Cigna Insurance

Cigna, a well-known name in the world of health insurance, has a rich history and a significant presence in the global healthcare market. With its roots dating back to the 18th century, Cigna has evolved into a comprehensive health services company, offering a wide range of insurance plans and healthcare solutions. This article delves into the intricacies of Cigna Insurance, exploring its offerings, impact, and future prospects.

A Legacy of Healthcare Excellence: Cigna’s Evolution

Cigna’s journey began in 1792 with the formation of the Insurance Company of North America (INA), one of the earliest insurance companies in the United States. Over the centuries, INA merged with and acquired various other insurance providers, eventually leading to the creation of Cigna as we know it today. The company’s name, Cigna, was adopted in 1982, marking a new era in its commitment to providing innovative healthcare solutions.

Throughout its history, Cigna has played a pivotal role in shaping the healthcare industry. It has been at the forefront of introducing groundbreaking insurance products and services, ensuring accessibility and affordability for individuals and businesses alike. Cigna's expertise lies in its ability to adapt to the ever-changing healthcare landscape, incorporating technological advancements and evolving regulatory frameworks into its strategies.

Key Milestones in Cigna’s Timeline

- 1982: Adoption of the Cigna brand name, symbolizing a unified identity for its diverse healthcare offerings.

- 1998: Expansion into the international market with the acquisition of INA’s European operations, marking Cigna’s global reach.

- 2008: Introduction of the Cigna Global Health Benefits plan, providing comprehensive coverage for expatriates and internationally mobile individuals.

- 2015: Launch of Cigna’s unique wellness program, focusing on preventive care and personalized health management.

- 2020: During the COVID-19 pandemic, Cigna played a critical role in supporting its customers with expanded coverage, telehealth services, and educational resources.

These milestones showcase Cigna's commitment to staying ahead of the curve, ensuring that its insurance plans remain relevant and responsive to the dynamic needs of its customers.

Cigna Insurance: A Comprehensive Overview

Cigna Insurance offers a vast array of products tailored to meet the diverse healthcare needs of individuals, families, and businesses. Its portfolio includes:

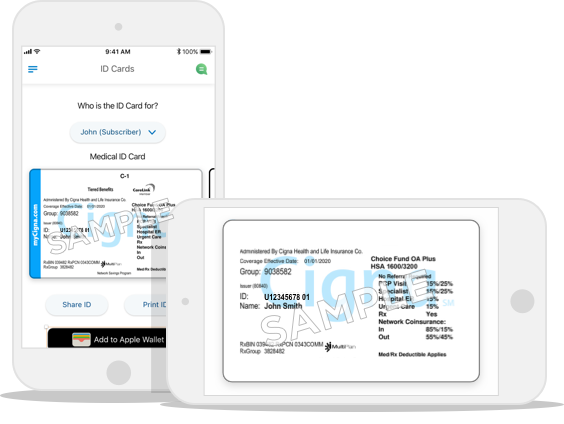

Health Insurance Plans

Cigna’s health insurance plans are designed to provide comprehensive coverage, ensuring access to quality healthcare services. These plans cater to various demographics, offering flexibility and customization. Key features include:

- Individual and Family Plans: Tailored coverage for individuals and families, including options for maternity care, vision, and dental benefits.

- Group Health Plans: Comprehensive coverage for businesses, with customizable options to meet the unique needs of each organization.

- Medicare Advantage Plans: Designed for individuals eligible for Medicare, offering additional benefits and reduced out-of-pocket expenses.

- Short-Term Health Insurance: Temporary coverage for those in transition or awaiting other insurance plans.

Dental and Vision Plans

Cigna’s dental and vision plans provide specialized coverage, ensuring optimal oral and visual health. These plans offer:

- Dental Care: A range of options, from preventive care to complex procedures, with access to a network of preferred dental providers.

- Vision Benefits: Comprehensive eye care, including exams, glasses, and contact lens coverage, with a focus on early detection and treatment of vision issues.

Life and Accident Insurance

Cigna’s life and accident insurance plans provide financial protection and peace of mind. These plans include:

- Life Insurance: Term life and whole life insurance options, offering coverage for various life stages and needs.

- Accidental Injury Insurance: Coverage for accidental injuries, providing financial support during recovery and rehabilitation.

Critical Illness and Disability Insurance

Cigna’s critical illness and disability insurance plans offer crucial support during challenging times. These plans provide:

- Critical Illness Coverage: Financial protection in the event of a serious illness, helping cover treatment costs and living expenses.

- Disability Insurance: Income protection for individuals unable to work due to illness or injury, ensuring financial stability during recovery.

Travel and Expatriate Insurance

Cigna’s travel and expatriate insurance plans cater to those on the move, providing essential coverage while away from home. These plans include:

- Travel Insurance: Comprehensive coverage for trips, including medical emergencies, trip cancellations, and lost luggage.

- Expatriate Insurance: Tailored plans for individuals living and working abroad, offering global coverage and support.

Cigna’s Impact: Empowering Individuals and Communities

Cigna’s impact extends far beyond its insurance offerings. The company actively engages in initiatives to improve the overall health and well-being of individuals and communities. Some notable examples include:

Wellness Programs

Cigna’s wellness programs focus on preventive care and healthy lifestyle choices. These initiatives aim to:

- Promote physical activity and healthy eating habits.

- Provide educational resources and support for managing chronic conditions.

- Offer incentives and rewards for achieving wellness goals.

Through these programs, Cigna encourages its customers to take an active role in their health, ultimately reducing the need for extensive medical interventions.

Community Outreach and Philanthropy

Cigna is deeply committed to giving back to the communities it serves. The company’s philanthropic efforts include:

- Supporting healthcare access and education in underserved communities.

- Sponsoring health-focused initiatives and events to raise awareness.

- Collaborating with non-profit organizations to address critical health issues.

By investing in these initiatives, Cigna aims to create a positive impact on a broader scale, fostering healthier communities and a more resilient healthcare system.

The Future of Cigna Insurance: Innovations and Trends

As the healthcare landscape continues to evolve, Cigna remains dedicated to staying at the forefront of innovation. The company is actively exploring and implementing cutting-edge technologies and strategies to enhance its insurance offerings. Some key areas of focus include:

Digital Health and Telemedicine

Cigna recognizes the growing importance of digital health solutions. The company is investing in telemedicine platforms, allowing customers to access healthcare services remotely. This not only improves convenience but also expands access to healthcare for those in remote areas or with limited mobility.

Artificial Intelligence and Data Analytics

Cigna is leveraging AI and data analytics to enhance its underwriting processes and risk assessment. These technologies enable the company to identify patterns, predict healthcare trends, and develop more personalized insurance plans.

Partnerships and Acquisitions

Cigna continues to explore strategic partnerships and acquisitions to expand its reach and capabilities. By collaborating with healthcare providers, technology companies, and other industry leaders, Cigna aims to create a more integrated and efficient healthcare ecosystem.

Global Expansion

With a strong presence in the United States and Europe, Cigna is eyeing further global expansion. The company is actively pursuing opportunities in emerging markets, aiming to bring its comprehensive insurance solutions to a wider audience.

Conclusion: A Trusted Companion in Healthcare

Cigna Insurance has established itself as a trusted partner in the healthcare industry, offering a comprehensive range of insurance plans and services. Its commitment to innovation, accessibility, and community impact positions it as a leader in the field. As the healthcare landscape continues to evolve, Cigna remains poised to adapt and thrive, ensuring that its customers receive the best possible care and support.

What sets Cigna’s health insurance plans apart from competitors?

+Cigna’s health insurance plans stand out for their comprehensive coverage, customization options, and focus on preventive care. The company’s commitment to wellness and its innovative approach to healthcare make its plans a preferred choice for many.

How does Cigna support customers during the COVID-19 pandemic?

+Cigna offered expanded coverage for COVID-19-related treatments, waived cost-sharing for telehealth services, and provided educational resources to help customers navigate the pandemic. The company’s response highlighted its dedication to customer well-being during challenging times.

What are the key benefits of Cigna’s wellness programs?

+Cigna’s wellness programs focus on preventive care, providing incentives and resources to encourage healthy lifestyle choices. These programs aim to reduce the incidence of chronic diseases, improve overall health, and lower healthcare costs for both individuals and the company.