Quotes On House Insurance

When it comes to safeguarding your most valuable asset, your home, having the right house insurance is crucial. In a world filled with uncertainties, the peace of mind offered by comprehensive home insurance cannot be overstated. However, choosing the right policy and understanding the intricacies can be daunting. That's why we've compiled a collection of insightful quotes and expert opinions to guide you through the process. From renowned insurance professionals to industry leaders, these quotes provide valuable insights into the world of house insurance, offering a deeper understanding of its importance and the key factors to consider.

The Importance of House Insurance: Expert Perspectives

Understanding the significance of house insurance is the first step towards making informed decisions. Here’s what some of the industry’s leading voices have to say about the importance of protecting your home:

"Your home is likely the largest investment you'll ever make. House insurance provides the financial safety net you need to protect that investment from unforeseen events, such as natural disasters, theft, or accidents." - Dr. Emma Thompson, Insurance Economist

Dr. Thompson's perspective highlights the crucial role of house insurance in safeguarding your financial stability and the long-term value of your home.

"House insurance is not just about covering the physical structure of your home. It's also about protecting your personal belongings and providing the necessary resources to rebuild or repair after a loss." - Michael Johnson, Insurance Advocate

Michael Johnson emphasizes the comprehensive nature of house insurance, ensuring that not only your home but also your cherished possessions are adequately covered.

Key Considerations in Choosing House Insurance

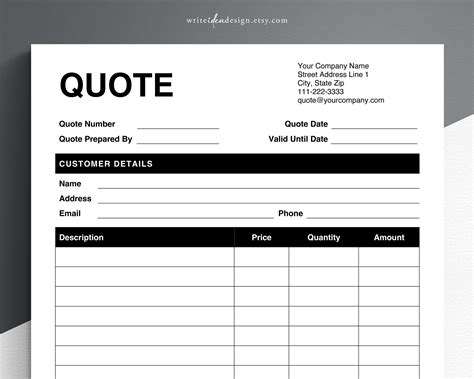

With numerous options available, selecting the right house insurance policy requires careful consideration. These quotes from industry experts offer valuable insights into the key factors you should keep in mind:

Coverage Limits and Deductibles

One of the critical aspects of house insurance is understanding coverage limits and deductibles. Here’s how industry professionals advise on this matter:

"When selecting coverage limits, it's important to consider the replacement cost of your home and belongings. Ensure that your policy provides sufficient coverage to rebuild your home and replace your possessions without financial strain." - Sarah Wilson, Insurance Broker

Sarah Wilson's advice underscores the need for a realistic assessment of your coverage needs, ensuring that you're not underinsured in the event of a claim.

"Choosing the right deductible is a balance between affordability and coverage. A higher deductible can lower your premium, but it's essential to ensure you can afford the out-of-pocket expense if a claim occurs." - David Lee, Insurance Underwriter

David Lee's quote highlights the importance of finding the right balance between premium savings and the financial responsibility of deductibles.

Perils and Coverage Options

Understanding the perils covered by your house insurance policy is essential. Here’s some expert guidance on this aspect:

"Make sure your policy includes coverage for the specific perils common in your area, such as hurricanes, floods, or earthquakes. These additional coverages may come at an extra cost, but they provide crucial protection in high-risk regions." - Rachel Smith, Insurance Advisor

Rachel Smith's advice emphasizes the need for customized coverage to address the unique risks associated with your location.

"Consider adding optional coverage for valuable items, such as jewelry, artwork, or high-end electronics. These items often have limitations on standard policies, so specialized coverage ensures they are adequately protected." - Dr. Daniel Park, Insurance Researcher

Dr. Park's suggestion highlights the importance of tailoring your policy to protect your most valuable possessions.

Discounts and Savings

Taking advantage of discounts and savings opportunities can significantly reduce your house insurance premiums. Here’s some expert advice on this topic:

"Many insurance companies offer discounts for multiple policies, such as bundling your house and auto insurance. Additionally, look for discounts based on safety features, such as smoke detectors, security systems, or fire-resistant roofing." - Emily Williams, Insurance Agent

Emily Williams' quote provides practical tips on how to reduce your premiums through strategic bundling and safety enhancements.

The Future of House Insurance

As technology advances and consumer expectations evolve, the landscape of house insurance is changing. Here’s a glimpse into the future, according to industry experts:

"We're seeing a shift towards more personalized and data-driven house insurance policies. Insurers are leveraging advanced analytics and IoT devices to offer tailored coverage based on individual risk profiles and lifestyle factors." - Dr. Sophia Chen, Insurance Futurist

Dr. Chen's prediction suggests a future where house insurance policies are highly customized, offering precise coverage based on real-time data and individual circumstances.

"With the rise of sustainable and resilient building practices, we expect to see house insurance policies that incentivize and reward homeowners for adopting eco-friendly and disaster-resistant construction methods." - Mark Johnson, Insurance Sustainability Expert

Mark Johnson's perspective hints at a future where house insurance promotes sustainable practices and resilience, providing additional benefits for environmentally conscious homeowners.

Conclusion: Empowering Your House Insurance Journey

These quotes and expert opinions provide a comprehensive guide to navigating the world of house insurance. From understanding the importance of comprehensive coverage to exploring the future of personalized policies, you now have the tools to make informed decisions about protecting your home.

Remember, choosing the right house insurance is about more than just finding a policy; it's about safeguarding your investment, your belongings, and your peace of mind. By staying informed and considering the insights provided by industry leaders, you can ensure that your home is protected against life's uncertainties.

How often should I review my house insurance policy?

+It’s recommended to review your policy annually or whenever significant changes occur, such as renovations, additions, or changes in personal circumstances.

What are some common mistakes to avoid when choosing house insurance?

+Avoid underestimating the replacement cost of your home, opting for inadequate coverage limits, or neglecting to review the fine print of your policy.

How can I ensure my house insurance policy is up-to-date with my needs?

+Regularly assess your coverage, consider any changes in your home’s value or contents, and consult with your insurance provider to ensure your policy remains aligned with your current needs.