Home Insurance Average

Home insurance is a vital financial protection measure for homeowners, providing coverage against various risks and unforeseen events. The average cost of home insurance can vary significantly depending on numerous factors, including the location, property value, and the level of coverage chosen. Understanding these factors and how they influence the average premium can help homeowners make informed decisions when selecting an insurance policy.

Factors Influencing Home Insurance Costs

Several key elements contribute to the overall cost of home insurance, each playing a significant role in determining the average premium. These factors are influenced by regional differences, property characteristics, and individual circumstances.

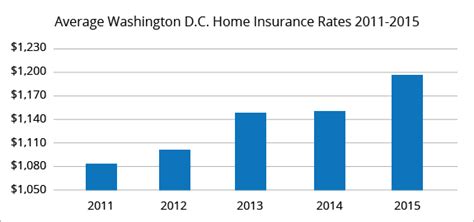

Location and Regional Differences

The geographical location of a home is one of the most critical factors affecting insurance costs. Areas prone to natural disasters, such as hurricanes, tornadoes, or earthquakes, typically have higher insurance premiums. For instance, homes located in coastal regions with a history of hurricanes may face higher insurance costs due to the increased risk of storm damage. Similarly, areas with a higher incidence of crimes like burglary or vandalism may also experience elevated insurance rates.

| Region | Average Premium |

|---|---|

| Coastal Areas (Hurricane Prone) | $2,500 - $3,000 annually |

| Earthquake-Prone Regions | $1,800 - $2,200 annually |

| Urban Centers with High Crime Rates | $1,500 - $2,000 annually |

| Rural Areas with Fewer Risks | $1,200 - $1,600 annually |

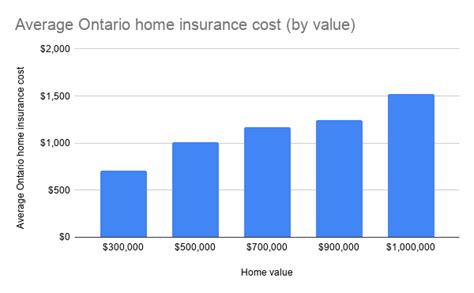

Property Value and Size

The value and size of a home are directly proportional to its insurance costs. Larger homes with higher replacement values generally require more extensive coverage, leading to higher premiums. The construction materials used and the age of the home also impact insurance costs. Homes built with more durable materials or those that have undergone recent renovations may enjoy lower insurance rates due to reduced risk of damage.

| Home Size | Average Premium |

|---|---|

| Small (Up to 1,500 sq. ft.) | $1,000 - $1,500 annually |

| Medium (1,500 - 3,000 sq. ft.) | $1,500 - $2,000 annually |

| Large (Over 3,000 sq. ft.) | $2,000 - $3,000 annually |

Coverage Types and Deductibles

The type and level of coverage chosen significantly influence home insurance costs. Basic coverage, known as HO-2 or named perils coverage, protects against specific risks like fire, theft, and vandalism. HO-3 or open perils coverage offers broader protection, covering all risks except those specifically excluded in the policy. The more comprehensive the coverage, the higher the premium. Additionally, the deductible, or the amount the homeowner pays out of pocket before the insurance kicks in, also affects the premium. Higher deductibles generally result in lower premiums.

Average Home Insurance Costs by Coverage Type

The average cost of home insurance can vary based on the type of coverage selected. Here’s a breakdown of the average premiums for different coverage types:

HO-2 (Named Perils) Coverage

HO-2 coverage, also known as named perils coverage, is a basic level of home insurance that provides protection against specific risks. These risks typically include fire, lightning, explosion, riot, vandalism, theft, and windstorm or hail damage. The average premium for HO-2 coverage ranges from 800 to 1,200 annually for a standard home. However, this can vary based on the location and the specific perils covered.

| Region | Average HO-2 Premium |

|---|---|

| Urban Areas | $900 - $1,100 annually |

| Suburban Areas | $850 - $1,050 annually |

| Rural Areas | $750 - $950 annually |

HO-3 (Open Perils) Coverage

HO-3 coverage, or open perils coverage, is a more comprehensive form of home insurance. It provides protection against all risks except those specifically excluded in the policy, such as floods, earthquakes, and intentional damage. The average premium for HO-3 coverage ranges from 1,200 to 1,800 annually for a standard home. The premium can be higher or lower depending on the location, the value of the home, and the specific exclusions in the policy.

| Region | Average HO-3 Premium |

|---|---|

| High-Risk Urban Areas | $1,500 - $2,000 annually |

| Suburban Areas with Moderate Risk | $1,300 - $1,600 annually |

| Rural Areas with Few Risks | $1,100 - $1,400 annually |

HO-5 (Premium) Coverage

HO-5 coverage, also known as premium or comprehensive coverage, is the highest level of home insurance available. It provides the broadest protection, covering both the structure of the home and its contents against all risks except those specifically excluded. HO-5 policies often include additional benefits such as replacement cost coverage, which ensures that the home is rebuilt to its pre-loss condition without any depreciation. The average premium for HO-5 coverage can range from 1,800 to 2,500 annually for a standard home.

| Region | Average HO-5 Premium |

|---|---|

| Urban Areas with High Property Values | $2,200 - $2,800 annually |

| Suburban Luxury Homes | $2,000 - $2,500 annually |

| Rural Areas with Valuable Properties | $1,600 - $2,200 annually |

Tips for Managing Home Insurance Costs

While the average cost of home insurance can vary, there are strategies homeowners can employ to manage and potentially reduce their premiums. Here are some effective tips:

- Shop Around: Compare quotes from multiple insurance providers. Prices can vary significantly, so shopping around can help you find the best deal.

- Bundle Policies: Consider bundling your home and auto insurance policies with the same provider. Many insurers offer discounts for customers who bundle their policies, which can lead to substantial savings.

- Increase Deductibles: Opting for a higher deductible can lower your premium. However, ensure that you can afford the higher out-of-pocket expense if a claim occurs.

- Maintain a Good Credit Score: Insurers often consider credit scores when calculating premiums. A higher credit score can lead to lower insurance rates.

- Review Coverage Regularly: As your home's value and your personal circumstances change, review your insurance coverage. Ensure that your policy remains adequate and that you're not overpaying for unnecessary coverage.

- Make Home Improvements: Certain home improvements, such as installing a security system or upgrading to a fire-resistant roof, can lower your insurance premiums. These improvements reduce the risk of theft or damage, making your home a safer investment for insurers.

Conclusion: Understanding the Average Home Insurance Cost

The average cost of home insurance is influenced by a multitude of factors, including location, property value, coverage types, and individual circumstances. By understanding these factors and the average premiums associated with different coverage levels, homeowners can make informed decisions when selecting an insurance policy. Additionally, by employing cost-saving strategies and regularly reviewing their coverage, homeowners can ensure they have adequate protection at a competitive rate.

What is the average cost of home insurance for a standard home in the US?

+The average cost of home insurance for a standard home in the US is around 1,000 to 1,500 annually. However, this can vary significantly based on factors such as location, property value, and coverage type.

Are there any ways to reduce home insurance costs?

+Yes, there are several strategies to reduce home insurance costs. These include shopping around for quotes, bundling policies, increasing deductibles, maintaining a good credit score, and regularly reviewing your coverage. Additionally, making home improvements that reduce the risk of damage or theft can lead to lower premiums.

What is the difference between HO-2, HO-3, and HO-5 coverage?

+HO-2 coverage (named perils) provides protection against specific risks like fire, theft, and vandalism. HO-3 coverage (open perils) offers broader protection, covering all risks except those specifically excluded. HO-5 coverage (premium) is the most comprehensive, providing coverage for all risks except those explicitly excluded, and often includes additional benefits like replacement cost coverage.