Insurance Cheap Car

In today's world, having car insurance is not just a wise decision but a legal necessity in most countries. However, the cost of car insurance can vary significantly, and finding an affordable policy can be a challenge. This comprehensive guide aims to delve into the world of cheap car insurance, offering expert insights and strategies to help you secure the best coverage at the lowest possible price. From understanding the factors that influence premiums to exploring money-saving tips and tricks, we'll cover everything you need to know to get the coverage you deserve without breaking the bank.

Understanding Cheap Car Insurance

Cheap car insurance, simply put, refers to insurance policies that offer the necessary coverage at a cost-effective rate. It is a common misconception that low-cost insurance policies compromise on coverage or quality. In reality, cheap car insurance policies are tailored to meet the specific needs of drivers who are looking for affordable options without sacrificing essential protection.

The insurance industry is highly competitive, and insurers are constantly innovating to attract new customers. This competition often results in a wide range of affordable policies that cater to different driver profiles. Whether you're a young driver just starting out, a seasoned motorist looking for a better deal, or someone with a less-than-perfect driving record, there are cheap car insurance options available to suit your unique circumstances.

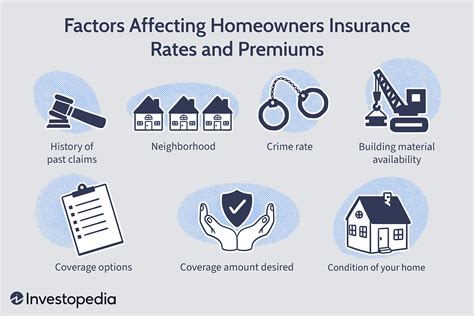

Factors Influencing Cheap Car Insurance Rates

Several key factors play a role in determining the cost of car insurance, and understanding these factors can help you navigate the market effectively. Here’s a breakdown of some of the most influential factors:

- Age and Driving Experience: Younger drivers, especially those under 25, often face higher insurance premiums due to their lack of driving experience. Insurance companies statistically associate younger drivers with a higher risk of accidents, which can lead to increased costs. However, as drivers gain more experience and maintain a clean driving record, their insurance rates typically decrease.

- Vehicle Type and Value: The make, model, and age of your vehicle can significantly impact your insurance costs. High-performance cars, luxury vehicles, and sports cars often attract higher premiums due to their potential for higher repair costs and increased risk of theft. Conversely, older, less expensive cars may qualify for lower insurance rates.

- Location and Usage: Where you live and how you use your vehicle can also affect your insurance rates. Urban areas often have higher premiums due to the increased risk of accidents and car theft. Additionally, if you use your vehicle for business purposes or commute long distances, your insurance costs may be higher.

- Driving Record: A clean driving record is a significant factor in determining insurance rates. Insurers prefer drivers with no recent accidents or traffic violations, as they pose a lower risk. A history of accidents or violations can lead to higher premiums or even difficulty in finding affordable insurance.

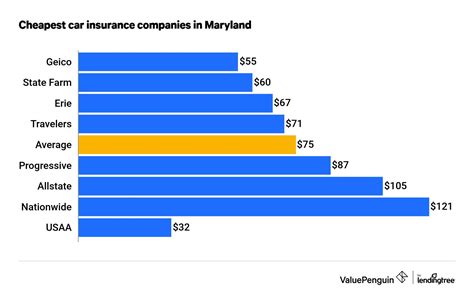

- Insurance Company and Policy Type: Different insurance companies offer a variety of policies with different features and pricing structures. Shopping around and comparing quotes from multiple insurers can help you find the best deal for your specific needs.

Tips and Strategies for Getting Cheap Car Insurance

Now that we’ve covered the fundamental factors that influence car insurance rates, let’s explore some practical tips and strategies to help you secure cheap car insurance:

Shop Around and Compare Quotes

One of the most effective ways to find cheap car insurance is to shop around and compare quotes from multiple insurers. Insurance rates can vary significantly between companies, so getting quotes from at least three to five providers can give you a good sense of the market and help you identify the most competitive rates.

When comparing quotes, pay attention to the coverage details and ensure that the policies offer the same level of protection. Some insurers may offer lower rates by providing less comprehensive coverage, so it's essential to understand exactly what you're getting for your money.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies together. For instance, if you have home insurance and car insurance with the same provider, you may be eligible for a bundled policy discount. Bundling can save you a significant amount on your overall insurance costs, so it’s worth considering if you have multiple insurance needs.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can often reduce your insurance premiums. However, it’s essential to choose a deductible amount that you’re comfortable paying in the event of an accident or claim. A higher deductible can result in substantial savings, but it’s a trade-off that requires careful consideration.

Take Advantage of Discounts

Insurance companies offer a variety of discounts to attract and retain customers. Some common discounts include:

- Safe Driver Discount: Many insurers reward drivers with a clean driving record and no recent accidents or violations. If you've maintained a safe driving history, you may be eligible for this discount.

- Multi-Car Discount: If you have multiple vehicles in your household, you may qualify for a discount by insuring them all with the same provider.

- Student Discount: Some insurers offer discounts to students who maintain good grades or are enrolled in specific driver education programs.

- Loyalty Discount: Staying with the same insurance company for an extended period can result in loyalty discounts.

- Safety Features Discount: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, or collision avoidance systems may qualify for a discount.

Maintain a Good Credit Score

Your credit score can play a role in determining your insurance rates. Insurance companies often use credit-based insurance scores to assess the risk associated with insuring a driver. Maintaining a good credit score can help you qualify for lower insurance rates, so it’s essential to manage your credit responsibly.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that uses technology to track your driving behavior. Insurers offer discounts based on your actual driving habits, such as safe driving practices, low mileage, and avoiding high-risk driving times. This type of insurance can be particularly beneficial for safe drivers who don’t drive frequently.

Performance Analysis: Real-World Examples

To illustrate the impact of these strategies, let’s consider some real-world examples of how drivers have successfully secured cheap car insurance:

Case Study 1: Young Driver

John, a 22-year-old recent college graduate, was looking for cheap car insurance. By shopping around and comparing quotes, he found that insurers offered varying rates based on his age and driving experience. He also qualified for a student discount due to his excellent academic record. Additionally, by opting for a higher deductible and maintaining a clean driving record, John was able to secure a comprehensive insurance policy at a competitive rate.

Case Study 2: Mature Driver

Sarah, a 45-year-old professional, was looking to reduce her insurance costs. She had a long-standing relationship with her insurance provider and had a clean driving record. By bundling her home and car insurance policies, Sarah was able to negotiate a loyalty discount. Furthermore, by taking advantage of safety features discounts (her vehicle had advanced safety systems) and increasing her deductible, Sarah achieved significant savings on her insurance premiums.

Case Study 3: Family with Multiple Vehicles

The Smith family, consisting of two parents and two teenage children, owned multiple vehicles. By insuring all their vehicles with the same provider, they qualified for a multi-car discount. Additionally, the parents, who had a long history of safe driving, negotiated a family plan discount. By combining these discounts with a safe driving record and a higher deductible, the Smith family achieved substantial savings on their insurance costs.

Future Implications and Industry Trends

The insurance industry is constantly evolving, and several trends are shaping the future of cheap car insurance:

- Technology Integration: Insurers are increasingly leveraging technology to offer more personalized and affordable insurance options. Telematics insurance, as mentioned earlier, is gaining popularity, and insurers are also exploring other innovative solutions, such as artificial intelligence and machine learning, to improve risk assessment and offer more precise pricing.

- Pay-Per-Mile Insurance: This emerging trend offers insurance coverage based on the actual miles driven. It can be particularly beneficial for drivers who don't use their vehicles frequently, as they pay only for the miles they drive.

- Usage-Based Pricing Models: Beyond telematics, insurers are exploring other usage-based pricing models. For instance, some insurers offer dynamic pricing that adjusts based on real-time driving conditions and behaviors.

- Peer-to-Peer Insurance: Peer-to-peer insurance platforms are gaining traction, allowing drivers to pool their resources and share risks collectively. This collaborative model can result in more affordable insurance options, especially for niche markets or specific driver profiles.

Conclusion

Cheap car insurance is not just a dream; it’s a reality that can be achieved with the right knowledge and strategies. By understanding the factors that influence insurance rates and employing the tips and tricks outlined in this guide, you can secure affordable coverage without compromising on the protection you need. Remember, shopping around, comparing quotes, and taking advantage of discounts are essential steps toward finding the best deal. Stay informed about industry trends, and don’t hesitate to reach out to insurance experts for personalized advice tailored to your specific circumstances.

How can I improve my chances of getting cheap car insurance as a young driver?

+As a young driver, it can be challenging to find affordable insurance. However, there are strategies you can employ. Maintain a clean driving record, consider adding an older, experienced driver to your policy (as a secondary driver), and explore discounts such as good student discounts or usage-based insurance programs. Additionally, some insurers offer specific policies for young drivers with lower premiums.

Are there any downsides to opting for a higher deductible to reduce insurance costs?

+While increasing your deductible can lead to lower premiums, it’s important to consider the financial implications. A higher deductible means you’ll have to pay more out of pocket in the event of an accident or claim. It’s a trade-off that requires careful consideration of your financial situation and risk tolerance.

Can I get cheap car insurance if I have a poor driving record or a history of accidents?

+While a poor driving record can make it more challenging to find affordable insurance, it’s not impossible. Some insurers specialize in high-risk drivers and offer policies with higher premiums. Additionally, by maintaining a clean driving record for a certain period, you may be able to gradually reduce your insurance costs over time.

How often should I review and compare my car insurance policy to ensure I’m getting the best deal?

+It’s recommended to review and compare your car insurance policy at least once a year. Insurance rates can change, and new discounts or policies may become available. Regularly shopping around can help you identify opportunities to save and ensure you’re always getting the most competitive rates.