Best Deal On Auto Insurance

Securing the best deal on auto insurance is a top priority for many drivers, as it directly impacts their finances and overall peace of mind on the road. With a myriad of insurance providers and policy options available, finding the optimal coverage at an affordable price can be a challenging task. This comprehensive guide aims to provide expert insights and practical strategies to help drivers navigate the complex world of auto insurance, offering a clear path to identifying and securing the most advantageous deal.

Understanding Auto Insurance Policies

Auto insurance policies are designed to offer financial protection to drivers and vehicle owners in the event of accidents, theft, or other incidents that may result in property damage or bodily injury. These policies are typically comprised of several key components, each providing coverage for specific scenarios.

Liability Coverage

Liability coverage is a fundamental aspect of any auto insurance policy. It safeguards the policyholder in the event they are found legally responsible for causing harm to others or their property in an accident. This coverage typically includes both bodily injury liability and property damage liability.

Bodily injury liability covers medical expenses and lost wages for individuals injured in an accident caused by the policyholder. Property damage liability, on the other hand, covers the cost of repairing or replacing the damaged property, such as the other driver's vehicle or any other affected property.

| Component | Coverage |

|---|---|

| Bodily Injury Liability | Medical expenses and lost wages |

| Property Damage Liability | Cost of repairing or replacing damaged property |

Collision and Comprehensive Coverage

Collision coverage is an optional add-on to your auto insurance policy that covers the cost of repairing or replacing your vehicle after an accident, regardless of fault. This coverage is particularly useful for drivers who have financed or leased their vehicles, as it can help cover the full cost of repairs or the vehicle’s replacement value.

Comprehensive coverage, on the other hand, provides protection against damage to your vehicle caused by incidents other than collisions. This can include events like theft, vandalism, natural disasters, or damage caused by animals. Similar to collision coverage, comprehensive coverage is optional but highly recommended to ensure your vehicle is protected from a wide range of potential risks.

Additional Coverages

Beyond the fundamental coverages, auto insurance policies often offer a variety of additional protections. These may include:

- Uninsured/Underinsured Motorist Coverage: Protects you in the event of an accident with a driver who has no insurance or insufficient insurance coverage.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): Provides broader medical coverage, often including rehabilitation and funeral expenses.

- Rental Car Reimbursement: Offers coverage for rental car expenses while your vehicle is being repaired.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the balance of your loan or lease in the event of a total loss.

Factors Influencing Auto Insurance Rates

Auto insurance rates can vary significantly based on a multitude of factors. Understanding these factors can help drivers make informed decisions when choosing an insurance policy and potentially negotiate better rates.

Driver Profile

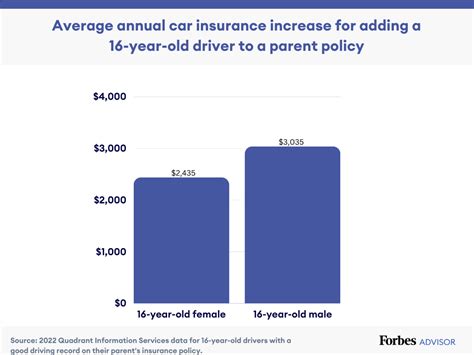

Your personal driving record and history are significant determinants of your auto insurance rates. Insurance providers consider factors such as your age, gender, marital status, and driving experience when calculating your premium. Younger drivers, for instance, are often considered higher risk and may face higher insurance costs.

Additionally, your driving record plays a crucial role. If you have a history of traffic violations or accidents, your insurance rates are likely to be higher. Conversely, maintaining a clean driving record can lead to reduced premiums over time.

Vehicle Factors

The type of vehicle you drive can also impact your insurance rates. Factors such as the make, model, and year of your vehicle, as well as its safety and theft ratings, are considered by insurance providers. Vehicles that are more expensive to repair or replace, or those that are commonly targeted by thieves, may result in higher insurance costs.

Furthermore, the primary use of your vehicle can affect your rates. Insurance providers often offer discounts for vehicles used primarily for commuting to work or personal use, as opposed to those used for business or commercial purposes.

Location and Usage

Your geographical location and the typical usage of your vehicle can significantly influence your insurance rates. Areas with higher population densities or higher crime rates may result in increased insurance costs. Similarly, if you primarily drive in urban areas with heavy traffic, your insurance rates are likely to be higher compared to drivers who mostly drive in rural or low-traffic areas.

The average annual mileage you drive is another crucial factor. Insurance providers often offer discounts to drivers who drive fewer miles per year, as this generally indicates a lower risk of accidents.

Coverage and Deductibles

The level of coverage you choose and the deductibles you select can directly impact your insurance rates. Opting for higher coverage limits and lower deductibles typically results in higher premiums, while choosing lower coverage limits and higher deductibles can lead to reduced premiums.

It's important to strike a balance between the coverage you need and the cost you can afford. While higher coverage limits and lower deductibles offer more financial protection, they can also significantly increase your insurance costs. Conversely, lower coverage limits and higher deductibles may result in reduced premiums, but could leave you financially vulnerable in the event of an accident.

Tips for Securing the Best Auto Insurance Deal

Finding the best deal on auto insurance requires a combination of research, understanding, and strategic decision-making. Here are some expert tips to help you navigate the process and secure the most advantageous insurance policy for your needs:

Shop Around and Compare Quotes

The auto insurance market is highly competitive, with numerous providers offering a wide range of policies and rates. It’s essential to shop around and compare quotes from multiple insurers to ensure you’re getting the best deal. Online comparison tools can be particularly useful for this, allowing you to quickly and easily compare policies and prices from various providers.

Understand Your Coverage Needs

Before selecting an auto insurance policy, take the time to understand your specific coverage needs. Consider factors such as your vehicle’s value, your financial situation, and your personal risk tolerance. By assessing your unique circumstances, you can choose a policy that provides adequate protection without unnecessary expenses.

Consider Bundle Discounts

Many insurance providers offer bundle discounts when you purchase multiple policies from them. For instance, you may be able to save on your auto insurance by also purchasing your home, renters, or life insurance policies from the same provider. These bundle discounts can significantly reduce your overall insurance costs, so it’s worth exploring this option if you’re in the market for multiple types of insurance.

Take Advantage of Discounts

Insurance providers often offer a variety of discounts to policyholders. Common discounts include those for safe driving records, vehicle safety features, loyalty, and multi-policy bundles. Additionally, some providers offer discounts for specific occupations, educational achievements, or membership in certain organizations. Be sure to inquire about all available discounts when shopping for auto insurance, as these can help reduce your premiums significantly.

Review and Adjust Your Policy Regularly

Auto insurance rates and policies can change over time due to various factors, such as changes in your personal circumstances, driving record, or the value of your vehicle. It’s essential to review your policy regularly and make adjustments as needed. This may involve increasing or decreasing your coverage limits, adjusting your deductibles, or exploring new providers to ensure you’re always getting the best deal available.

The Future of Auto Insurance

The auto insurance industry is undergoing significant transformations, driven by technological advancements and changing consumer needs. As autonomous vehicles and electric cars become more prevalent, the traditional auto insurance model is likely to evolve to accommodate these new technologies and the unique risks they present.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and GPS to monitor driving behavior, is gaining traction in the auto insurance industry. This technology allows insurance providers to offer usage-based insurance policies, where premiums are calculated based on real-time driving data. These policies can provide significant benefits to safe drivers, as they offer the potential for substantial premium reductions.

However, there are also concerns surrounding privacy and data security with telematics-based insurance. As this technology continues to develop, it's crucial for both insurers and consumers to strike a balance between utilizing the benefits of real-time data and protecting individual privacy.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles presents a unique challenge for the auto insurance industry. As these vehicles become more common, the traditional model of assigning liability based on driver behavior may need to be reevaluated. Instead, liability may shift towards the manufacturers of autonomous vehicles or the developers of the software that powers them.

Insurance providers will need to adapt their policies and coverage to accommodate the unique risks associated with autonomous vehicles. This may involve developing new types of insurance products that focus on the technology and systems that power these vehicles, rather than the human drivers.

Electric Vehicles and Insurance

Electric vehicles (EVs) are also gaining popularity, and their unique characteristics present new considerations for auto insurance. EVs often have higher repair and replacement costs due to their specialized components, which can lead to increased insurance premiums. However, EVs also tend to have lower accident rates due to their advanced safety features, which can offset these increased costs.

As the market for EVs continues to grow, insurance providers will need to develop specialized policies that account for the unique risks and benefits associated with these vehicles. This may involve offering incentives or discounts to EV owners, such as reduced premiums for vehicles with advanced safety features or charging station reimbursement.

Conclusion

Securing the best deal on auto insurance requires a thorough understanding of the insurance landscape, your personal needs, and the factors that influence rates. By shopping around, comparing quotes, and leveraging discounts and bundle options, you can find a policy that provides adequate coverage at a competitive price. As the auto insurance industry continues to evolve, staying informed about new technologies and insurance products will be crucial to making informed decisions about your coverage.

What is the average cost of auto insurance in the United States?

+

The average cost of auto insurance in the United States varies significantly depending on factors such as the state you live in, your driving record, and the make and model of your vehicle. According to recent data, the national average for auto insurance premiums is approximately 1,674 per year, or around 140 per month. However, it’s important to note that this average can vary widely, with some drivers paying significantly more or less depending on their individual circumstances.

How can I lower my auto insurance rates?

+

There are several strategies you can employ to lower your auto insurance rates. First, consider increasing your deductible, as this can often lead to significant premium reductions. Additionally, maintain a clean driving record and explore discounts for safe driving, vehicle safety features, and loyalty to your insurance provider. Finally, regularly review and compare quotes from different insurers to ensure you’re getting the best deal.

What factors influence my auto insurance rates?

+

Your auto insurance rates are influenced by a variety of factors, including your age, gender, marital status, driving record, and the type of vehicle you drive. Your geographical location, the average mileage you drive annually, and the level of coverage you choose also play significant roles. Additionally, your credit score can impact your insurance rates, with higher scores often leading to lower premiums.