Compare Insurance Quotes For Cars

Finding the best insurance coverage for your car can be a complex and time-consuming process. With numerous insurance providers offering a wide range of policies, it's essential to compare quotes to ensure you're getting the most suitable and cost-effective coverage for your vehicle. In this comprehensive guide, we'll delve into the world of car insurance, exploring the factors that influence quotes, the steps to compare them effectively, and provide you with valuable insights to make an informed decision.

Understanding Car Insurance Quotes

Car insurance quotes are tailored estimates provided by insurance companies to offer coverage for your vehicle. These quotes are based on various factors, including your personal information, the type of car you drive, your driving history, and the coverage options you select. Understanding the components of an insurance quote is crucial to making accurate comparisons.

Key Components of Insurance Quotes

When requesting quotes, you’ll encounter several essential elements that make up the overall cost of car insurance:

- Liability Coverage: This covers damages or injuries you cause to others. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: Pays for repairs to your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: Provides protection for non-accident-related incidents like theft, vandalism, or natural disasters.

- Medical Payments Coverage: Helps cover medical expenses for you and your passengers in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has little or no insurance.

- Deductibles: The amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums.

- Premium: The cost of your insurance policy, calculated based on the coverage options and your personal risk factors.

Factors Influencing Car Insurance Quotes

Several key factors come into play when insurance providers calculate quotes for car insurance. Understanding these factors can help you anticipate the cost of your insurance and make informed decisions when comparing quotes.

Vehicle Type and Usage

The make, model, and year of your vehicle significantly impact your insurance quote. Cars with higher repair costs or those prone to theft may result in higher premiums. Additionally, the primary purpose of using your vehicle (e.g., commuting, business, or pleasure) can also influence the quote.

Driving History and Demographics

Your driving record is a critical factor in determining insurance quotes. A clean driving history with no accidents or violations is likely to result in lower premiums. Insurance companies also consider demographic factors such as age, gender, marital status, and location, as these can affect the risk associated with insuring a driver.

Coverage and Deductibles

The coverage options you choose play a significant role in the overall cost of your insurance. Comprehensive and collision coverage, while providing more protection, can increase your premium. Additionally, selecting higher deductibles can lower your premium, but it’s essential to choose an amount you’re comfortable paying out-of-pocket.

Discounts and Special Programs

Many insurance companies offer discounts and special programs to attract customers and reward safe driving. These can include discounts for bundling multiple policies (e.g., car and home insurance), safe driver programs, loyalty discounts, or even discounts for specific professions or affiliations.

Comparing Insurance Quotes: A Step-by-Step Guide

Now that we’ve explored the factors influencing car insurance quotes, let’s dive into a step-by-step process to effectively compare quotes and find the best coverage for your needs.

Step 1: Gather Information

Before requesting quotes, gather the necessary information to ensure a smooth process. This includes your driver’s license number, vehicle identification number (VIN), details about your car (make, model, year), and information about your driving history (e.g., accidents, violations, claims history). Having this information ready will expedite the quote comparison process.

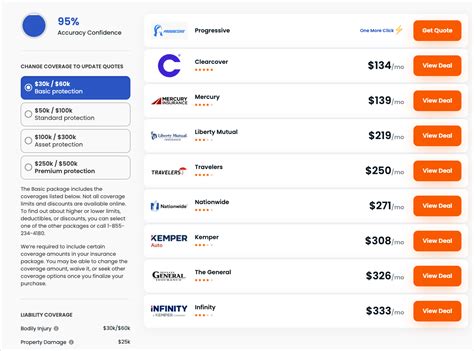

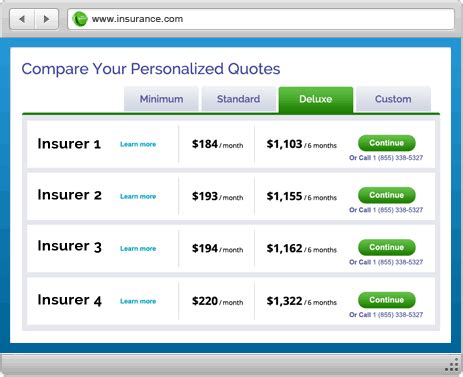

Step 2: Choose Insurance Providers

Select a range of insurance providers to request quotes from. Consider a mix of well-known companies and smaller, regional insurers. Online insurance marketplaces or comparison websites can be a great starting point to explore a variety of options.

Step 3: Request Quotes

Visit the websites or contact the chosen insurance providers to request quotes. Ensure you provide accurate and consistent information to each provider to get an apples-to-apples comparison. When requesting quotes, specify the coverage options and deductibles you’re interested in to tailor the quotes to your needs.

Step 4: Analyze and Compare

Once you have multiple quotes, it’s time to analyze and compare them. Pay close attention to the following aspects:

- Coverage Options: Ensure each quote includes the coverage you desire. Compare the limits and deductibles to ensure they align with your preferences.

- Premium Amount: Compare the total premium cost, including any applicable discounts. Look for the best value, considering both the cost and the coverage provided.

- Additional Benefits: Some insurers offer unique benefits or perks, such as roadside assistance, rental car coverage, or accident forgiveness. Consider these extras when comparing quotes.

- Customer Service and Reputation: Research the insurance providers’ customer service reputation and financial stability. Check online reviews and ratings to gauge their reliability.

Step 5: Negotiate and Finalize

If you find a quote that meets your needs and budget, you can negotiate further or finalize the policy. Contact the insurance provider to discuss any questions or concerns you may have. Remember, you can always shop around and compare quotes annually to ensure you’re still getting the best deal.

Additional Tips for Finding the Best Car Insurance

To further enhance your car insurance journey, consider these additional tips:

- Maintain a Clean Driving Record: A clean driving history can lead to significant savings on your insurance premiums. Avoid accidents and violations to keep your record clean.

- Bundle Policies: If you have multiple insurance needs (e.g., car, home, life), consider bundling your policies with one insurer. This can result in substantial discounts.

- Explore Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums.

- Consider Higher Deductibles: While it may increase your out-of-pocket expenses in the event of a claim, opting for higher deductibles can lower your monthly premiums.

- Stay Informed: Keep up-to-date with insurance trends and changes in your state’s laws. Understanding the latest developments can help you make more informed decisions.

Conclusion

Comparing insurance quotes for cars is a crucial step in ensuring you find the best coverage at the most competitive price. By understanding the factors that influence quotes, following a systematic comparison process, and considering additional tips, you can make an informed decision that suits your unique needs and budget. Remember, car insurance is an essential aspect of vehicle ownership, and finding the right coverage can provide peace of mind and financial protection on the road.

How often should I compare car insurance quotes?

+It’s recommended to compare quotes annually or whenever you experience a significant life change (e.g., marriage, moving, buying a new car). Regular comparisons ensure you stay up-to-date with the best available rates and coverage options.

Can I switch insurance providers mid-policy?

+Yes, you can switch insurance providers at any time. However, be mindful of any cancellation fees or penalties associated with ending your current policy early. Ensure you have the new policy in place before canceling the old one to avoid gaps in coverage.

What are some common discounts offered by insurance providers?

+Common discounts include multi-policy discounts (bundling car and home insurance), safe driver discounts, loyalty discounts, good student discounts, and discounts for certain professions or affiliations. Check with your insurer to see what discounts you may be eligible for.