Veterans Insurance

The world of insurance can be complex and often daunting, especially for veterans who have served their countries and now face unique challenges in their transition to civilian life. Recognizing this, the concept of Veterans Insurance has emerged as a specialized field, offering tailored coverage to meet the specific needs of veterans and their families. This article delves into the intricacies of Veterans Insurance, exploring its benefits, coverage options, and the impact it can have on the lives of those who have selflessly served.

Understanding Veterans Insurance

Veterans Insurance is a specialized insurance category designed to provide comprehensive protection for veterans and their dependents. It acknowledges the distinct risks and circumstances that veterans may encounter, offering tailored solutions to address their unique needs. This specialized insurance aims to bridge the gap between traditional insurance policies and the specific requirements of those who have dedicated their lives to military service.

The concept of Veterans Insurance gained prominence as veterans and their advocates recognized the limitations of standard insurance policies. Many veterans face challenges such as service-related disabilities, mental health issues, and unique occupational risks. These factors often require specialized coverage, and Veterans Insurance aims to fill this critical gap.

Key Features of Veterans Insurance

Veterans Insurance offers a range of features that cater specifically to veterans’ needs. Here are some key aspects:

- Service-Related Disability Coverage: Provides financial protection for veterans with service-related disabilities, ensuring they receive adequate support for their unique circumstances.

- Mental Health Support: Recognizes the prevalence of mental health issues among veterans and offers coverage for related treatments and therapies.

- Occupation-Specific Risks: Addresses the risks associated with various military occupations, such as coverage for combat-related incidents or specialized equipment.

- Family Protection: Offers comprehensive coverage for veterans’ families, including life insurance, health insurance, and education plans for dependents.

- Veteran Discounts: Many Veterans Insurance providers offer discounted rates or additional benefits as a token of appreciation for veterans’ service.

By understanding the unique challenges veterans face, these insurance policies aim to provide a safety net, ensuring that veterans and their families receive the support they deserve.

Benefits of Veterans Insurance

Veterans Insurance offers a multitude of benefits that can significantly impact the lives of veterans and their families. Here’s a closer look at some of these advantages:

Financial Security

One of the primary benefits of Veterans Insurance is the financial security it provides. For veterans with service-related disabilities, the insurance coverage ensures a stable financial future. It covers a range of expenses, from medical treatments to assistive devices, providing peace of mind and ensuring that veterans can access the care they need without financial strain.

Moreover, the life insurance component of Veterans Insurance offers a safety net for veterans' families, providing a financial cushion in the event of an unforeseen tragedy.

Tailored Coverage

Veterans Insurance is designed with an understanding of the unique risks and challenges veterans face. The policies are tailored to provide coverage for specific circumstances, such as combat-related incidents or occupational hazards. This level of customization ensures that veterans receive the protection they need, without paying for unnecessary coverage.

Mental Health Support

Mental health issues are prevalent among veterans, and Veterans Insurance recognizes this by offering coverage for mental health treatments. This includes access to counseling, therapy, and even specialized programs designed to support veterans dealing with post-traumatic stress disorder (PTSD) or other mental health challenges.

Family Protection

Veterans Insurance goes beyond individual protection, extending its benefits to veterans’ families. The comprehensive coverage includes health insurance, ensuring that veterans’ dependents have access to quality healthcare. Additionally, education plans and life insurance policies provide a safety net for the future, ensuring that veterans’ families are taken care of even in their absence.

Discounts and Appreciation

Many Veterans Insurance providers offer discounts or additional benefits as a way of showing appreciation for veterans’ service. These discounts can significantly reduce the cost of insurance, making it more accessible and affordable for veterans and their families.

Coverage Options and Customization

Veterans Insurance offers a wide range of coverage options, allowing veterans to tailor their policies to their specific needs. Here’s an overview of some key coverage areas:

Health Insurance

Health insurance is a critical component of Veterans Insurance. It covers a range of medical expenses, including:

- Hospitalization and medical treatments

- Prescription medications

- Specialized therapies (e.g., physical therapy, speech therapy)

- Mental health treatments and counseling

Veterans can choose from various health insurance plans, including those that cover pre-existing conditions or offer discounted rates for veterans with certain disabilities.

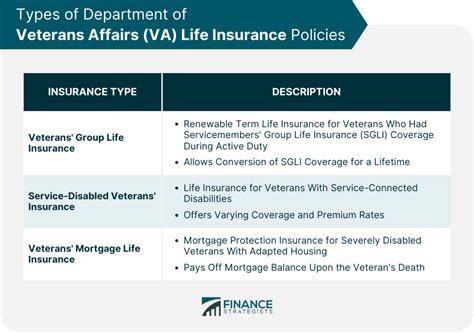

Life Insurance

Life insurance is an essential aspect of financial planning, and Veterans Insurance offers a range of life insurance policies. These policies provide a death benefit to the veteran’s beneficiaries, ensuring financial stability in the event of an unforeseen tragedy. Veterans can choose from term life insurance, whole life insurance, or policies that offer additional riders for specific circumstances.

Disability Income Insurance

Disability income insurance is particularly crucial for veterans, given the higher risk of service-related disabilities. This coverage provides a regular income stream to veterans who become disabled, ensuring they can maintain their standard of living and meet their financial obligations.

Long-Term Care Insurance

Long-term care insurance is designed to cover the costs of extended care, such as nursing home stays or in-home care. This coverage is especially beneficial for veterans who may require long-term assistance due to service-related injuries or disabilities.

Property and Casualty Insurance

Veterans Insurance also offers property and casualty insurance, covering veterans’ assets and liabilities. This includes homeowners insurance, auto insurance, and liability coverage, ensuring that veterans’ possessions and legal responsibilities are protected.

Performance and Impact Analysis

The impact of Veterans Insurance on the lives of veterans and their families is significant and far-reaching. Here’s an analysis of its performance and the positive changes it has brought about:

Financial Stability

Veterans Insurance has played a crucial role in providing financial stability to veterans and their families. By offering comprehensive coverage, it ensures that veterans can access the necessary healthcare, maintain their standard of living, and plan for their future. This financial security is especially important for veterans with service-related disabilities, as it allows them to focus on their recovery and well-being without the added stress of financial burdens.

Improved Access to Healthcare

The health insurance component of Veterans Insurance has significantly improved access to healthcare for veterans. It covers a wide range of medical treatments, including specialized therapies and mental health support. This ensures that veterans can receive the care they need, regardless of their financial situation. The inclusion of mental health coverage is particularly impactful, as it addresses a critical need within the veteran community.

Family Support

Veterans Insurance goes beyond individual protection, offering support to veterans’ families. The family protection plans ensure that veterans’ dependents have access to quality healthcare and education. This support extends to the veteran’s spouse and children, providing a safety net that allows families to thrive even in the face of adversity.

Community Appreciation

Veterans Insurance is not just about providing coverage; it’s also a way for the community to show appreciation for veterans’ service. The discounts and additional benefits offered by insurance providers are a testament to this appreciation. These initiatives not only make insurance more affordable but also serve as a reminder of the respect and gratitude veterans deserve.

Policyholder Satisfaction

Veterans Insurance providers have consistently received positive feedback from policyholders. Veterans appreciate the tailored coverage, the understanding of their unique circumstances, and the support they receive. The insurance industry’s recognition of veterans’ needs has led to higher levels of satisfaction and trust, fostering a positive relationship between veterans and their insurance providers.

Future Implications and Innovations

The future of Veterans Insurance looks promising, with ongoing innovations and improvements that will further enhance the lives of veterans and their families. Here’s a glimpse into some potential developments:

Digital Innovations

The insurance industry is embracing digital technologies, and Veterans Insurance is likely to follow suit. This could include the development of mobile apps that allow veterans to manage their policies, file claims, and access resources more efficiently. Digital innovations can also improve the speed and accuracy of claim processing, ensuring veterans receive the benefits they are entitled to in a timely manner.

Expanded Coverage

As the needs of veterans evolve, so too will the coverage options within Veterans Insurance. This may include an expansion of mental health coverage, addressing the rising concerns around veteran suicide and providing more comprehensive support. Additionally, as veterans transition into different stages of life, such as retirement, the insurance policies may adapt to offer coverage tailored to their changing needs.

Collaborative Initiatives

Veterans Insurance providers may collaborate with veteran-focused organizations and advocacy groups to develop even more specialized coverage. This could involve working with mental health professionals to design programs specifically for veterans or partnering with vocational rehabilitation centers to provide support for veterans transitioning into civilian careers.

Community Engagement

Veterans Insurance can play a vital role in engaging the community and raising awareness about veteran-related issues. Insurance providers can partner with veteran support organizations to host events, provide educational resources, and offer discounts or incentives to those who participate in veteran-focused initiatives. This community engagement can foster a sense of belonging and support for veterans, further enhancing the impact of Veterans Insurance.

Policy Customization

As Veterans Insurance continues to evolve, policy customization will become even more refined. This could involve the development of personalized insurance plans based on an individual veteran’s needs and circumstances. By utilizing advanced analytics and risk assessment tools, insurance providers can offer tailored coverage that addresses each veteran’s unique situation.

Conclusion

Veterans Insurance is more than just a policy; it’s a commitment to supporting those who have dedicated their lives to serving their countries. By offering tailored coverage, financial security, and a network of support, Veterans Insurance has the potential to transform the lives of veterans and their families. As the insurance industry continues to innovate and adapt, the future of Veterans Insurance looks bright, ensuring that veterans receive the respect, appreciation, and protection they deserve.

How do I choose the right Veterans Insurance provider?

+Choosing the right Veterans Insurance provider involves careful consideration. Research and compare different providers, looking at their coverage options, customer reviews, and any veteran-specific discounts or programs they offer. It’s essential to find a provider that understands your unique needs and provides comprehensive coverage at a reasonable cost.

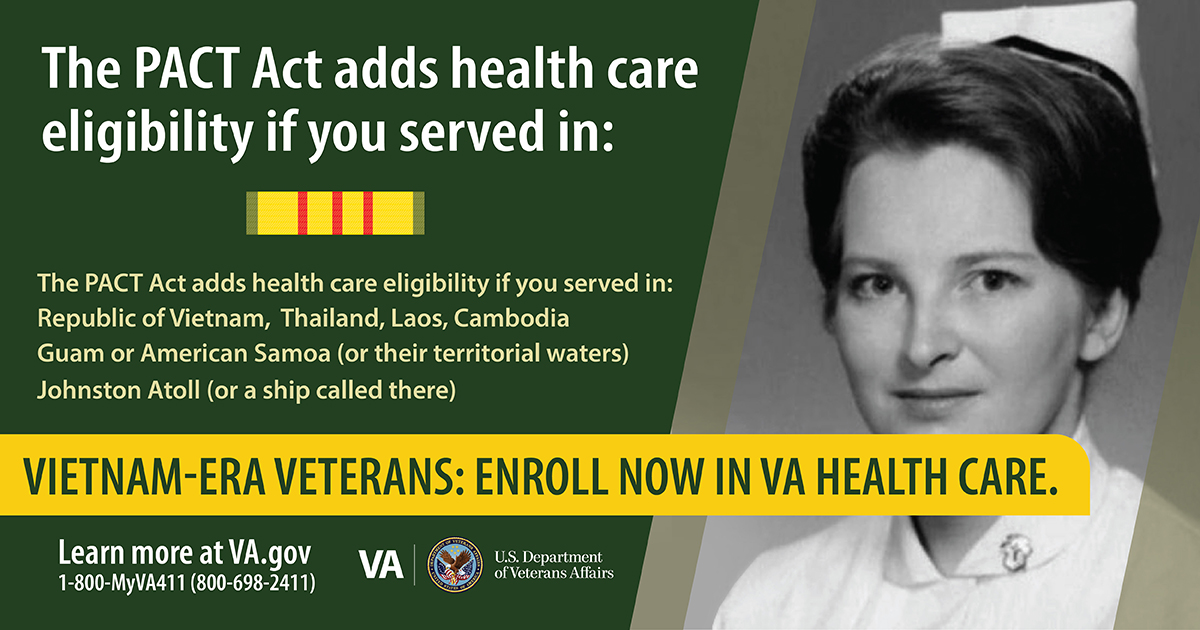

Are there any government programs that offer insurance benefits for veterans?

+Yes, there are government programs such as the Veterans Affairs (VA) Health Care Program and the Veterans Group Life Insurance (VGLI) program. These programs offer health and life insurance coverage to eligible veterans. It’s important to explore these options and understand the eligibility criteria and benefits they provide.

Can Veterans Insurance cover pre-existing conditions?

+Veterans Insurance policies may vary in their coverage of pre-existing conditions. Some providers offer specific plans that cover pre-existing conditions, while others may have exclusions or waiting periods. It’s crucial to review the policy details and discuss your specific circumstances with your insurance provider to ensure adequate coverage.

How can I get more information about Veterans Insurance options?

+To learn more about Veterans Insurance, you can reach out to insurance providers that specialize in veteran coverage. They can provide detailed information about their policies, coverage options, and any discounts or benefits specifically tailored for veterans. Additionally, veteran support organizations and online resources can offer valuable insights and guidance.