Clue Report In Insurance

In the ever-evolving world of insurance, data-driven insights have become a powerful tool for insurers to navigate the complexities of the industry. Among these insights, the Clue Report stands out as a critical resource, offering a comprehensive view of insurance claims and their associated details. This article delves into the intricacies of the Clue Report, its impact on the insurance landscape, and its potential to shape the future of risk assessment and management.

Unraveling the Clue Report: A Comprehensive Overview

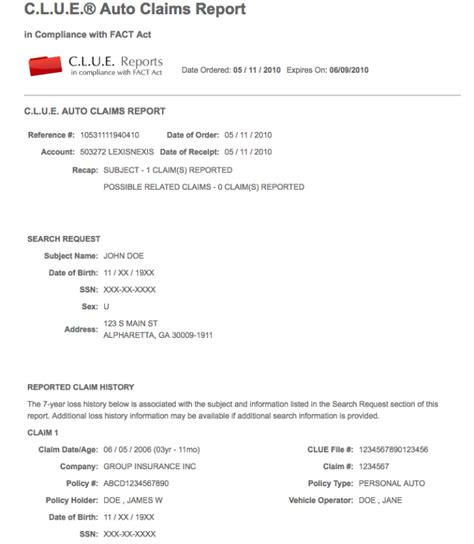

The Clue Report, an acronym for Comprehensive Loss Underwriting Exchange Report, is a detailed document that provides a comprehensive overview of an insured individual’s or entity’s claim history. It serves as a vital resource for insurers, offering a wealth of information that aids in underwriting, risk assessment, and claim management.

Originating from the collaboration between insurance companies and the Insurance Services Office (ISO), the Clue Report was designed to streamline the insurance process and enhance the accuracy of risk assessment. By centralizing claim data, the report has revolutionized the way insurers approach their operations, enabling them to make more informed decisions and deliver more efficient services.

The Components of a Clue Report

A Clue Report typically includes a range of information, each element playing a crucial role in the insurance process.

- Personal Information: This section contains basic details about the insured individual or entity, including name, address, date of birth, and policy number.

- Claim History: The heart of the Clue Report, this section provides a comprehensive timeline of all insurance claims made by the insured. It includes details such as the date of the incident, the type of claim (e.g., property damage, liability), the cause, and the outcome.

- Loss Details: Here, insurers can find specific information about the losses incurred in each claim. This may include the value of the claim, the extent of damage, and any relevant repairs or replacements.

- Involved Parties: The Clue Report also lists other individuals or entities involved in the claims, such as witnesses, claimants, or third parties.

- Vehicle Information (if applicable): For auto insurance claims, the report includes details about the vehicles involved, such as make, model, and year.

- Additional Notes: This section provides any additional information that may be relevant to the claim, such as police reports, witness statements, or medical records.

| Category | Data Included |

|---|---|

| Personal Information | Name, Address, Date of Birth, Policy Number |

| Claim History | Date, Type, Cause, Outcome |

| Loss Details | Value, Damage Extent, Repairs/Replacements |

| Involved Parties | Witnesses, Claimants, Third Parties |

| Vehicle Information | Make, Model, Year |

| Additional Notes | Police Reports, Witness Statements, Medical Records |

The Impact of Clue Reports on Insurance Operations

The introduction of Clue Reports has had a profound impact on the insurance industry, reshaping the way insurers operate and interact with their clients.

Enhanced Risk Assessment

Clue Reports provide insurers with a comprehensive view of an insured’s claim history, allowing them to assess risk more accurately. By analyzing past claims, insurers can identify patterns, trends, and potential red flags that may impact future risk exposure. This level of insight enables insurers to tailor their policies and pricing to match the risk profile of their clients, ensuring fair and competitive rates.

Streamlined Underwriting Process

The underwriting process, which involves evaluating and classifying risks, is a critical yet time-consuming aspect of insurance. Clue Reports simplify this process by providing a centralized repository of claim data. Underwriters can quickly access and analyze this information, making informed decisions about policy approvals, coverage limits, and exclusions. This efficiency not only speeds up the underwriting process but also reduces the potential for errors and inconsistencies.

Improved Claim Management

Clue Reports are invaluable tools for claim management. They provide a detailed record of past claims, allowing insurers to identify potential fraud, duplicate claims, or ongoing issues that may impact future claims. With this information, insurers can develop more effective claim handling strategies, improve their response times, and enhance their overall customer service.

Data-Driven Decision Making

Insurers are increasingly relying on data analytics to drive their decision-making processes. Clue Reports, with their wealth of historical data, offer a rich source of information for these analytics. Insurers can use this data to identify trends, forecast future claims, and develop more effective risk management strategies. This data-driven approach not only improves operational efficiency but also enhances the accuracy of risk assessment and pricing.

The Future of Clue Reports: Embracing Technology and Innovation

As the insurance industry continues to evolve, Clue Reports are poised to play an even more significant role. With advancements in technology and data analytics, the future of Clue Reports looks promising.

Digital Transformation

The digital age has brought about a shift towards paperless processes, and Clue Reports are no exception. Insurers are increasingly adopting digital platforms and tools to manage and access Clue Reports, making the process more efficient and secure. Digital Clue Reports can be easily shared, updated, and accessed remotely, streamlining the insurance process for both insurers and insureds.

Integration with Advanced Analytics

Advanced analytics, machine learning, and artificial intelligence are transforming the way insurers interpret and use data. Clue Reports, when integrated with these technologies, can provide even deeper insights. Insurers can use predictive analytics to forecast potential claims, identify high-risk areas, and develop targeted risk management strategies. This level of precision can lead to more effective insurance products and improved customer satisfaction.

Real-Time Updates and Alerts

The future of Clue Reports may involve real-time updates and alerts, keeping insurers informed of new claims or changes in an insured’s risk profile. This real-time data can enable insurers to respond quickly to emerging risks, adjust policies accordingly, and maintain a competitive edge in the market.

Personalized Insurance Solutions

With the insights gained from Clue Reports and advanced analytics, insurers can move towards more personalized insurance solutions. By understanding an insured’s unique risk profile, insurers can offer tailored policies and coverage options that meet their specific needs. This level of customization can enhance customer satisfaction and loyalty.

FAQs

How often are Clue Reports updated?

+Clue Reports are typically updated on a monthly basis, ensuring that insurers have access to the most current claim information. However, in some cases, updates may be more frequent, especially if there are significant changes to an insured’s claim history.

Can insured individuals access their own Clue Reports?

+Yes, insured individuals have the right to access their Clue Reports. They can request a copy from their insurer or directly from the Insurance Services Office (ISO). This transparency ensures that insureds are aware of their claim history and can address any inaccuracies or disputes.

How does the Clue Report impact insurance rates?

+The Clue Report plays a crucial role in determining insurance rates. Insurers use the claim history and risk assessment provided by the report to set premiums and coverage limits. A history of frequent or high-value claims may result in higher rates, while a clean claim record may lead to more competitive pricing.

In conclusion, the Clue Report is a powerful tool that has transformed the insurance landscape. Its comprehensive nature, combined with the advancements in technology and analytics, positions it as a key enabler for insurers to deliver more efficient, effective, and personalized insurance solutions. As the insurance industry continues to evolve, the Clue Report will undoubtedly remain a cornerstone of risk assessment and management.