How To Buy Life Insurance

Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. Whether you're a young adult starting your career or a seasoned professional planning for the future, understanding how to buy life insurance is essential. In this comprehensive guide, we will delve into the world of life insurance, exploring the key considerations, types of policies, and the steps to make an informed purchase. By the end of this article, you'll have the knowledge and confidence to navigate the life insurance market and choose a policy that aligns with your needs and goals.

Understanding the Basics of Life Insurance

Life insurance serves as a financial safety net, ensuring that your loved ones are protected and provided for in the event of your untimely passing. It offers a death benefit, a sum of money paid to your beneficiaries upon your death, which can help cover various expenses and maintain their financial stability.

The primary purpose of life insurance is to mitigate the financial impact of losing a primary income earner or a vital source of support. It can provide funds for funeral costs, outstanding debts, daily living expenses, and even long-term financial goals such as college education or retirement planning. By purchasing life insurance, you're not only securing your family's future but also gaining the flexibility to customize coverage according to your unique circumstances.

Key Considerations Before Purchasing Life Insurance

Before diving into the life insurance market, it's crucial to assess your specific needs and circumstances. Consider the following factors:

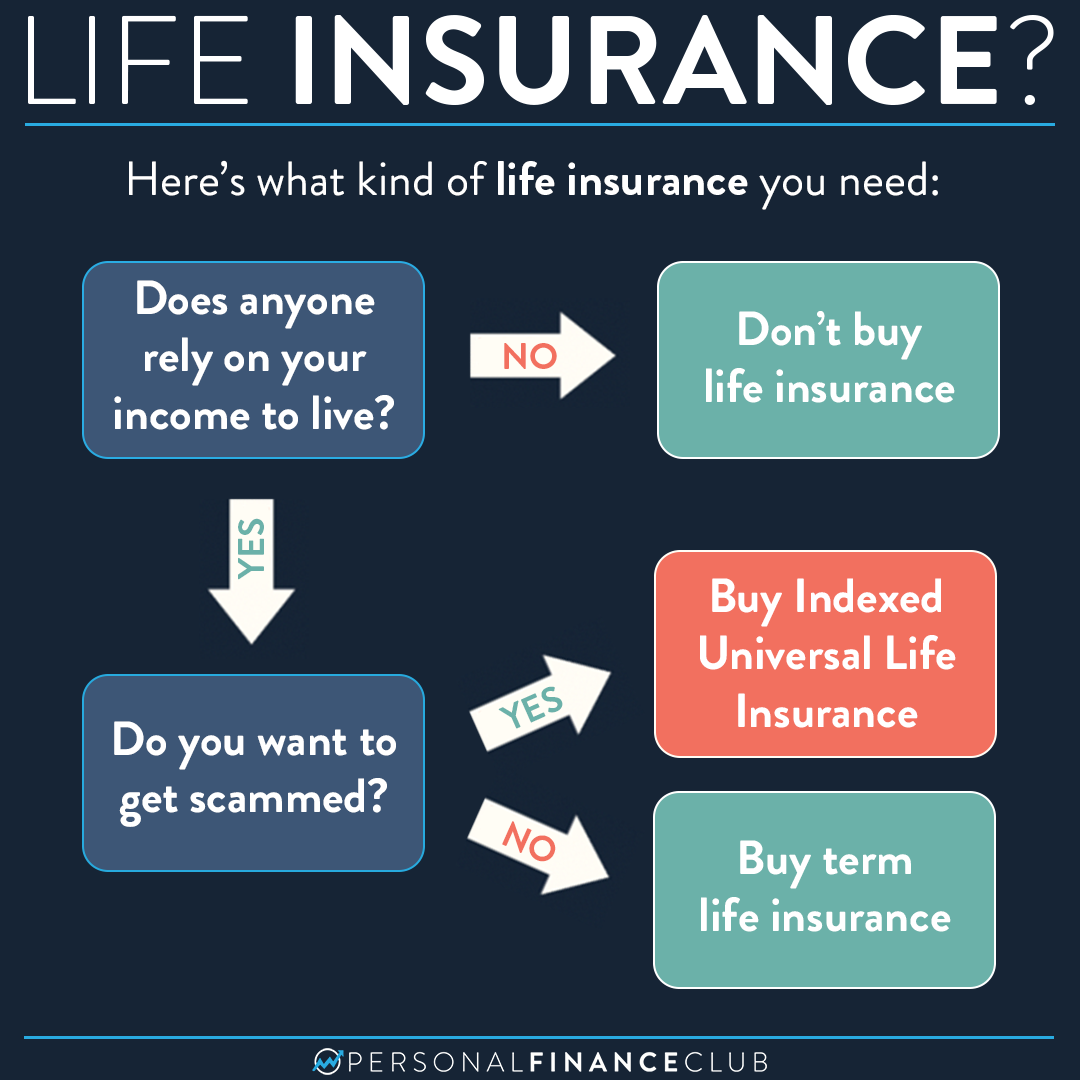

- Financial Dependents: Identify who relies on your income, such as your spouse, children, or aging parents. Their financial needs will influence the amount of coverage you require.

- Outstanding Debts: Evaluate any outstanding debts, including mortgages, loans, or credit card balances. Life insurance can help ensure these obligations are met, preventing financial strain on your loved ones.

- Future Expenses: Consider future expenses such as children's education, wedding costs, or retirement planning. Life insurance can provide a financial cushion to support these milestones.

- Personal Goals: Reflect on your personal financial goals, such as building an emergency fund or investing for the future. Life insurance can be a valuable component of your overall financial strategy.

- Existing Policies: Check if you already have life insurance through your employer or other sources. Understanding your existing coverage will help you avoid duplicating benefits and manage costs effectively.

Types of Life Insurance Policies

Life insurance policies come in various forms, each designed to meet specific needs and preferences. The two main categories are:

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It offers pure protection, meaning it pays out a death benefit if the policyholder dies within the term. Term life insurance is often more affordable than permanent policies, making it a popular choice for individuals with limited budgets or specific financial goals.

Here are some key features of term life insurance:

- Affordability: Term life insurance is generally more cost-effective, allowing you to secure higher coverage amounts for a lower premium.

- Flexibility: You can choose the term length that aligns with your financial goals, such as covering your mortgage or providing for your children's education.

- Renewal Options: Many term policies offer the option to renew or convert to a permanent policy, ensuring continued coverage even if your circumstances change.

- No Cash Value: Term life insurance does not accumulate cash value over time, making it a straightforward and efficient protection option.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the policyholder's entire life. It combines protection with a cash value component, allowing the policy to accumulate savings over time. Permanent life insurance policies include whole life, universal life, and variable life insurance.

Key features of permanent life insurance include:

- Lifetime Coverage: As long as premiums are paid, the policy remains in force, providing peace of mind that your loved ones are protected regardless of age or health.

- Cash Value Accumulation: A portion of your premium payments goes towards building cash value, which can be accessed through loans or withdrawals, providing financial flexibility.

- Tax Benefits: The cash value within permanent life insurance policies grows tax-deferred, offering potential tax advantages over other investment vehicles.

- Guaranteed Death Benefit: Unlike term insurance, permanent life insurance guarantees a death benefit, ensuring your loved ones receive the full amount upon your passing.

Evaluating Your Needs and Choosing the Right Policy

When selecting a life insurance policy, it's essential to align your choice with your specific needs and financial goals. Consider the following factors to make an informed decision:

Coverage Amount

Determine the coverage amount required to meet your financial obligations and provide for your loved ones. Factors such as income, debts, and future expenses will influence this decision. Use online calculators or consult with a financial advisor to estimate the appropriate coverage amount.

Policy Duration

Decide whether you need temporary coverage (term life insurance) or lifetime protection (permanent life insurance). Term life insurance is ideal for covering specific financial goals, while permanent life insurance provides long-term security and flexibility.

Premium Affordability

Evaluate your budget and choose a policy with premiums you can comfortably afford. While it's essential to have adequate coverage, ensuring you can maintain the policy over the long term is crucial.

Cash Value Considerations

If you're interested in building cash value, permanent life insurance may be a suitable choice. However, keep in mind that the cash value component may reduce the overall death benefit, so carefully weigh the benefits against your primary protection needs.

Policy Riders and Add-Ons

Some life insurance policies offer additional riders or add-ons that can enhance coverage. Common options include accelerated death benefits for terminal illnesses, waiver of premium riders, and long-term care riders. Consider whether these add-ons align with your specific needs and budget.

The Life Insurance Purchasing Process

Now that you have a solid understanding of the basics and have evaluated your needs, it's time to dive into the life insurance purchasing process. Follow these steps to ensure a smooth and informed journey:

Step 1: Compare Quotes and Providers

Research and compare quotes from multiple insurance providers. Online tools and comparison websites can help you gather quotes and evaluate policy features and premiums. Consider factors such as financial strength, customer satisfaction, and the range of policy options offered by each provider.

Step 2: Obtain a Quote

Once you've narrowed down your options, request a quote from your chosen provider(s). Provide accurate and detailed information about your health, lifestyle, and financial situation to ensure an accurate quote.

Step 3: Understand the Policy Terms

Carefully review the policy terms and conditions. Pay attention to the coverage amount, duration, premium payments, and any exclusions or limitations. Ensure you understand the policy's fine print and ask questions if any terms are unclear.

Step 4: Complete the Application Process

Submit your application, providing all the necessary information and documentation. The application process may involve a medical examination and health assessment. Be honest and accurate in your responses to ensure a smooth approval process.

Step 5: Review and Accept the Policy

Once your application is approved, review the policy documents thoroughly. Ensure that the coverage amount, premium payments, and policy terms align with your expectations. If everything is satisfactory, accept the policy and make the initial premium payment.

Step 6: Maintain and Review Your Policy

Life insurance is a long-term commitment, so it's essential to maintain and review your policy regularly. Stay up-to-date with premium payments and consider reviewing your coverage as your financial situation and needs evolve. You may need to adjust your policy or consider additional coverage to ensure it continues to meet your requirements.

Common Misconceptions and Pitfalls to Avoid

When navigating the life insurance market, it's important to be aware of common misconceptions and potential pitfalls. Here are a few to watch out for:

Overestimating Coverage Needs

Avoid the temptation to purchase excessive coverage. While it's essential to have adequate protection, overinsuring can lead to unnecessary expenses and strain your budget. Use reliable calculators and seek professional advice to determine the appropriate coverage amount.

Underestimating the Importance of Life Insurance

Don't underestimate the value of life insurance. Even if you have savings or investments, life insurance provides a crucial safety net, ensuring your loved ones' financial security and peace of mind.

Neglecting Policy Review and Updates

Life insurance is not a one-time purchase; it requires regular review and updates. As your financial situation and needs change, ensure your policy remains aligned with your goals. Review your coverage periodically and consider adjustments to reflect major life events such as marriage, childbirth, or career changes.

Choosing the Wrong Provider

Select a reputable and financially stable insurance provider. Research their track record, customer satisfaction, and financial strength ratings. Choosing a reliable provider ensures your policy's longevity and provides peace of mind.

Conclusion: Securing Your Future with Life Insurance

Life insurance is a vital financial tool that offers protection, security, and peace of mind for you and your loved ones. By understanding the basics, evaluating your needs, and following a systematic purchasing process, you can confidently navigate the life insurance market and choose a policy that meets your unique circumstances.

Remember, life insurance is a long-term commitment, and regular review and adjustments are essential to ensure it continues to provide the coverage you need. Stay informed, seek professional advice when needed, and make life insurance a cornerstone of your financial planning.

Frequently Asked Questions

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on various factors, including your income, debts, financial obligations, and future goals. Use online calculators or consult with a financial advisor to estimate the appropriate coverage amount. Consider factors such as outstanding debts, income replacement, and future expenses like children’s education or retirement planning.

What are the main differences between term and permanent life insurance?

+Term life insurance provides coverage for a specified period, offering protection at an affordable cost. It is ideal for covering short-term financial goals or specific obligations. Permanent life insurance, on the other hand, offers lifetime coverage and includes a cash value component, providing long-term security and flexibility. It is more expensive but offers guaranteed death benefits and tax-deferred cash value accumulation.

Can I switch from term to permanent life insurance?

+Yes, many term life insurance policies offer the option to convert to permanent life insurance. This allows you to transition from temporary coverage to lifetime protection, ensuring your loved ones remain financially secure as your needs evolve. Conversion options and requirements may vary between policies, so review your term policy’s terms and conditions carefully.

What factors influence life insurance premiums?

+Life insurance premiums are influenced by several factors, including your age, health, lifestyle, and the type of policy you choose. Younger individuals typically pay lower premiums, while health conditions or high-risk activities may result in higher costs. The coverage amount and policy duration also impact premium rates. It’s important to disclose accurate information during the application process to avoid surprises and ensure a fair premium.

How often should I review and update my life insurance policy?

+Regularly reviewing and updating your life insurance policy is crucial to ensure it aligns with your changing needs. Major life events such as marriage, childbirth, career changes, or significant financial milestones may warrant policy adjustments. Aim to review your policy annually or whenever there is a significant change in your circumstances. This ensures your loved ones remain adequately protected and your financial goals are met.