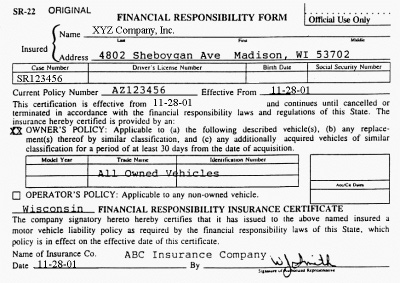

Define Sr 22 Insurance

SR-22 insurance, often referred to as a "certificate of financial responsibility," is a special type of insurance document that plays a crucial role in the world of automotive insurance. This unique certificate is not an insurance policy per se, but rather a form that an insurance provider files with a state's Department of Motor Vehicles (DMV) on behalf of a high-risk driver. The SR-22 serves as proof that the driver has purchased the state-required minimum amount of liability insurance coverage, typically after certain driving-related incidents.

Understanding SR-22 Insurance

SR-22 insurance is often mandated by state laws and is usually required for drivers who have been involved in severe traffic violations, such as driving under the influence (DUI) or driving while intoxicated (DWI), or those who have accumulated multiple traffic offenses and have had their driver’s license suspended or revoked.

The primary purpose of SR-22 insurance is to ensure that these high-risk drivers meet the minimum liability insurance requirements set by their state. By filing an SR-22, drivers demonstrate their financial responsibility and ability to pay for any damages or injuries they might cause in a future accident. This is especially important as these drivers are considered a higher risk on the roads, and the SR-22 helps protect other drivers and pedestrians from potential financial burdens caused by these high-risk drivers.

Key Characteristics of SR-22 Insurance

SR-22 insurance differs from standard auto insurance policies in several key ways:

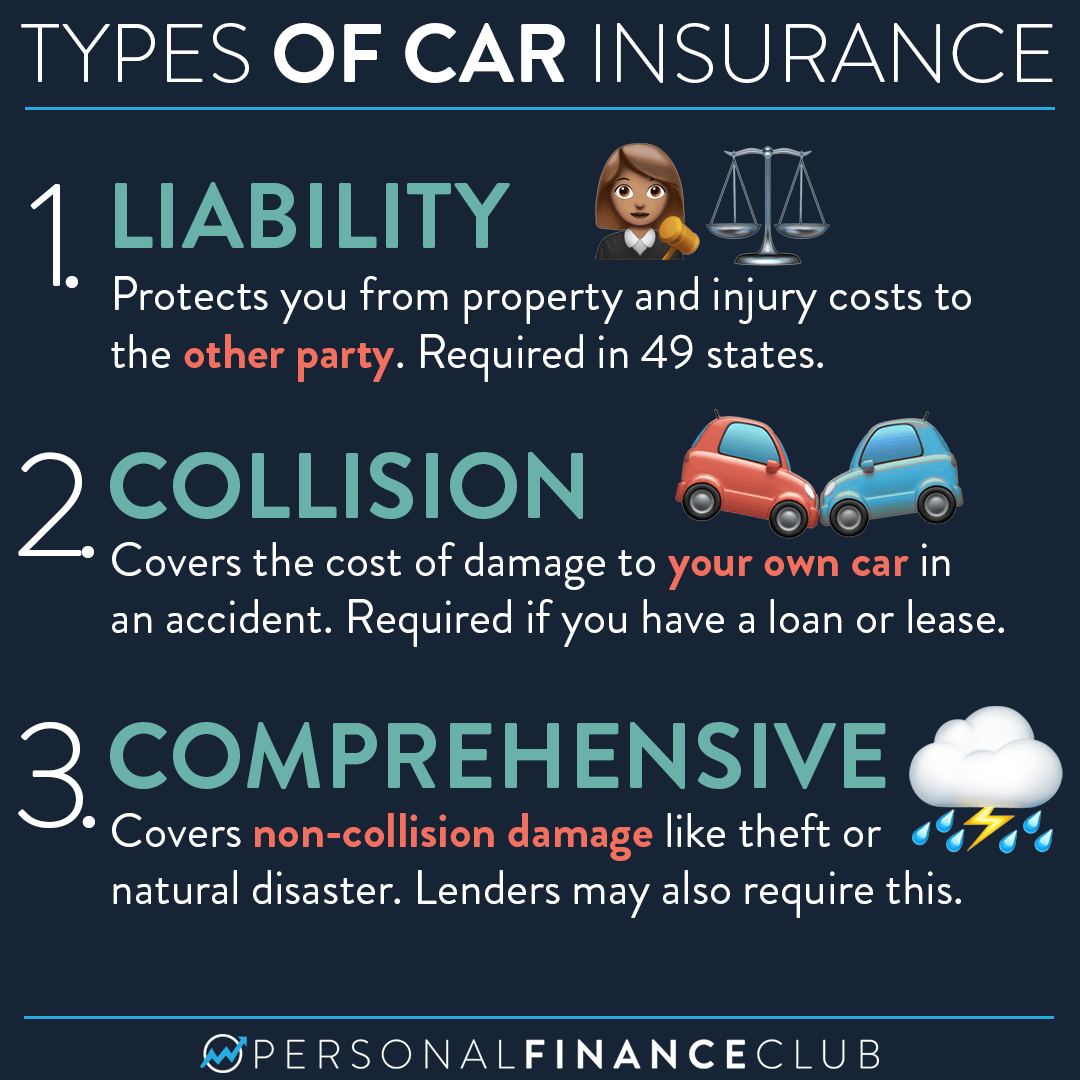

- Purpose: While regular auto insurance policies are designed to protect the policyholder and their vehicle, SR-22 insurance is primarily for the benefit of others, ensuring that the high-risk driver can cover any damages or injuries they cause.

- Duration: SR-22 insurance is usually required for a set period, often ranging from 3 to 5 years, depending on the state and the nature of the violation. During this time, the driver must maintain continuous coverage to avoid further legal issues.

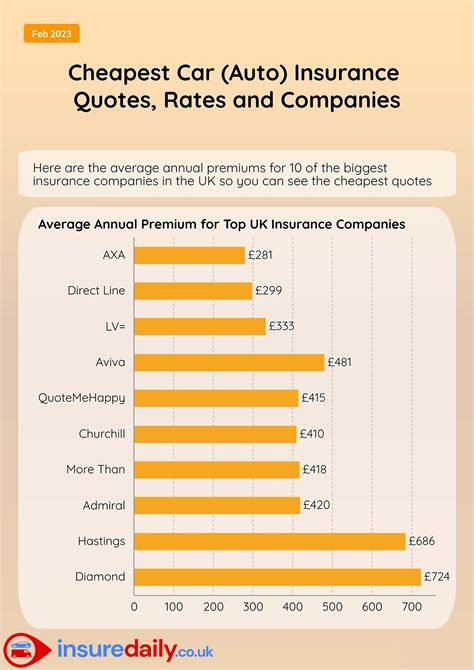

- Cost: SR-22 insurance can be significantly more expensive than standard auto insurance due to the higher risk associated with the driver. This is because insurance companies consider these drivers more likely to be involved in accidents and file claims.

- Obtaining SR-22: To obtain an SR-22, drivers typically need to contact their insurance provider, who will then file the SR-22 form with the state's DMV. Some states may also require the driver to pay a fee for the SR-22 filing.

Who Needs SR-22 Insurance

SR-22 insurance is typically required for drivers who have committed serious traffic violations or have had their driver’s license suspended or revoked. Some common scenarios where an SR-22 might be necessary include:

- DUI/DWI Convictions: Drivers convicted of driving under the influence or driving while intoxicated are often required to file an SR-22 to regain their driving privileges.

- Hit-and-Run Incidents: If a driver is involved in a hit-and-run accident and fails to provide the required information, they may need to file an SR-22.

- Multiple Traffic Offenses: Drivers who accumulate several traffic violations within a short period, such as speeding tickets or at-fault accidents, may be required to file an SR-22.

- Lack of Insurance Coverage: In some states, drivers who are caught driving without the minimum required insurance coverage may need to file an SR-22.

The Impact of SR-22 Insurance

The requirement to file an SR-22 can have significant implications for drivers. In addition to the increased cost of insurance, drivers with an SR-22 may face other challenges, including:

- Difficulty in Obtaining Insurance: Not all insurance providers offer SR-22 insurance, so drivers may need to shop around to find a suitable insurer.

- Longer Renewal Periods: SR-22 insurance policies often have shorter durations, requiring drivers to renew their policy more frequently.

- Potential for License Suspension: If a driver fails to maintain continuous SR-22 insurance coverage, their license may be suspended again, leading to further legal complications.

The SR-22 Process

The process of obtaining and maintaining SR-22 insurance typically involves the following steps:

- Violation Occurs: The driver commits a serious traffic violation, such as a DUI, or has their license suspended for another reason.

- Reinstatement of License: To regain their driving privileges, the driver is often required to provide proof of financial responsibility, which leads to the need for an SR-22.

- Obtaining SR-22 Insurance: The driver contacts an insurance provider who offers SR-22 insurance and purchases a policy that meets their state's minimum liability requirements.

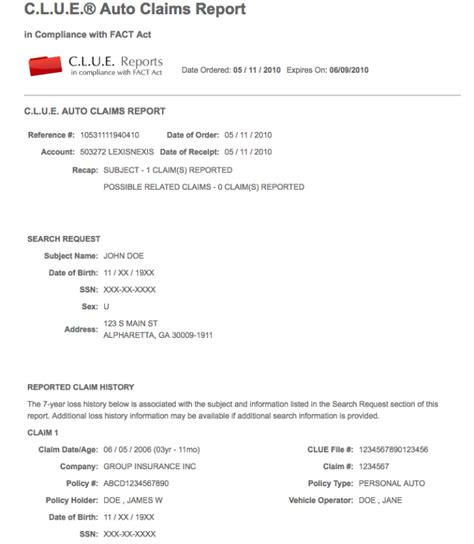

- SR-22 Filing: The insurance provider files the SR-22 form with the state's DMV, indicating that the driver has the required insurance coverage.

- Maintaining Coverage: The driver must ensure that their SR-22 insurance policy remains active for the entire duration required by the state. Any lapses in coverage could result in the driver's license being suspended again.

Renewal and Cancellation

SR-22 insurance policies typically have shorter durations than standard auto insurance policies. When the policy expires, the insurance provider will file a new SR-22 form with the DMV to continue coverage. However, if the policy is canceled or lapses, the insurance provider is required by law to notify the DMV, which could result in the driver’s license being suspended once more.

| State | SR-22 Requirement |

|---|---|

| Alabama | Required for DUI/DWI and multiple traffic violations |

| California | Mandatory for all DUI convictions |

| Florida | Needed for license reinstatement after suspension |

| Illinois | SR-22 filing required for certain violations |

| Texas | Mandatory for drivers with a suspended license |

The Bottom Line

SR-22 insurance is a specialized form of insurance documentation that serves as proof of financial responsibility for high-risk drivers. It’s often a requirement for drivers who have committed serious traffic violations or have had their license suspended. While it can be costly and challenging to obtain, SR-22 insurance is a crucial step toward regaining driving privileges and ensuring the safety of others on the road.

How long is an SR-22 insurance policy typically valid for?

+The duration of an SR-22 insurance policy can vary depending on the state and the nature of the violation. In most cases, SR-22 insurance is required for a period of 3 to 5 years.

Can I drive without SR-22 insurance if I’ve had a DUI?

+In many states, driving without SR-22 insurance after a DUI is illegal. It’s crucial to maintain continuous SR-22 insurance coverage to avoid further legal issues.

What happens if my SR-22 insurance lapses or is canceled?

+If your SR-22 insurance lapses or is canceled, your insurance provider is required to notify the DMV. This could lead to your license being suspended again.