Explanation Of Car Insurance

Car insurance is a vital aspect of vehicle ownership, offering financial protection and peace of mind to drivers around the world. It is a contract between an individual and an insurance company, where the insurer agrees to cover the policyholder for specific risks associated with owning and operating a motor vehicle. With the diverse range of vehicles on the road, from compact cars to luxury SUVs, and the myriad of driving conditions and scenarios, car insurance plays a crucial role in managing the potential financial burden arising from accidents, theft, or other unforeseen events.

This comprehensive guide will delve into the intricacies of car insurance, providing an in-depth understanding of its various facets. From the fundamental types of coverage to the nuanced factors influencing policy costs, and the practical steps involved in selecting the right insurance plan, we aim to empower readers with the knowledge needed to make informed decisions about their automotive insurance.

Understanding the Basics of Car Insurance

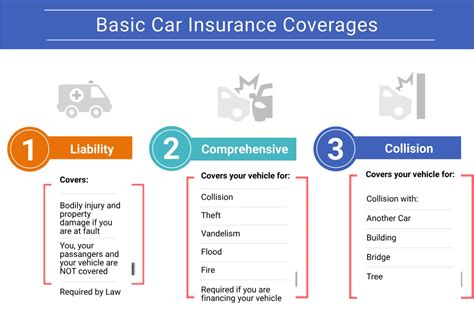

At its core, car insurance is a safety net designed to mitigate the financial impact of unforeseen incidents related to vehicle ownership. It encompasses a range of coverages, each addressing specific risks. These include liability coverage, which protects the policyholder from financial liability arising from accidents they cause, and comprehensive coverage, which provides a safety net for a broad spectrum of non-collision incidents, such as theft, vandalism, and natural disasters.

Additionally, car insurance offers medical coverage, which assists with the costs of treating injuries sustained in an accident, regardless of fault. It also includes collision coverage, which is crucial for repairing or replacing a vehicle after an accident. The type and extent of coverage one chooses depend on various factors, including the value of the vehicle, the driver's record, and the specific risks they wish to mitigate.

Liability Coverage: Protecting Others and Yourself

Liability coverage is a cornerstone of car insurance, providing financial protection in the event of an accident where the policyholder is at fault. It covers the costs of injuries or damages sustained by others involved in the accident, including medical expenses, lost wages, and property damage. This coverage is vital as it helps ensure the policyholder can meet their legal obligations and protects them from potentially devastating financial consequences.

| Liability Coverage Types | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured individuals. |

| Property Damage Liability | Pays for the repair or replacement of damaged property. |

Comprehensive Coverage: A Broad Safety Net

Comprehensive coverage, often referred to as “other than collision” coverage, is designed to protect against a wide range of non-collision incidents. This includes events like theft, vandalism, natural disasters, and even incidents like hitting an animal. It’s an essential component of car insurance, as it provides financial protection for damages not typically covered by liability or collision coverage.

Comprehensive coverage can be especially beneficial for vehicle owners in areas prone to natural disasters or those with high rates of theft or vandalism. It offers peace of mind, knowing that the policyholder is protected against a wide array of potential risks, even those that are less common.

Medical Coverage: Assisting with Healthcare Costs

Medical coverage, also known as Personal Injury Protection (PIP) or Medical Payments (MedPay), is a crucial aspect of car insurance. It provides financial assistance for the treatment of injuries sustained in an accident, regardless of who is at fault. This coverage can include expenses such as hospital stays, doctor visits, medication, and even funeral costs in the event of a fatality.

Having medical coverage ensures that the policyholder can focus on their recovery without the added stress of managing medical bills. It is particularly beneficial in no-fault states, where this coverage may be the primary source of financial assistance for accident victims.

Collision Coverage: Repairing or Replacing Your Vehicle

Collision coverage is designed to cover the costs of repairing or replacing a vehicle after an accident, regardless of fault. This coverage is essential for vehicle owners, as it provides a safety net for one of their most valuable assets. Whether it’s a minor fender bender or a more severe collision, collision coverage can help ensure the vehicle is restored to its pre-accident condition.

It's important to note that collision coverage typically comes with a deductible, which is the amount the policyholder must pay out of pocket before the insurance kicks in. Choosing the right deductible can be a balancing act between lower premiums and higher out-of-pocket expenses in the event of an accident. It's a decision that should be made based on the policyholder's financial comfort and the value of their vehicle.

Factors Influencing Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. These factors can vary significantly from person to person and state to state, making car insurance a highly personalized financial commitment.

Vehicle Type and Usage

The type of vehicle one drives and how it is used can significantly impact insurance costs. Generally, sports cars and luxury vehicles tend to have higher insurance premiums due to their higher repair costs and the fact that they are often driven more aggressively. Additionally, vehicles that are primarily used for business purposes or are driven long distances may also face higher insurance rates.

It's important to note that vehicle usage isn't just about how often you drive. It also includes factors like the purpose of your trips (commuting vs. pleasure driving) and the locations you frequent (urban areas vs. rural). These factors can influence your insurance rates, as they may increase the likelihood of accidents or claims.

Driver’s Record and Experience

A driver’s record and experience are critical factors in determining insurance rates. Insurance companies carefully review driving histories, looking for any signs of potential risk. This includes traffic violations, at-fault accidents, and even the number of years the driver has been licensed. Generally, a clean driving record and a longer history of safe driving can lead to lower insurance premiums.

On the other hand, a history of traffic violations or accidents can significantly increase insurance costs. This is because insurance companies view these incidents as indicators of future risk. Similarly, younger drivers, especially those under 25, often pay higher premiums due to their lack of driving experience and the higher risk associated with this demographic.

Location and Driving Conditions

The location where a vehicle is garaged and the driving conditions it frequently encounters can significantly impact insurance rates. Urban areas, for example, often have higher insurance costs due to the increased risk of accidents and theft. Similarly, regions with harsh winters may see higher rates due to the increased likelihood of weather-related incidents.

Additionally, the specific address where the vehicle is garaged can play a role. Insurance companies may use data on crime rates, accident frequencies, and even traffic congestion levels in a given area to determine insurance rates. This means that even within a city, insurance costs can vary significantly based on the specific neighborhood or zip code.

Coverage Types and Limits

The types of coverage and the limits chosen by the policyholder significantly influence insurance costs. Each coverage type, whether it’s liability, comprehensive, collision, or medical, comes with its own set of costs. Additionally, the limits chosen, such as the maximum amount the insurer will pay for a covered loss, can also impact premiums.

Generally, the more coverage and the higher the limits, the higher the insurance premiums. This is because the insurance company is taking on more financial risk. However, it's important to strike a balance between coverage and cost. While higher limits and more comprehensive coverage provide greater protection, they also result in higher premiums. It's a decision that should be made based on the policyholder's specific needs and financial situation.

Insurance Company and Policy Add-ons

The insurance company one chooses can significantly impact insurance costs. Different companies offer varying rates based on their business models, target markets, and risk assessments. Additionally, the specific policy add-ons or endorsements chosen can also affect premiums. These add-ons can provide additional coverage for specific risks or enhance existing coverage.

It's important to shop around and compare rates from multiple insurance companies. While a particular company may offer a competitive rate for a basic policy, they may not be the best option for a policy with extensive add-ons. Similarly, some companies may offer discounts for bundling multiple policies or for certain affiliations, such as being a member of a specific organization or having certain safety features in your vehicle.

Choosing the Right Car Insurance Policy

Selecting the right car insurance policy is a crucial decision that requires careful consideration of various factors. It involves understanding one’s specific needs, researching available options, and making informed choices that balance coverage and cost. Here are some key steps to guide you through the process of choosing the right car insurance policy.

Assess Your Insurance Needs

The first step in choosing a car insurance policy is to assess your specific insurance needs. Consider the value of your vehicle, your driving habits, and the potential risks you may face. For instance, if you live in an area with a high risk of theft or natural disasters, you may want to prioritize comprehensive coverage. Similarly, if you frequently drive long distances or have a history of accidents, you may want to opt for higher liability limits.

Additionally, consider your financial situation and what you can afford in the event of an accident. While it's important to have adequate coverage, you don't want to be overinsured, paying for coverage you don't need. At the same time, you also don't want to be underinsured, risking significant out-of-pocket expenses in the event of a claim.

Research Insurance Companies and Policies

Once you have a clear understanding of your insurance needs, it’s time to research insurance companies and their policies. Start by making a list of reputable insurers in your area. You can ask for recommendations from friends and family or check online reviews and ratings. It’s important to choose a financially stable company that has a good track record of paying claims promptly and fairly.

When researching policies, pay close attention to the types of coverage offered, the limits of liability, and any exclusions or limitations. Make sure the policy provides the coverage you need and that you understand any fine print or exclusions. It's also a good idea to check if the insurer offers any discounts, such as for safe driving, multiple policies, or certain vehicle features.

Get Multiple Quotes

Getting multiple quotes is a crucial step in choosing the right car insurance policy. It allows you to compare rates and coverage from different insurers, ensuring you get the best value for your money. Most insurance companies offer online quote tools, making it easy to get a quote in a matter of minutes. However, be sure to provide accurate and detailed information to ensure you get an accurate quote.

When comparing quotes, look beyond just the price. Consider the reputation of the insurer, the quality of their customer service, and their claims handling process. A lower premium may be attractive, but if the insurer is slow to pay claims or has a history of poor customer service, it may not be worth the risk.

Review Your Policy Regularly

Car insurance needs can change over time, so it’s important to review your policy regularly to ensure it still meets your needs. Life events such as getting married, buying a new car, or moving to a different area can all impact your insurance requirements. Additionally, your driving record and the value of your vehicle may change, influencing the type and amount of coverage you need.

Regularly reviewing your policy also allows you to take advantage of any changes in the insurance market. New insurers may enter the market, offering competitive rates or unique coverage options. Existing insurers may also adjust their rates or introduce new discounts, so it's worth checking in periodically to see if you can save money or enhance your coverage.

Understand Your Deductibles

Deductibles are an important aspect of car insurance that can significantly impact your out-of-pocket costs in the event of a claim. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if you have a 500 deductible and your car is damaged in an accident that costs 3,000 to repair, you will pay the first 500, and your insurance will cover the remaining 2,500.

Choosing a higher deductible can lower your insurance premiums, as you're assuming more financial risk. However, it's important to select a deductible that you can afford to pay in the event of a claim. If you choose a deductible that's too high, you may struggle to pay it if an accident occurs. On the other hand, a lower deductible provides more financial protection but typically comes with higher premiums.

Making a Car Insurance Claim

When an accident or incident occurs that’s covered by your car insurance policy, you’ll need to make a claim to have your vehicle repaired or replaced, and any other covered damages taken care of. The claims process can vary depending on the insurance company and the specifics of your policy, but here’s a general guide on what to expect when making a car insurance claim.

Notifying Your Insurance Company

The first step in making a car insurance claim is to notify your insurance company as soon as possible after the incident. Most insurance companies have a 24-hour claims hotline or online portal where you can report the claim. Provide as much detail as you can about the incident, including the date, time, location, and any other relevant information. It’s important to be honest and accurate in your report, as any false or misleading information can void your coverage.

When reporting the claim, you'll typically need to provide your policy number, the make and model of your vehicle, and the other party's information if they were involved in the incident. The insurance company will then assign a claims adjuster to handle your case.

The Claims Adjuster’s Role

The claims adjuster is responsible for investigating your claim, determining fault (if applicable), and assessing the extent of the damages. They will review the details of the incident, any police reports, photos or videos of the scene, and any other evidence you provide. The adjuster may also speak with witnesses or the other party involved in the incident to gather more information.

Once the adjuster has gathered all the necessary information, they will evaluate the claim and determine whether it's covered by your policy. They will also assess the value of the damages and the cost of repairs or replacement. If there's a dispute about fault or the value of the damages, the adjuster may request additional information or documentation to support your claim.

Assessing and Repairing the Damage

After the claims adjuster has determined that your claim is valid and covered by your policy, they will authorize the repairs or replacement of your vehicle. You’ll typically have the option to choose your own repair shop, but some insurance companies may have preferred shops or networks that they work with regularly.

If you choose a repair shop outside of the insurer's network, you may need to pay for the repairs upfront and then submit the receipts to your insurance company for reimbursement. On the other hand, if you use a preferred shop, the insurance company may pay the shop directly, up to the agreed-upon amount for the repairs.

Understanding Your Coverage Limits

It’s important to understand the limits of your car insurance coverage when making a claim. Each type of coverage, such as liability, comprehensive, or collision, has its own limits, which are the maximum amounts your insurance company will pay for covered damages. These limits are typically set when you purchase your policy and can be increased or decreased at your request.

If the cost of repairs or replacement exceeds your coverage limits, you'll be responsible for paying the remaining amount out of pocket. This is why it's crucial to choose coverage limits that align with the value of your vehicle and your financial situation. Additionally, some policies may have deductibles, which are amounts you must pay upfront before your insurance coverage kicks in. Understanding your deductibles is essential when budgeting for potential out-of-pocket expenses.

Tips for Lowering Your Car Insurance Costs

Car insurance can be a significant expense, but there are several strategies you can employ to lower your insurance costs without sacrificing coverage. Here are some practical tips to help you save money on your car insurance premiums.

Shop Around for the Best Rates

One of the most effective ways to lower your car insurance costs is to shop around for the best rates. Insurance companies use different formulas to calculate premiums, so it’s worth getting quotes from multiple insurers to find the best deal. You can use online comparison tools or contact insurance agents directly to request quotes. When comparing rates, make sure you’re getting quotes for the same coverage limits and deductibles to ensure an accurate comparison.

Bundle Your Policies

If you have multiple insurance needs, such as car, home, or life insurance, consider bundling your policies with the same insurer. Many insurance companies offer discounts for customers who bundle multiple policies, as it’s more convenient for the insurer to manage a single customer’s policies and claims. By bundling your policies, you can often save money on each individual policy, resulting in significant overall savings.

Increase Your Deductibles

Increasing your deductibles is another effective way to lower your car insurance premiums