General Car Insurance Quote

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers. Obtaining a general car insurance quote is the first step toward securing adequate coverage for your vehicle and understanding the associated costs. This comprehensive guide aims to delve into the intricacies of car insurance quotes, offering valuable insights to help you navigate the process with ease and confidence.

Understanding the Fundamentals of Car Insurance

Car insurance serves as a financial safeguard, protecting drivers from potential losses arising from accidents, theft, or other unforeseen events. It operates on a contractual basis, where the policyholder agrees to pay a premium in exchange for the insurance company’s commitment to cover specified damages or losses.

The world of car insurance is vast, offering a range of coverage types to suit diverse needs. Here's a glimpse into the primary categories:

- Liability Coverage: This is the most basic form, covering bodily injury and property damage claims made against you if you're at fault in an accident. It's mandatory in most states and protects your finances in the event of a lawsuit.

- Collision Coverage: This option covers damage to your vehicle resulting from a collision with another vehicle or object. It's an optional coverage but highly recommended, especially if your vehicle is still being financed or leased.

- Comprehensive Coverage: Comprehensive insurance provides protection against non-collision incidents like theft, vandalism, weather-related damage, or collisions with animals. It's another optional coverage but is essential for comprehensive protection.

- Personal Injury Protection (PIP): PIP coverage, available in some states, covers medical expenses and lost wages for you and your passengers, regardless of fault. It ensures prompt access to medical treatment and financial support after an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient coverage to pay for the damages. It's crucial for safeguarding your financial well-being.

The Art of Obtaining an Accurate Car Insurance Quote

Securing an accurate car insurance quote involves a thoughtful consideration of various factors that influence the cost of your policy. Here’s a comprehensive guide to help you navigate this process seamlessly.

Factors Influencing Your Car Insurance Quote

The price of your car insurance policy is influenced by a multitude of factors, each playing a unique role in determining your coverage costs. Understanding these factors is key to securing an accurate quote that aligns with your needs and budget.

- Vehicle Type and Make: Different vehicles attract different insurance premiums. Factors like the make, model, and year of your vehicle, as well as its safety and anti-theft features, can significantly impact your insurance costs.

- Driver's Profile: Your driving record and history are critical in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents or traffic violations may result in higher costs.

- Age and Gender: In some states, insurance rates can be influenced by your age and gender. Younger drivers, especially those under 25, and male drivers tend to be associated with higher insurance rates due to statistical risk factors.

- Marital Status: Being married can sometimes result in lower insurance rates, as married individuals are statistically less likely to be involved in accidents.

- Credit Score: In many states, your credit score can be a factor in determining your insurance rates. Maintaining a good credit score can lead to more favorable insurance premiums.

- Coverage and Deductibles: The level of coverage you choose and the deductibles you're willing to pay also play a role in your insurance costs. Higher coverage limits and lower deductibles generally result in higher premiums.

- Location and Usage: The area where you live and the primary usage of your vehicle can impact your insurance rates. Urban areas with higher accident rates may result in higher premiums, and drivers who use their vehicles for business purposes may also face increased costs.

Online Quoting: A Convenient Option

In today’s digital age, obtaining a car insurance quote has never been easier. Many insurance providers offer online quoting tools, allowing you to quickly and conveniently assess your coverage options and costs. These tools typically guide you through a series of questions about your vehicle, driving history, and desired coverage levels to provide a personalized quote.

While online quoting is a convenient starting point, it's essential to remember that the quote is an estimate. The actual cost of your insurance policy may vary slightly once your application is fully processed and your unique circumstances are taken into account.

Working with an Insurance Agent

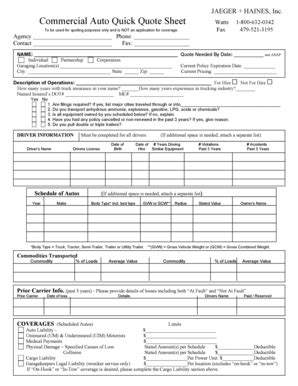

For those seeking a more personalized approach, working with an insurance agent can be beneficial. Insurance agents can provide expert guidance, helping you navigate the complexities of car insurance and tailor a policy that suits your specific needs.

When meeting with an agent, be prepared to discuss your driving history, vehicle details, and desired coverage levels. The agent will use this information to shop around and find the best policy and rate for your circumstances. They can also answer any questions you may have about the quoting process and provide insights into the coverage options available to you.

Comparing Quotes: The Key to Finding the Best Deal

Obtaining multiple car insurance quotes is a smart strategy to ensure you’re getting the best value for your money. Comparing quotes from different providers allows you to identify the policy that offers the most comprehensive coverage at the most competitive price.

When comparing quotes, pay attention to the following:

- Coverage Limits: Ensure that the quotes you're comparing offer similar coverage limits. This includes liability limits, collision and comprehensive coverage, and any additional coverage options you may require.

- Deductibles: Compare the deductibles associated with each quote. Lower deductibles may result in higher premiums, so strike a balance that aligns with your financial comfort level.

- Discounts: Many insurance providers offer discounts for various reasons, such as good driving records, multiple policy holdings, or safety features in your vehicle. Be sure to inquire about and compare the discounts offered by each provider.

- Customer Service and Claims Handling: While price is important, don't overlook the quality of service and claims handling. Research the reputation of each insurance provider and read reviews from current and past customers to ensure you're choosing a reliable and responsive company.

Tips for Lowering Your Car Insurance Costs

While car insurance is a necessary expense, there are strategies you can employ to reduce your costs without compromising on coverage. Here are some tips to help you save on your car insurance premiums.

Choose Your Coverage Wisely

Review your coverage options carefully and choose only the coverage you need. If you own an older vehicle, for instance, you may not need collision or comprehensive coverage, as the cost of these policies might exceed the vehicle’s actual value.

Additionally, consider raising your deductibles. While this means you'll pay more out of pocket if you file a claim, it can significantly reduce your insurance premiums.

Explore Discounts

Insurance providers offer a variety of discounts that can lower your premiums. Common discounts include:

- Good Driver Discount: This discount is offered to drivers with a clean driving record, free from accidents or violations.

- Multiple Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Safety Features Discount: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems often qualify for discounts.

- Low Mileage Discount: If you drive fewer miles annually, you may be eligible for a low mileage discount.

- Student Discount: Students who maintain good grades or take a driver's education course may qualify for discounts.

Maintain a Good Credit Score

In many states, your credit score is a factor in determining your insurance rates. A higher credit score can lead to lower premiums, so it’s essential to maintain a good credit history.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach where your insurance premium is based on your actual driving behavior. This type of insurance uses telematics devices to monitor factors like driving speed, braking habits, and mileage. If you’re a safe and cautious driver, you may qualify for significant discounts.

Understanding the Fine Print: Deciphering Your Car Insurance Policy

Once you’ve secured your car insurance policy, it’s crucial to understand the fine print to ensure you’re fully aware of your coverage and responsibilities. Here’s a guide to help you navigate the key components of your policy.

Policy Limits and Deductibles

Your car insurance policy will outline the limits of your coverage, specifying the maximum amount your insurance provider will pay for various types of claims. It’s important to understand these limits to ensure you have adequate coverage for your needs.

Deductibles are another critical aspect of your policy. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, but it's essential to select a deductible amount that you're comfortable paying in the event of a claim.

Covered Perils and Exclusions

Your car insurance policy will also detail the perils (risks) that are covered and those that are excluded. Common covered perils include accidents, theft, and vandalism. However, it’s important to note that natural disasters like floods or earthquakes may not be covered under standard policies and may require additional coverage.

Claims Process and Procedures

Understanding the claims process is vital to ensure a smooth and efficient experience if you ever need to file a claim. Your policy will outline the steps you need to take to initiate a claim, including any necessary documentation and timelines.

It's also essential to understand the policy's coverage for rental cars, as well as any time limitations for reporting accidents or incidents.

Renewal and Cancellation

Your car insurance policy will include information on renewal and cancellation procedures. It’s important to understand when your policy renews and what steps you need to take to ensure a seamless renewal process.

Additionally, understanding the cancellation process and any associated fees or penalties is crucial. Some policies may have a cancellation fee, while others may allow for cancellation at any time without penalty.

The Future of Car Insurance: Trends and Innovations

The world of car insurance is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of car insurance and the trends shaping the industry.

Telematics and Usage-Based Insurance

Telematics technology, which uses devices to monitor driving behavior, is transforming the car insurance landscape. Usage-based insurance, where premiums are based on driving habits, is becoming increasingly popular. This approach rewards safe drivers with lower premiums, while encouraging safer driving behaviors across the board.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are being leveraged by insurance providers to streamline processes and enhance customer experiences. AI-powered chatbots, for instance, can provide instant support and guidance to policyholders, while machine learning algorithms can analyze vast amounts of data to identify patterns and predict risks, leading to more accurate underwriting and pricing.

Connected Cars and Data Analytics

The rise of connected cars, equipped with advanced sensors and data-sharing capabilities, is opening up new avenues for insurance providers. These vehicles generate vast amounts of data, which can be analyzed to gain insights into driving behavior, vehicle performance, and potential risks. This data can be used to offer more personalized insurance policies and tailored coverage options.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is making its mark on the insurance industry. By providing a secure and transparent way to store and share data, blockchain can streamline processes like claims handling and policy administration. It can also enhance trust and transparency between insurance providers and policyholders.

The Rise of Insurtech Startups

Insurtech startups, focused on innovating the insurance industry, are disrupting traditional business models and introducing new, customer-centric approaches. These startups often leverage technology to offer more efficient and personalized insurance products, catering to the changing needs and expectations of modern consumers.

Conclusion: Empowering Your Car Insurance Journey

Obtaining a car insurance quote is a critical step in securing adequate coverage for your vehicle and protecting your financial well-being. By understanding the factors that influence your insurance rates, comparing quotes, and exploring strategies to lower your costs, you can make informed decisions and choose a policy that suits your needs and budget.

As the car insurance industry continues to evolve, embracing technological advancements and consumer-centric innovations, staying informed and engaged is key. By keeping up with the latest trends and leveraging the power of technology, you can navigate the world of car insurance with confidence and make the most of your coverage.

How often should I review my car insurance policy and quote?

+It’s a good practice to review your car insurance policy and quote annually or whenever you experience a significant life event, such as moving to a new area, buying a new car, or getting married. These changes can impact your insurance needs and premiums, so staying updated is crucial.

Can I negotiate my car insurance rates?

+While insurance rates are primarily based on statistical data and are not typically negotiable, you can still explore options to lower your costs. Consider shopping around for quotes from different providers, as rates can vary significantly. Additionally, take advantage of any applicable discounts and consider adjusting your coverage or deductibles to find the best balance for your needs.

What should I do if I’m not satisfied with my car insurance quote or policy?

+If you’re dissatisfied with your car insurance quote or policy, it’s important to take action. First, carefully review your policy to ensure you understand all the terms and conditions. If you have concerns or questions, reach out to your insurance provider’s customer service team. They can address your queries and guide you toward a more suitable policy or coverage level.