How To Apply For Medical Insurance

Understanding the Process: A Step-by-Step Guide to Applying for Medical Insurance

Navigating the healthcare system and securing adequate medical insurance coverage is an essential aspect of maintaining your well-being and financial security. The process of applying for medical insurance can seem daunting, but with the right approach and understanding of the key steps involved, it can be a straightforward and rewarding experience. This comprehensive guide aims to demystify the process, providing you with the tools and knowledge to confidently apply for medical insurance that meets your unique needs.

Preparing for Your Application

Before you begin the application process, it’s crucial to prepare yourself with the necessary information and documentation. Here’s what you need to consider:

Assessing Your Needs

Start by evaluating your current and future healthcare needs. Consider factors such as your age, existing medical conditions, and family history. If you have specific health concerns or require specialized care, ensure that the insurance plan you choose covers these adequately. Some plans may offer more comprehensive coverage for certain conditions or provide access to specialized healthcare professionals.

Researching Insurance Providers

The market for medical insurance is diverse, with numerous providers offering a range of plans. Take the time to research and compare different providers based on their reputation, financial stability, and the coverage they offer. Look for reviews and ratings from trusted sources to get an idea of the provider’s track record and customer satisfaction.

| Insurance Provider | Plan Coverage | Customer Satisfaction |

|---|---|---|

| Medicare Advantage | Comprehensive coverage, including dental and vision | 4.5/5 stars, with praise for customer service |

| HealthPlanPro | Focuses on preventive care, offering discounts for healthy lifestyle choices | 4/5 stars, with some concerns about claim processing |

| VitalCare | Specializes in coverage for chronic conditions, with access to top specialists | 4.8/5 stars, highly recommended for complex healthcare needs |

Gathering Required Documents

To apply for medical insurance, you’ll need to provide certain documents to verify your identity, residency, and income. These typically include:

- Proof of identity: This could be a driver’s license, passport, or state-issued ID.

- Proof of residency: A recent utility bill or lease agreement will suffice.

- Income documentation: Recent pay stubs or tax returns are often required.

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Details of any existing health conditions or medications you’re currently taking

The Application Process

Once you’ve prepared all the necessary documents and selected a suitable insurance provider, it’s time to initiate the application process. Here’s a step-by-step guide to help you through:

Step 1: Choose Your Plan

Insurance providers typically offer a range of plans with varying levels of coverage and costs. Consider factors such as:

- Premiums: The amount you pay monthly for your insurance coverage.

- Deductibles: The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Co-payments: Fixed amounts you pay for certain services, like doctor visits or prescription medications.

- Co-insurance: The percentage of costs you pay after meeting your deductible.

- Out-of-pocket maximum: The most you’ll pay in a year for covered services.

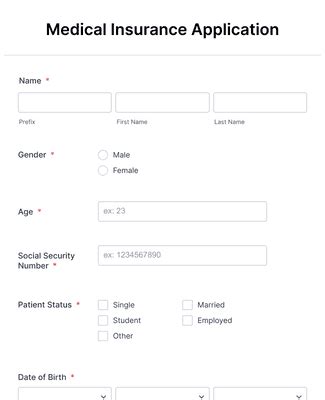

Step 2: Complete the Application Form

Most insurance providers offer online application forms, making the process convenient and efficient. Ensure that you fill out the form accurately and completely, providing all the required information and documentation. Common sections on the application form include:

- Personal information: Name, date of birth, contact details, and marital status.

- Residency and citizenship status: To verify eligibility for certain plans.

- Income and financial information: For determining your premium and any applicable subsidies.

- Health history: Disclosure of pre-existing conditions and current medications.

- Coverage preferences: Selecting your desired plan and any additional benefits.

Step 3: Submit Your Application

After completing the application form, you’ll need to submit it, along with any supporting documents, to the insurance provider. This can typically be done online, via email, or by mail. Ensure that you keep a copy of your application and any supporting documents for your records.

Step 4: Wait for Approval

Once your application is submitted, the insurance provider will review it and make a decision. This process can take several weeks, depending on the provider and the complexity of your application. During this time, you may be required to provide additional information or documentation to support your application.

Step 5: Receive Your Policy

If your application is approved, you’ll receive your insurance policy, outlining the terms and conditions of your coverage. This document will include important details such as:

- The effective date of your coverage.

- A summary of benefits and coverage limits.

- Information on how to use your insurance, including provider networks and claim processes.

- Any exclusions or limitations to your coverage.

Understanding Your Policy

Once you have your medical insurance policy, it’s crucial to thoroughly review and understand its terms and conditions. Here are some key aspects to consider:

Policy Coverage and Benefits

Your policy will outline the specific healthcare services and treatments that are covered. This includes details on:

- Inpatient and outpatient services: Hospital stays, surgeries, and specialist consultations.

- Preventive care: Regular check-ups, screenings, and immunizations.

- Prescription medications: Coverage for brand-name and generic drugs, as well as any applicable copayments.

- Mental health and substance abuse treatment: Coverage for counseling, therapy, and rehabilitation.

- Dental and vision care: Basic and major services, including orthodontic treatment and eye exams.

Provider Networks and Referrals

Medical insurance plans often have networks of preferred providers, including doctors, hospitals, and other healthcare facilities. It’s important to understand whether your chosen plan requires you to use these providers or allows you more flexibility. Additionally, some plans may require referrals from your primary care physician for certain specialist services.

Claim Processes and Procedures

Understanding how to file claims for covered services is essential. Your insurance provider will have specific procedures in place, which may involve submitting claims online, by mail, or through your healthcare provider. Familiarize yourself with these processes to ensure smooth and timely reimbursement.

Renewal and Changes to Your Policy

Medical insurance policies typically have an annual renewal process. It’s important to review your policy each year to ensure it still meets your needs and to make any necessary changes. This could include updating your personal information, adjusting your coverage level, or switching to a different plan offered by your provider.

Frequently Asked Questions

Can I apply for medical insurance if I have a pre-existing condition?

+

Yes, you can apply for medical insurance even if you have a pre-existing condition. However, the coverage and premiums may vary depending on the severity of the condition. Some insurance providers offer specialized plans for individuals with specific health concerns.

What happens if I miss the deadline for applying during the open enrollment period?

+

Missing the open enrollment deadline may limit your options for obtaining medical insurance. You may be eligible for a Special Enrollment Period if you experience certain life events, such as losing your job or getting married. Otherwise, you’ll have to wait until the next open enrollment period.

Can I include my family members on my medical insurance plan?

+

Yes, most medical insurance plans offer family coverage, allowing you to include your spouse, children, and sometimes even extended family members. The cost and coverage details will vary depending on the plan and provider.

What should I do if I have difficulty understanding the terms and conditions of my policy?

+

If you have questions or need clarification on any aspect of your policy, don’t hesitate to contact your insurance provider’s customer service team. They can provide guidance and ensure you understand your coverage and benefits.