Insurance Coverage

Insurance coverage is a vital aspect of financial planning and risk management, offering individuals and businesses protection against various uncertainties and unforeseen events. With the right insurance policies in place, people can safeguard their assets, health, and livelihoods, ensuring peace of mind and stability during challenging times. In today's complex and ever-evolving world, understanding the intricacies of insurance coverage is more important than ever. This comprehensive guide aims to delve into the world of insurance, exploring its different types, the factors influencing coverage, and the key considerations individuals and businesses must make to ensure adequate protection.

Understanding the Basics of Insurance Coverage

At its core, insurance coverage is a contract between an individual or entity (the policyholder) and an insurance company. The policyholder pays a premium to the insurer, who, in return, agrees to compensate the policyholder for specific losses, damages, or expenses outlined in the insurance policy. This arrangement transfers the financial risk from the policyholder to the insurance company, providing a safety net against potential financial losses.

Key Components of Insurance Policies

Insurance policies are complex legal documents, but understanding their key components is essential for making informed decisions. Here’s a breakdown of the fundamental elements:

- Coverage Limits: This specifies the maximum amount the insurance company will pay for a covered loss. It’s crucial to ensure the limits are adequate to cover potential losses.

- Deductibles and Co-pays: Policyholders often have to pay a portion of the claim themselves, known as the deductible. Some policies also have co-pays, which are similar to co-insurance in health insurance, where the policyholder pays a percentage of the covered expense.

- Exclusions: Insurance policies list specific events or circumstances that are not covered. Understanding these exclusions is vital to avoid unexpected gaps in coverage.

- Renewal and Cancellation: Most policies are renewable annually, but the policyholder can choose to cancel the policy at any time. On the other hand, the insurance company may cancel the policy under certain conditions, such as non-payment of premiums or material misrepresentation.

Types of Insurance Coverage

The insurance industry offers a vast array of policies tailored to meet specific needs. Here’s an overview of some common types of insurance coverage:

- Life Insurance: This provides financial protection to the policyholder’s beneficiaries in the event of their death. There are two main types: term life insurance, which offers coverage for a specific period, and permanent life insurance, which provides lifelong coverage and often includes a cash value component.

- Health Insurance: Health insurance covers medical expenses, including hospital stays, doctor visits, prescription drugs, and sometimes preventive care. It’s essential for managing unexpected medical costs and maintaining good health.

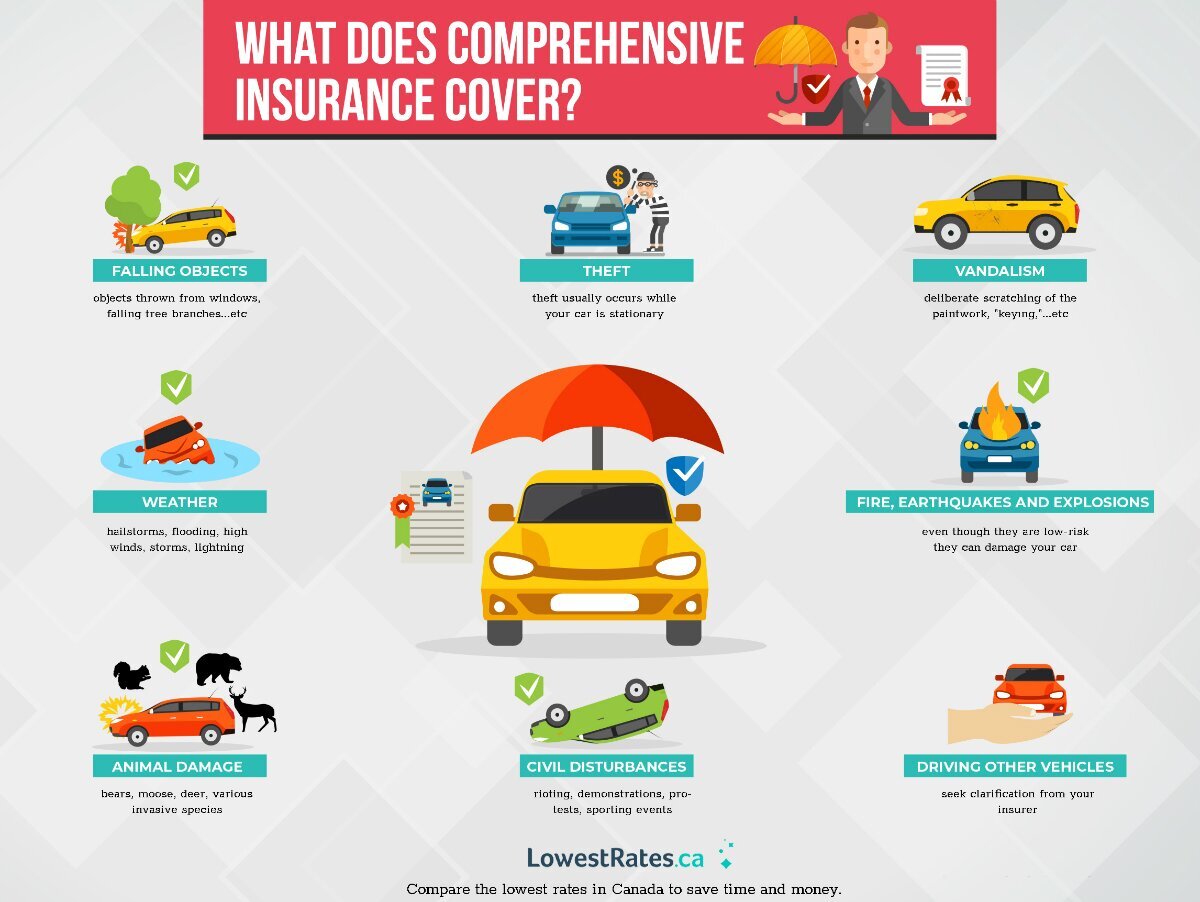

- Auto Insurance: Auto insurance provides financial protection against physical damage, bodily injury, and liability resulting from vehicle ownership, use, and maintenance. It’s mandatory in many jurisdictions.

- Homeowners Insurance: This policy protects homeowners against damages to their property and liabilities arising from ownership, including theft, fire, and certain natural disasters. It also covers personal belongings and provides liability coverage for accidents that occur on the insured property.

- Business Insurance: Businesses face unique risks, and insurance policies are tailored to protect them. This can include general liability insurance, product liability insurance, professional liability insurance (also known as errors and omissions insurance), and business interruption insurance, among others.

- Travel Insurance: Travel insurance covers various risks associated with traveling, such as medical emergencies, trip cancellations, lost luggage, and delays.

Factors Influencing Insurance Coverage

The cost and availability of insurance coverage can vary significantly based on several factors. Understanding these influences is crucial when shopping for insurance policies.

Risk Assessment

Insurance companies assess the risk associated with insuring an individual or business. Higher-risk policyholders typically pay higher premiums to compensate for the increased likelihood of claims. For example, a person with a history of health issues may pay higher health insurance premiums, while a business in a high-crime area may face higher commercial insurance rates.

Location

The location of the insured property or business can significantly impact insurance costs. Areas prone to natural disasters, such as hurricanes or earthquakes, often have higher insurance premiums. Similarly, urban areas with higher crime rates may see increased premiums for home or auto insurance.

Policyholder’s Profile

The characteristics of the policyholder play a crucial role in determining insurance rates. For example, a young driver with a clean driving record may enjoy lower auto insurance rates compared to an older driver with a history of accidents. Similarly, a healthy individual with a low-risk lifestyle may pay less for health insurance than someone with pre-existing conditions.

Type of Coverage

Different types of insurance coverage have varying costs. For instance, comprehensive auto insurance, which covers a wider range of incidents, will typically be more expensive than liability-only coverage. Similarly, health insurance plans with lower deductibles and co-pays often have higher premiums.

Deductibles and Co-pays

Policyholders can often choose their deductibles and co-pays, which directly impact the premium. Higher deductibles and co-pays usually result in lower premiums, as the policyholder is responsible for a larger portion of the expenses.

Key Considerations for Choosing Insurance Coverage

Selecting the right insurance coverage involves careful consideration of various factors. Here are some key aspects to keep in mind:

Assessing Your Needs

Start by evaluating your specific needs. Consider the risks you want to protect against and the potential financial impact of those risks. For example, if you own a business, you’ll need to assess the unique risks associated with your industry and location.

Comparing Policies

Don’t settle for the first policy you come across. Compare different policies from multiple insurance providers to find the best coverage and value. Look beyond the premium and consider the policy’s terms, conditions, and exclusions.

Understanding Policy Limits

Ensure that the policy limits are adequate to cover potential losses. For instance, in health insurance, higher policy limits can provide more comprehensive coverage for serious illnesses or injuries.

Considering Deductibles and Co-pays

While higher deductibles and co-pays can lower premiums, they also increase your out-of-pocket expenses. Weigh the potential savings against the risk of facing higher expenses if you need to make a claim.

Reviewing Exclusions

Carefully review the policy’s exclusions to ensure you’re not leaving yourself vulnerable to unforeseen gaps in coverage. For instance, many standard home insurance policies exclude flood damage, so you may need to purchase separate flood insurance.

Understanding Renewal and Cancellation

Understand the renewal process and any conditions that could lead to cancellation. Some policies may have automatic renewal, while others require action on your part. Also, be aware of any cancellation fees or penalties.

The Future of Insurance Coverage

The insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Here are some trends shaping the future of insurance coverage:

Digital Transformation

The rise of digital technology has transformed the insurance industry. Insurers are increasingly leveraging data analytics, artificial intelligence, and machine learning to enhance risk assessment, streamline processes, and personalize coverage. This digital transformation is improving efficiency, accuracy, and customer experience.

Personalized Insurance

With advanced data analytics, insurers can now offer more personalized coverage. By analyzing an individual’s or business’s unique characteristics and risk profile, insurers can tailor policies to provide the most relevant and cost-effective coverage.

Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is gaining popularity. This type of insurance policy uses telematics devices to track driving behavior, such as miles driven, time of day, and driving habits. By offering discounts to safe drivers, usage-based insurance encourages safer driving practices.

Parametric Insurance

Parametric insurance is an innovative approach that pays out based on the occurrence of a specific parameter, such as an earthquake’s magnitude or the amount of rainfall during a storm. This type of insurance provides rapid payouts, making it particularly useful in disaster-prone areas.

Blockchain Technology

Blockchain technology is poised to revolutionize the insurance industry by enhancing security, transparency, and efficiency. Smart contracts, for instance, can automate certain insurance processes, such as claim payments, reducing the need for manual intervention.

Conclusion

Insurance coverage is a critical component of financial planning and risk management. By understanding the different types of insurance, the factors influencing coverage, and the key considerations when choosing policies, individuals and businesses can make informed decisions to protect their assets, health, and livelihoods. As the insurance industry continues to evolve, staying informed about the latest trends and innovations will be essential for navigating the complex world of insurance coverage.

How often should I review my insurance coverage?

+It’s recommended to review your insurance coverage annually to ensure it still meets your needs. Life events such as marriage, having children, buying a new home, or starting a business can significantly impact your insurance requirements. Regular reviews allow you to make necessary adjustments and maintain adequate coverage.

What happens if I don’t have insurance coverage and face a covered loss?

+If you don’t have insurance coverage and experience a loss that would typically be covered by insurance, you’ll have to bear the financial burden yourself. This can result in significant out-of-pocket expenses, potentially impacting your financial stability. It’s always better to have insurance coverage to protect against such unforeseen events.

Can I customize my insurance policy to fit my specific needs?

+Yes, many insurance policies offer customizable options. You can often choose different coverage limits, deductibles, and add-on coverages to create a policy that aligns with your specific needs and budget. It’s important to work with an insurance agent or broker who can guide you through the customization process.

What should I do if I’m unsure about the type of insurance coverage I need?

+If you’re uncertain about your insurance needs, it’s best to consult with an insurance professional. They can assess your specific circumstances, such as your assets, liabilities, and personal or business goals, and recommend the appropriate types and levels of coverage. They can also provide valuable insights and guidance to help you make informed decisions.