Classic Car Auto Insurance Companies

Insuring a classic car is a unique endeavor, requiring specialized knowledge and coverage tailored to the specific needs of antique and vintage vehicles. In this comprehensive guide, we delve into the world of classic car insurance, exploring the top companies in the industry, the factors that influence coverage, and the steps to ensure your classic ride is protected.

Understanding the Classic Car Insurance Landscape

The market for classic car insurance is distinct from standard auto insurance, catering to the unique requirements of collectors, enthusiasts, and owners of vintage vehicles. These policies recognize that classic cars are more than just modes of transportation; they are often prized possessions, representing a passion for automotive history and craftsmanship.

Classic car insurance companies offer a range of specialized coverage options, designed to address the specific needs of antique and vintage vehicles. This includes considerations such as limited mileage, storage conditions, and the potential for parts replacement, which differ significantly from the needs of modern vehicles.

Top Classic Car Insurance Companies

The classic car insurance market boasts a variety of reputable companies, each with its own unique offerings and specialties. Here’s an in-depth look at some of the industry leaders, along with the key features and benefits they provide to classic car owners.

Hagerty

Hagerty is a renowned name in the classic car insurance industry, known for its comprehensive coverage options and dedicated focus on the classic car community. Founded by classic car enthusiast Frank Hagerty, the company has grown to become a leading provider of insurance and related services for vintage vehicles.

Hagerty offers a range of coverage options, including Agreed Value Coverage, which ensures that in the event of a total loss, the insured receives the full agreed-upon value of the vehicle. This is particularly valuable for classic car owners, as it accounts for the unique and often hard-to-quantify value of their vehicles.

Additionally, Hagerty provides Flexible Usage Policies, recognizing that classic cars are often driven for pleasure rather than daily commutes. This flexibility allows owners to choose the level of coverage that best suits their driving habits, from frequent use to limited, special-event-only driving.

Hagerty's policies also include Roadside Assistance, which can be a lifesaver for classic car owners on the road. This feature provides peace of mind, ensuring prompt assistance in case of breakdowns or other emergencies.

Another standout feature of Hagerty's policies is their Event Coverage, which extends beyond the vehicle itself to cover costs associated with attending classic car events. This can include coverage for hotel stays, meals, and even the cost of registering for the event, making it an ideal choice for enthusiasts who regularly participate in car shows and rallies.

Furthermore, Hagerty offers Concierge Services, providing personalized support and advice to policyholders. This service can assist with everything from classic car restoration projects to locating hard-to-find parts, making it a valuable resource for classic car owners.

Grundy Insurance

Grundy Insurance is another well-established name in the classic car insurance industry, offering a range of specialized coverage options for antique and classic vehicles. With a focus on providing comprehensive protection, Grundy has built a reputation for reliability and customer satisfaction.

One of Grundy's standout features is its Agreed Value Coverage, which ensures that policyholders receive the full agreed-upon value of their classic car in the event of a total loss. This provides peace of mind, knowing that the vehicle's unique value is recognized and protected.

Grundy's policies also include Inflation Guard, a feature that automatically adjusts the agreed value of the vehicle each year to account for inflation. This ensures that the coverage keeps pace with the increasing value of classic cars over time.

Additionally, Grundy offers Total Loss Replacement, which provides a replacement vehicle of like kind and quality in the event of a total loss. This feature is particularly valuable for classic car owners, as it ensures that they can continue to enjoy their passion for vintage vehicles without compromise.

Grundy's policies also include Flexible Usage Options, allowing policyholders to choose coverage that aligns with their driving habits. This flexibility is a key consideration for classic car owners, as these vehicles are often driven less frequently than modern cars.

Furthermore, Grundy provides Enhanced Liability Coverage, which can be crucial for classic car owners who participate in car shows and other events. This coverage protects against potential liabilities that may arise from these activities, providing an added layer of protection.

American Collectors Insurance

American Collectors Insurance is a leading provider of classic car insurance, offering a range of specialized policies tailored to the unique needs of antique and classic vehicle owners. With a focus on customer service and comprehensive coverage, American Collectors has established itself as a trusted name in the industry.

One of the standout features of American Collectors' policies is their Agreed Value Coverage, which ensures that policyholders receive the full agreed-upon value of their classic car in the event of a total loss. This coverage recognizes the unique value of classic vehicles, which often exceeds standard insurance valuations.

American Collectors also offers Mileage Options, allowing policyholders to choose coverage based on their expected annual mileage. This flexibility is particularly valuable for classic car owners, as these vehicles are often driven less frequently than modern cars.

Additionally, American Collectors provides Event Coverage, which extends protection to classic car owners participating in car shows, rallies, and other automotive events. This coverage can include expenses such as hotel stays, meals, and event registration fees, providing a comprehensive solution for enthusiasts.

Another key feature of American Collectors' policies is their Replacement Parts Coverage, which ensures that policyholders have access to the necessary parts to maintain and repair their classic vehicles. This can be a significant advantage, as classic car parts can often be difficult to source.

Furthermore, American Collectors offers Roadside Assistance, providing peace of mind for classic car owners on the road. This service can be invaluable in the event of a breakdown or other emergency, ensuring prompt assistance and minimizing downtime.

Classic Auto Insurance

Classic Auto Insurance is a specialist provider of classic car insurance, offering a range of tailored coverage options for antique and vintage vehicles. With a focus on customer service and comprehensive protection, Classic Auto has established itself as a trusted name in the industry.

One of the key features of Classic Auto's policies is their Agreed Value Coverage, which ensures that policyholders receive the full agreed-upon value of their classic car in the event of a total loss. This coverage is particularly valuable for classic car owners, as it recognizes the unique and often sentimental value of their vehicles.

Classic Auto also offers Flexible Usage Policies, allowing policyholders to choose coverage that aligns with their driving habits. This flexibility is crucial for classic car owners, as these vehicles are often driven less frequently than modern cars, and their usage may vary depending on the season or the owner's preferences.

Additionally, Classic Auto provides Roadside Assistance, which can be a lifesaver for classic car owners on the road. This feature ensures prompt assistance in case of breakdowns or other emergencies, providing peace of mind and minimizing potential disruptions.

Another standout feature of Classic Auto's policies is their Parts and Labor Coverage, which provides coverage for the cost of parts and labor required to repair or maintain the classic car. This can be a significant advantage, as classic car parts can often be expensive and difficult to source.

Furthermore, Classic Auto offers Event Coverage, which extends protection to classic car owners participating in car shows, rallies, and other automotive events. This coverage can include expenses such as hotel stays, meals, and event registration fees, making it an ideal choice for enthusiasts who actively engage in the classic car community.

J.C. Taylor Classic Car Insurance

J.C. Taylor is a veteran in the classic car insurance industry, offering a range of specialized policies tailored to the unique needs of antique and vintage vehicle owners. With a rich history in the industry, J.C. Taylor has established itself as a trusted provider of comprehensive coverage for classic car enthusiasts.

One of the standout features of J.C. Taylor's policies is their Agreed Value Coverage, which ensures that policyholders receive the full agreed-upon value of their classic car in the event of a total loss. This coverage is particularly valuable for classic car owners, as it recognizes the unique and often irreplaceable nature of their vehicles.

J.C. Taylor also offers Flexible Usage Policies, allowing policyholders to choose coverage that aligns with their driving habits. This flexibility is crucial for classic car owners, as these vehicles are often driven less frequently than modern cars, and their usage may vary depending on the owner's preferences and the vehicle's condition.

Additionally, J.C. Taylor provides Parts and Labor Coverage, which covers the cost of parts and labor required to repair or maintain the classic car. This feature is particularly advantageous, as classic car parts can often be difficult to source and may require specialized labor to install.

Another key feature of J.C. Taylor's policies is their Event Coverage, which extends protection to classic car owners participating in car shows, rallies, and other automotive events. This coverage can include expenses such as hotel stays, meals, and event registration fees, providing a comprehensive solution for enthusiasts who actively engage in the classic car community.

Furthermore, J.C. Taylor offers Concierge Services, providing personalized support and advice to policyholders. This service can assist with various aspects of classic car ownership, from locating hard-to-find parts to providing guidance on restoration projects, making it a valuable resource for classic car enthusiasts.

Factors Influencing Classic Car Insurance Rates

Classic car insurance rates are influenced by a variety of factors, each playing a unique role in determining the cost of coverage. Understanding these factors can help classic car owners make informed decisions when selecting an insurance policy and managing their coverage.

Vehicle Value and Condition

The value and condition of the classic car are key considerations in determining insurance rates. Classic cars with higher values, whether due to their rarity, historical significance, or unique features, typically require more extensive coverage and thus command higher insurance premiums.

Similarly, the condition of the vehicle is a critical factor. Well-maintained classic cars with a documented service history and original parts are often viewed more favorably by insurers, resulting in potentially lower insurance rates. Conversely, classic cars in need of extensive restoration or with a history of repairs may face higher insurance costs.

Usage and Storage

The way a classic car is used and stored can significantly impact insurance rates. Classic cars that are driven infrequently, stored in secure locations, and maintained with care may qualify for lower insurance rates, as they pose a lower risk of accidents or theft.

Conversely, classic cars that are driven regularly, particularly in high-traffic areas or for long distances, may face higher insurance costs. The increased exposure to potential accidents or theft raises the risk profile of the vehicle, leading to higher insurance premiums.

Driver Profile and History

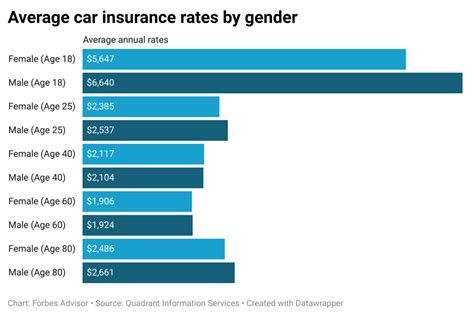

The driver’s profile and history are critical factors in determining classic car insurance rates. Insurers consider factors such as the driver’s age, driving record, and experience with classic cars. Younger drivers or those with a history of accidents or violations may face higher insurance rates, as they are statistically more likely to be involved in accidents.

Conversely, experienced classic car owners with a clean driving record and a history of safe driving may qualify for lower insurance rates. Insurers view these drivers as lower-risk, which can result in more favorable insurance premiums.

Coverage Options and Deductibles

The coverage options chosen by the policyholder and the associated deductibles can significantly impact insurance rates. Comprehensive coverage, which provides protection against a wide range of risks, typically commands higher insurance premiums. Conversely, choosing a higher deductible, which means the policyholder pays more out-of-pocket in the event of a claim, can result in lower insurance rates.

It's important for classic car owners to carefully consider their coverage needs and risk tolerance when selecting insurance options. Balancing the desire for comprehensive protection with the potential cost savings of higher deductibles is a key consideration in managing insurance costs.

Tips for Choosing the Right Classic Car Insurance

Selecting the right classic car insurance involves a careful consideration of various factors. Here are some tips to guide classic car owners in making informed decisions about their insurance coverage.

Assess Your Coverage Needs

Before choosing an insurance provider, it’s crucial to assess your specific coverage needs. Consider the value and condition of your classic car, the way you use and store it, and any unique requirements you may have, such as coverage for specific events or participation in car shows.

Understanding your coverage needs will help you identify the insurance options that best fit your situation. It's important to strike a balance between comprehensive protection and cost-effectiveness, ensuring that you have the coverage you need without paying for unnecessary features.

Compare Multiple Providers

Don’t settle for the first insurance provider you encounter. It’s essential to compare multiple providers to find the best fit for your needs. Each provider offers unique coverage options, policy terms, and pricing structures, so exploring a range of options can help you identify the most suitable and cost-effective coverage.

When comparing providers, consider factors such as their reputation in the classic car insurance market, the flexibility of their policies, and the range of coverage options they offer. Reading reviews and seeking recommendations from other classic car owners can also provide valuable insights into the quality of service and coverage provided by different insurers.

Understand Policy Terms and Conditions

Before committing to an insurance policy, it’s crucial to thoroughly understand the terms and conditions. This includes not only the coverage provided but also the exclusions, limitations, and any special conditions that may apply.

Pay close attention to the fine print, ensuring that you understand the details of the policy. This can help you avoid surprises and ensure that you're getting the coverage you expect. If you have any questions or concerns about the policy terms, don't hesitate to reach out to the insurer for clarification.

Consider Additional Benefits and Services

Beyond the basic coverage, some classic car insurance providers offer additional benefits and services that can enhance the overall value of the policy. These may include roadside assistance, concierge services, event coverage, or access to a network of classic car specialists.

While these additional benefits are not essential, they can provide significant value to classic car owners. For example, roadside assistance can be a lifesaver in case of a breakdown, while concierge services can assist with various aspects of classic car ownership, from restoration projects to sourcing hard-to-find parts.

Review and Adjust Your Coverage Regularly

Classic cars and their insurance needs can evolve over time. Regularly reviewing and adjusting your coverage is essential to ensure that it continues to meet your changing requirements.

As your classic car collection grows, your driving habits change, or your circumstances evolve, your insurance needs may also shift. Staying proactive and keeping your coverage up-to-date ensures that you have the protection you need without paying for coverage you no longer require.

Future of Classic Car Insurance

The classic car insurance market is evolving, driven by technological advancements and changing consumer preferences. As the classic car community continues to grow and diversify, insurance providers are adapting to meet the unique needs of this specialized market.

One key trend in the future of classic car insurance is the increasing use of data analytics and telematics. Insurers are leveraging advanced technologies to gather and analyze data, enabling them to make more informed decisions about risk assessment and pricing. This data-driven approach can lead to more accurate and personalized insurance offerings, benefiting both insurers and classic car owners.

Additionally, the rise of digital platforms and online services is transforming the way classic car insurance is purchased and managed. Online portals and mobile apps are making it easier for classic car owners to compare policies, purchase coverage, and manage their insurance needs, providing a more convenient and efficient experience.

Furthermore, the classic car insurance market is seeing a growing focus on sustainability and environmental considerations. With an increasing number of classic car owners embracing eco-friendly practices, insurers are developing coverage options that cater to these needs. This includes offering incentives for the use of sustainable fuels, providing coverage for electric classic cars, and supporting classic car owners in their efforts to minimize their environmental impact.

As the classic car insurance market continues to evolve, it's essential for classic car owners to stay informed and engage with their insurance providers. By understanding the latest trends and developments, classic car owners can make informed decisions about their insurance coverage, ensuring they have the protection they need to enjoy their passion for vintage vehicles.

What is the difference between classic car insurance and standard auto insurance?

+Classic car insurance is tailored to the unique needs of antique and vintage vehicles, recognizing their value as collectible items and often providing specialized coverage options not typically found in standard auto insurance policies.