Insurance Sbi

Welcome to an in-depth exploration of insurance offerings from the State Bank of India (SBI), India's largest public sector bank. In this article, we will delve into the comprehensive range of insurance products and services provided by SBI, highlighting their unique features, benefits, and how they cater to the diverse needs of individuals and businesses.

With a rich history spanning over two centuries, SBI has established itself as a trusted financial institution, offering a wide array of banking and financial solutions. The bank's foray into the insurance sector has further expanded its reach, providing customers with access to tailored insurance products that offer protection, security, and peace of mind.

SBI General Insurance: Comprehensive Coverage for a Secure Future

SBI General Insurance, a joint venture between SBI and Insurance Australia Group (IAG), has been at the forefront of providing innovative insurance solutions. The company offers a diverse range of products, including:

Health Insurance Plans

SBI General Insurance understands the importance of comprehensive health coverage. Their health insurance plans are designed to offer financial protection against rising medical expenses. With various plans catering to different needs, individuals and families can secure their health and well-being.

- SBI Health Companion: A comprehensive health insurance plan that covers hospitalization expenses, pre- and post-hospitalization costs, and offers tax benefits under Section 80D of the Income Tax Act.

- SBI Smart Woman: A specialized plan for women, providing coverage for critical illnesses, maternity benefits, and personal accident risks.

- SBI Family Health Companion: This plan extends coverage to the entire family, ensuring holistic protection with features like family floater and lifelong renewability.

| Plan | Coverage | Key Benefits |

|---|---|---|

| SBI Health Companion | ₹1 Lakh - ₹10 Lakh | Cashless treatment, pre-existing disease cover, no-claim bonus |

| SBI Smart Woman | ₹2 Lakh - ₹50 Lakh | Critical illness cover, maternity benefits, personal accident cover |

| SBI Family Health Companion | ₹5 Lakh - ₹15 Lakh | Family floater option, lifelong renewability, OPD cover |

Motor Insurance

SBI General Insurance offers comprehensive and third-party motor insurance plans to protect vehicles against accidents, theft, and damage. The plans provide coverage for private cars, two-wheelers, and commercial vehicles.

- SBI Motor Protect: A comprehensive plan covering own damage, third-party liability, and personal accident for the vehicle owner.

- SBI Third-Party Liability: This plan provides legal protection against third-party claims arising from accidents involving the insured vehicle.

Travel Insurance

Traveling comes with its own set of risks. SBI General Insurance’s travel insurance plans offer protection against unforeseen events, including medical emergencies, trip cancellations, and baggage loss.

- SBI Travel Companion: A comprehensive travel insurance plan offering coverage for international and domestic trips, with options for single and multi-trip policies.

- SBI Student Travel Companion: Tailored for students traveling abroad for education, this plan provides coverage for medical expenses, repatriation, and personal accident risks.

Home Insurance

SBI General Insurance’s home insurance plans provide comprehensive coverage for homeowners and tenants. These plans protect against fire, natural disasters, theft, and other damages.

- SBI Home Protect: A comprehensive home insurance plan covering the structure and contents of the home, with options for additional coverage for valuables and personal liability.

- SBI Renters Insurance: Designed for tenants, this plan provides coverage for the contents of the rented property, offering protection against theft, fire, and other risks.

Personal Accident Insurance

Accidents can happen anytime, and SBI General Insurance’s personal accident plans provide financial support during such unforeseen events. These plans offer coverage for medical expenses, hospitalization, and disability.

- SBI Personal Accident Cover: A basic plan providing lump-sum compensation in case of accidental death or permanent disability.

- SBI Smart Personal Accident: This plan offers enhanced coverage, including daily hospital cash benefits, and compensation for temporary disability.

SBI Life Insurance: Securing Your Tomorrow

SBI Life Insurance, a joint venture between SBI and BNP Paribas Cardif, is a leading life insurance provider in India. The company offers a range of life insurance products designed to meet the financial protection and investment needs of individuals and families.

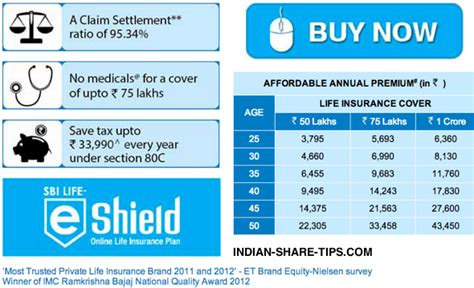

Term Insurance Plans

Term insurance plans from SBI Life provide pure protection, offering high coverage at affordable premiums. These plans ensure financial security for your loved ones in case of an untimely demise.

- SBI Life eSmart Protection: A purely online term plan with flexible coverage options and affordable premiums.

- SBI Life Saral Shield: A comprehensive term plan offering coverage for death due to natural and accidental causes, with an option for waiver of premium in case of total and permanent disability.

Whole Life Insurance

Whole life insurance plans provide lifelong coverage, ensuring financial protection for your loved ones throughout their lives. These plans also offer maturity benefits upon survival.

- SBI Life Smart Wealth: A whole life insurance plan that provides coverage for life, along with the option to receive regular income during the policy term.

- SBI Life eSmart Wealth: An online whole life insurance plan with flexible premium payment options and the potential for wealth accumulation.

Unit-Linked Insurance Plans (ULIPs)

ULIPs offer the dual benefits of life insurance coverage and market-linked investment returns. SBI Life’s ULIPs provide an opportunity to build wealth while enjoying life insurance protection.

- SBI Life Smart Investor: A ULIP plan that offers a range of fund options, allowing policyholders to choose the investment strategy that aligns with their risk appetite and financial goals.

- SBI Life eSmart Investor: An online ULIP plan with simplified features, providing flexibility and convenience in policy management.

Pension Plans

SBI Life’s pension plans are designed to help individuals secure their retirement years. These plans offer regular income during retirement while providing life insurance coverage.

- SBI Life Smart Pension: A traditional pension plan offering guaranteed monthly pension payments and life cover throughout the policy term.

- SBI Life eSmart Pension: An online pension plan with flexible premium payment options and the potential for higher pension amounts through market-linked returns.

The Benefits of SBI Insurance

Choosing SBI insurance products offers a range of advantages, including:

- Trusted Brand: SBI, with its rich legacy, is a trusted financial institution, ensuring reliability and security in insurance offerings.

- Comprehensive Coverage: SBI insurance products provide extensive coverage, catering to a wide range of insurance needs.

- Affordable Premiums: SBI's insurance plans are competitively priced, making insurance accessible to a broader customer base.

- Convenient Digital Experience: Many SBI insurance products are available online, offering a seamless and convenient policy purchase and management experience.

- Personalized Solutions: SBI insurance advisors work closely with customers to understand their unique needs and tailor insurance solutions accordingly.

Conclusion

SBI’s foray into the insurance sector has been a successful venture, offering customers a wide array of insurance products that provide comprehensive coverage, financial protection, and peace of mind. Whether it’s health, life, motor, travel, or home insurance, SBI has a solution tailored to meet individual and business requirements. With its trusted brand, affordable premiums, and personalized approach, SBI continues to be a preferred choice for insurance coverage in India.

Can I customize my insurance plan with SBI to suit my specific needs?

+

Absolutely! SBI insurance products offer a range of customizable options. Whether you’re looking for higher coverage limits, additional riders, or specific exclusions, SBI’s insurance advisors can help tailor a plan that aligns perfectly with your unique requirements.

Are there any discounts or promotions available for SBI insurance products?

+

Yes, SBI insurance frequently offers promotional discounts and special rates on various plans. Additionally, they provide loyalty benefits and no-claim bonuses to reward customers for their continued trust.

How can I renew my SBI insurance policy online?

+

Renewing your SBI insurance policy online is straightforward. Simply log in to your SBI account, navigate to the insurance section, and follow the step-by-step process to renew your policy. It’s quick, convenient, and paperless!

What should I do in case of an insurance claim?

+

In the event of an insurance claim, contact SBI’s customer support team immediately. They will guide you through the claim process, providing assistance and ensuring a smooth and timely settlement. Remember to keep all relevant documents and proof of loss handy.

Can I port my existing insurance policy to SBI?

+

Yes, you can port your existing insurance policy to SBI. The process is simple and straightforward. Contact SBI’s insurance team, and they will assist you in understanding the porting process and ensure a seamless transition.