Health Insurance Tax

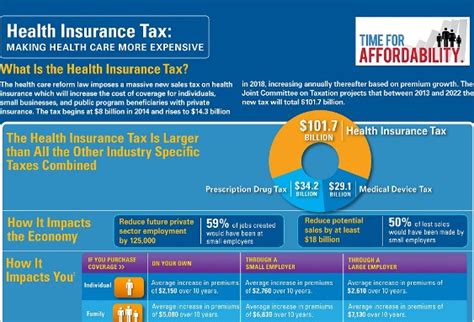

In the realm of healthcare and finance, the concept of the Health Insurance Tax is a critical element that has a significant impact on the industry and its stakeholders. This tax, often referred to as the Health Insurance Providers Fee, has been a subject of debate and analysis due to its potential influence on healthcare costs and accessibility. Let's delve into the intricacies of this tax, its implications, and its role in shaping the healthcare landscape.

Understanding the Health Insurance Tax

The Health Insurance Tax, implemented as part of the Affordable Care Act (ACA), is a fee levied on health insurance providers, specifically those offering coverage through the Health Insurance Marketplace. This tax, which came into effect in 2014, was designed to help fund the expansion of healthcare coverage under the ACA. It applies to insurance companies, third-party administrators, and self-insured group health plans, with certain exemptions for smaller entities.

Tax Structure and Collection

The Health Insurance Tax is calculated based on a company’s net premiums written for fully insured business. The tax rate is set annually by the Department of Health and Human Services (HHS) and is applied to the total net premiums. For example, in 2023, the tax rate was set at 4.29%, meaning that for every 100 in net premiums, 4.29 is contributed towards the tax. This fee is then passed on to consumers through slightly higher insurance premiums.

To illustrate, consider a health insurance provider with a total net premium income of $1 billion for the year. Applying the 4.29% tax rate, the provider would owe approximately $42.9 million in Health Insurance Tax. This amount is significant and can have a notable impact on the provider's financial health and, subsequently, its ability to offer competitive insurance plans.

Exemptions and Relief Measures

Recognizing the potential strain on smaller insurance providers, the ACA includes provisions for exemptions and relief. For instance, the tax does not apply to individual and small group health insurance policies, providing a measure of relief for smaller businesses and self-employed individuals. Additionally, there are mechanisms in place to ensure that the tax burden is shared equitably among providers, preventing larger companies from absorbing a disproportionate share.

| Year | Tax Rate | Estimated Revenue |

|---|---|---|

| 2023 | 4.29% | $12.8 billion |

| 2022 | 4.25% | $12.5 billion |

| 2021 | 4.15% | $12.1 billion |

Impact on the Healthcare Industry

The imposition of the Health Insurance Tax has had wide-ranging effects on various stakeholders in the healthcare ecosystem.

Insurance Providers

For health insurance providers, the tax represents a significant financial burden. It can reduce profit margins, especially for smaller companies, and may lead to strategic shifts in their business models. To mitigate the impact, providers often pass on the tax cost to consumers, which can result in higher insurance premiums. This, in turn, may make insurance less affordable for some individuals and families, potentially leading to reduced coverage uptake.

Consumers and Patients

Consumers, particularly those with lower incomes or those who are already struggling to afford healthcare, may face increased insurance costs due to the Health Insurance Tax. This can make healthcare less accessible, potentially leading to delayed or forgone medical care. However, it’s important to note that the tax also contributes to funding the expansion of healthcare coverage, ensuring that more people have access to essential medical services.

Healthcare Providers

Healthcare providers, such as hospitals and clinics, may experience indirect effects of the Health Insurance Tax. With potential shifts in insurance coverage and affordability, they may see changes in patient demographics and insurance mix. This can influence their financial planning and resource allocation strategies. Additionally, if insurance companies face financial challenges due to the tax, it could impact timely reimbursements for healthcare services provided.

Analysis and Future Implications

The Health Insurance Tax has been a subject of extensive analysis and debate among policymakers, economists, and healthcare experts. While it has helped generate substantial revenue to support the expansion of healthcare coverage, it has also sparked concerns about its potential impact on insurance affordability and access.

Affordability and Accessibility

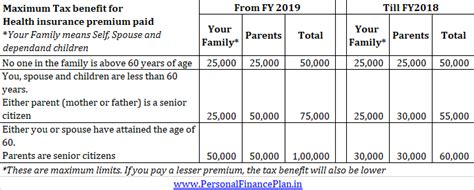

One of the primary concerns surrounding the Health Insurance Tax is its potential to increase insurance premiums, making healthcare less affordable for certain segments of the population. This could lead to a decrease in insurance coverage uptake, especially among lower-income individuals and families. However, it’s important to note that the tax revenue also supports initiatives to make insurance more affordable, such as subsidies and tax credits.

Financial Stability of Insurance Providers

The tax can also pose financial challenges for insurance providers, particularly smaller companies. Higher tax burdens may lead to reduced profit margins and, in some cases, even financial distress. This could result in consolidation within the industry, with larger providers absorbing smaller ones, which may have implications for competition and consumer choice.

Potential Solutions and Reforms

Addressing the potential challenges posed by the Health Insurance Tax requires a nuanced approach. Some experts suggest reforms that could include adjusting the tax rate based on insurance company size or financial health, providing additional tax incentives for insurance providers to keep premiums affordable, or exploring alternative funding mechanisms to support the expansion of healthcare coverage.

Expert Perspective

According to Dr. Emily Henderson, a healthcare economist and policy advisor, “The Health Insurance Tax is a complex issue with no easy solutions. While it does contribute to funding essential healthcare initiatives, we must carefully consider its impact on insurance affordability and provider sustainability. Finding a balance that ensures both financial stability and accessibility is crucial for the long-term viability of our healthcare system.”

Conclusion

The Health Insurance Tax is a critical component of the healthcare financing landscape, with far-reaching implications for insurance providers, consumers, and the broader healthcare industry. As we navigate the complexities of healthcare reform and financing, it is essential to continue evaluating and refining policies like the Health Insurance Tax to ensure they effectively support our healthcare system’s goals of accessibility, affordability, and quality.

What is the purpose of the Health Insurance Tax?

+The Health Insurance Tax, also known as the Health Insurance Providers Fee, was implemented to help fund the expansion of healthcare coverage under the Affordable Care Act (ACA). It applies to health insurance providers and is designed to contribute to the financial stability of the healthcare system.

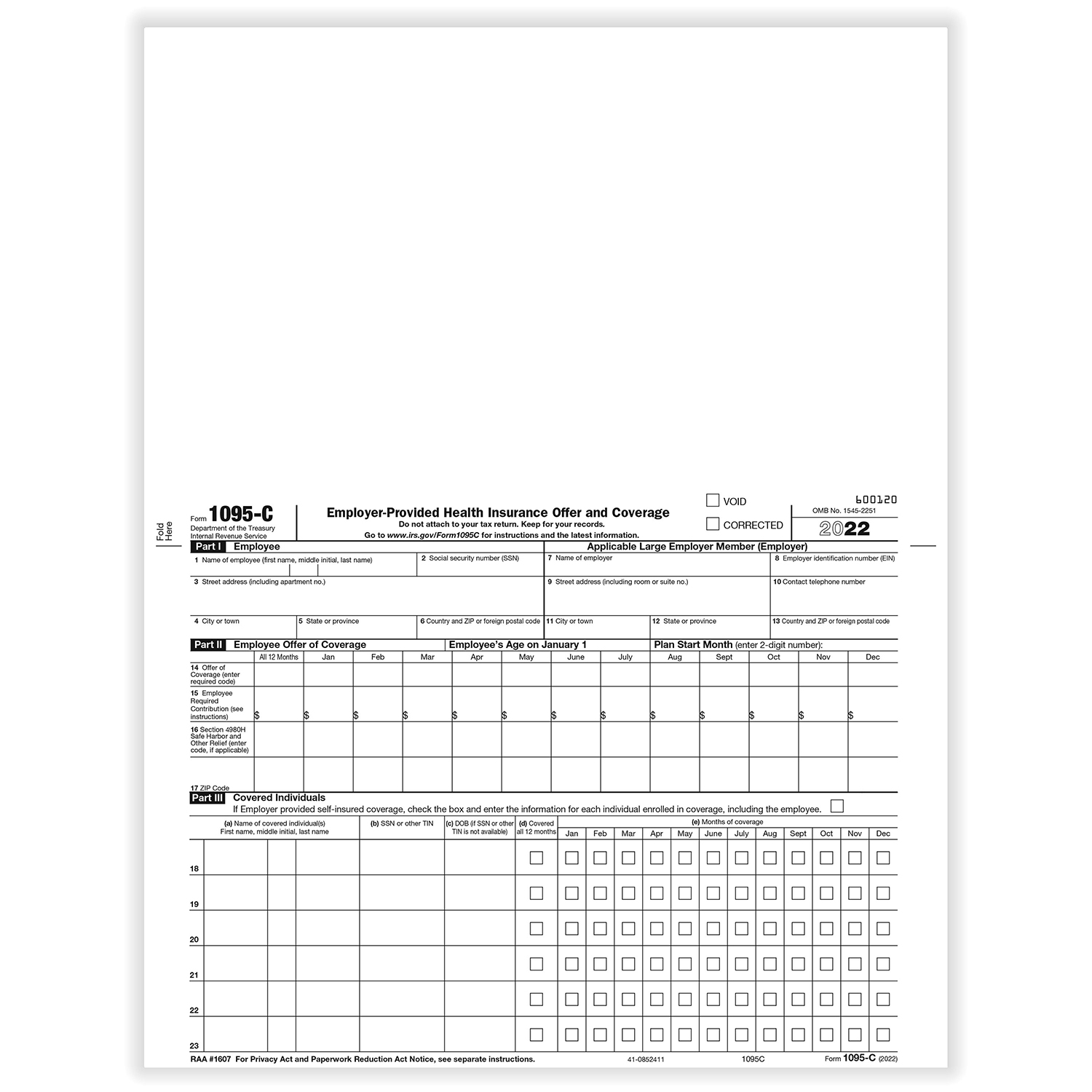

Who is responsible for paying the Health Insurance Tax?

+The tax is levied on health insurance providers, including insurance companies, third-party administrators, and self-insured group health plans. However, there are exemptions for certain smaller entities to provide relief and ensure equitable tax burden sharing.

How is the Health Insurance Tax calculated?

+The tax is calculated based on a company’s net premiums written for fully insured business. The tax rate is set annually by the Department of Health and Human Services (HHS) and is applied to the total net premiums. For example, in 2023, the tax rate was 4.29%.

What are the potential impacts of the Health Insurance Tax on consumers and patients?

+The tax can lead to increased insurance premiums, making healthcare less affordable for some individuals and families. This may result in reduced coverage uptake and potential delays or forgone medical care. However, the tax revenue also supports initiatives to make insurance more affordable, such as subsidies and tax credits.