Car Insurance Comparison Tool

When it comes to car insurance, making an informed decision can be a daunting task. With countless providers offering various coverage options, finding the right policy at the best price can be challenging. That's where a car insurance comparison tool steps in as your trusted ally, simplifying the process and empowering you to make confident choices. This comprehensive guide delves into the world of car insurance comparison tools, exploring their features, benefits, and how they can revolutionize your insurance shopping experience.

Unveiling the Power of Car Insurance Comparison Tools

Car insurance comparison tools are digital platforms designed to streamline the process of comparing insurance policies. These innovative tools act as a one-stop shop, bringing together multiple insurance providers and their offerings onto a single platform. By inputting your specific needs and preferences, these tools provide tailored recommendations, helping you navigate the complex world of car insurance with ease.

Features and Functionality

Car insurance comparison tools offer a range of features to enhance your insurance shopping experience. Here’s a breakdown of some key functionalities:

- Quick Quotes: Instantly receive multiple quotes from different providers, allowing you to compare prices and coverage options at a glance.

- Customizable Options: Tailor your search by specifying your desired coverage limits, deductibles, and additional features, ensuring you get quotes that match your exact needs.

- Provider Ratings: Access comprehensive ratings and reviews of insurance providers, helping you assess their reliability, customer service, and overall reputation.

- Comparison Charts: Visualize the differences between policies with detailed comparison charts, making it easier to identify the best fit for your budget and requirements.

- Expert Advice: Some tools provide educational resources and expert guidance, offering valuable insights to help you understand complex insurance terms and make informed decisions.

By leveraging these features, car insurance comparison tools empower you to take control of your insurance journey, ensuring you find the most suitable policy at a competitive price.

Benefits of Using a Comparison Tool

Using a car insurance comparison tool offers a multitude of advantages. Here’s a glimpse into how these tools can revolutionize your insurance shopping experience:

- Time and Effort Savings: Instead of spending hours researching and contacting individual providers, comparison tools consolidate the process, saving you valuable time and effort.

- Personalized Recommendations: By considering your unique circumstances, these tools provide tailored recommendations, ensuring you receive quotes that align with your specific needs and preferences.

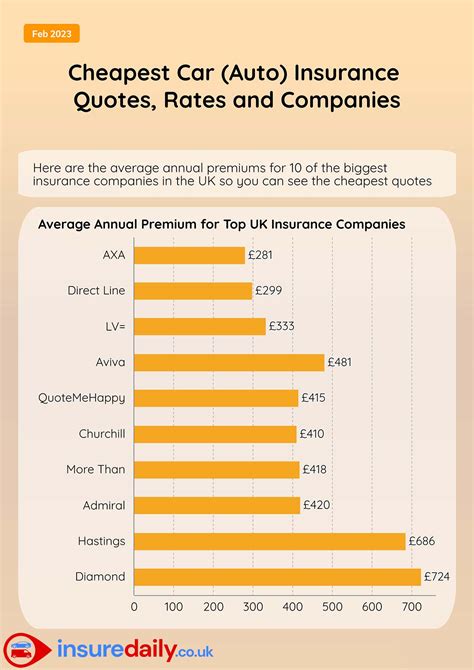

- Price Comparison: Easily compare prices from multiple providers, allowing you to identify the most cost-effective options and potentially save hundreds of dollars on your insurance premiums.

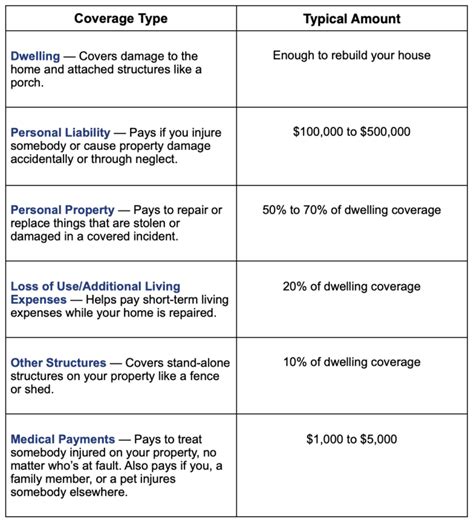

- Coverage Insights: Gain a deeper understanding of the coverage options available, helping you make informed decisions and ensure you have the right protection for your vehicle and personal circumstances.

- Provider Transparency: Access transparent information about insurance providers, including their financial stability, customer satisfaction ratings, and claim handling processes, enabling you to choose a reputable and reliable company.

With the benefits of car insurance comparison tools, you can confidently navigate the insurance market, make well-informed choices, and secure the best coverage for your vehicle.

Maximizing Your Experience: Tips and Best Practices

To make the most of your car insurance comparison tool experience, consider the following tips and best practices:

- Define Your Needs: Clearly identify your insurance requirements, including the type of coverage you need, your preferred deductibles, and any additional features you desire. This will help the tool provide more accurate recommendations.

- Compare Multiple Quotes: Don't settle for the first quote you receive. Take advantage of the tool's ability to provide multiple quotes and compare them side by side. This ensures you get the best possible deal and aren't missing out on better options.

- Read Reviews: Utilize the provider ratings and reviews available on the comparison tool. Reading firsthand experiences from other customers can provide valuable insights into the quality of service and claim handling processes of different insurance providers.

- Understand Exclusions: Pay close attention to the exclusions and limitations of each policy. Understanding what is not covered can help you make more informed decisions and ensure you have adequate protection for your specific circumstances.

- Consider Long-Term Savings: While price is an important factor, also consider the long-term value of the policy. Some providers may offer loyalty discounts or additional perks that can save you money over time. Weigh these factors to find the most cost-effective option in the long run.

By following these tips, you can maximize the benefits of using a car insurance comparison tool and make confident decisions that align with your insurance needs and budget.

The Future of Car Insurance Shopping

As technology continues to advance, car insurance comparison tools are evolving to offer even more sophisticated features. Here’s a glimpse into the future of car insurance shopping:

- AI-Powered Recommendations: Advanced algorithms and artificial intelligence will further personalize insurance recommendations, taking into account your driving behavior, location, and even real-time traffic conditions to provide even more accurate and tailored quotes.

- Real-Time Pricing: Comparison tools will leverage real-time data and pricing algorithms to offer dynamic quotes, ensuring you receive the most up-to-date and competitive prices from insurance providers.

- In-Depth Coverage Analysis: Future tools will provide comprehensive coverage analysis, breaking down the nuances of each policy and explaining the implications of different coverage options, helping you make more informed choices.

- Seamless Policy Management: Integration with insurance providers' systems will allow for seamless policy management, enabling you to easily update your coverage, make payments, and access important documents directly from the comparison tool.

- Enhanced Customer Support: With the integration of chatbots and virtual assistants, comparison tools will offer 24/7 customer support, providing instant answers to your insurance-related queries and guiding you through the entire insurance shopping process.

The future of car insurance shopping is promising, with technology revolutionizing the way we compare and purchase insurance policies. Car insurance comparison tools will continue to evolve, making the process more efficient, personalized, and accessible to all.

Conclusion

Car insurance comparison tools have revolutionized the way we shop for insurance, offering a streamlined and personalized experience. By leveraging these powerful tools, you can save time, money, and effort while finding the perfect insurance policy that meets your unique needs. As technology advances, the future of car insurance shopping looks brighter than ever, with innovative features and enhanced capabilities that will further empower consumers.

How accurate are the quotes provided by car insurance comparison tools?

+Car insurance comparison tools strive for accuracy by gathering information directly from insurance providers. However, it’s important to note that quotes are estimates and may not reflect the final price you’ll pay. Factors like your driving record, credit score, and specific policy details can impact the final premium. Always review the fine print and contact providers for a more precise quote.

Can I compare all types of car insurance policies using these tools?

+Yes, car insurance comparison tools are designed to accommodate a wide range of policy types, including liability-only coverage, comprehensive plans, and specialized options like classic car insurance or ride-sharing coverage. You can typically filter your search based on your specific needs to find the most relevant policies.

What if I have a unique insurance situation or specific requirements?

+Car insurance comparison tools often provide advanced search options to accommodate unique circumstances. You can input specific details like multiple vehicles, young drivers, or high-risk occupations to find policies tailored to your needs. Additionally, some tools offer live chat or phone support to assist with complex insurance situations.