Insurance School

Welcome to the world of insurance education, where knowledge is your greatest asset. Insurance School, a term that encompasses a vast landscape of learning and preparation, is an essential gateway for those aspiring to build a career in the insurance industry. This article delves into the intricacies of Insurance School, offering an in-depth exploration of its significance, curriculum, and the transformative impact it can have on your professional journey.

Unveiling the Significance of Insurance School

Insurance School represents a pivotal step towards a comprehensive understanding of the insurance sector. It is here that individuals are equipped with the foundational knowledge and skills necessary to navigate the complex landscape of insurance products, regulations, and ethical practices. This educational journey is not merely about passing exams; it is about developing a deep appreciation for the role of insurance in society and its potential to impact lives.

The importance of Insurance School extends beyond theoretical learning. It provides a structured framework for professionals to stay updated with the latest industry trends, technologies, and regulatory changes. This continuous learning process is vital in an industry that is constantly evolving to meet the dynamic needs of consumers and businesses alike.

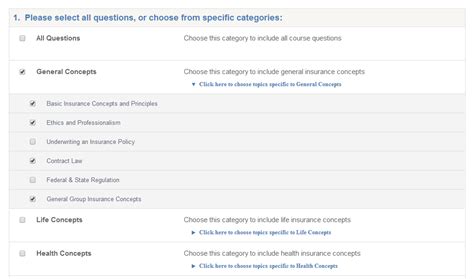

Curriculum: A Deep Dive into Insurance Education

The curriculum of Insurance School is meticulously designed to cover a broad spectrum of topics, ensuring a holistic grasp of the insurance domain. Core modules typically include an introduction to the insurance industry, covering its history, structure, and key players. Students delve into the fundamentals of insurance contracts, understanding the legal and ethical aspects that underpin these agreements.

Insurance products form a significant part of the curriculum, with detailed studies on life insurance, health insurance, property and casualty insurance, and specialty lines. Students learn about the various types of policies, their coverage, exclusions, and the underwriting process. This practical knowledge is further enhanced by modules on risk management, where students explore strategies to identify, assess, and mitigate risks.

Additionally, Insurance School curriculums often include sections on actuarial science, providing insights into the mathematical and statistical techniques used in insurance. Financial management and accounting modules equip students with the skills to understand and manage the financial aspects of insurance businesses. The curriculum may also touch upon regulatory compliance, ethics, and professional conduct, ensuring that graduates are well-prepared to navigate the legal and ethical intricacies of the industry.

Specialized Courses and Electives

Beyond the core curriculum, Insurance School offers a range of specialized courses and electives to cater to diverse career paths within the industry. These may include courses on insurance sales and marketing, providing practical skills for those aspiring to be insurance agents or brokers. Other specialized courses might focus on insurance technology, data analytics, or specific sectors such as marine, aviation, or cyber insurance.

Elective modules allow students to explore areas of personal interest or career focus. For instance, students interested in the health insurance sector might opt for courses on healthcare finance or medical underwriting. Those leaning towards the legal aspects of insurance could choose modules on insurance law or dispute resolution.

| Specialization Area | Course Examples |

|---|---|

| Insurance Sales and Marketing | Effective Communication Strategies, Customer Relationship Management |

| Insurance Technology | InsurTech Innovations, Digital Transformation in Insurance |

| Healthcare Insurance | Healthcare Finance, Medical Underwriting |

| Legal and Compliance | Insurance Law, Dispute Resolution |

The Transformative Impact: Shaping Insurance Careers

The influence of Insurance School extends far beyond the classroom. It is a catalyst for personal and professional growth, empowering individuals to pursue rewarding careers in various insurance sectors. The skills and knowledge gained during this educational journey are invaluable, shaping the trajectory of insurance professionals’ careers.

For those aspiring to be insurance agents or brokers, Insurance School provides a solid foundation to build a successful practice. The understanding of insurance products, risk management, and sales strategies learned during the program is instrumental in developing a thriving client base and delivering tailored insurance solutions.

Insurance School graduates are also well-positioned for careers in insurance underwriting. The in-depth knowledge of insurance products and risk assessment techniques acquired during their studies enables them to make informed decisions about policy coverage and pricing. This expertise is crucial in ensuring the financial stability of insurance companies and providing adequate protection to policyholders.

Moreover, the curriculum's focus on regulatory compliance and ethical practices prepares graduates to navigate the complex legal landscape of the insurance industry. This is especially important given the highly regulated nature of the sector, where compliance is not just a legal requirement but also a cornerstone of maintaining public trust and confidence.

Career Opportunities and Industry Recognition

The comprehensive nature of Insurance School programs, coupled with the practical skills they impart, makes graduates highly sought-after by insurance companies and related industries. The qualifications earned through these programs are often recognized as industry standards, opening doors to a wide range of career opportunities.

Graduates can pursue careers as insurance underwriters, brokers, agents, or consultants. They may also find opportunities in insurance companies' corporate offices, working in areas such as product development, actuarial analysis, or claims management. The knowledge gained from Insurance School can also be applied in related fields, such as risk management consulting or financial services.

Furthermore, many Insurance School programs offer opportunities for industry networking and mentorship, connecting students with established professionals in the field. These connections can provide invaluable insights into the industry, open doors to job opportunities, and offer guidance on career development.

Future Implications: Navigating Industry Changes

The insurance industry is undergoing significant transformations, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Insurance School plays a crucial role in preparing professionals to navigate these changes effectively.

As the industry embraces digital technologies, from online insurance platforms to advanced data analytics, Insurance School curriculums must adapt to ensure graduates are equipped with the necessary digital skills. This includes understanding the potential of big data and analytics in insurance, as well as the ethical considerations surrounding data privacy and security.

Additionally, with the rise of InsurTech startups and digital disruptors, the insurance industry is experiencing a wave of innovation. Insurance School programs should incorporate modules on entrepreneurial skills and innovation management to prepare students for the dynamic nature of the industry. This includes understanding the potential of blockchain, artificial intelligence, and other emerging technologies in insurance.

The changing regulatory landscape, especially with the increased focus on consumer protection and environmental, social, and governance (ESG) considerations, also demands a responsive curriculum. Insurance School programs should include modules on regulatory changes, sustainability in insurance, and ethical considerations to ensure graduates are well-prepared to navigate these complex issues.

Conclusion: Empowering Insurance Professionals

Insurance School is more than just an educational institution; it is a gateway to a dynamic and impactful career. By offering a comprehensive curriculum that combines theoretical knowledge with practical skills, Insurance School empowers individuals to make a meaningful contribution to the insurance industry. As the industry continues to evolve, the role of Insurance School becomes even more crucial in shaping the future of insurance professionals.

Whether you are a newcomer to the industry or an experienced professional seeking to enhance your skills, Insurance School provides the tools and knowledge to thrive in this exciting and ever-changing field. It is through this dedicated learning journey that the insurance sector can continue to innovate, adapt, and provide essential protection and financial security to individuals and businesses worldwide.

What are the prerequisites for enrolling in an Insurance School program?

+

Prerequisites for Insurance School programs can vary, but generally, a high school diploma or equivalent is the minimum requirement. Some programs may have additional requirements such as a certain GPA or relevant work experience. It’s best to check with the specific Insurance School you’re interested in for their exact prerequisites.

How long does it typically take to complete an Insurance School program?

+

The duration of Insurance School programs can vary. Full-time programs may take around 2-3 years to complete, while part-time or online programs might take longer, ranging from 3 to 5 years. The duration depends on factors like the intensity of the program, the number of courses taken per term, and the student’s availability and commitment.

Are there online or part-time options for studying at Insurance School?

+

Yes, many Insurance Schools offer online or part-time study options to cater to students with diverse schedules and commitments. These flexible programs allow students to balance their education with work or other responsibilities, making insurance education more accessible.

What career paths can I pursue after completing an Insurance School program?

+

Completing an Insurance School program opens up a wide range of career opportunities. Graduates can pursue roles such as insurance agents, brokers, underwriters, risk managers, actuaries, or consultants. The skills and knowledge gained during the program provide a solid foundation for various careers in the insurance industry.