Long Care Insurance

Long-term care insurance is a crucial financial planning tool that provides individuals and their families with peace of mind, ensuring they are prepared for the unexpected costs and challenges associated with extended care needs. As life expectancy increases and medical advancements continue to extend our years, the likelihood of requiring long-term care services also rises. This comprehensive guide will delve into the intricacies of long-term care insurance, exploring its benefits, coverage options, and the impact it can have on your financial well-being and future.

Understanding Long-Term Care Insurance

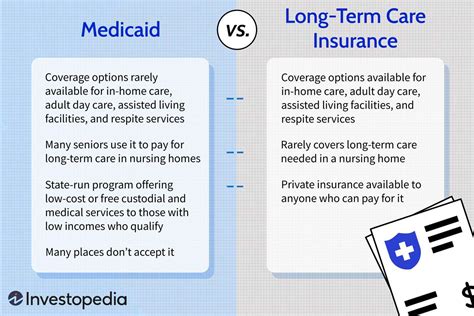

Long-term care insurance is a specialized type of coverage designed to protect individuals from the substantial financial burden that often accompanies the need for extended care. Unlike traditional health insurance, which primarily focuses on acute medical conditions and short-term treatments, long-term care insurance addresses the costs and services required for ongoing support, such as assistance with daily activities, nursing home stays, or in-home care.

The need for long-term care can arise from a variety of circumstances, including aging-related conditions, chronic illnesses, accidents, or cognitive impairments. These situations may require individuals to rely on professional caregivers, either in their homes or in specialized facilities, for an extended period. The cost of such care can quickly deplete personal savings, emphasizing the importance of having a comprehensive financial plan that includes long-term care insurance.

The Growing Demand for Long-Term Care

The demand for long-term care services is on the rise, primarily due to the increasing lifespan of individuals and the growing awareness of the benefits of long-term care insurance. According to recent studies, approximately 70% of individuals over the age of 65 will require some form of long-term care during their lifetimes. This statistic underscores the necessity of financial preparedness for this aspect of aging.

Moreover, the cost of long-term care is significant and continues to rise. For instance, the average cost of a private room in a nursing home can exceed $100,000 per year, and in-home care services can range from $20 to $30 per hour, depending on the level of care required. Long-term care insurance steps in to bridge this financial gap, ensuring individuals have access to the care they need without depleting their assets or relying solely on government assistance.

Benefits of Long-Term Care Insurance

Long-term care insurance offers a multitude of benefits that extend beyond financial protection. Here are some key advantages of investing in this type of insurance:

- Peace of Mind: Knowing that you have coverage in place for potential long-term care needs can provide immense relief. It allows individuals and their families to focus on their health and well-being without the added stress of financial worries.

- Preservation of Assets: Long-term care insurance helps protect your savings, investments, and other assets. By covering the costs of care, it ensures that your financial legacy is preserved for future generations or other personal goals.

- Choice of Care: With long-term care insurance, you have the flexibility to choose the type of care that best suits your needs. Whether you prefer to receive care in the comfort of your own home or in a specialized facility, the insurance provides the financial support to make that choice.

- Inflation Protection: Many long-term care insurance policies include inflation protection, which adjusts your benefits over time to account for rising costs. This feature ensures that your coverage remains adequate, even as the cost of care increases.

- Tax Benefits: In some cases, long-term care insurance premiums may be tax-deductible, depending on the individual's circumstances and the policy terms. Consulting with a financial advisor or tax professional can provide more information on potential tax advantages.

Customizing Your Coverage

One of the notable advantages of long-term care insurance is the ability to tailor your coverage to your specific needs and preferences. Insurance providers offer a range of options to customize your policy, including:

| Coverage Option | Description |

|---|---|

| Daily Benefit Amount | The amount of money the policy will pay out per day for covered care services. |

| Benefit Period | The duration for which the policy will provide coverage, ranging from a few years to lifelong protection. |

| Elimination Period | The waiting period before the policy begins paying benefits, often measured in days. |

| Inflation Protection | A feature that adjusts the benefit amount annually to keep pace with rising care costs. |

| Care Settings | The locations where the policy will cover care, such as nursing homes, assisted living facilities, or in-home care. |

Working closely with an insurance professional can help you navigate these options and select the coverage that aligns with your unique circumstances and financial goals.

Who Should Consider Long-Term Care Insurance?

Long-term care insurance is a valuable tool for individuals across various life stages and financial situations. Here are some groups that may particularly benefit from this type of insurance:

- Older Adults: Individuals in their retirement years are at a higher risk of requiring long-term care. Long-term care insurance provides a safety net for this stage of life, ensuring that aging doesn't lead to financial hardship.

- Individuals with a Family History of Chronic Illness: If your family has a history of conditions that may require long-term care, such as Alzheimer's or Parkinson's disease, insurance can offer peace of mind and financial protection.

- Younger Adults with Disabilities: Younger individuals with disabilities or special needs may require long-term care services for an extended period. Long-term care insurance can help ensure they receive the care they need without financial strain.

- Caregivers: If you are a primary caregiver for a loved one, having long-term care insurance can provide support if your caregiving responsibilities change or increase over time.

- Individuals with High Net Worth: For those with substantial assets, long-term care insurance can be a strategic tool to protect their wealth and ensure it is passed on to their heirs or used for their chosen legacy.

The Role of Health and Age

Health and age play a significant role in long-term care insurance. Generally, it is more affordable and accessible to obtain this type of insurance at a younger age and in good health. However, even individuals with pre-existing conditions or health challenges can still find suitable coverage options.

It's important to note that long-term care insurance is not just for the elderly. While the risk of requiring long-term care increases with age, younger adults can also benefit from early planning. By purchasing insurance at a younger age, individuals can often secure lower premiums and have more options for coverage.

How to Choose the Right Long-Term Care Insurance

Selecting the right long-term care insurance policy involves careful consideration of your personal circumstances and financial goals. Here are some key factors to keep in mind during your decision-making process:

- Coverage Needs: Assess your current and potential future care needs. Consider factors such as your health history, family medical history, and the level of care you anticipate requiring. This will help you determine the appropriate daily benefit amount and benefit period for your policy.

- Financial Capacity: Evaluate your financial situation and determine how much you can comfortably afford for insurance premiums. Remember that long-term care insurance is a long-term investment, so it's important to find a policy that fits within your budget without compromising your financial stability.

- Policy Features: Review the various features and benefits offered by different insurance providers. Compare options for inflation protection, care settings, and additional services like case management or respite care. These features can significantly impact the value and flexibility of your policy.

- Reputation and Stability: Research the insurance company's reputation and financial stability. You want to ensure that the company you choose will be able to honor your policy and provide the coverage you need, even in the long term.

- Expert Advice: Consider seeking guidance from a qualified insurance professional or financial advisor who specializes in long-term care planning. They can provide personalized recommendations and help you navigate the complex world of insurance options.

Working with an Insurance Advisor

Engaging the services of an insurance advisor can be a valuable step in securing the right long-term care insurance. These professionals have extensive knowledge of the insurance market and can provide tailored recommendations based on your unique needs. They can also assist with the application process and ensure that you fully understand the terms and conditions of your chosen policy.

When working with an insurance advisor, be sure to ask about their experience and expertise in long-term care planning. Look for advisors who are licensed and have a proven track record of success in this area. Additionally, consider seeking referrals from trusted sources to find an advisor who aligns with your values and financial goals.

The Future of Long-Term Care Insurance

The landscape of long-term care insurance is evolving, with ongoing advancements in policy design and coverage options. Here are some trends and developments to watch for in the future:

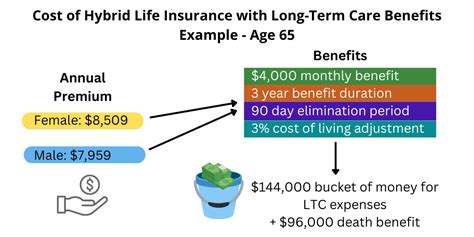

- Hybrid Policies: Insurance providers are introducing hybrid policies that combine long-term care coverage with life insurance or annuity benefits. These policies offer a unique solution, providing both long-term care protection and a death benefit, which can be especially appealing to individuals seeking comprehensive financial planning.

- Innovative Care Options: As technology advances, long-term care insurance may increasingly cover innovative care solutions, such as telemedicine or virtual care. These options can enhance the flexibility and accessibility of care, particularly for individuals in remote areas or with limited mobility.

- Enhanced Consumer Education: There is a growing emphasis on consumer education and awareness regarding long-term care planning. Insurance providers and financial institutions are investing in resources and initiatives to help individuals better understand their options and the importance of early planning.

- Partnerships and Collaborations: Insurance companies are partnering with healthcare providers, senior living communities, and other organizations to offer integrated care solutions. These collaborations aim to improve the overall care experience and provide more comprehensive support for policyholders.

Staying Informed

To stay abreast of developments in long-term care insurance, it’s essential to regularly review industry news and updates. Consider subscribing to reputable financial publications or following trusted sources in the insurance and healthcare sectors. Additionally, attend webinars or seminars focused on long-term care planning to gain insights into the latest trends and best practices.

Engaging in ongoing education and staying informed about long-term care insurance ensures that you can make well-informed decisions about your financial future. It also allows you to adapt your coverage as your needs and the industry evolve.

Conclusion

Long-term care insurance is a vital component of comprehensive financial planning, offering individuals and their families a sense of security and financial protection. By understanding the benefits, coverage options, and trends in this field, you can make informed decisions to safeguard your future well-being. Remember, early planning and customization are key to ensuring your long-term care needs are met with the support and dignity you deserve.

What are the typical costs associated with long-term care insurance?

+The cost of long-term care insurance can vary significantly based on factors such as age, health status, coverage options, and the insurance provider. Generally, premiums tend to be lower for younger individuals in good health and increase with age and higher coverage amounts. It’s essential to obtain quotes from multiple providers to find the most suitable and affordable policy for your needs.

How do I know if I qualify for long-term care insurance?

+Most insurance providers require a medical assessment to determine eligibility for long-term care insurance. This assessment helps evaluate your health status and the potential risk of requiring long-term care. While pre-existing conditions may impact your eligibility or the cost of coverage, many providers offer options for individuals with specific health concerns.

Can I customize my long-term care insurance policy after purchasing it?

+The ability to customize your policy after purchase depends on the terms of your specific insurance contract. Some policies allow for adjustments in coverage amounts or benefit periods, while others may have restrictions. It’s important to review your policy carefully and consult with your insurance provider if you have questions or wish to make changes.