Medicare Health Insurance Plans

Medicare, the federal health insurance program in the United States, is a complex system that offers various coverage options to cater to the diverse healthcare needs of the elderly and certain individuals with disabilities. Understanding the different Medicare health insurance plans and their benefits is crucial for making informed decisions about your healthcare coverage. In this comprehensive guide, we will delve into the intricacies of Medicare, exploring its history, the different plan types, eligibility criteria, and the enrollment process. Additionally, we will provide valuable insights into the coverage and costs associated with each plan, helping you navigate the Medicare landscape with confidence.

The Evolution of Medicare: A Brief Overview

Medicare, established in 1965 under the Social Security Amendments, has undergone significant transformations over the years. Initially designed to provide healthcare coverage for individuals aged 65 and older, it has since expanded its reach to include younger individuals with specific disabilities and certain medical conditions. The program’s evolution reflects the changing healthcare landscape and the growing need for accessible and comprehensive insurance options.

Understanding Medicare Plan Types

Medicare offers a range of plan types, each with its own unique features and coverage options. The primary plan types include:

Medicare Part A (Hospital Insurance)

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. It is typically provided free of charge to individuals who have worked and paid Medicare taxes for a certain period.

Key Features:

- Coverage for up to 60 days in a hospital (lifetime reserve days may be available for extended stays)

- Skilled nursing facility care for up to 100 days post-hospitalization

- Hospice care for terminally ill individuals

- Limited home healthcare services

Medicare Part B (Medical Insurance)

Medicare Part B covers a wide range of outpatient medical services and supplies, including doctor visits, diagnostic tests, durable medical equipment, and some preventive care services.

Key Features:

- Coverage for doctor services, including office visits and outpatient procedures

- Diagnostic tests, such as X-rays and laboratory work

- Durable medical equipment, including wheelchairs and oxygen equipment

- Certain preventive services, like flu shots and mammograms

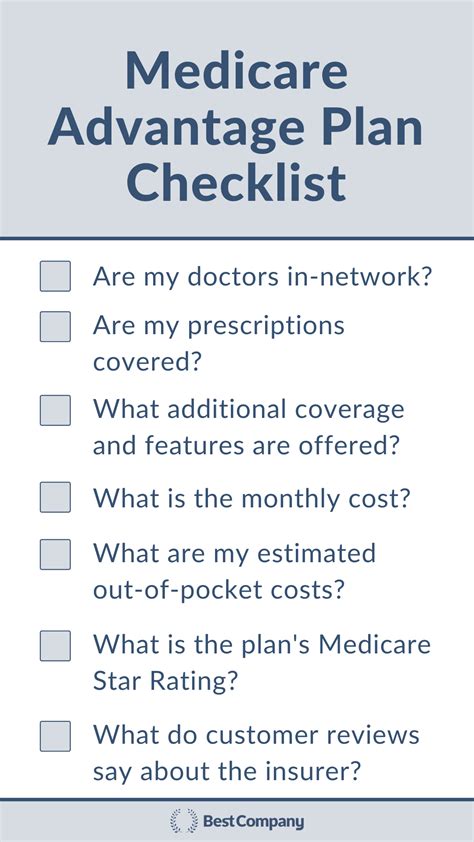

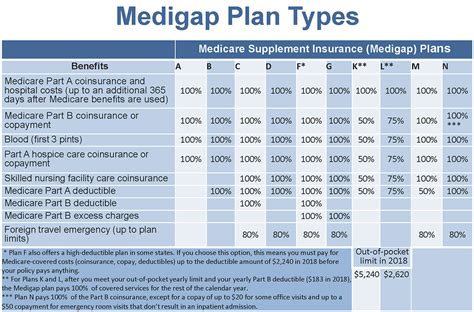

Medicare Part C (Medicare Advantage Plans)

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Part A and Part B). These plans are offered by private insurance companies and must cover all the services provided by Original Medicare. However, they often include additional benefits and may have different rules and costs.

Key Features:

- HMO and PPO plans with network providers

- Additional benefits like dental, vision, and hearing coverage

- Prescription drug coverage (Part D) is often included

- May have lower out-of-pocket costs compared to Original Medicare

Medicare Part D (Prescription Drug Coverage)

Medicare Part D provides coverage for prescription drugs. It is offered through private insurance companies and is designed to help beneficiaries manage the cost of their medications.

Key Features:

- Coverage for a wide range of prescription medications

- Different plan options with varying formularies and costs

- Annual deductible and co-pays for covered drugs

- Catastrophic coverage for beneficiaries with high drug costs

Eligibility and Enrollment

Understanding your eligibility for Medicare is the first step toward enrolling in the right plan. Generally, individuals who are:

- 65 years or older

- Under 65 and have been receiving Social Security Disability Insurance (SSDI) for at least 24 months

- Of any age with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS)

may be eligible for Medicare. It’s important to note that eligibility criteria can vary based on specific circumstances, so consulting with a Medicare expert or your local Social Security office is advisable.

The enrollment process typically involves:

- Determining your eligibility and preferred coverage options.

- Choosing the right plan type (Part A, Part B, Part C, or Part D) based on your needs and preferences.

- Completing the enrollment process, which may include filling out forms and providing necessary documentation.

- Reviewing and comparing plan benefits, costs, and coverage to ensure you make an informed decision.

Coverage and Costs

The coverage and costs associated with Medicare plans can vary significantly depending on the plan type and your specific circumstances. Here's a breakdown of the key considerations:

Medicare Part A

Most individuals do not pay a monthly premium for Medicare Part A if they or their spouse have worked and paid Medicare taxes for at least 40 quarters. However, there may be deductibles and coinsurance for certain services.

For those who do not meet the work requirement, a premium may be charged. The standard monthly premium for 2024 is $516, with higher premiums for individuals with higher incomes.

Medicare Part B

The standard monthly premium for Medicare Part B in 2024 is 164.90 for most beneficiaries. However, income-related premiums may apply to individuals with higher incomes.</p> <p>There is also an annual deductible of 233 for Part B services, after which beneficiaries pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment.

Medicare Part C (Medicare Advantage)

Medicare Advantage plans may have additional costs, such as premiums, deductibles, and copayments. These costs can vary widely depending on the plan and the specific benefits offered. Some plans may also require an additional premium for Part D prescription drug coverage.

Medicare Part D

Medicare Part D plans have an annual deductible, which can range from 0 to over 500, depending on the plan. After meeting the deductible, beneficiaries typically pay a percentage of the cost of each covered drug (coinsurance), with a limit on their out-of-pocket spending.

It’s important to note that the specific costs and coverage details can vary significantly between plans, so it’s essential to carefully review the plan’s benefits and costs before enrolling.

Navigating the Medicare Landscape

Understanding the intricacies of Medicare health insurance plans is crucial for making informed decisions about your healthcare coverage. By familiarizing yourself with the different plan types, eligibility criteria, and coverage options, you can ensure that you select a plan that aligns with your unique needs and preferences.

Remember, Medicare is a complex system, and seeking guidance from trusted sources, such as Medicare experts or your local Social Security office, can provide valuable insights and support throughout the enrollment process.

FAQs

What is the difference between Medicare Part A and Part B?

+Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. It is typically provided free of charge to eligible individuals. On the other hand, Medicare Part B covers outpatient medical services and supplies, including doctor visits, diagnostic tests, and durable medical equipment. Part B requires a monthly premium, and beneficiaries typically pay 20% of the Medicare-approved amount for most services.

Are there any income-related premiums for Medicare Part B?

+Yes, income-related premiums may apply for Medicare Part B. The standard monthly premium for most beneficiaries is $164.90 in 2024. However, individuals with higher incomes may be subject to higher premiums. The income thresholds and corresponding premium amounts are adjusted annually and are based on modified adjusted gross income (MAGI) from two years prior.

Can I have both Medicare Part A and Part C simultaneously?

+No, you cannot have both Medicare Part A and Part C simultaneously. Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Part A and Part B). If you enroll in a Medicare Advantage plan, you will generally receive all your Medicare benefits through that plan. However, you may still need to enroll in Medicare Part D for prescription drug coverage if it is not included in your chosen Medicare Advantage plan.