General Liability Insurance Cover

General Liability Insurance Cover: Protecting Your Business from Unforeseen Risks

In the complex landscape of business operations, one crucial aspect that every entrepreneur must navigate is the realm of insurance. General Liability Insurance is a cornerstone of risk management, offering a safety net for businesses against a multitude of unforeseen events and potential liabilities. This comprehensive guide aims to delve deep into the world of General Liability Insurance, exploring its intricacies, benefits, and the vital role it plays in safeguarding businesses of all sizes and industries.

Understanding General Liability Insurance

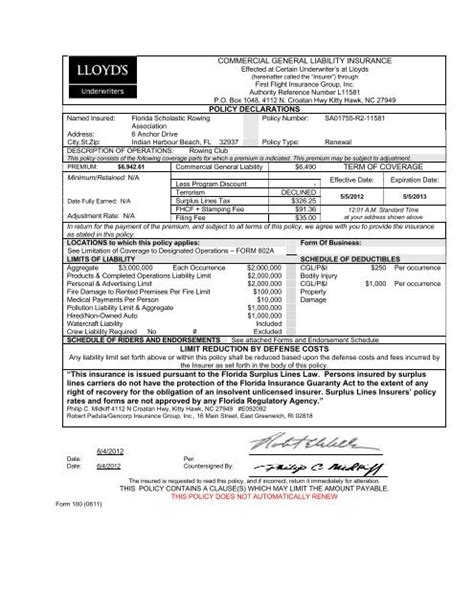

General Liability Insurance, often referred to as GL Insurance, is a form of business insurance that provides protection against a wide array of claims and liabilities that a business might face during its regular operations. These claims can stem from various sources, including bodily injury, property damage, personal injury, and advertising injury.

At its core, GL Insurance is designed to shield businesses from the financial fallout that can arise from lawsuits and claims. It acts as a crucial safety measure, ensuring that businesses can continue to operate smoothly even in the face of unexpected legal battles and financial burdens.

The Importance of General Liability Insurance

In today’s dynamic business environment, the importance of General Liability Insurance cannot be overstated. Here’s why it is an essential component of any business’s risk management strategy:

Protection against Bodily Injury and Property Damage Claims

Accidents can happen anywhere, and when they involve your business, the consequences can be severe. General Liability Insurance steps in to cover the costs associated with bodily injury claims, such as medical expenses and legal fees, should a customer or visitor sustain an injury on your premises.

Additionally, it provides coverage for property damage claims, whether it's accidental damage to a client's property during a service call or a more significant incident that results in substantial repairs or replacements.

Defending against Personal and Advertising Injury Claims

In the digital age, businesses are increasingly exposed to risks related to personal and advertising injury. General Liability Insurance offers protection against claims arising from issues like copyright infringement, defamation, or invasion of privacy. This coverage is particularly relevant for businesses that heavily rely on marketing and advertising.

Peace of Mind and Business Continuity

Perhaps the most significant benefit of General Liability Insurance is the peace of mind it provides. Knowing that you have robust protection in place allows business owners to focus on growth and innovation without constantly worrying about the financial implications of potential liabilities.

Key Components of General Liability Insurance

General Liability Insurance policies typically encompass several key components, each designed to address specific risks. These components include:

Bodily Injury and Property Damage Liability

This coverage is the backbone of GL Insurance, providing protection against claims arising from bodily injury or property damage caused by your business’s operations. It covers medical expenses, legal defense costs, and any compensation awarded to the claimant.

Personal and Advertising Injury Liability

As mentioned earlier, this coverage addresses claims related to personal injury, such as slander, libel, or copyright infringement. It also covers claims arising from the content of your advertising, ensuring that your business is protected even if your marketing efforts inadvertently cause harm.

Medical Payments Coverage

Medical Payments Coverage is a unique aspect of GL Insurance that provides immediate coverage for medical expenses incurred by individuals injured on your premises, regardless of fault. This coverage demonstrates your commitment to the well-being of your customers and can help prevent minor incidents from escalating into costly lawsuits.

Products and Completed Operations Liability

For businesses that manufacture, sell, or distribute products, Products and Completed Operations Liability coverage is crucial. It protects against claims arising from defects in your products or services even after they have been delivered to the customer.

Additional Insured Endorsements

In certain situations, your business might be required to add another party as an additional insured on your General Liability policy. This could be a landlord, a client, or a vendor. Additional Insured Endorsements provide coverage for these parties in specific circumstances, ensuring that your business relationships remain protected.

Real-World Examples of General Liability Claims

Understanding the potential risks that General Liability Insurance covers is best illustrated through real-world examples. Here are a few scenarios where GL Insurance has proven to be a lifeline for businesses:

Slip and Fall Incidents

Imagine a customer slips on a wet floor in your retail store, sustaining a serious injury. The customer sues your business for negligence. With General Liability Insurance, you can rest assured that the policy will cover the legal fees, medical expenses, and any compensation awarded to the injured party.

Product Liability Claims

Consider a scenario where a customer purchases a defective product from your online store, leading to property damage or personal injury. The customer files a lawsuit, alleging that your business is responsible for the defects. Products and Completed Operations Liability coverage steps in to protect your business, covering the costs associated with the claim.

Advertising Injury Claims

In the digital marketing realm, a competitor might claim that your advertising campaign has infringed on their copyright or defamed their business. Personal and Advertising Injury Liability coverage would defend your business against such claims, ensuring that your marketing efforts remain protected.

Customizing Your General Liability Insurance Policy

Every business is unique, and so are its insurance needs. General Liability Insurance policies can be tailored to meet the specific requirements of your business. Here are some key considerations when customizing your GL policy:

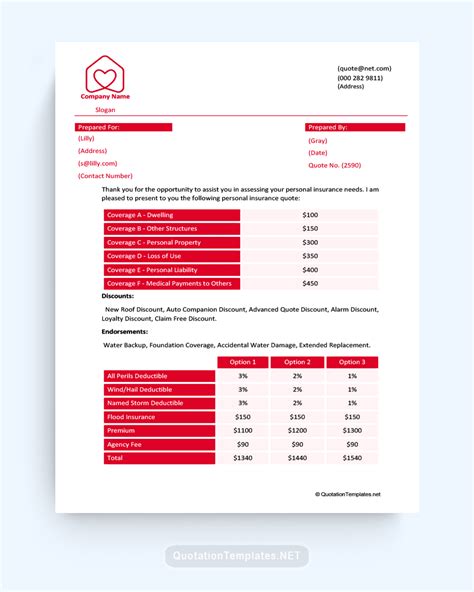

Coverage Limits

Determine the appropriate coverage limits based on the size and nature of your business. Higher coverage limits provide more protection but also come with a higher premium. It’s crucial to strike a balance that aligns with your business’s risk appetite.

Deductibles

Deductibles are the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, but they also mean you’ll have to bear more of the financial burden in the event of a claim. Consider your business’s financial resilience when selecting a deductible.

Policy Exclusions

General Liability Insurance policies often come with standard exclusions, such as professional liability claims or pollution-related incidents. However, you can often purchase additional endorsements or separate policies to address these specific risks. Carefully review the exclusions to ensure your policy aligns with your business’s needs.

Optional Coverages

Depending on your business’s unique risks, you might consider adding optional coverages to your GL policy. These could include Cyber Liability Insurance, Employment Practices Liability Insurance (EPLI), or Business Income Coverage. Consult with an insurance professional to identify the optional coverages that are right for your business.

The Role of Insurance Brokers and Agents

When navigating the complex world of General Liability Insurance, partnering with a reputable insurance broker or agent can be invaluable. These professionals have extensive knowledge of the insurance market and can guide you in selecting the right policy for your business.

Insurance brokers and agents act as your advocates, ensuring that you understand the nuances of your policy and that your coverage aligns with your business's evolving needs. They can also assist in filing claims and negotiating with insurance providers to maximize the benefits you receive.

The Future of General Liability Insurance

As the business landscape continues to evolve, so too will the nature of risks and liabilities. General Liability Insurance will remain a cornerstone of risk management, adapting to emerging trends and challenges. Here’s a glimpse into the future of GL Insurance:

Increasing Focus on Cyber Risks

With the rise of digital transformation, businesses are increasingly vulnerable to cyber risks. General Liability Insurance policies are likely to incorporate more robust cyber liability coverage, addressing issues like data breaches, ransomware attacks, and online defamation.

Emphasis on Environmental Concerns

As environmental awareness grows, businesses are under increasing pressure to adopt sustainable practices. General Liability Insurance policies may start to offer more comprehensive coverage for environmental liabilities, including pollution-related incidents and sustainability-related lawsuits.

Enhanced Coverage for Emerging Technologies

As businesses embrace emerging technologies like artificial intelligence, robotics, and the Internet of Things (IoT), General Liability Insurance will need to adapt to cover the unique risks associated with these innovations. This could include coverage for data-related incidents, intellectual property disputes, and liability arising from autonomous systems.

Conclusion

General Liability Insurance is an indispensable tool for businesses to navigate the unpredictable world of liabilities and claims. By providing protection against a wide range of risks, GL Insurance ensures that businesses can focus on their core operations and growth strategies without being bogged down by the fear of unforeseen financial burdens.

As you embark on your journey to secure General Liability Insurance for your business, remember that it's not just about meeting regulatory requirements or ticking a box on your to-do list. It's about safeguarding your business's future and ensuring its resilience in the face of adversity. With the right policy in place, you can rest assured that your business is protected, allowing you to pursue your goals with confidence and peace of mind.

What is the difference between General Liability Insurance and Professional Liability Insurance (E&O)?

+General Liability Insurance covers a broad range of liabilities, including bodily injury, property damage, and personal injury claims. On the other hand, Professional Liability Insurance, also known as Errors and Omissions (E&O) Insurance, specifically protects professionals against claims arising from their services, such as negligence, errors, or omissions. While GL Insurance is suitable for a wide range of businesses, E&O Insurance is tailored for professionals like consultants, accountants, and lawyers.

Can General Liability Insurance cover lawsuits arising from employee negligence?

+Yes, General Liability Insurance typically covers lawsuits resulting from employee negligence during the course of their employment. However, it’s important to note that certain employee-related risks, such as workplace injuries or discrimination claims, are often excluded from GL policies and may require separate coverage, such as Workers’ Compensation Insurance or Employment Practices Liability Insurance (EPLI).

How much does General Liability Insurance cost?

+The cost of General Liability Insurance can vary significantly based on factors like the nature of your business, its size, and the coverage limits you select. On average, small businesses can expect to pay anywhere from 300 to 1,000 annually for GL Insurance. However, it’s crucial to obtain multiple quotes and tailor the coverage to your specific needs to ensure you’re getting the best value for your money.

Are there any industries or businesses that don’t require General Liability Insurance?

+While General Liability Insurance is a vital component of risk management for most businesses, certain industries or businesses with minimal public interaction may have lower exposure to liability risks. However, even in such cases, it’s recommended to have at least a basic level of GL Insurance to protect against unforeseen incidents. It’s always best to consult with an insurance professional to determine the appropriate coverage for your specific business.