Geico Car Insurance Cost

When it comes to choosing car insurance, one of the most popular options in the United States is GEICO. Known for its catchy advertising campaigns and competitive rates, GEICO (Government Employees Insurance Company) has become a go-to provider for many drivers. However, the cost of GEICO car insurance can vary greatly depending on a multitude of factors. In this comprehensive guide, we will delve into the world of GEICO car insurance, exploring the various elements that influence its cost and providing valuable insights to help you make an informed decision.

Understanding GEICO Car Insurance Costs

GEICO offers a wide range of auto insurance policies tailored to meet the diverse needs of its customers. The cost of these policies is determined by a combination of personal factors, vehicle specifics, and coverage choices. Let's break down these elements to gain a clearer understanding of how GEICO calculates its insurance premiums.

Personal Factors

Your personal circumstances play a significant role in determining the cost of your GEICO car insurance. Here are some key factors that can influence your premium:

- Age and Gender: Younger drivers, particularly those under the age of 25, often face higher insurance rates due to their perceived risk. Gender can also impact premiums, although this factor is becoming less significant as insurance companies move towards gender-neutral pricing.

- Driving Record: A clean driving record with no accidents or violations is highly favorable and can lead to lower insurance costs. On the other hand, a history of accidents, speeding tickets, or DUI convictions may result in higher premiums or even policy denials.

- Credit Score: Believe it or not, your credit score can affect your insurance rates. GEICO, like many insurers, considers credit as a factor in assessing risk. A higher credit score may result in lower premiums, while a lower score could lead to increased costs.

- Marital Status: Being married can sometimes result in lower insurance rates, as married couples are often viewed as lower-risk drivers.

- Occupation and Education: Certain occupations and educational backgrounds may be associated with lower insurance rates. For example, professionals with advanced degrees or specific occupations like teachers or military personnel may qualify for discounts.

It's important to note that personal factors are beyond your control, but being aware of their impact can help you understand why your insurance premiums are set at a certain level.

Vehicle-Specific Factors

The type of vehicle you drive and its characteristics also influence the cost of your GEICO car insurance. Here's how:

- Vehicle Make and Model: Different car makes and models carry varying levels of risk. Sports cars, luxury vehicles, and high-performance models are often associated with higher insurance costs due to their potential for higher repair costs and increased likelihood of accidents.

- Vehicle Age and Condition: Older vehicles generally have lower insurance premiums compared to newer models. Additionally, the condition of your vehicle, including any modifications or customizations, can impact your insurance rates.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, air bags, and collision avoidance systems, may qualify for lower insurance rates as they reduce the risk of accidents and injuries.

- Usage and Mileage: How you use your vehicle and the number of miles you drive annually can affect your insurance rates. High-mileage drivers or those who use their vehicles for business purposes may face higher premiums.

Coverage Choices

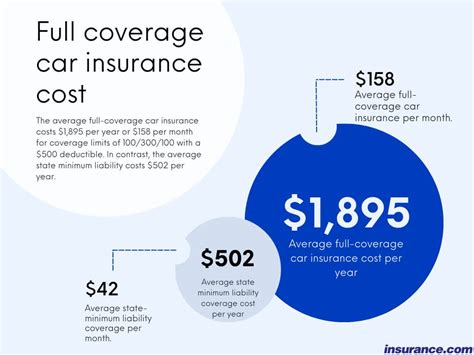

The level of coverage you choose is a critical factor in determining the cost of your GEICO car insurance. GEICO offers a range of coverage options to suit different needs and budgets:

- Liability Coverage: This is the most basic form of insurance, covering damages you cause to others' property or injuries you cause to others in an accident. It is required by law in most states, but the minimum limits can vary.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you're involved in an accident, regardless of fault. It is an optional coverage but highly recommended, especially for newer or financed vehicles.

- Comprehensive Coverage: Comprehensive coverage protects against damages caused by non-collision events, such as theft, vandalism, natural disasters, or collisions with animals. Like collision coverage, it is optional but essential for comprehensive protection.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers, regardless of fault, in the event of an accident.

- Additional Coverages: GEICO offers a range of optional coverages, including rental car reimbursement, emergency road service, and mechanical breakdown insurance, which can further customize your policy to meet your specific needs.

The more coverage you choose, the higher your insurance premiums will typically be. However, it's important to strike a balance between coverage and cost to ensure you have adequate protection without overpaying.

Factors Influencing GEICO Car Insurance Costs

In addition to the personal, vehicle, and coverage factors mentioned above, there are several other elements that can impact the cost of your GEICO car insurance. Let's explore these factors in more detail:

Location and Usage

Where you live and how you use your vehicle can significantly influence your insurance rates. Here's how these factors come into play:

- Location: Insurance rates can vary greatly depending on your state, county, and even your specific neighborhood. Areas with higher population densities, increased traffic, and a higher incidence of accidents and crimes tend to have higher insurance rates.

- Usage: The purpose for which you use your vehicle can impact your insurance rates. If you primarily use your car for personal commuting, your rates may be lower compared to those who use their vehicles for business purposes or as a primary mode of transportation for a large family.

Discounts and Savings

GEICO offers a variety of discounts to help you save on your car insurance premiums. These discounts can significantly reduce your overall costs, so it's important to understand which ones you may be eligible for:

- Multi-Policy Discount: If you have multiple insurance policies with GEICO, such as auto and homeowners insurance, you may qualify for a multi-policy discount. This is a great way to save money by bundling your insurance needs.

- Good Driver Discount: Maintaining a clean driving record for a certain period, typically 3-5 years, can earn you a good driver discount. This reward recognizes your responsible driving behavior and can lead to substantial savings.

- Military Discount: GEICO offers special discounts to active-duty military personnel, veterans, and their families. This is a way for the company to show its appreciation for their service and can result in significant cost savings.

- Student Discount: If you're a student or have a student driver in your household, you may be eligible for a discount. Good grades or certain educational achievements can also qualify you for additional savings.

- Safety Equipment Discount: Installing approved safety equipment, such as anti-theft devices or automatic braking systems, in your vehicle can earn you a discount. These features reduce the risk of theft and accidents, leading to lower insurance rates.

- Payment Method Discount: GEICO offers discounts for certain payment methods, such as paying your premium in full or using electronic payment options. These discounts are a way to encourage prompt and convenient payments.

Additional Factors

There are a few other factors that can indirectly impact the cost of your GEICO car insurance:

- Claims History: While a clean driving record is beneficial, a history of making insurance claims can also impact your rates. Frequent claims, even if they are not your fault, may result in higher premiums as insurers consider you a higher risk.

- Inflation and Market Changes: Over time, the cost of car insurance tends to increase due to inflation and changes in the insurance market. This means that even if your personal circumstances and vehicle details remain the same, your insurance rates may still rise.

- State Regulations: Each state has its own insurance regulations, which can influence the cost of car insurance. Factors such as mandatory coverage requirements, minimum liability limits, and no-fault vs. tort systems can all impact the overall cost of insurance.

Analyzing GEICO Car Insurance Performance

Now that we've explored the various factors that influence the cost of GEICO car insurance, let's take a closer look at the company's performance and customer satisfaction. Understanding how GEICO fares in the market can provide valuable insights into the value it offers to its customers.

Financial Strength and Stability

When choosing an insurance provider, it's crucial to consider their financial strength and stability. GEICO, as one of the largest insurance companies in the United States, boasts an excellent financial standing. It has consistently maintained high ratings from leading insurance rating agencies, such as AM Best and Standard & Poor's.

GEICO's strong financial position ensures that it can meet its obligations to policyholders, providing peace of mind in the event of a claim. This stability also allows the company to offer competitive rates and a wide range of coverage options to suit different customer needs.

Customer Satisfaction and Service

Customer satisfaction is a key indicator of an insurance company's performance. GEICO has a reputation for providing excellent customer service, with a dedicated team of knowledgeable and friendly representatives available to assist policyholders.

The company offers a range of convenient online and mobile tools, making it easy for customers to manage their policies, file claims, and access important information. GEICO's commitment to customer satisfaction is evident in its numerous awards and recognition, including top rankings in J.D. Power's U.S. Auto Insurance Study and the National Association of Insurance Commissioners' (NAIC) Consumer Complaint Study.

Claim Handling and Response

The true test of an insurance company's performance is often how it handles claims. GEICO has a strong track record when it comes to claim handling and response. The company is known for its efficient and timely claim processing, ensuring that policyholders receive the compensation they are entitled to without unnecessary delays.

GEICO's claim adjusters are experienced and trained to handle a wide range of claim scenarios, from minor fender benders to complex total loss cases. The company's claim process is designed to be straightforward and transparent, providing policyholders with clear guidance and support throughout the claims journey.

Policy Features and Benefits

GEICO offers a comprehensive suite of policy features and benefits to enhance the overall customer experience. These include:

- Digital Tools and Mobile Apps: GEICO provides a user-friendly online platform and mobile apps, allowing policyholders to manage their policies, pay bills, and access policy documents from anywhere, anytime.

- Accident Forgiveness: This optional coverage feature waives rate increases after an at-fault accident, providing peace of mind and protection against premium hikes.

- Emergency Roadside Assistance: GEICO offers 24/7 roadside assistance, including towing, battery jumps, flat tire changes, and more, providing valuable support in unexpected situations.

- Mechanical Breakdown Insurance: This coverage option provides protection against unexpected vehicle repairs, offering peace of mind and financial security.

- Rental Car Reimbursement: In the event of an insured loss, GEICO's rental car reimbursement coverage can help cover the cost of a rental vehicle, ensuring you have a reliable mode of transportation during repairs.

Comparative Analysis: GEICO vs. Competitors

To gain a comprehensive understanding of GEICO's position in the market, it's beneficial to compare it with other leading car insurance providers. Let's take a look at how GEICO stacks up against some of its competitors:

| Insurance Provider | Average Annual Premium | Discounts Offered | Customer Satisfaction |

|---|---|---|---|

| GEICO | $1,200 - $1,500 | Multi-policy, good driver, military, student, safety equipment, payment method | 4.6/5 (J.D. Power) |

| State Farm | $1,300 - $1,600 | Multi-policy, good driver, defensive driving, student, loyalty | 4.4/5 (J.D. Power) |

| Progressive | $1,100 - $1,400 | Multi-policy, good driver, snapshot discount, military, student, loyalty | 4.3/5 (J.D. Power) |

| Allstate | $1,400 - $1,700 | Multi-policy, good student, safe driving, loyalty | 4.2/5 (J.D. Power) |

| USAA | $900 - $1,200 | Multi-policy, good driver, military, loyalty | 4.7/5 (J.D. Power) |

As the table illustrates, GEICO offers competitive average annual premiums and an extensive range of discounts. Its customer satisfaction rating is impressive, ranking it among the top insurance providers in the industry. While USAA offers even lower premiums, it is exclusively available to military members and their families.

Future Implications and Industry Trends

The car insurance industry is constantly evolving, and GEICO, like other insurers, is adapting to stay ahead of the curve. Here are some key trends and future implications to consider:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle usage, is gaining popularity in the insurance industry. GEICO offers a usage-based insurance program called "GEICO DriveEasy" that uses a small device installed in your vehicle to monitor driving habits. This program can result in discounts for safe driving behavior.

As telematics becomes more prevalent, it is likely that GEICO and other insurers will further integrate this technology into their policies, offering more personalized rates based on actual driving behavior.

Digital Transformation and Online Services

The insurance industry is increasingly moving towards digital transformation, and GEICO has embraced this trend. The company continues to enhance its online and mobile platforms, making it easier for customers to manage their policies, file claims, and access important information.

As technology advances, we can expect GEICO to continue improving its digital services, providing even more convenience and efficiency to its customers.

Rising Repair Costs and Inflation

One of the key challenges facing the insurance industry is the rising cost of vehicle repairs. As technology advances and vehicles become more complex, repair costs are increasing. This trend can lead to higher insurance premiums as insurers need to cover these rising expenses.

Inflation also plays a significant role in the overall cost of car insurance. As the cost of living increases, so do the costs associated with repairing and replacing vehicles, which can result in higher insurance rates over time.

Regulatory Changes and Market Dynamics

The insurance industry is heavily regulated, and changes in state and federal regulations can impact the cost and availability of car insurance. GEICO, along with other insurers, must adapt to these changes to ensure compliance and maintain a competitive edge.

Additionally, market dynamics, such as competition from new entrants and changes in consumer preferences, can influence the pricing and availability of insurance products. GEICO must remain agile and responsive to these market shifts to continue providing value to its customers.