Private Health Insurance Cost Calculator

Empowering Healthcare Decisions: The Comprehensive Guide to Private Health Insurance Costs

In the realm of healthcare, understanding the financial aspects is crucial. Private health insurance, a cornerstone of many healthcare systems, offers individuals and families a range of benefits and peace of mind. However, navigating the complexities of insurance costs can be daunting. This comprehensive guide aims to demystify the process, providing you with the tools and insights to make informed decisions about your healthcare coverage.

Whether you're a young professional looking to secure your health or a family planning for the future, this article will serve as your trusted companion. We'll delve into the factors influencing insurance premiums, explore cost-saving strategies, and provide real-world examples to illustrate the impact of these choices. By the end, you'll possess the knowledge to tailor your insurance plan to your unique needs, ensuring optimal coverage without unnecessary financial burden.

The Fundamentals of Private Health Insurance Costs

Private health insurance costs are influenced by a multitude of factors, each playing a significant role in determining your premium. Understanding these fundamentals is key to making informed choices. Let's break it down into digestible components.

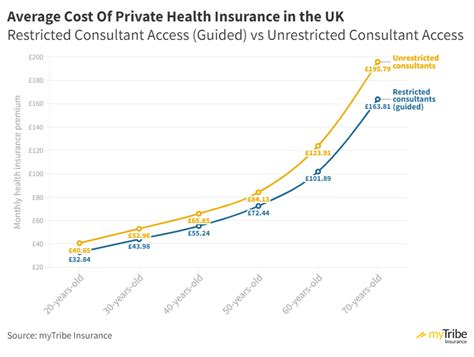

Age: A Primary Cost Determinant

Age is one of the most influential factors when it comes to insurance costs. Generally, younger individuals enjoy lower premiums due to their relatively lower health risks. As we age, our health becomes more susceptible to various conditions, leading to increased healthcare needs and, consequently, higher insurance costs. For instance, a 25-year-old might pay half the premium of a 55-year-old for the same coverage.

However, it's important to note that age-based discrimination is illegal in many countries, ensuring fair access to healthcare for all. In these regions, insurance companies must offer the same plans to individuals of all ages, with premium variations based solely on other factors like health status, location, and chosen benefits.

| Age Group | Average Premium (in USD) |

|---|---|

| 20-29 | 450 |

| 30-39 | 550 |

| 40-49 | 680 |

| 50-59 | 820 |

| 60-69 | 980 |

Health Status: Impact on Premiums

Your current health status and medical history are significant factors in determining insurance costs. Pre-existing conditions, chronic illnesses, and even lifestyle choices can influence your premium. For example, a smoker might pay a higher premium for health insurance, as smoking is associated with various health complications.

Insurance companies often require a medical examination or review of your health records before issuing a policy. This ensures that the premium accurately reflects your health risks. However, it's worth noting that many countries have laws protecting individuals with pre-existing conditions, ensuring they have access to affordable healthcare.

Location: Geographical Cost Variations

The cost of private health insurance can vary significantly based on your geographical location. Urban areas, with their higher costs of living and denser populations, often have higher insurance premiums. Rural areas, on the other hand, might offer more affordable options due to lower healthcare demand and costs.

Additionally, the availability of healthcare facilities and specialists in your area can impact insurance costs. Regions with a higher concentration of medical professionals and advanced healthcare infrastructure might see slightly higher premiums.

Policy Coverage and Benefits: Tailoring Your Plan

The extent of coverage and the benefits included in your insurance plan are major cost drivers. Comprehensive plans that cover a wide range of medical services, including specialist consultations, hospital stays, and prescription medications, will naturally come with higher premiums. Conversely, basic plans with limited coverage will be more affordable.

When choosing a plan, it's essential to consider your healthcare needs. If you have specific medical requirements or anticipate frequent healthcare visits, a more comprehensive plan might be the wiser choice. However, if you're generally healthy and have minimal healthcare needs, a basic plan could provide adequate coverage at a lower cost.

Family Size and Dependents: Shared Costs

If you're insuring your entire family, the number of family members and any dependents will impact your premium. Typically, family plans offer a discounted rate per person, making it more cost-effective than individual plans. However, the specific discount and overall cost will depend on the insurance provider and the chosen plan.

It's crucial to assess your family's healthcare needs when selecting a plan. Consider any pre-existing conditions, regular medications, or specialized healthcare requirements. Choosing a plan that adequately covers these needs is essential to ensure your family's health and financial security.

Strategies for Cost-Effective Private Health Insurance

Now that we've explored the fundamental cost drivers, let's delve into some strategies to help you secure cost-effective private health insurance without compromising on coverage.

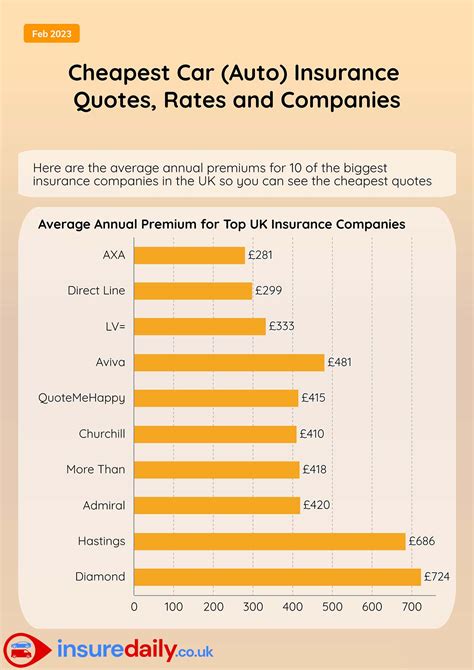

Compare Providers and Plans

The private health insurance market is diverse, with numerous providers offering a range of plans. Take the time to compare different providers and their offerings. Look beyond the premium and consider the coverage, benefits, and any exclusions. Some plans might appear cheaper upfront but could have significant limitations, making them unsuitable for your needs.

Online comparison tools and insurance brokers can be valuable resources. They provide a comprehensive overview of available plans, allowing you to make an informed decision. Additionally, many insurance providers offer online quotes, making it convenient to assess and compare various options.

Assess Your Healthcare Needs

Before choosing a plan, assess your healthcare needs. Consider your medical history, any ongoing treatments or medications, and your family's healthcare requirements. This assessment will help you determine the level of coverage you need. For instance, if you require regular specialist consultations, ensure your plan covers this adequately.

It's also beneficial to look at your past healthcare expenses. Analyzing your medical records can provide insights into your future healthcare needs. This data-driven approach ensures you select a plan that aligns with your unique requirements, avoiding unnecessary expenses.

Consider High-Deductible Plans

High-deductible health plans (HDHPs) offer a cost-effective option for those who are generally healthy and have minimal healthcare needs. These plans have lower premiums but higher deductibles, meaning you pay more out-of-pocket before the insurance coverage kicks in. However, HDHPs are often paired with Health Savings Accounts (HSAs), allowing you to save pre-tax dollars for future healthcare expenses.

HSAs provide a tax-efficient way to manage your healthcare costs. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This dual benefit makes HDHPs an attractive option for those looking to save on insurance premiums while maintaining control over their healthcare finances.

Utilize Preventive Care

Preventive care is a powerful tool to maintain your health and manage insurance costs. Many private health insurance plans offer coverage for preventive services, such as vaccinations, regular check-ups, and screenings. Taking advantage of these services can help identify potential health issues early on, leading to more effective treatment and lower long-term costs.

Additionally, maintaining a healthy lifestyle through regular exercise, a balanced diet, and stress management can reduce your risk of developing costly health conditions. This proactive approach not only improves your overall well-being but also contributes to lower insurance premiums over time.

Review and Adjust Your Plan Periodically

Your healthcare needs and the private health insurance market are not static. It's essential to review your plan periodically to ensure it continues to meet your requirements. Life events like marriage, the birth of a child, or a change in employment can significantly impact your healthcare needs and the suitability of your current plan.

Stay informed about changes in the insurance market, new plans, and any updates to your existing provider's offerings. Regularly assessing your plan ensures you're not overpaying for coverage you no longer need or missing out on more suitable options that could provide better value.

Real-World Examples: Understanding Private Health Insurance Costs

To bring these concepts to life, let's explore some real-world examples of private health insurance costs and the factors influencing them.

Example 1: Young Professional, Single, Urban Dweller

Sarah, a 28-year-old professional living in a metropolitan area, opts for a basic private health insurance plan. Her premium is relatively low at $400 per month due to her young age and good health. The plan covers essential medical services, including emergency care, specialist consultations, and a limited number of prescription medications.

However, as Sarah's career progresses and her income increases, she decides to upgrade her plan. She chooses a more comprehensive option with a higher premium of $650 per month. This plan provides broader coverage, including dental and vision care, as well as higher limits for prescription medications. Sarah's decision is driven by her desire for more comprehensive protection and the financial stability to support a higher premium.

Example 2: Family of Four, Rural Setting

The Jones family, consisting of parents Jane and John, and their two children aged 10 and 12, live in a rural area. They opt for a family plan with a premium of $1,200 per month. The plan covers a wide range of medical services, including specialist consultations, hospital stays, and prescription medications. The family size discount makes this plan more cost-effective than individual plans.

Jane, who has a history of high blood pressure, ensures the plan includes coverage for her regular medications and check-ups. Additionally, the plan's coverage for children's vaccinations and regular check-ups provides peace of mind for the entire family. The Jones family's choice demonstrates the importance of assessing individual needs and selecting a plan that offers comprehensive coverage tailored to the entire family.

Example 3: Senior Citizen, Urban Retirement Community

Mr. Johnson, a 72-year-old retiree living in an urban retirement community, requires a plan that caters to his age-related health needs. He opts for a comprehensive plan with a premium of $1,500 per month. The plan includes coverage for specialized geriatric care, prescription medications for chronic conditions, and regular check-ups to monitor his health.

Mr. Johnson's choice highlights the importance of age-appropriate coverage. As we age, our healthcare needs evolve, and a plan that addresses these specific requirements is crucial. Additionally, living in a retirement community with easy access to healthcare facilities influenced his decision, ensuring he could receive timely and convenient medical attention.

The Future of Private Health Insurance Costs

The landscape of private health insurance is continually evolving, influenced by technological advancements, changing healthcare needs, and policy reforms. Here's a glimpse into the future and how these factors might impact insurance costs.

Telemedicine and Digital Health Solutions

The integration of telemedicine and digital health solutions is revolutionizing healthcare access and delivery. These technologies offer convenient and cost-effective alternatives to traditional in-person consultations. Insurance providers are increasingly incorporating telemedicine benefits into their plans, which could lead to lower premiums over time as the costs of healthcare delivery decrease.

Additionally, digital health solutions, such as wearable devices and health tracking apps, provide valuable data for both individuals and insurance companies. This data-driven approach allows for more accurate risk assessment and personalized insurance plans, potentially reducing costs for both parties.

Policy Reforms and Universal Healthcare

Policy reforms and the movement towards universal healthcare are gaining traction globally. These initiatives aim to provide affordable and accessible healthcare to all citizens. While the specifics vary by region, the overall goal is to reduce healthcare costs and ensure equitable access.

In regions where universal healthcare is implemented, private health insurance often coexists with the public system, providing additional benefits and specialized care. In such scenarios, private insurance costs are influenced by the overall healthcare landscape and the unique needs of individuals seeking supplementary coverage.

Changing Healthcare Needs and Trends

As our understanding of healthcare evolves, so do our needs. Emerging trends, such as precision medicine and personalized healthcare, offer tailored treatment approaches based on individual genetic profiles and health data. While these advancements can lead to more effective treatments, they also come with higher costs.

Insurance providers will need to adapt their plans to incorporate these emerging healthcare trends. This could result in more specialized and expensive plans for those seeking cutting-edge treatments. However, for the majority of individuals, the focus will likely remain on cost-effective, broad-spectrum coverage.

Conclusion

Understanding the complexities of private health insurance costs empowers you to make informed decisions about your healthcare coverage. By considering the fundamental cost drivers and employing cost-effective strategies, you can secure a plan that meets your unique needs without breaking the bank.

Remember, your healthcare and financial situation are unique. Regularly assess your needs, stay informed about the insurance market, and don't hesitate to seek professional advice. With the right plan in place, you can navigate the healthcare system with confidence, knowing you're covered for whatever life throws your way.

Can I get private health insurance if I have a pre-existing condition?

+Yes, many insurance providers offer plans for individuals with pre-existing conditions. However, the premium might be higher, and there may be certain exclusions or waiting periods for specific conditions. It’s essential to carefully review the plan details to understand the coverage and any limitations.

Are there any tax benefits associated with private health insurance?

+Yes, in many countries, private health insurance premiums are tax-deductible. Additionally, contributions to Health Savings Accounts (HSAs) paired with High-Deductible Health Plans (HDHPs) offer tax advantages, allowing you to save pre-tax dollars for future healthcare expenses.

What happens if I need to make a claim on my private health insurance?

+Making a claim on your private health insurance involves submitting the necessary documentation, such as medical bills and receipts, to your insurance provider. The process can vary depending on the insurer and the specific plan. It’s important to carefully review your policy’s claim process and any requirements to ensure a smooth experience.

Can I switch insurance providers if I find a better plan?

+Absolutely! The private health insurance market is competitive, and you have the freedom to switch providers if you find a plan that better suits your needs or offers more favorable terms. However, it’s crucial to carefully review the new plan’s coverage, benefits, and any potential waiting periods or exclusions.

How often should I review my private health insurance plan?

+It’s recommended to review your insurance plan annually or whenever there’s a significant change in your personal circumstances, such as a new job, marriage, or the birth of a child. Regular reviews ensure your plan continues to meet your evolving healthcare needs and provides the best value for your money.