Sr22 Car Insurance

When it comes to car insurance, understanding the different types of coverage and their implications is crucial. For individuals with a less than perfect driving record, an SR22 insurance policy may be required. SR22 insurance, often referred to as certificate of financial responsibility, is a specialized form of car insurance that serves a unique purpose in the automotive industry. In this comprehensive article, we delve into the intricacies of SR22 car insurance, exploring its purpose, requirements, coverage options, and the steps to obtain it. By the end, you'll have a clear understanding of what SR22 insurance entails and how it can impact your driving privileges.

Understanding SR22 Car Insurance

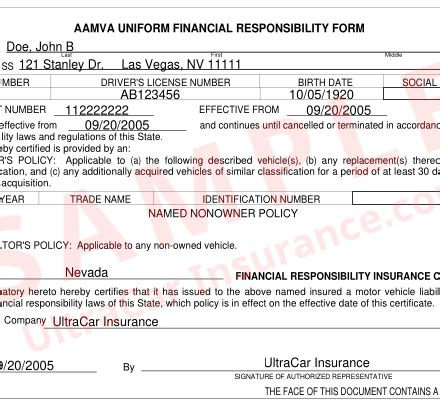

SR22 insurance is a specific type of car insurance that is mandated by state authorities in the United States. It is typically required for drivers who have been involved in serious traffic violations, had their driver’s license suspended or revoked, or have been convicted of a DUI/DWI offense. The primary purpose of SR22 insurance is to demonstrate financial responsibility and prove that the driver has adequate liability coverage to meet the state’s minimum requirements.

Here's a breakdown of the key aspects of SR22 car insurance:

Purpose of SR22 Insurance

- Proof of Financial Responsibility: SR22 insurance serves as a legal document, certifying that the policyholder has the necessary liability coverage to compensate others in case of an accident. It assures the state that the driver is financially responsible and can provide compensation for any damages or injuries caused.

- Reinstatement of Driving Privileges: In many cases, individuals with a revoked or suspended license must obtain SR22 insurance to regain their driving privileges. The SR22 form is filed with the state’s Department of Motor Vehicles (DMV) and acts as a guarantee of financial responsibility.

- Compliance with Court Orders: Courts may order individuals convicted of certain offenses to carry SR22 insurance as a condition of their probation or sentence. Failure to maintain SR22 insurance can result in legal consequences and further driving restrictions.

Requirements for SR22 Insurance

The requirements for SR22 insurance vary depending on the state and the specific circumstances of the driver. However, there are some common factors that apply across most states:

- State-Mandated Minimum Coverage: SR22 insurance typically includes the state-mandated minimum liability coverage, which varies by state. This coverage ensures that the policyholder can provide compensation for bodily injury and property damage caused to others in an accident.

- Filing of SR22 Form: The policyholder must complete and file an SR22 form with the state's DMV. This form is usually provided by the insurance company and certifies that the driver has the required liability coverage. The SR22 form must be updated whenever there are changes to the policy, such as non-renewal or cancellation.

- Duration of SR22 Insurance: The duration of SR22 insurance can vary. In some cases, it may be required for a specified period, such as three years, after which the driver may be eligible to switch to a standard insurance policy. In other cases, SR22 insurance may be a long-term requirement until the driver demonstrates a consistent record of safe driving.

Obtaining SR22 Car Insurance

Obtaining SR22 car insurance involves a few key steps. Here’s a detailed guide to help you through the process:

Step 1: Check Your State’s Requirements

Start by researching your state’s specific requirements for SR22 insurance. Each state has its own regulations, so understanding the details is crucial. You can visit your state’s DMV website or contact your local DMV office to obtain information on the minimum liability coverage, the duration of SR22 insurance, and any additional requirements.

Step 2: Choose an Insurance Provider

Not all insurance providers offer SR22 insurance, so it’s essential to find a company that specializes in this type of coverage. Research reputable insurance companies that cater to high-risk drivers and offer SR22 policies. Consider factors such as customer reviews, financial stability, and the range of coverage options they provide.

Step 3: Obtain a Quote

Contact the insurance providers you’ve shortlisted and request quotes for SR22 insurance. Provide them with accurate information about your driving record, including any violations or convictions. Be transparent about your situation, as it will impact the cost and availability of the policy.

Step 4: Understand the Coverage Options

Review the quotes and understand the coverage options offered by each insurance provider. Ensure that the policy meets your state’s minimum liability requirements. Consider adding additional coverage, such as comprehensive and collision coverage, to protect your vehicle and assets.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage liability for others involved in an accident caused by the policyholder. |

| Comprehensive Coverage | Provides protection against damage to the insured vehicle due to non-collision incidents like theft, vandalism, or natural disasters. |

| Collision Coverage | Covers damage to the insured vehicle in the event of a collision with another vehicle or object. |

| Medical Payments Coverage | Assists with medical expenses for the policyholder and passengers in the insured vehicle, regardless of fault. |

Step 5: File the SR22 Form

Once you’ve chosen an insurance provider and obtained the SR22 policy, the insurance company will file the SR22 form with your state’s DMV. This form serves as proof of financial responsibility and is a mandatory requirement for SR22 insurance.

Step 6: Maintain Compliance

SR22 insurance requires strict compliance to avoid legal issues. Make sure to keep your policy active and pay your premiums on time. If there are any changes to your policy, such as non-renewal or cancellation, promptly inform your insurance provider and the DMV to update the SR22 form.

Cost of SR22 Car Insurance

The cost of SR22 car insurance can be significantly higher than standard insurance policies. This is because insurance providers consider individuals with SR22 requirements to be high-risk drivers. Factors that influence the cost of SR22 insurance include the severity of your driving record, the state’s minimum liability requirements, and the coverage options you choose.

To manage the cost, consider the following strategies:

- Shop Around: Compare quotes from multiple insurance providers to find the most affordable option. Don't settle for the first quote you receive.

- Improve Your Driving Record: Over time, a clean driving record can lead to reduced insurance rates. Focus on safe driving practices and avoid any further violations.

- Review Coverage Options: Assess your coverage needs and consider dropping optional coverages like comprehensive and collision if you own an older vehicle. However, ensure that you maintain the state-mandated minimum liability coverage.

- Explore Discounts: Insurance providers may offer discounts for safe driving, multiple vehicles on the same policy, or loyalty. Ask your insurance provider about any applicable discounts.

Conclusion: Navigating SR22 Car Insurance

SR22 car insurance is a specialized form of coverage designed to help drivers with a less than perfect driving record regain their driving privileges and demonstrate financial responsibility. By understanding the purpose, requirements, and process of obtaining SR22 insurance, you can navigate this unique insurance option with confidence. Remember to research your state’s specific regulations, choose a reputable insurance provider, and maintain compliance with your policy to avoid any legal complications.

FAQ

Can I get SR22 insurance if I have a clean driving record?

+

SR22 insurance is typically required for individuals with a history of serious traffic violations or DUI/DWI convictions. If you have a clean driving record, you are unlikely to need SR22 insurance. Standard car insurance policies are more suitable for individuals with a clean record.

How long does SR22 insurance last?

+

The duration of SR22 insurance can vary depending on your state’s regulations and the circumstances of your case. In some states, SR22 insurance may be required for a specified period, such as three years, after which you may be eligible to switch to a standard policy. In other cases, SR22 insurance may be a long-term requirement until you demonstrate a consistent record of safe driving.

Can I drive without SR22 insurance if it’s required by the court or DMV?

+

Driving without SR22 insurance when it is mandated by the court or DMV can have severe legal consequences. It is important to comply with the requirements and maintain your SR22 insurance policy to avoid further driving restrictions, penalties, or legal issues.