American Insurance General

Welcome to a comprehensive exploration of American Insurance General, a leading provider in the insurance industry with a rich history and a wide range of services. This expert-level article aims to delve into the intricacies of this company, its offerings, and its impact on the market. With a focus on providing an engaging and informative read, we will uncover the key aspects that make American Insurance General a notable player in the world of insurance.

American Insurance General: A Legacy of Trust and Innovation

American Insurance General, often referred to as AIG, has established itself as a stalwart in the insurance sector, boasting a legacy that spans over a century of financial expertise and industry leadership. Founded in 1919, AIG has not only witnessed but actively shaped the evolution of the insurance landscape, adapting and innovating to meet the diverse needs of its global clientele.

Headquartered in the bustling city of New York, AIG operates as a multinational insurance corporation, offering an extensive array of services that encompass property, casualty, life, and health insurance, alongside a suite of investment products and financial services. With a presence in over 100 countries and territories, the company's reach is truly global, catering to both individual consumers and corporate entities alike.

AIG's success story is not merely a result of its expansive product offerings; it lies in the company's unwavering commitment to innovation, customer satisfaction, and financial stability. This dedication has earned AIG a reputation as a trusted partner, providing comprehensive insurance solutions tailored to the unique risks and challenges faced by its diverse customer base.

A Historical Perspective

To truly appreciate the magnitude of AIG's influence, a historical lens is necessary. The company's journey began in the aftermath of World War I, a time of economic uncertainty and changing societal dynamics. Recognizing the need for robust financial protection, Cornelius Vander Starr, the visionary founder of AIG, set out to establish an insurance enterprise that would revolutionize the industry.

Starr's pioneering spirit and innovative mindset led to the creation of a company that quickly gained traction, expanding its operations beyond the borders of the United States. By the mid-20th century, AIG had solidified its position as a global leader, offering specialized insurance solutions to individuals and businesses in a wide array of sectors.

The company's rapid ascent was not without its challenges. AIG weathered economic downturns, political upheavals, and changing market dynamics, adapting its strategies and product offerings to remain resilient and competitive. This adaptability has been a hallmark of AIG's success, allowing it to navigate the complexities of the insurance landscape with agility and foresight.

AIG's Comprehensive Product Suite

At the core of AIG's success is its comprehensive product portfolio, designed to address a myriad of insurance needs. Here's an overview of some of the key offerings:

- Property Insurance: AIG provides tailored coverage for residential, commercial, and industrial properties, offering protection against damage, theft, and liability risks.

- Casualty Insurance: This segment includes liability insurance, workers' compensation, and various other risk management solutions, safeguarding businesses and individuals from potential legal and financial liabilities.

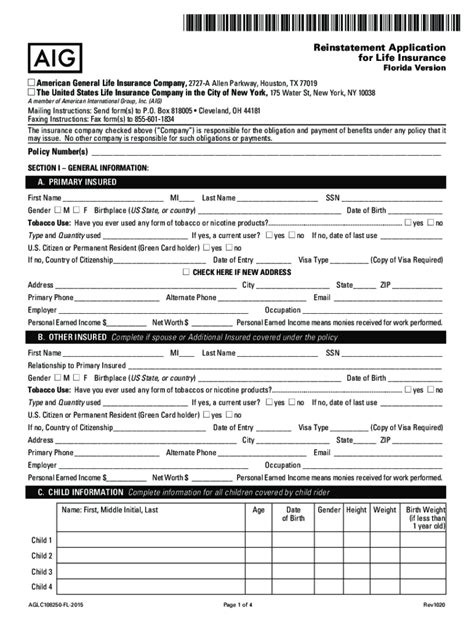

- Life Insurance: AIG's life insurance products offer financial protection and peace of mind, with a range of options including term life, whole life, and universal life insurance policies.

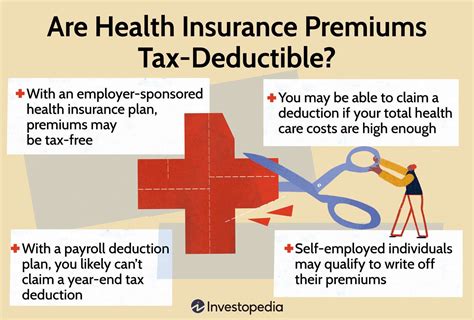

- Health Insurance: The company's health insurance plans cover a wide spectrum of medical expenses, including hospitalization, outpatient care, prescription drugs, and preventive services.

- Investment Products: AIG also offers a range of investment and retirement planning solutions, providing customers with opportunities to grow and protect their wealth.

Each of these product lines is underpinned by AIG's commitment to innovation and customer-centricity, ensuring that the company remains at the forefront of the insurance industry.

Financial Strength and Ratings

AIG's financial stability is a cornerstone of its reputation and a key factor in its success. The company's strong financial position is reflected in the ratings it receives from independent rating agencies. Here's a snapshot of AIG's financial strength ratings from some of the leading agencies:

| Rating Agency | Financial Strength Rating |

|---|---|

| A.M. Best | A (Excellent) |

| Standard & Poor's | A+ (Strong) |

| Moody's | A2 (Good) |

| Fitch Ratings | A (Strong) |

These ratings underscore AIG's commitment to financial prudence and stability, providing customers with confidence in the company's ability to honor its obligations.

Industry Recognition and Awards

AIG's contributions to the insurance industry have not gone unnoticed. The company has garnered numerous accolades and awards, solidifying its position as an industry leader and innovator. Here are some notable recognitions:

- Global Brand Award: Recognized as one of the world's most valuable insurance brands by leading brand valuation firms.

- Innovation Awards: AIG has received multiple awards for its innovative product development and risk management solutions.

- Customer Service Excellence: The company has been consistently ranked highly for its exceptional customer service, with awards from prominent customer satisfaction surveys.

- Industry Leadership: AIG's executives and leaders have been recognized for their vision, strategic thinking, and contributions to the insurance sector.

Sustainable Practices and Social Responsibility

Beyond its core insurance offerings, AIG is committed to sustainable practices and social responsibility. The company has implemented initiatives focused on environmental sustainability, community engagement, and ethical business practices. Here are some key highlights:

- Environmental Initiatives: AIG has set ambitious goals to reduce its carbon footprint, with a focus on energy efficiency, waste reduction, and sustainable business practices.

- Community Engagement: The company actively supports local communities through various initiatives, including education programs, disaster relief efforts, and charitable donations.

- Diversity and Inclusion: AIG fosters a diverse and inclusive workplace, recognizing the value of diverse perspectives and experiences in driving innovation and business success.

- Ethical Business Practices: The company adheres to stringent ethical guidelines, ensuring fair and transparent business practices across all its operations.

Future Outlook and Innovations

As the insurance landscape continues to evolve, AIG remains at the forefront, leveraging technology and innovation to stay ahead of the curve. The company is actively exploring new avenues, including:

- Digital Transformation: AIG is investing in digital technologies to enhance customer experience, streamline operations, and improve efficiency.

- Data Analytics: The company is harnessing the power of data analytics to better understand customer needs, improve risk assessment, and develop innovative products.

- Artificial Intelligence: AIG is integrating AI into its operations, from customer service to claims processing, to deliver faster and more accurate services.

- Sustainable Solutions: The company is developing insurance products and services that address emerging risks related to climate change and sustainability.

With a focus on innovation and a commitment to customer satisfaction, AIG is well-positioned to navigate the challenges and opportunities of the future, continuing to deliver value to its global customer base.

Frequently Asked Questions (FAQs)

What sets AIG apart from other insurance providers?

+AIG's unique selling proposition lies in its comprehensive product portfolio, global reach, and commitment to innovation. The company's ability to adapt to changing market dynamics and provide tailored solutions sets it apart, ensuring it remains a trusted partner for its customers.

How does AIG ensure financial stability and customer confidence?

+AIG's financial stability is underpinned by its robust risk management practices, conservative investment strategies, and strong financial ratings. The company's commitment to transparency and ethical business practices further enhances customer confidence.

What are some of AIG's key innovations in the insurance industry?

+AIG has pioneered several innovations, including the development of parametric insurance products, the integration of blockchain technology for smart contracts, and the use of AI in claims processing and customer service. These innovations have enhanced efficiency, improved risk assessment, and delivered better customer experiences.

How does AIG contribute to sustainability and social responsibility?

+AIG's sustainability initiatives focus on reducing its environmental impact, supporting local communities, and promoting diversity and inclusion. The company's commitment to ethical business practices and its involvement in industry-wide sustainability efforts further demonstrate its dedication to corporate social responsibility.

American Insurance General, or AIG, continues to be a powerhouse in the insurance industry, combining a rich legacy with a forward-thinking approach. As it navigates the complexities of the modern insurance landscape, AIG remains a trusted partner for individuals and businesses seeking comprehensive protection and financial security.