Car Insurance Policies

Car insurance policies are an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers around the world. These policies are designed to cover a wide range of potential incidents and accidents, ensuring that policyholders can manage the costs associated with vehicle-related damages and liabilities. In this comprehensive guide, we will delve into the intricacies of car insurance policies, exploring the various coverage options, factors influencing premiums, the claims process, and the future of this vital industry.

Understanding Car Insurance Policies

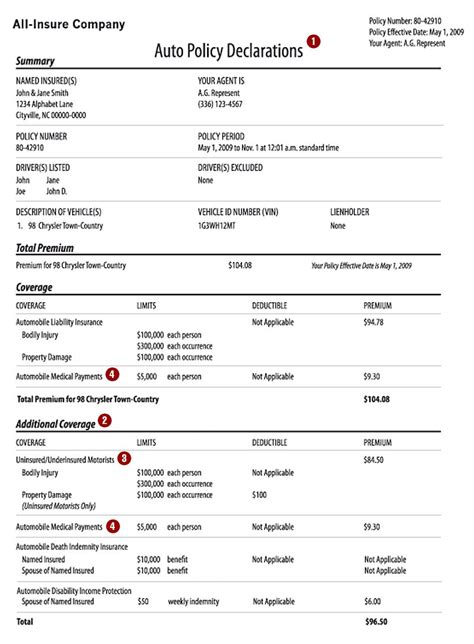

At its core, a car insurance policy is a contract between an insurance provider and a policyholder. This contract outlines the terms and conditions of coverage, specifying the types of incidents and damages that are covered, as well as the limits and deductibles associated with the policy. The primary goal of car insurance is to protect the policyholder from the financial burden of unexpected vehicle-related events, such as accidents, theft, or natural disasters.

Car insurance policies are tailored to meet the unique needs of each policyholder, taking into account factors such as the driver's age, driving history, the type of vehicle, and the intended use of the car. As a result, insurance policies can vary significantly in terms of coverage, premiums, and additional features.

Types of Car Insurance Policies

There are several types of car insurance policies available, each offering different levels of coverage and catering to diverse driver profiles. Here are some of the most common types of car insurance policies:

- Liability Coverage: This is the most basic form of car insurance, covering damages caused by the policyholder to others in an accident. It includes bodily injury liability and property damage liability.

- Comprehensive Coverage: Comprehensive insurance provides protection against non-collision incidents such as theft, vandalism, natural disasters, and animal-related accidents. It covers the cost of repairs or replacements for the policyholder's vehicle.

- Collision Coverage: Collision insurance covers damages to the policyholder's vehicle resulting from an accident, regardless of fault. This coverage is essential for protecting against the high costs of vehicle repairs or replacements.

- Personal Injury Protection (PIP): PIP coverage, often mandatory in no-fault states, provides compensation for medical expenses, lost wages, and funeral costs for the policyholder and their passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders when involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Each of these policies can be customized with additional features and endorsements to suit specific needs. For instance, policyholders may opt for rental car coverage, gap insurance, or roadside assistance as add-ons to their primary policy.

Factors Influencing Car Insurance Premiums

The cost of car insurance, known as the premium, is determined by a complex interplay of various factors. Insurance companies use these factors to assess the risk associated with insuring a particular driver and vehicle. Here are some key factors that influence car insurance premiums:

- Driver's Age and Experience: Younger drivers, especially those under 25, often face higher premiums due to their lack of experience and higher accident rates. Conversely, experienced drivers with a clean driving record may enjoy lower premiums.

- Vehicle Type and Usage: The type of vehicle, its age, make, and model, can significantly impact insurance premiums. High-performance vehicles and luxury cars typically cost more to insure due to their higher repair and replacement costs. Additionally, the intended use of the vehicle, such as personal or commercial use, can affect premiums.

- Driving History: A driver's past record is a crucial factor in determining insurance premiums. Those with a history of accidents, traffic violations, or DUI convictions may face higher premiums or even policy denial.

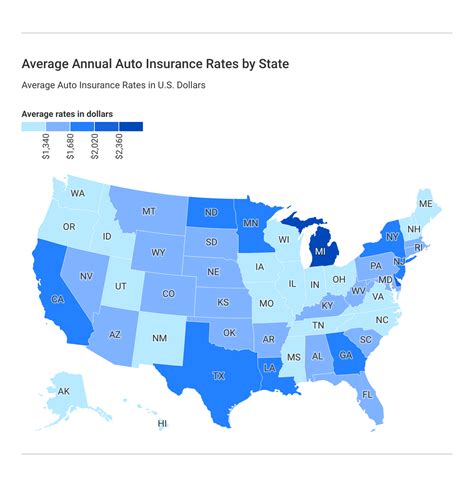

- Location and Usage: The area where the vehicle is primarily used can impact premiums. Urban areas with higher traffic volumes and accident rates may result in higher insurance costs. Similarly, the frequency of driving and the number of miles driven annually can influence premiums.

- Credit History: In many states, insurance companies use credit-based insurance scores to assess risk. A poor credit history may result in higher premiums, as it is seen as an indicator of potential financial instability.

- Discounts and Bundles: Insurance companies often offer discounts to policyholders who take additional safety measures, such as installing anti-theft devices or completing defensive driving courses. Additionally, bundling multiple insurance policies, such as home and auto insurance, can result in significant savings.

The Claims Process

Understanding the claims process is crucial for policyholders, as it ensures they receive the coverage and compensation they are entitled to. Here’s a step-by-step guide to the car insurance claims process:

- Report the Incident: Policyholders should promptly report any accidents, thefts, or other covered incidents to their insurance provider. This can often be done via a dedicated claims hotline or online portal.

- Gather Information: Collect as much information as possible about the incident, including photographs of the damage, contact details of involved parties, and any relevant documentation, such as police reports or medical records.

- File a Claim: Once the necessary information is gathered, policyholders can file a claim with their insurance provider. This typically involves completing a claim form and providing the supporting documentation.

- Claims Assessment: The insurance company will assess the claim, reviewing the provided information and investigating the incident. They may assign an adjuster to evaluate the damages and determine the extent of coverage.

- Repairs and Compensation: If the claim is approved, the insurance company will either facilitate repairs at a preferred repair shop or provide the policyholder with a settlement to cover the cost of repairs or replacements. In some cases, policyholders may be required to pay a deductible before receiving compensation.

It's important for policyholders to understand their policy's coverage limits and deductibles, as these can significantly impact the amount of compensation they receive.

The Future of Car Insurance Policies

The car insurance industry is evolving rapidly, driven by advancements in technology and changing consumer expectations. Here are some key trends and developments shaping the future of car insurance policies:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is revolutionizing the way insurance premiums are calculated. Usage-based insurance, or pay-as-you-drive insurance, uses telematics data to assess a driver’s risk based on their actual driving habits. This allows insurance companies to offer more personalized and accurate premiums, rewarding safe drivers with lower rates.

Connected Cars and Data Analytics

The rise of connected cars, equipped with advanced sensors and communication systems, is generating vast amounts of data. Insurance companies are leveraging this data to gain deeper insights into driving behavior, vehicle performance, and potential risks. By analyzing this data, insurers can develop more precise risk models and offer tailored insurance products.

Artificial Intelligence and Automation

Artificial intelligence (AI) and machine learning are transforming various aspects of the insurance industry, including the claims process. AI-powered systems can automate claim assessments, detect fraud, and streamline the overall claims handling process, reducing costs and improving efficiency.

Insurtech Innovation

Insurtech startups are disrupting the traditional insurance landscape by offering innovative digital solutions. These companies leverage technology to provide more transparent, convenient, and personalized insurance experiences. From instant policy comparisons and online claims filing to real-time risk assessment, Insurtech is driving significant changes in the car insurance market.

Autonomous Vehicles and Liability Shifts

The emergence of autonomous vehicles presents a unique challenge for the insurance industry. As the liability for accidents shifts from human drivers to vehicle manufacturers and technology providers, insurance policies will need to adapt to cover these new risks. Insurers are already exploring ways to insure autonomous vehicles, including developing specialized policies and risk models.

Conclusion

Car insurance policies are a vital component of responsible vehicle ownership, providing financial protection and peace of mind to drivers. By understanding the various types of coverage, factors influencing premiums, and the claims process, policyholders can make informed decisions to ensure they have adequate protection. As the car insurance industry continues to evolve, driven by technology and innovation, policyholders can expect more personalized and efficient insurance experiences tailored to their unique needs.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever there are significant changes in your life, such as a new vehicle purchase, a move to a different location, or a change in marital status. Regular policy reviews ensure that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.

Can I switch car insurance providers mid-policy term?

+Yes, you can switch car insurance providers at any time. However, be mindful of any cancellation fees or penalties associated with your current policy. It’s a good idea to compare multiple insurance providers and get quotes before making a switch to ensure you’re getting the best coverage and rates.

What factors determine my car insurance premium?

+Your car insurance premium is influenced by various factors, including your age, driving record, the type and value of your vehicle, your location, and the coverage options you choose. Insurance companies use these factors to assess your risk level and determine your premium.

How can I lower my car insurance premiums?

+There are several strategies to reduce your car insurance premiums. These include maintaining a clean driving record, increasing your deductible, taking advantage of discounts (such as safe driver discounts or multi-policy discounts), and shopping around for the best rates.

What happens if I don’t have car insurance and get into an accident?

+Driving without car insurance is illegal in most states, and if you’re involved in an accident, you’ll be personally liable for any damages or injuries caused. This can result in significant financial consequences, including lawsuits and high out-of-pocket expenses. It’s crucial to have adequate car insurance coverage to protect yourself and others on the road.