Calculate House Insurance

House insurance, often referred to as homeowners insurance or home insurance, is a vital protection measure for homeowners and renters alike. It provides financial security and peace of mind by covering various aspects related to your home and its contents. Calculating house insurance involves assessing the value of your property, understanding the different types of coverage, and considering factors that influence insurance premiums. In this comprehensive guide, we will delve into the process of calculating house insurance, exploring the key components and variables that impact your insurance needs and costs.

Understanding House Insurance Coverage

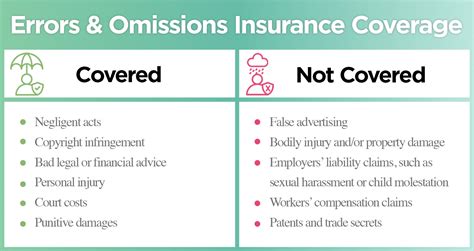

House insurance offers a range of coverage options to safeguard your home and personal belongings. The primary types of coverage include:

- Dwelling Coverage: This covers the physical structure of your home, including walls, roofs, and permanent fixtures. It ensures that in the event of damage or destruction, you can rebuild or repair your home.

- Personal Property Coverage: This coverage protects the contents of your home, such as furniture, appliances, electronics, and clothing. It provides compensation for losses due to covered perils like theft, fire, or natural disasters.

- Liability Coverage: Liability insurance protects you against legal claims and lawsuits arising from accidents or injuries that occur on your property. It covers medical expenses and legal fees, providing financial protection for unexpected liabilities.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered incident, this coverage helps cover temporary living expenses, such as hotel stays or rental costs, until you can return to your home.

When calculating house insurance, it's essential to understand the coverage limits and deductibles associated with each type of coverage. Coverage limits define the maximum amount the insurance company will pay for a covered loss, while deductibles are the portion of the loss that you, the policyholder, are responsible for paying out of pocket.

Assessing the Value of Your Home

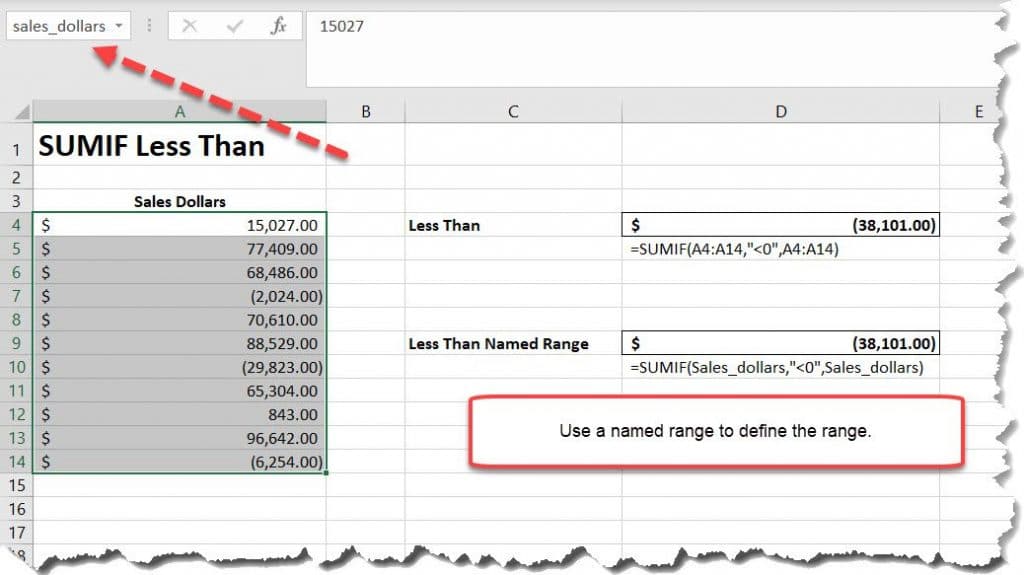

The first step in calculating house insurance is to accurately assess the value of your home. This involves determining the replacement cost, which is the estimated amount it would cost to rebuild your home from the ground up using similar materials and construction methods.

To calculate the replacement cost, you can consider the following factors:

- Construction Materials: Evaluate the quality and cost of the materials used in your home's construction, including the foundation, walls, roofing, and any unique features.

- Square Footage: Measure the total square footage of your home, including all floors and rooms. This will help determine the scale of construction required in the event of a total loss.

- Local Building Codes: Familiarize yourself with the building codes and regulations in your area. These codes may influence the cost of construction and the requirements for materials and labor.

- Labor Costs: Research the prevailing labor rates in your region for skilled construction workers. This will give you an idea of the cost of hiring professionals to rebuild your home.

It's important to note that the replacement cost may differ from the market value of your home. The market value is influenced by factors such as location, demand, and real estate trends, while the replacement cost focuses solely on the cost of reconstruction.

Special Considerations for High-Value Homes

If you own a high-value home, additional considerations may come into play when calculating house insurance. Here are some factors to keep in mind:

- Replacement Cost Guarantee: Some insurance companies offer replacement cost guarantees, ensuring that they will cover the full cost of rebuilding your home, regardless of the policy limit. This provides added peace of mind for homeowners of high-value properties.

- Increased Coverage Limits: High-value homes often require higher coverage limits to adequately protect the property and its contents. It’s crucial to review your policy limits and adjust them as necessary to ensure sufficient coverage.

- Customized Coverage: High-value homes may have unique features, such as custom artwork, antique furnishings, or valuable collectibles. To adequately insure these items, you may need to add riders or endorsements to your policy, ensuring they are specifically covered.

Factors Influencing Insurance Premiums

Insurance premiums, the amount you pay for your house insurance policy, are influenced by various factors. Understanding these factors can help you make informed decisions when calculating your insurance needs and costs.

Location and Risk Factors

The location of your home plays a significant role in determining insurance premiums. Areas prone to natural disasters, such as hurricanes, earthquakes, or floods, typically have higher insurance costs. Additionally, the crime rate and the proximity to fire stations and emergency services can impact premiums.

Insurance companies assess the risk factors associated with your location and adjust premiums accordingly. It's essential to review your policy and understand the specific risks covered and excluded in your area.

Home Construction and Features

The construction materials and features of your home can influence insurance premiums. Homes built with fire-resistant materials or equipped with advanced security systems may qualify for lower premiums. Additionally, the age of your home and its maintenance history can impact insurance costs.

Upgrading your home's safety features, such as installing smoke detectors, fire sprinklers, or reinforced doors, can lead to reduced insurance premiums. These features not only enhance the security of your home but also lower the risk of losses, making you a more desirable insurance candidate.

Insurance Deductibles

Insurance deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can result in lower insurance premiums. However, it’s important to strike a balance between affordability and financial preparedness for potential losses.

When selecting a deductible, consider your financial situation and the likelihood of incurring covered losses. A higher deductible may save you money on premiums, but it also means you'll be responsible for a larger portion of the cost in the event of a claim. Assess your risk tolerance and choose a deductible that aligns with your comfort level and financial capabilities.

Credit Score and Insurance History

Insurance companies may consider your credit score and insurance history when calculating premiums. A good credit score and a clean insurance history, with no claims or accidents, can lead to lower premiums. On the other hand, a poor credit score or a history of frequent claims may result in higher insurance costs.

Maintaining a positive credit score and practicing responsible insurance behavior, such as avoiding unnecessary claims and promptly reporting any losses, can positively impact your insurance premiums over time. Insurance companies view stable, responsible policyholders as lower-risk candidates, which can translate to savings on your insurance costs.

Choosing the Right Coverage Limits

When calculating house insurance, it’s crucial to choose coverage limits that align with your specific needs and circumstances. Here are some considerations to help you determine the right coverage limits:

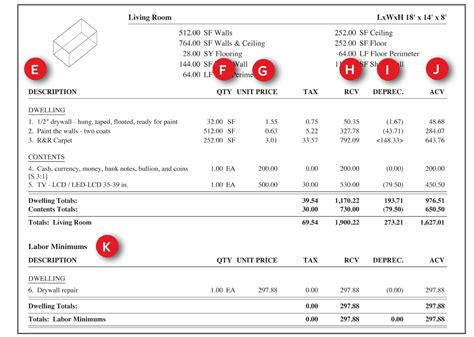

- Replacement Cost vs. Actual Cash Value: Understand the difference between replacement cost coverage and actual cash value coverage. Replacement cost coverage ensures that you receive the full amount to rebuild your home, while actual cash value coverage considers depreciation and may result in lower payouts.

- Personal Property Coverage: Evaluate the value of your personal belongings and choose coverage limits that adequately protect your possessions. Consider factors such as the cost of replacing electronics, furniture, and valuables.

- Liability Coverage: Assess your liability risks and choose liability coverage limits that provide sufficient protection. Keep in mind that liability claims can result in substantial legal expenses and medical costs.

- Additional Living Expenses: Determine the average cost of temporary housing or rental expenses in your area. Choose coverage limits that would cover your living expenses for an adequate period if your home becomes uninhabitable due to a covered loss.

Comparing Insurance Quotes

To ensure you’re getting the best value for your house insurance, it’s beneficial to compare quotes from multiple insurance providers. Obtain quotes from at least three reputable insurers, considering factors such as coverage options, deductibles, and customer service ratings.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional benefits or discounts offered. Look for policies that provide comprehensive coverage at a competitive price. Remember that the cheapest option may not always offer the best value, so evaluate the overall package and choose the insurer that aligns with your needs and budget.

Regularly Review and Update Your Policy

House insurance needs can change over time, so it’s essential to regularly review and update your policy. Life events such as home renovations, marriage, or the addition of valuable possessions may impact your insurance requirements.

Conduct an annual review of your policy to ensure it still meets your needs. Update your coverage limits, deductibles, and any additional endorsements as necessary. Stay informed about any changes in your area that may impact insurance risks, such as new construction projects or changes in local ordinances.

By staying proactive and keeping your policy up-to-date, you can ensure that you have the appropriate coverage and avoid gaps or insufficient protection.

Conclusion

Calculating house insurance involves a careful assessment of your home’s value, understanding the different types of coverage, and considering the factors that influence insurance premiums. By following the steps outlined in this guide, you can make informed decisions and obtain the right house insurance coverage to protect your home and personal belongings.

Remember to regularly review your policy, stay informed about changes in your area, and compare quotes to ensure you're getting the best value for your insurance needs. House insurance provides financial security and peace of mind, allowing you to focus on enjoying your home without the worry of unexpected losses.

What is the difference between replacement cost and actual cash value coverage in house insurance?

+Replacement cost coverage ensures that you receive the full amount to rebuild your home, regardless of depreciation. Actual cash value coverage considers depreciation and may result in lower payouts.

How often should I review and update my house insurance policy?

+It is recommended to review your policy annually and update it whenever significant life changes or home improvements occur.

Can I customize my house insurance policy to cover specific items or situations?

+Yes, you can customize your policy by adding riders or endorsements to cover specific items, such as jewelry, artwork, or high-value electronics. Additionally, you can tailor your coverage to include specific situations, such as flood or earthquake protection.