Types Of Automobile Insurance

Automobile insurance, commonly known as car insurance, is a crucial aspect of vehicle ownership. It provides financial protection and peace of mind to drivers, ensuring they are covered for various incidents and potential liabilities on the road. With a wide range of coverage options and varying state requirements, understanding the different types of automobile insurance is essential for making informed decisions about your policy.

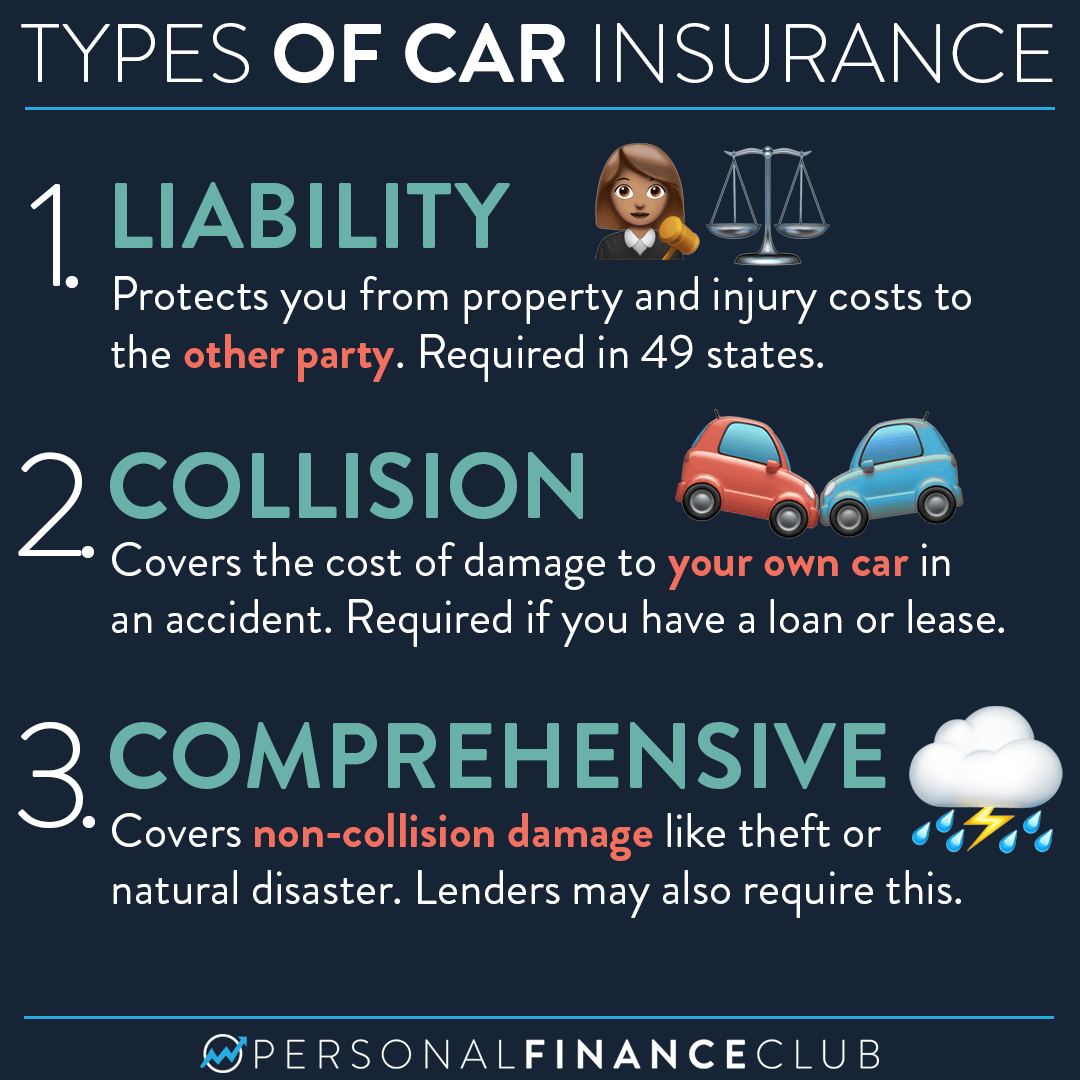

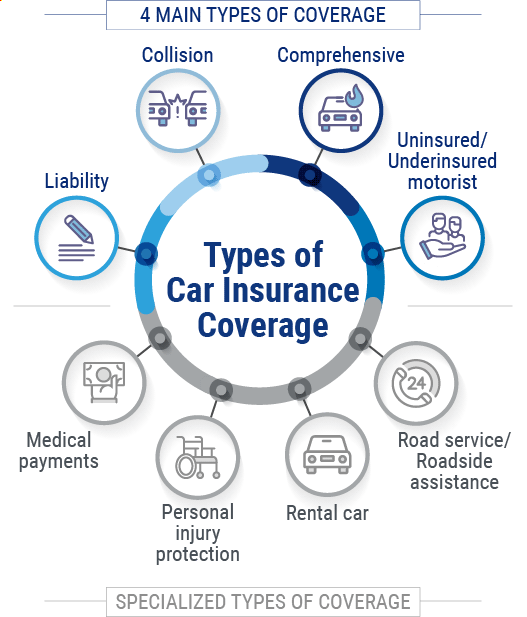

Liability Coverage

Liability insurance is the most fundamental type of automobile insurance, serving as a legal requirement in most states. This coverage protects you from financial losses arising from bodily injury or property damage caused to others as a result of an accident for which you are at fault. It typically includes two main components:

- Bodily Injury Liability: This coverage pays for the medical expenses and lost wages of individuals injured in an accident caused by you. It also covers legal defense costs if a lawsuit is filed against you.

- Property Damage Liability: Property damage liability covers the cost of repairing or replacing vehicles, structures, and other property damaged in an accident for which you are responsible.

Liability insurance is vital as it safeguards you from potentially devastating financial consequences resulting from accidents. While the specific limits and requirements vary by state, it is recommended to choose higher liability limits to provide more comprehensive protection.

Collision and Comprehensive Coverage

Collision and comprehensive insurance are optional coverages that offer additional protection for your vehicle. These coverages are often required by lenders if you are financing or leasing your car.

Collision Coverage

Collision insurance covers the cost of repairing or replacing your vehicle if it is damaged in an accident, regardless of fault. This coverage applies to collisions with other vehicles, objects, or in the event of a rollover. It is particularly valuable for newer or financed vehicles, as it ensures you are not left with a large repair bill or the full cost of replacement.

| Key Benefits of Collision Coverage | Real-World Examples |

|---|---|

| Covers repair costs for accidents with other vehicles or objects | A collision with a deer on a rural road can be covered by collision insurance, ensuring your vehicle is repaired promptly. |

| Provides protection for financed or leased vehicles | If you lease a car, collision insurance is essential to avoid paying out-of-pocket for repairs or replacement. |

Comprehensive Coverage

Comprehensive insurance offers protection for your vehicle against non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals. It is a vital coverage to have, as it ensures your vehicle is protected from a wide range of unforeseen events.

| Common Comprehensive Coverage Scenarios | Actual Examples |

|---|---|

| Theft or vandalism | Comprehensive coverage can reimburse you for the cost of a stolen vehicle or repairs needed after your car is vandalized. |

| Natural disasters | If your car is damaged in a hurricane or hailstorm, comprehensive insurance can cover the repairs or replacement. |

| Animal collisions | A collision with a deer or other wildlife is covered by comprehensive insurance, ensuring your vehicle is repaired. |

Personal Injury Protection (PIP)

Personal Injury Protection, often referred to as PIP, is a type of automobile insurance coverage that provides benefits to the insured driver and passengers regardless of fault in an accident. PIP coverage is mandatory in some states and highly recommended in others due to its comprehensive nature.

Key Features of Personal Injury Protection

- Medical Expenses: PIP covers the cost of medical treatment, including hospital stays, surgeries, doctor visits, and rehabilitation, for the insured driver and passengers.

- Lost Wages: If the insured driver or passengers are unable to work due to injuries sustained in an accident, PIP provides compensation for lost income.

- Funeral Expenses: In the unfortunate event of a fatality, PIP coverage can assist with funeral and burial costs.

- Alternative Transportation: If your vehicle is damaged and requires repairs, PIP may provide coverage for alternative transportation during the repair period.

PIP coverage ensures that you and your passengers receive the necessary medical care and financial support after an accident, regardless of who is at fault. It is a valuable addition to your automobile insurance policy, providing peace of mind and ensuring that you are not left financially burdened by medical expenses or lost wages.

Medical Payments Coverage (MedPay)

Medical Payments Coverage, commonly known as MedPay, is an optional type of automobile insurance that specifically covers medical expenses resulting from an automobile accident. MedPay is designed to provide quick and efficient coverage for medical bills, ensuring you receive the necessary treatment without delay.

Key Benefits of Medical Payments Coverage

- Prompt Medical Care: MedPay ensures that you and your passengers receive immediate medical attention without worrying about upfront costs. It covers a wide range of medical expenses, including emergency room visits, hospital stays, surgeries, and rehabilitation.

- No-Fault Coverage: Unlike other types of automobile insurance, MedPay is a no-fault coverage, meaning it provides benefits regardless of who is at fault in the accident. This makes it an essential coverage for ensuring your medical needs are met, even in situations where liability is unclear.

- Additional Benefits: In addition to covering medical expenses, MedPay may also provide benefits for funeral expenses, ambulance services, and even lost wages in some states. These additional benefits make MedPay a comprehensive and valuable addition to your automobile insurance policy.

Medical Payments Coverage is particularly beneficial for individuals who want to ensure they receive the necessary medical care promptly and without financial strain. It provides peace of mind, knowing that your medical needs are taken care of, regardless of the circumstances of the accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an essential type of automobile insurance that provides protection in situations where the at-fault driver has little or no insurance coverage. This coverage is designed to protect you and your passengers from financial losses resulting from accidents caused by uninsured or underinsured drivers.

Key Features of Uninsured/Underinsured Motorist Coverage

- Protection Against Uninsured Drivers: UM coverage steps in when the at-fault driver has no insurance, ensuring you are compensated for your injuries and property damage.

- Coverage for Underinsured Drivers: UIM coverage comes into play when the at-fault driver’s liability insurance is insufficient to cover your losses. It provides additional compensation to bridge the gap between their coverage and your actual expenses.

- No-Fault Coverage: UM/UIM coverage is a no-fault coverage, meaning it provides benefits regardless of who is at fault in the accident. This ensures that you are protected even if the other driver is at fault but lacks adequate insurance.

Uninsured/Underinsured Motorist Coverage is a critical component of your automobile insurance policy, especially in areas with a high prevalence of uninsured or underinsured drivers. It provides financial protection and peace of mind, ensuring that you are not left to bear the burden of medical expenses, property damage, or other losses resulting from an accident caused by an uninsured or underinsured driver.

Other Optional Coverages

In addition to the standard coverages, automobile insurance policies offer a range of optional add-ons that can enhance your protection and provide additional peace of mind.

Rental Car Coverage

Rental car coverage, also known as rental reimbursement, provides coverage for the cost of renting a vehicle while your insured car is being repaired due to a covered incident. This coverage is particularly valuable for individuals who rely heavily on their vehicles for daily activities and cannot afford to be without a car for an extended period.

Gap Insurance

Gap insurance, or Guaranteed Auto Protection, covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease. This coverage is essential for individuals who have financed or leased their vehicles, as it ensures that you are not left with a large balance if your car is totaled or stolen.

Roadside Assistance

Roadside assistance coverage provides emergency services such as towing, battery jump-starts, flat tire changes, and fuel delivery. It is a convenient and cost-effective way to ensure you have help readily available when you need it most.

Custom Parts and Equipment Coverage

If you have made significant modifications to your vehicle, such as adding custom wheels, audio systems, or performance enhancements, custom parts and equipment coverage ensures that these upgrades are protected in the event of an accident or other covered incident.

These optional coverages can be tailored to your specific needs and circumstances, providing additional peace of mind and ensuring that your vehicle and personal belongings are protected comprehensively.

Understanding Deductibles and Premiums

When selecting automobile insurance, it’s crucial to consider the impact of deductibles and premiums on your coverage. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

It’s essential to strike a balance between the deductible and premium that aligns with your financial capabilities and risk tolerance. While a higher deductible can save you money on premiums, it means you’ll pay more out of pocket if you need to file a claim. On the other hand, a lower deductible provides more financial protection but comes at a higher premium cost.

Consider your budget and the likelihood of needing to file a claim when choosing your deductible. If you’re a safe driver with a low risk of accidents, a higher deductible and lower premium may be a suitable option. However, if you’re more risk-averse or have a history of accidents, a lower deductible and higher premium may provide the peace of mind you need.

Conclusion

Understanding the different types of automobile insurance is crucial for making informed decisions about your coverage. From liability insurance, which is a legal requirement, to optional coverages like collision, comprehensive, and personal injury protection, each type of insurance serves a unique purpose. By carefully selecting the right combination of coverages and deductibles, you can ensure that you are protected financially and have the peace of mind to enjoy your time on the road.

Frequently Asked Questions

What is the difference between collision and comprehensive coverage?

+Collision coverage specifically applies to accidents involving your vehicle, regardless of fault. It covers repair or replacement costs if your car is damaged in a collision. Comprehensive coverage, on the other hand, provides protection for your vehicle against non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals.

Is Personal Injury Protection (PIP) necessary for my automobile insurance policy?

+PIP coverage is mandatory in some states and highly recommended in others. It provides comprehensive benefits for medical expenses, lost wages, and funeral expenses, regardless of fault. If you want to ensure you and your passengers receive prompt medical care and financial support after an accident, PIP is a valuable addition to your policy.

What is Uninsured/Underinsured Motorist Coverage, and why is it important?

+Uninsured/Underinsured Motorist Coverage (UM/UIM) is crucial for protecting you in situations where the at-fault driver has little or no insurance coverage. It provides compensation for your injuries and property damage, ensuring you are not left financially burdened by the actions of an uninsured or underinsured driver.

How do I choose the right deductible for my automobile insurance policy?

+When selecting a deductible, consider your budget and risk tolerance. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums. If you’re a safe driver with a low risk of accidents, a higher deductible may be suitable. However, if you prefer more financial protection, a lower deductible is recommended, even if it means paying a higher premium.