Renter Liability Insurance

Renting a home or apartment is a common practice for many individuals and families worldwide. It offers flexibility and often comes with its own set of unique considerations, one of which is liability insurance. Renter liability insurance is an essential aspect of protecting yourself and your belongings, providing coverage for various scenarios that could potentially arise during your tenancy. This article delves into the intricacies of renter liability insurance, exploring its significance, coverage details, and the benefits it offers to renters.

Understanding Renter Liability Insurance

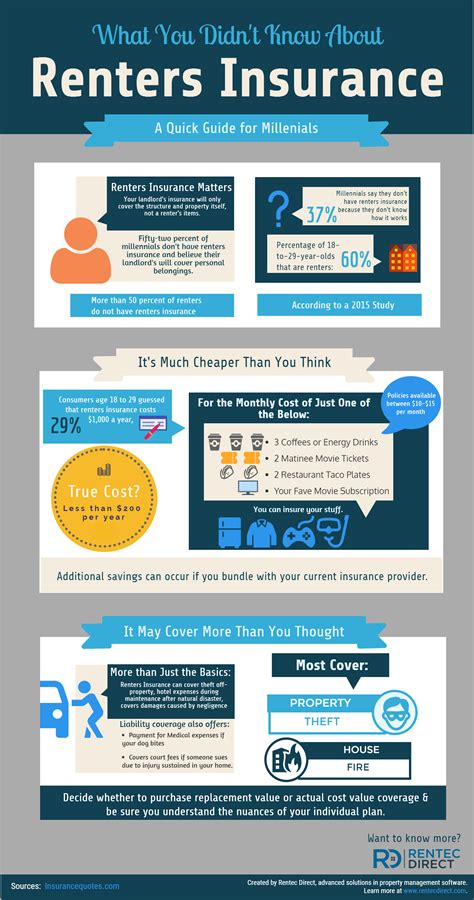

Renter liability insurance, often an optional add-on to your standard renter’s insurance policy, is designed to protect you from financial liability in the event of an accident or injury that occurs on your rented property. It covers a range of scenarios, from guest injuries to property damage, ensuring you are not personally responsible for paying expensive legal fees or settlements.

Coverage Scenarios

The coverage provided by renter liability insurance is extensive and can vary slightly depending on the policy and the insurance provider. However, some common scenarios where this insurance proves invaluable include:

- Guest Injuries: If a guest or visitor is injured on your rental property due to a slip, trip, or fall, renter liability insurance can cover the medical costs and potential legal fees that may arise.

- Property Damage: In the event that you accidentally cause damage to the rental property or the belongings of others, this insurance will cover the cost of repairs or replacements.

- Dog Bites: If you have a pet, particularly a dog, renter liability insurance is crucial. It covers costs associated with injuries caused by your pet, which can be a significant financial burden without adequate insurance.

- Libel or Slander: In rare cases, you might be held liable for libel or slander, especially if you publish something defamatory about another person. Renter liability insurance can provide coverage for such instances.

While these are some of the more common scenarios, renter liability insurance can also cover a wide range of other incidents, such as water damage caused by a faulty appliance, fire damage from a cooking accident, or even injuries caused by defective products within your rental.

| Coverage Type | Description |

|---|---|

| Personal Liability | Protects you from lawsuits and claims arising from bodily injury or property damage caused by you or a family member. |

| Medical Payments | Covers the medical expenses of guests who are injured on your rental property, regardless of fault. |

| Damage to Property of Others | Provides coverage if you accidentally damage someone else's property, including rental items like appliances or fixtures. |

Benefits of Renter Liability Insurance

Renters who opt for liability insurance enjoy several benefits that enhance their financial security and peace of mind. Here’s a closer look at some of these advantages:

Financial Protection

The primary benefit of renter liability insurance is the financial protection it offers. In the event of an accident or injury on your rented property, you could face significant legal fees and potential settlements. Without insurance, these costs would come directly out of your pocket, which could be devastating, especially for those on a tight budget. Renter liability insurance ensures that these financial burdens are covered, providing a safety net for your finances.

Peace of Mind

Knowing that you have renter liability insurance gives you peace of mind. You can relax and enjoy your home, confident that you are protected from unforeseen circumstances. Whether you’re hosting a party, having friends over for a barbecue, or simply living your daily life, the knowledge that you’re covered can significantly reduce stress and anxiety.

Legal Defense

In the unfortunate event that you are sued, renter liability insurance provides legal defense coverage. This means that your insurance company will cover the cost of hiring an attorney to defend you in court. This benefit is particularly valuable, as legal fees can quickly become overwhelming, often exceeding the cost of the original claim.

Customizable Coverage

One of the key advantages of renter liability insurance is its flexibility. You can often tailor your policy to meet your specific needs and budget. Whether you’re looking for higher coverage limits, additional endorsements, or specific exclusions, most insurance providers offer customizable options to ensure you get the right coverage for your situation.

How to Choose the Right Renter Liability Insurance

Selecting the right renter liability insurance policy involves careful consideration of your unique needs and circumstances. Here are some key factors to keep in mind when making your decision:

Coverage Limits

Coverage limits refer to the maximum amount your insurance policy will pay out for a single claim or for all claims during the policy period. It’s important to choose coverage limits that align with your financial ability to cover potential losses. While higher limits provide more protection, they also result in higher premiums. Assess your financial situation and choose limits that offer sufficient coverage without straining your budget.

Policy Deductibles

A policy deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it also means you’ll have to pay more out of pocket if you need to make a claim. Consider your financial ability to cover a higher deductible and choose one that strikes the right balance between cost and coverage.

Additional Endorsements

Additional endorsements, or policy riders, can be added to your base policy to provide extra coverage for specific risks. For example, if you have valuable jewelry or art, you might want to add a personal property endorsement to ensure these items are fully covered. Similarly, if you frequently host events, you might want to add a social host liability endorsement to protect you from claims related to alcohol consumption on your property.

Insurance Provider Reputation

The reputation of your insurance provider is crucial. Research and choose a reputable company with a history of prompt claim payments and good customer service. Read reviews, compare ratings, and consider the provider’s financial stability to ensure they will be able to fulfill their obligations in the event of a claim.

Comparing Quotes

Obtain quotes from multiple insurance providers to compare prices and coverage options. While cost is an important factor, it shouldn’t be the sole determining factor. Ensure that you’re comparing policies with similar coverage limits and deductibles to get an accurate comparison of value.

Frequently Asked Questions

Does renter liability insurance cover my personal belongings?

+No, renter liability insurance primarily covers your legal liability for accidents or injuries that occur on your rental property. It does not provide coverage for your personal belongings. For protection against theft, damage, or loss of your possessions, you’ll need to purchase a separate renter’s insurance policy.

How much does renter liability insurance typically cost?

+The cost of renter liability insurance can vary depending on several factors, including the coverage limits you choose, your location, and your personal circumstances. On average, you can expect to pay around 200 to 300 annually for a basic policy with standard coverage limits. However, the cost can increase or decrease based on your specific needs and the insurer’s rates.

Can I bundle renter liability insurance with other policies for a discount?

+Yes, many insurance companies offer discounts when you bundle multiple policies together. For instance, you might be able to save money by purchasing renter liability insurance along with renter’s insurance, auto insurance, or other types of coverage. Bundling policies can not only save you money but also streamline your insurance management.

What happens if I cause an accident but don’t have renter liability insurance?

+If you cause an accident or injury on your rental property and don’t have renter liability insurance, you could be personally liable for all associated costs. This includes medical bills, property damage repairs, and potentially legal fees and settlements. Without insurance, you would have to pay for these expenses out of your own pocket, which could be financially devastating.

Is renter liability insurance mandatory in all states?

+No, renter liability insurance is not mandatory in all states. However, it is highly recommended, as it provides essential protection against unforeseen circumstances. Even if your state doesn’t require it, having renter liability insurance is a wise decision to safeguard your financial well-being and peace of mind.

In conclusion, renter liability insurance is a vital component of any renter’s insurance portfolio. It offers comprehensive protection against a wide range of potential liabilities, ensuring that renters can enjoy their homes with peace of mind. By understanding the coverage, benefits, and selection process, renters can make informed decisions to secure their financial future and protect their loved ones.