Auto Insurance Quick Quote

Auto insurance is a vital aspect of vehicle ownership, offering financial protection and peace of mind to drivers across the globe. With the rise of digital technology, obtaining an auto insurance quick quote has become more accessible and convenient than ever. In this comprehensive guide, we will delve into the world of auto insurance quick quotes, exploring the process, factors influencing rates, and providing valuable insights to help you navigate this crucial aspect of vehicle ownership.

Understanding Auto Insurance Quick Quotes

Auto insurance quick quotes are a fast and efficient way to obtain preliminary estimates for vehicle insurance coverage. These quotes provide an initial assessment of the potential cost of insurance, allowing drivers to compare options and make informed decisions. While a quick quote does not provide a precise insurance policy cost, it serves as a valuable tool for initial research and comparison.

The Process of Obtaining a Quick Quote

Obtaining an auto insurance quick quote is a straightforward process that can be completed online or over the phone. Here’s a step-by-step breakdown:

- Choose a Reputable Insurance Provider: Start by selecting a trusted insurance company that offers online quoting services. Research their reputation, customer reviews, and the range of coverage options they provide.

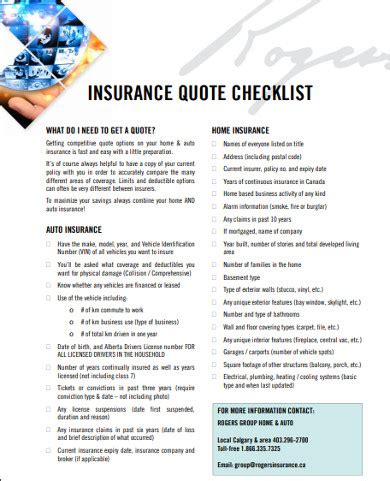

- Gather Necessary Information: Before initiating the quote process, gather essential details about your vehicle, driving history, and personal information. This includes the make, model, and year of your car, as well as your driver's license number, social security number, and previous insurance details.

- Visit the Insurance Provider's Website: Navigate to the chosen insurance provider's official website. Look for a "Get a Quote" or "Quick Quote" button or link, which will direct you to the online quoting tool.

- Enter Vehicle and Driver Details: Fill out the online form with accurate information about your vehicle, including its make, model, year, mileage, and any additional features or modifications. Provide details about your driving history, such as accident and violation records.

- Select Coverage Options: Choose the type and level of coverage you desire. Most insurance providers offer options for liability, collision, comprehensive, and additional coverages like personal injury protection or uninsured/underinsured motorist coverage.

- Provide Personal Information: Enter your personal details, including your name, address, date of birth, and contact information. Some providers may also require information about your occupation and education level.

- Review and Submit: Carefully review the information you have provided to ensure accuracy. Double-check the coverage options and limits to ensure they align with your needs. Once satisfied, submit the quote request.

- Receive Your Quick Quote: Within a short period, typically a few minutes, you will receive an estimated quote for your auto insurance. This quote will provide an overview of the potential cost of coverage based on the information you provided.

Factors Influencing Auto Insurance Rates

Auto insurance rates are determined by various factors, and understanding these influences can help you make more informed choices. Here are some key factors that impact insurance rates:

- Driver's Age and Experience: Younger drivers, especially those under 25, often face higher insurance rates due to their lack of driving experience. Conversely, mature drivers with a long history of safe driving may benefit from lower rates.

- Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role in insurance rates. Sports cars and luxury vehicles typically attract higher premiums due to their higher repair costs and theft risks. Additionally, the primary use of the vehicle (commuting, business, pleasure) can impact rates.

- Location and Driving Conditions: Where you live and drive can affect your insurance rates. Areas with higher populations, denser traffic, and a higher incidence of accidents or theft may result in higher premiums. Climate conditions and the presence of natural disasters can also influence rates.

- Driving History: Your driving record is a critical factor in determining insurance rates. A clean driving history with no accidents or violations can lead to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase insurance costs.

- Credit Score: In many regions, insurance providers consider an individual's credit score when determining rates. A higher credit score is often associated with lower insurance costs, as it is seen as an indicator of financial responsibility.

- Coverage and Deductibles: The level of coverage you choose directly impacts your insurance rates. Higher coverage limits and lower deductibles generally result in higher premiums. It's essential to find a balance between adequate coverage and affordable rates.

Maximizing Your Auto Insurance Experience

While auto insurance quick quotes provide a valuable starting point, there are additional steps you can take to optimize your insurance experience and potentially save money.

Comparing Multiple Quotes

To ensure you’re getting the best deal, compare quotes from multiple insurance providers. Each provider may have different rating factors and offer unique discounts, so exploring options can lead to significant savings. Online insurance marketplaces and comparison websites can make this process more efficient.

Bundling Policies

Consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many insurance providers offer discounts when you purchase multiple policies from them, known as a “multi-policy discount.” This can be a cost-effective way to insure your assets.

Understanding Discounts

Insurance providers offer various discounts to attract customers and reward safe driving practices. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-car discounts. Research and inquire about available discounts to lower your insurance costs.

Maintaining a Safe Driving Record

A clean driving record is one of the most effective ways to keep your insurance rates low. Avoid accidents, avoid traffic violations, and practice safe driving habits. Additionally, consider enrolling in a defensive driving course, which may qualify you for further discounts.

Reviewing Your Policy Regularly

Insurance needs can change over time, so it’s essential to review your policy annually. Assess whether your coverage levels are still adequate and if any life changes (such as a new vehicle or a move to a different location) require policy adjustments. Regular reviews ensure you have the right coverage at the right price.

Auto Insurance Quick Quotes: Future Trends and Innovations

The world of auto insurance is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of auto insurance quick quotes:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are gaining traction, offering personalized insurance rates based on real-time driving data. These programs use GPS and telematics technology to monitor driving behavior, rewarding safe drivers with lower premiums.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are being utilized to enhance the accuracy and speed of insurance quoting processes. These technologies can analyze vast amounts of data, including driving behavior, weather conditions, and accident patterns, to provide more precise quotes.

Digital Onboarding and Policy Management

Insurance providers are investing in digital platforms and mobile apps to streamline the quoting and policy management process. Digital onboarding allows for a more seamless and efficient experience, reducing the time and effort required to obtain insurance coverage.

Incorporating Connected Car Data

As vehicles become increasingly connected, insurance providers are exploring ways to leverage vehicle data for more accurate risk assessment. Connected car data, such as mileage, maintenance records, and driving behavior, can provide valuable insights into a driver’s habits and potential risks.

Conclusion

Auto insurance quick quotes are a powerful tool for drivers seeking convenient and efficient ways to explore insurance options. By understanding the process, factors influencing rates, and available strategies to optimize coverage, you can make informed decisions about your auto insurance. As the industry continues to evolve, embracing technological advancements and innovative approaches, the future of auto insurance promises even greater convenience and customization.

How accurate are auto insurance quick quotes?

+Quick quotes provide an estimated range of insurance costs based on the information you provide. While they offer a useful starting point, they may not account for all factors that influence your actual premium. It’s advisable to obtain multiple quotes and speak with an insurance agent to get a more accurate assessment.

Can I customize my coverage in a quick quote?

+Yes, most online quoting tools allow you to select different coverage options and adjust limits to suit your needs. You can choose liability, collision, comprehensive, and additional coverages, tailoring your quote to your desired level of protection.

What are some common discounts available for auto insurance?

+Common discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-policy discounts. Additionally, some providers offer discounts for vehicle safety features, anti-theft devices, and enrollment in defensive driving courses.