Insurance Cheap

In today's world, insurance is an essential financial tool that provides protection and peace of mind. However, finding affordable insurance coverage can be a daunting task, especially with the numerous options and varying policies available. This article aims to delve into the realm of cheap insurance, exploring the factors that influence affordability, strategies to secure the best deals, and the potential trade-offs associated with low-cost policies. By understanding the intricacies of the insurance market, you can make informed decisions and navigate towards more affordable coverage options.

Understanding the Fundamentals of Cheap Insurance

Cheap insurance, at its core, is a coverage plan that offers financial protection at a lower cost compared to standard policies. It is a popular choice for those on a tight budget or individuals seeking to minimize their insurance expenses. While the concept of cheap insurance is appealing, it is crucial to approach it with a nuanced understanding to ensure it aligns with your specific needs and circumstances.

The Factors Shaping Insurance Costs

The cost of insurance is influenced by a multitude of factors, including the type of coverage, the level of risk associated with the insured individual or entity, and the insurance provider’s operating costs and profit margins. Additionally, external factors such as market competition, regulatory environment, and economic conditions can also impact insurance prices.

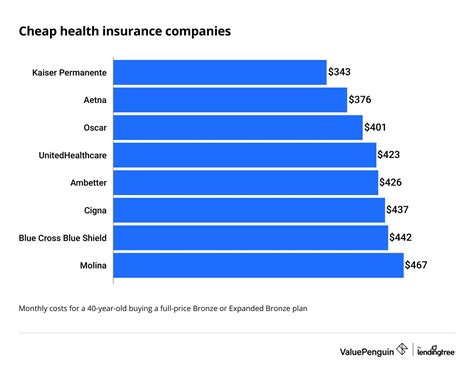

For instance, auto insurance rates can vary significantly based on factors like the make and model of the vehicle, the driver's age and driving record, and the location where the vehicle is primarily driven. Similarly, health insurance costs can be influenced by an individual's age, pre-existing medical conditions, and the scope of coverage required.

| Insurance Type | Key Cost Factors |

|---|---|

| Auto Insurance | Vehicle type, driver's record, location |

| Health Insurance | Age, medical history, coverage scope |

| Home Insurance | Property value, location, risk factors |

| Life Insurance | Age, health status, lifestyle factors |

The Trade-Offs of Cheap Insurance

While cheap insurance offers an attractive financial proposition, it is essential to consider the potential trade-offs. In most cases, lower premiums are achieved by either limiting the scope of coverage or increasing the insured’s financial responsibility in the event of a claim.

For instance, a cheap auto insurance policy might have a higher deductible, meaning you pay more out of pocket before the insurance coverage kicks in. Similarly, a low-cost health insurance plan may have a narrow network of providers or limited coverage for certain procedures, potentially leading to higher out-of-pocket expenses.

It is crucial to carefully review the terms and conditions of any cheap insurance policy to ensure it provides the necessary coverage without exposing you to excessive financial risks.

Strategies to Secure Affordable Insurance

Securing affordable insurance is not merely a matter of chance; it involves a combination of research, comparison, and strategic decision-making. By implementing the following strategies, you can increase your chances of finding cheap insurance that meets your needs:

Research and Comparison

The insurance market is vast and diverse, with numerous providers offering a wide range of policies. Conducting thorough research and comparing different options is essential to identify the most affordable coverage that aligns with your requirements.

Utilize online comparison tools and insurance marketplaces to quickly assess various policies' premiums, coverage limits, and exclusions. Additionally, review customer reviews and ratings to gauge the reliability and reputation of different insurance providers.

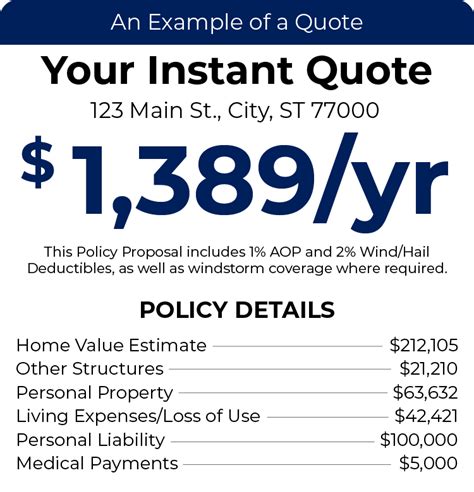

For instance, if you're seeking home insurance, compare policies from multiple providers based on factors such as coverage limits for different perils (e.g., fire, theft, natural disasters), deductibles, and additional coverages (e.g., flood insurance, identity theft protection). This comprehensive comparison will help you identify the most cost-effective option.

Bundle and Discounts

Many insurance providers offer discounts and incentives to encourage customers to purchase multiple policies from them. By bundling your insurance needs, such as auto and home insurance, you can often secure significant savings.

Additionally, inquire about other potential discounts, such as loyalty discounts for long-term customers, safe driver discounts for auto insurance, or health-conscious discounts for life or health insurance. These discounts can substantially reduce your insurance costs over time.

Increase Deductibles and Reduce Coverage

One of the most effective ways to reduce insurance premiums is by increasing your deductibles. A deductible is the amount you pay out of pocket before your insurance coverage begins. By opting for a higher deductible, you assume more financial responsibility in the event of a claim, which often leads to lower premiums.

Similarly, carefully review your coverage needs and consider reducing non-essential coverages. For example, if you have substantial savings or other assets, you might choose to reduce your life insurance coverage or opt for a term policy instead of whole life insurance.

Improve Your Risk Profile

Insurance providers assess your risk profile to determine your insurance premiums. By taking steps to improve your risk profile, you can potentially reduce your insurance costs.

For instance, if you're seeking auto insurance, maintaining a clean driving record, taking defensive driving courses, or installing anti-theft devices in your vehicle can lead to lower premiums. Similarly, for health insurance, adopting a healthy lifestyle, quitting smoking, or managing pre-existing conditions effectively can positively impact your insurance rates.

The Future of Affordable Insurance

The insurance industry is undergoing significant transformations, driven by technological advancements and changing consumer expectations. These changes have the potential to revolutionize the affordability of insurance, making it more accessible and tailored to individual needs.

The Rise of Insurtech

Insurtech, a portmanteau of insurance and technology, refers to the use of innovative technologies to streamline insurance processes, enhance customer experiences, and reduce costs. Insurtech startups and established insurance providers are leveraging technologies such as artificial intelligence, machine learning, and blockchain to disrupt traditional insurance models.

For example, some Insurtech companies are developing usage-based insurance models for auto insurance, where premiums are determined based on real-time driving data rather than static factors like age and location. This approach can lead to more accurate pricing and potentially lower premiums for safe drivers.

Personalized Insurance Solutions

The future of affordable insurance lies in personalized solutions that cater to individual needs and circumstances. With the advent of big data analytics and advanced risk assessment tools, insurance providers can offer tailored coverage options at competitive prices.

For instance, health insurance providers are increasingly using wearable devices and health tracking apps to collect real-time health data. This data can be used to offer personalized insurance plans with incentives for healthy behaviors, potentially reducing premiums for individuals who actively manage their health.

Insurtech’s Impact on Accessibility

Insurtech innovations are also making insurance more accessible to underserved populations. For example, parametric insurance, which uses pre-defined parameters to trigger payouts, is gaining traction in developing countries. This type of insurance can provide coverage for natural disasters or crop failures at a lower cost and with faster payouts, benefiting those who may not have access to traditional insurance.

Conclusion: Navigating the Path to Affordable Insurance

Cheap insurance is an attractive proposition for many, but it requires a thoughtful approach to ensure it aligns with your needs and circumstances. By understanding the factors that influence insurance costs, considering the potential trade-offs of low-cost policies, and implementing strategic decision-making, you can navigate the insurance market to find affordable coverage.

As the insurance industry continues to evolve with technological advancements and changing consumer expectations, the future of affordable insurance looks promising. Insurtech innovations, personalized insurance solutions, and improved accessibility are all contributing to a more inclusive and cost-effective insurance landscape. By staying informed and engaged, you can make the most of these advancements to secure the best insurance deals for your needs.

How can I find the cheapest insurance policy for my needs?

+To find the cheapest insurance policy that suits your needs, start by researching and comparing policies from multiple providers. Use online comparison tools and consider factors like coverage limits, deductibles, and any additional benefits. Additionally, look for discounts and incentives offered by insurance companies, such as bundling discounts or loyalty programs. Finally, assess your risk profile and consider increasing your deductibles or reducing non-essential coverages to lower your premiums.

Are there any drawbacks to choosing cheap insurance?

+Yes, cheap insurance often comes with trade-offs. Lower premiums may result in higher deductibles, narrower coverage, or limited provider networks. It’s important to carefully review the policy terms and conditions to ensure you’re not sacrificing essential coverage. Additionally, some cheap insurance policies may have strict guidelines for filing claims, potentially making the claims process more complex or less favorable.

Can I switch to a cheaper insurance provider if I’m already insured?

+Absolutely! Insurance policies are not set in stone, and you have the freedom to switch providers at any time. However, it’s crucial to compare policies and understand the terms of your current coverage to ensure a smooth transition. Consider the coverage limits, deductibles, and any additional benefits offered by the new provider to ensure you’re making a well-informed decision.