Free Insurance Quotation

In today's fast-paced world, protecting our financial well-being and ensuring peace of mind is more crucial than ever. This is where the concept of insurance steps in, offering a safety net against unforeseen circumstances. However, navigating the complex world of insurance policies and providers can be a daunting task. That's why obtaining a free insurance quotation is an essential first step in securing the right coverage for your unique needs.

The Importance of a Free Insurance Quotation

A free insurance quotation is an invaluable tool that empowers individuals and businesses to make informed decisions about their insurance coverage. It provides an opportunity to compare various policies, assess their suitability, and understand the associated costs without any obligation. By obtaining multiple quotations, you can tailor your insurance plan to your specific requirements, whether it's auto insurance, health coverage, life insurance, or property protection.

Moreover, a free quotation allows you to explore the market and identify the most competitive rates and comprehensive coverage options. It's a transparent process that ensures you are not only getting the best value for your money but also the peace of mind that comes with knowing you are adequately insured.

Understanding the Quotation Process

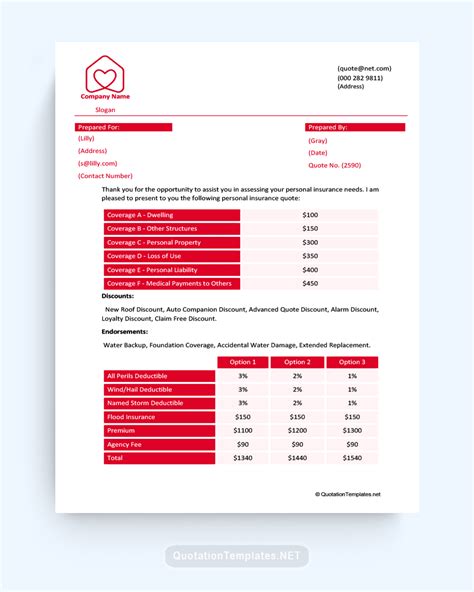

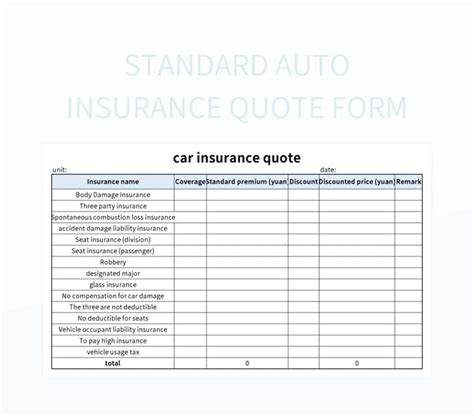

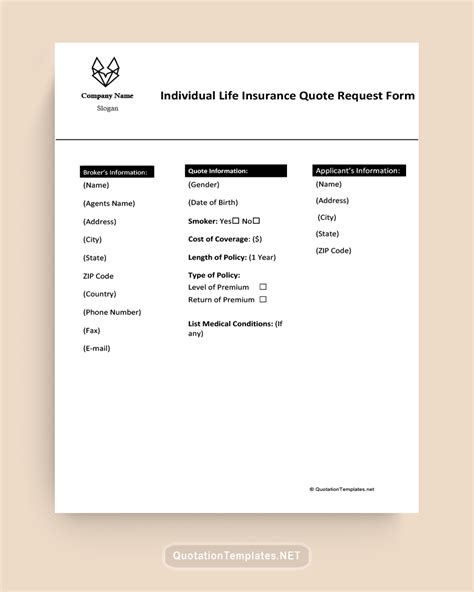

The process of acquiring a free insurance quotation is straightforward and convenient. Typically, it involves providing some basic information about yourself, your needs, and the type of coverage you're interested in. This information is then used by insurance providers to generate a personalized quotation that outlines the cost of the policy, the coverage limits, and any additional benefits or exclusions.

It's important to note that the accuracy of your quotation depends on the completeness and honesty of the information you provide. Any changes in your circumstances or requirements may affect the final cost and coverage of your insurance policy, so it's crucial to keep your information up-to-date.

Online vs. In-Person Quotations

In today's digital age, many insurance providers offer online quotation services, allowing you to obtain a quote from the comfort of your home. These online platforms are designed to be user-friendly and often provide immediate quotations based on the information you input. However, for more complex insurance needs or personalized advice, meeting with an insurance agent in person can be beneficial.

An in-person meeting with an insurance agent allows for a more detailed discussion of your specific circumstances and goals. They can provide expert advice, clarify any uncertainties, and guide you through the quotation process, ensuring you understand every aspect of the policy.

Factors Affecting Your Insurance Quotation

The cost of your insurance policy is influenced by several factors, and understanding these can help you secure the best possible quotation. Here are some key considerations:

- Type of Insurance: Different types of insurance policies, such as auto, health, life, or property, come with varying costs and coverage options. Each type of insurance has its unique considerations and factors that influence the quotation.

- Coverage Limits: The amount of coverage you require will impact your quotation. Higher coverage limits generally result in higher premiums, so it's essential to find a balance that suits your needs and budget.

- Deductibles and Co-Payments: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Co-payments, on the other hand, are the portion of costs you share with the insurance provider. Opting for higher deductibles or co-payments can reduce your premium costs.

- Personal Circumstances: Your age, gender, health status, driving record, and credit score can all affect your insurance quotation. For instance, younger individuals may pay higher premiums for auto insurance, while those with a clean driving record may receive discounts.

- Policy Add-ons: Additional coverage options, such as rental car coverage or roadside assistance, can increase your premium. It's important to carefully consider these add-ons to ensure they align with your needs and budget.

The Role of Technology in Insurance Quotations

Advancements in technology have revolutionized the insurance industry, making the quotation process more efficient and accessible. Many insurance providers now utilize sophisticated algorithms and data analytics to generate accurate and personalized quotations.

Additionally, the use of telematics in auto insurance has become increasingly popular. Telematics devices installed in vehicles collect data on driving behavior, such as speed, acceleration, and braking. This data is then used to provide more precise quotations, often resulting in discounts for safe driving habits.

Making the Most of Your Free Insurance Quotation

Once you've obtained a free insurance quotation, it's essential to thoroughly review and compare the options presented. Consider the following steps to make an informed decision:

- Compare Multiple Quotations: Don't settle for the first quotation you receive. Compare quotes from different insurance providers to identify the best value and coverage.

- Understand the Fine Print: Carefully read through the policy documents to understand the coverage limits, exclusions, and any additional terms and conditions. Ensure you are comfortable with all aspects of the policy.

- Ask Questions: If you have any doubts or uncertainties, don't hesitate to reach out to the insurance provider or an agent. They can provide clarification and ensure you fully understand the quotation.

- Negotiate: In some cases, you may be able to negotiate the terms of your insurance policy, especially if you are a loyal customer or have a strong relationship with the provider. Don't be afraid to discuss potential discounts or tailored coverage options.

- Review Regularly: Your insurance needs may change over time, so it's important to review your policy and quotation annually or whenever your circumstances change. This ensures you always have the right coverage and aren't paying for unnecessary premiums.

The Future of Insurance Quotations

The insurance industry is continuously evolving, and the future of insurance quotations looks promising. With the rise of digital technologies and data analytics, insurance providers are better equipped to offer more precise and personalized quotations.

Furthermore, the use of artificial intelligence and machine learning algorithms is expected to enhance the quotation process, making it even more efficient and accurate. These technologies can analyze vast amounts of data to provide tailored recommendations and quotations based on individual needs and circumstances.

| Insurance Type | Average Premium Cost |

|---|---|

| Auto Insurance | $1,200 - $1,800 annually |

| Health Insurance | Varies widely based on coverage and provider |

| Life Insurance | $200 - $1,000 annually (term life) |

| Property Insurance | $500 - $2,000 annually |

Frequently Asked Questions

Can I get a free insurance quotation without providing personal information?

+While some insurance providers may offer preliminary quotations without detailed personal information, a more accurate and personalized quotation will require providing basic details such as your age, location, and the type of insurance you're seeking.

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review my insurance quotations and policies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's recommended to review your insurance policies and quotations annually or whenever there's a significant change in your personal circumstances, such as a new vehicle purchase, a move to a different location, or a change in health status.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any hidden costs or fees associated with insurance quotations?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Insurance quotations should provide a transparent overview of the policy costs. However, it's important to carefully review the policy documents to understand any potential additional fees, such as administrative charges or policy cancellation fees.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I get a free insurance quotation if I have a pre-existing medical condition?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can still obtain a free insurance quotation even with a pre-existing condition. However, the quotation may be subject to additional considerations and may require more detailed information about your health status.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I know if I'm getting a competitive insurance quotation?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To ensure you're getting a competitive quotation, it's advisable to compare quotes from multiple insurance providers. Online comparison tools can be helpful in this regard, as they allow you to see a range of quotations side by side.</p>

</div>

</div>

</div>