coverage and affordability. The policy had a slightly higher premium of $200 annually, with a $1,000 deductible and coverage limits of $30,000 for personal property and $200,000 for liability. The higher coverage limits and deductible reflected the increased risk associated with her location.

Performance Analysis and Expert Insights

When it comes to renters insurance, it's crucial to strike a balance between affordability and adequate coverage. Here are some expert insights to help you make informed decisions:

Assessing Your Needs

Before shopping for renters insurance, take the time to assess your specific needs. Consider the value of your belongings, your liability concerns, and any unique circumstances, such as owning expensive musical instruments or collectibles. This assessment will guide you in choosing the right coverage limits and policy features.

The Impact of Location

As demonstrated in our case studies, location is a significant factor in renters insurance costs. If you live in an area with high crime rates or a history of natural disasters, you may need to budget for higher premiums. However, this doesn't mean you should settle for inadequate coverage. Work with an insurance agent to find a policy that provides sufficient protection at a reasonable cost.

The Role of Deductibles

Deductibles are an essential aspect of renters insurance policies. While choosing a higher deductible can lower your monthly premium, it's important to consider your financial situation. If you're comfortable paying a higher deductible in the event of a claim, you can save money on your premium. However, if you're on a tight budget, a lower deductible may be more suitable, despite the slightly higher premium.

The Benefits of Bundling

Bundling your renters insurance with other policies, such as auto insurance, can lead to significant savings. Many insurance providers offer discounts when you have multiple policies with them. This not only simplifies your insurance management but also provides an opportunity to save money.

The Importance of Reviews and Ratings

When shopping for renters insurance, it's crucial to consider the reputation and financial stability of the insurance provider. Read reviews and check ratings from reputable sources to ensure you're choosing a reliable insurer. A financially stable insurer is more likely to be able to pay out claims promptly and efficiently.

Future Implications and Industry Trends

The renters insurance market is continually evolving, and staying informed about industry trends can help you make wise decisions regarding your coverage.

The Rise of Digital Insurance

The digital transformation of the insurance industry is a notable trend. Online insurance providers are gaining popularity due to their convenience, competitive rates, and ease of use. These providers often offer streamlined policies and digital tools for managing your insurance, making the process more efficient and cost-effective.

Personalized Insurance Options

As technology advances, insurance providers are increasingly able to offer personalized insurance policies. These policies take into account your unique circumstances and risk profile, providing tailored coverage at a potentially lower cost. This trend towards personalization is expected to continue, offering renters more flexibility and affordability.

The Impact of Climate Change

Climate change and its associated natural disasters are becoming more frequent and severe. This trend can influence renters insurance costs, particularly in areas prone to these events. It's essential to stay informed about the potential risks in your area and ensure your policy provides adequate coverage for these scenarios.

Frequently Asked Questions

How much does renters insurance typically cost?

+The cost of renters insurance can vary widely depending on factors such as location, the value of your belongings, and your chosen coverage limits. On average, renters insurance premiums range from 150 to 300 annually. However, it’s possible to find more affordable options by comparing quotes and exploring discounts.

Do I really need renters insurance if my landlord has insurance?

+Yes, renters insurance is essential even if your landlord has insurance. Landlord insurance typically covers the structure of the building, but it does not protect your personal belongings. Renters insurance provides coverage for your possessions and liability protection, ensuring you’re financially protected in case of loss or accident.

What factors can I control to lower my renters insurance costs?

+There are several factors within your control that can influence the cost of your renters insurance. These include choosing a higher deductible, maintaining a good credit score, installing security features in your rental, and exploring discounts by bundling policies or maintaining a long-term relationship with your insurer. By taking these steps, you can potentially lower your insurance costs.

Are there any additional costs associated with renters insurance?

+In addition to the annual premium, there may be some additional costs associated with renters insurance. These can include administrative fees, policy change fees, or surcharges for specific coverage options. It’s important to review your policy details and understand any potential additional costs to avoid surprises.

How often should I review and update my renters insurance policy?

+It’s recommended to review your renters insurance policy annually or whenever there are significant changes in your circumstances. This includes changes in your personal belongings, moving to a new location, or experiencing life events that may impact your insurance needs. Regular reviews ensure that your coverage remains adequate and up-to-date.