Cheap Car Insurance Auto

In today's world, finding affordable car insurance is a top priority for many vehicle owners. With rising costs and a competitive market, it's crucial to understand how to secure the best rates while maintaining comprehensive coverage. This comprehensive guide will delve into the strategies and factors that influence cheap car insurance, providing you with the tools to make informed decisions.

Understanding Cheap Car Insurance: Strategies and Considerations

Cheap car insurance is not just about the lowest premium; it’s a delicate balance between cost and coverage. While it’s tempting to opt for the cheapest option, it’s essential to ensure that the policy meets your specific needs. Here, we explore the key strategies and considerations to achieve the best value for your money.

1. Comprehensive Research and Comparison

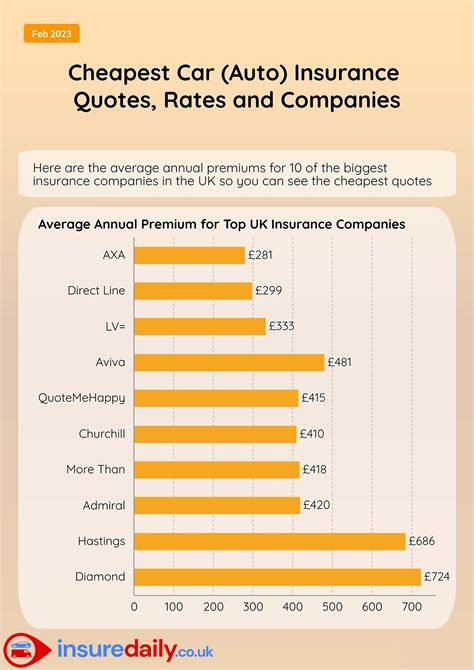

The insurance market is vast and varied, with numerous providers offering unique policies. Conducting thorough research is crucial to identify the best deals. Compare quotes from multiple insurers, ensuring you understand the coverage limits, deductibles, and any additional perks or discounts offered. Online comparison tools can be a great starting point, but it’s also beneficial to speak directly with insurers to clarify any doubts and negotiate better rates.

2. Understanding Your Coverage Needs

Every driver’s insurance needs are unique. Factors like your age, gender, driving history, and the type of vehicle you own play a significant role in determining the appropriate coverage. For instance, younger drivers often pay higher premiums due to their lack of experience, while mature drivers with a clean record may benefit from reduced rates. Understanding your specific risks and requirements is essential to finding the right balance between cost and coverage.

3. Utilizing Discounts and Incentives

Insurance providers often offer a range of discounts and incentives to attract customers. These can include loyalty discounts for long-term customers, multi-policy discounts for those who bundle their insurance needs, and safe-driving incentives for maintaining a clean driving record. Some insurers also provide discounts for specific occupations or educational achievements. Be sure to inquire about these discounts when comparing policies to ensure you’re not missing out on potential savings.

4. Customizing Your Policy

Not all insurance policies are created equal. Customizing your policy to suit your specific needs can lead to significant savings. For example, if you own an older vehicle, you may not need collision coverage, as the cost of repairs may exceed the vehicle’s value. Similarly, if you have a low-risk driving profile, you could consider raising your deductible to lower your premiums. However, it’s important to strike a balance and ensure you’re not compromising on essential coverage.

5. Maintaining a Clean Driving Record

Your driving history is a critical factor in determining your insurance rates. A clean driving record demonstrates responsible behavior and can lead to significant savings. Conversely, a history of accidents or traffic violations can increase your premiums. It’s essential to drive safely and responsibly to maintain a positive driving record, which not only reduces your insurance costs but also contributes to overall road safety.

6. Exploring Alternative Options

While traditional insurance providers offer comprehensive coverage, exploring alternative options can sometimes lead to cheaper rates. Telematics insurance, for instance, uses a device to track your driving behavior, rewarding safe drivers with lower premiums. Additionally, usage-based insurance programs, where premiums are calculated based on actual mileage, can benefit low-mileage drivers. These alternative options provide a fresh approach to insurance, often resulting in cost savings for specific demographics.

7. Bundling Your Insurance Policies

Bundling multiple insurance policies with the same provider is a common strategy to reduce overall costs. By combining your car insurance with home, life, or health insurance, you can often negotiate better rates. This is because insurers prefer to handle all your insurance needs, leading to simplified administration and potential discounts. It’s a convenient way to manage your insurance portfolio while also saving money.

8. Understanding State-Specific Regulations

Insurance regulations vary across states, and understanding these differences is crucial to navigating the market effectively. Some states have no-fault insurance systems, while others follow a tort system. The mandatory minimum coverage levels also differ, influencing the overall cost of insurance. Staying informed about your state’s specific regulations ensures you’re aware of the legal requirements and can make more informed decisions when choosing a policy.

9. Regularly Reviewing and Adjusting Your Policy

Insurance needs can change over time, and it’s important to regularly review your policy to ensure it remains relevant and cost-effective. Life events such as marriage, having children, or purchasing a new home can influence your insurance requirements. Additionally, market fluctuations and changes in your driving habits can also impact your premium. Regularly reviewing and adjusting your policy ensures you’re not overpaying for coverage you no longer need or underinsured for new risks.

10. Seeking Professional Advice

The insurance market can be complex, and it’s not always easy to navigate on your own. Seeking professional advice from an insurance broker or agent can provide valuable insights. They can help you understand the nuances of different policies, identify potential savings, and ensure you’re adequately covered. While it may incur a small fee, the expertise and peace of mind it provides can be well worth the investment.

Performance Analysis: Real-World Examples of Cheap Car Insurance

To provide a tangible understanding of cheap car insurance, let’s delve into some real-world examples. These case studies will illustrate how different individuals or households achieved significant savings on their car insurance while maintaining comprehensive coverage.

Case Study 1: Young Driver with a Clean Record

John, a 22-year-old student, recently purchased his first car. With a clean driving record and good academic grades, he was eligible for multiple discounts. By comparing quotes from various insurers and negotiating based on his excellent driving profile, John secured a comprehensive policy with a reputable insurer at a premium of $850 annually. This is significantly lower than the average premium for young drivers, highlighting the benefits of a clean record and effective negotiation.

Case Study 2: Mature Couple with Multiple Vehicles

Sarah and David, a retired couple, own two vehicles. By bundling their car insurance policies with their home insurance, they were able to negotiate a significant discount. Additionally, their mature age and clean driving records further reduced their premiums. With a combined annual premium of $1,200 for both vehicles, they achieved substantial savings compared to the average rates for their demographic.

Case Study 3: Urban Driver with Telematics Insurance

Emily, a city-dweller, opted for telematics insurance due to the potential for cost savings. By agreeing to have her driving behavior monitored, she received a discounted premium of $900 annually. This option suited her well, as her safe driving habits were rewarded with lower rates. Telematics insurance provided an innovative solution to her insurance needs, demonstrating the benefits of exploring alternative options.

Case Study 4: Rural Family with Usage-Based Insurance

The Jones family, residing in a rural area, had low mileage due to their remote location. By opting for usage-based insurance, they paid a premium based on their actual mileage. With an annual premium of $1,050, they achieved significant savings compared to traditional insurance policies, which often charge a flat rate regardless of usage. This case study highlights the advantages of usage-based insurance for low-mileage drivers.

Evidence-Based Future Implications

As the insurance market continues to evolve, certain trends and innovations are likely to influence the availability and cost of cheap car insurance in the future. Here, we explore some of these implications based on current industry trends and technological advancements.

1. Increased Use of Telematics and Usage-Based Insurance

The rise of telematics and usage-based insurance is a significant trend that is expected to continue. As more drivers embrace these innovative options, insurers will have a larger pool of data to analyze, leading to more accurate risk assessments. This could result in tailored premiums based on individual driving behavior, further incentivizing safe driving practices and potentially reducing overall insurance costs.

2. Integration of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are already being utilized by insurers to streamline processes and enhance risk assessment. These technologies can analyze vast amounts of data quickly and accurately, leading to more efficient underwriting and claims processing. As AI and ML become more sophisticated, they could play a significant role in reducing administrative costs, which could translate into lower premiums for consumers.

3. Growth of Peer-to-Peer Insurance

Peer-to-peer insurance, also known as peer-to-peer (P2P) insurance, is an emerging trend in the insurance industry. This model allows individuals to pool their resources and share risks, often resulting in lower premiums. While still in its infancy, P2P insurance has the potential to disrupt the traditional insurance market, offering cheaper alternatives and empowering individuals to take more control over their insurance needs.

4. Expansion of Digital Insurance Platforms

The digital transformation of the insurance industry is well underway, with many insurers now offering online platforms for policy management and claims processing. These digital platforms provide convenience and efficiency, often resulting in cost savings for both insurers and consumers. As more insurers embrace digital transformation, we can expect to see further innovations and cost reductions, benefiting those seeking cheap car insurance.

5. Focus on Preventative Measures and Healthier Lifestyles

Insurers are increasingly recognizing the benefits of preventative measures and healthier lifestyles. This trend is particularly evident in the health insurance sector, where incentives for gym memberships or healthy lifestyle choices are becoming more common. As this trend expands into the car insurance market, we may see insurers offering discounts or rewards for drivers who take steps to improve their overall health and well-being, potentially reducing the risk of accidents and claims.

Conclusion

Cheap car insurance is an achievable goal, and with the right strategies and considerations, you can secure comprehensive coverage at a reasonable cost. From conducting thorough research and understanding your specific needs to exploring alternative options and seeking professional advice, there are numerous ways to navigate the insurance market effectively. By staying informed and proactive, you can make informed decisions that benefit both your wallet and your peace of mind.

FAQ

How often should I review my car insurance policy?

+It’s recommended to review your policy annually or whenever there’s a significant change in your circumstances, such as a move, marriage, or purchasing a new vehicle. Regular reviews ensure your coverage remains adequate and cost-effective.

Can I switch insurance providers to save money?

+Absolutely! Shopping around and comparing quotes from different insurers is a great way to find cheaper rates. Don’t be afraid to switch providers if you find a better deal that suits your needs.

What factors influence car insurance premiums the most?

+Several factors influence car insurance premiums, including your age, driving history, the type of vehicle you own, and your location. Additionally, the coverage options and deductibles you choose can significantly impact your premium.

Are there any downsides to usage-based insurance?

+While usage-based insurance can lead to significant savings for low-mileage drivers, it may not be suitable for those who frequently drive. Some drivers may find the monitoring aspect intrusive, and there’s a risk of higher premiums if your driving behavior is less than ideal.

Can I get cheap car insurance if I have a poor driving record?

+It can be challenging to find cheap car insurance with a poor driving record, but it’s not impossible. Some insurers specialize in providing coverage for high-risk drivers. Additionally, focusing on improving your driving habits and regularly reviewing your policy can help reduce premiums over time.