Insurance Network

The insurance industry has undergone significant transformations in recent years, and one of the most notable developments is the emergence of insurance networks. These networks are revolutionizing the way insurance services are delivered, offering enhanced connectivity, streamlined processes, and improved customer experiences. In this comprehensive article, we will delve into the world of insurance networks, exploring their origins, key features, benefits, and their potential to shape the future of the insurance landscape.

Understanding Insurance Networks: An Evolution of the Industry

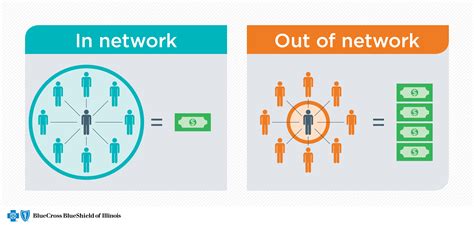

Insurance networks represent a shift from traditional, siloed insurance models to a more interconnected and collaborative approach. They are essentially platforms or ecosystems that bring together various stakeholders in the insurance industry, including insurers, brokers, agents, and service providers, with the aim of creating a seamless and efficient insurance ecosystem.

The concept of insurance networks has gained traction due to the evolving needs of both insurance companies and consumers. In an increasingly digital and interconnected world, insurance customers expect faster, more convenient, and personalized services. At the same time, insurance providers seek to optimize their operations, reduce costs, and enhance their ability to offer innovative products and services.

Key Features of Insurance Networks

Insurance networks are characterized by several distinct features that set them apart from conventional insurance models:

- Interconnectedness: At the heart of insurance networks is the principle of connectivity. These platforms facilitate the exchange of data, information, and services between different players in the insurance value chain. This interconnectedness enables real-time collaboration and streamlined processes.

- Data-Driven Insights: Insurance networks leverage advanced data analytics and machine learning to gain valuable insights from the vast amounts of data they collect. This data-driven approach allows for better risk assessment, more accurate underwriting, and personalized product offerings.

- Digital Transformation: Insurance networks embrace digital technologies to enhance the customer experience. They often feature user-friendly online portals, mobile applications, and digital tools that enable customers to manage their insurance policies, file claims, and access services with ease.

- Ecosystem Collaboration: By bringing together multiple stakeholders, insurance networks foster collaboration and innovation. Insurers, brokers, and service providers can work together to develop new products, streamline claims processes, and deliver tailored solutions to meet specific customer needs.

- Flexibility and Customization: Insurance networks offer a high degree of flexibility, allowing insurers to adapt their offerings to changing market demands and customer preferences. This customization extends to product design, pricing, and service delivery, ensuring a more tailored approach.

| Network Feature | Description |

|---|---|

| Data Exchange | Enables secure and efficient sharing of data between network participants, facilitating collaboration and informed decision-making. |

| Risk Assessment Tools | Provides advanced analytics for accurate risk profiling, helping insurers and brokers make informed underwriting decisions. |

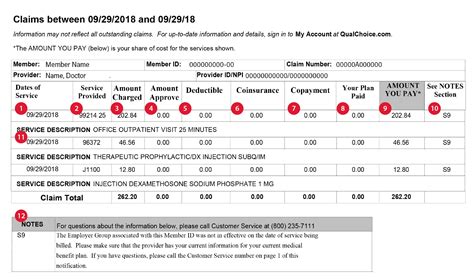

| Claim Management Platform | Offers a centralized system for efficient claim processing, ensuring timely and transparent resolution for policyholders. |

Benefits of Insurance Networks for Insurers and Consumers

The adoption of insurance networks brings a multitude of benefits to both insurers and insurance consumers. Let’s explore how these innovative platforms are transforming the industry and enhancing the overall insurance experience.

Advantages for Insurers

- Operational Efficiency: Insurance networks streamline processes, reducing administrative burdens and minimizing manual interventions. This results in significant cost savings and improved operational efficiency for insurers.

- Enhanced Risk Management: With access to a wealth of data and advanced analytics, insurers can make more informed decisions regarding risk assessment and underwriting. This leads to better risk selection and management, ultimately improving profitability.

- Product Innovation: By collaborating with diverse stakeholders within the network, insurers can tap into a wealth of expertise and resources. This enables them to develop innovative products and services that cater to the evolving needs of their customers.

- Improved Customer Engagement: Insurance networks provide insurers with powerful tools to engage with their customers. From personalized policy recommendations to seamless digital interactions, insurers can build stronger relationships and enhance customer satisfaction.

- Scalability and Flexibility: The interconnected nature of insurance networks allows insurers to scale their operations quickly and adapt to changing market conditions. They can easily expand their product offerings and reach new markets, ensuring long-term growth and sustainability.

Benefits for Insurance Consumers

- Seamless Experience: Insurance networks offer a unified and intuitive customer experience. Policyholders can manage their insurance policies, file claims, and access support through a single platform, eliminating the need for multiple interactions with different providers.

- Personalized Services: Thanks to the data-driven insights generated by insurance networks, customers can benefit from highly personalized insurance products and services. From customized coverage options to tailored risk management advice, insurance networks cater to individual needs.

- Faster Claim Resolution: The efficient data exchange and collaboration within insurance networks streamline the claims process. Customers can expect quicker and more transparent claim resolutions, reducing the stress and uncertainty associated with insurance claims.

- Digital Convenience: Insurance networks embrace digital technologies, empowering customers to manage their insurance needs anytime, anywhere. Mobile apps, online portals, and digital tools provide convenience and flexibility, making insurance more accessible and user-friendly.

- Enhanced Transparency: Insurance networks promote transparency by providing customers with clear and concise information about their policies, coverage, and claim status. This transparency builds trust and ensures that customers are well-informed about their insurance options.

Case Studies: Real-World Success Stories

To illustrate the impact and potential of insurance networks, let’s explore a few real-world case studies that showcase how these innovative platforms are transforming the industry:

InsurTech Platform: Connecting Brokers and Insurers

One prominent insurance network is an InsurTech platform that acts as a digital marketplace, connecting independent insurance brokers with a wide range of insurance carriers. This network enables brokers to efficiently search and compare insurance products, streamline their quoting processes, and offer their clients a broader selection of coverage options.

For insurers, this platform provides access to a diverse broker network, allowing them to reach a wider customer base and gain valuable insights into market trends. By leveraging the network's data analytics, insurers can make data-driven decisions, improve their underwriting processes, and develop more targeted marketing strategies.

Telematics-Based Auto Insurance Network

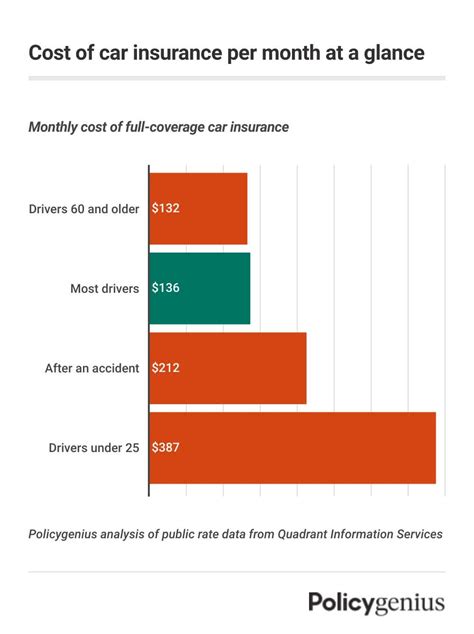

In the realm of auto insurance, a leading insurer has implemented a telematics-based insurance network. This network utilizes advanced telematics technology to track and analyze driving behavior, offering policyholders the opportunity to earn discounts based on their safe driving habits.

The network collects real-time data on driving patterns, including speed, acceleration, and braking, which is then used to assess risk and provide personalized insurance rates. By incentivizing safe driving, this insurance network not only benefits policyholders with lower premiums but also contributes to overall road safety.

Health Insurance Network: Empowering Patients

In the healthcare sector, a collaborative health insurance network has emerged, bringing together insurers, healthcare providers, and patients. This network focuses on improving patient care and outcomes by facilitating seamless communication and coordination between all stakeholders.

Through a secure digital platform, patients can access their medical records, schedule appointments, and receive personalized health recommendations. Insurers benefit from real-time access to patient data, enabling them to offer more accurate and cost-effective coverage. Healthcare providers, meanwhile, can collaborate more efficiently, ensuring patients receive timely and appropriate care.

The Future of Insurance Networks: Trends and Innovations

As insurance networks continue to evolve and gain traction, several trends and innovations are shaping their future trajectory. Here’s a glimpse into what we can expect in the coming years:

Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation technologies is set to revolutionize insurance networks. AI-powered chatbots and virtual assistants will enhance customer support, providing instant responses and personalized assistance. Automation will further streamline processes, reducing the need for manual interventions and accelerating claim resolutions.

Blockchain for Secure Data Exchange

Blockchain technology is expected to play a significant role in securing data exchange within insurance networks. By leveraging blockchain’s decentralized and tamper-proof nature, insurers can ensure the integrity and privacy of sensitive customer data, fostering trust and confidence among network participants.

InsurTech Partnerships and Innovations

Insurance networks will increasingly collaborate with InsurTech startups and innovative technology providers. These partnerships will drive the development of new products, services, and business models, leveraging cutting-edge technologies such as AI, machine learning, and IoT (Internet of Things) to enhance the customer experience and operational efficiency.

Expanded Ecosystem Collaboration

Insurance networks will continue to expand their ecosystems, bringing together a diverse range of stakeholders. This expanded collaboration will include not only insurers, brokers, and agents but also financial institutions, healthcare providers, and other industry players. By working together, these entities can deliver holistic solutions that address the evolving needs of customers.

Personalized Insurance Products

The ability to gather and analyze vast amounts of data will enable insurance networks to offer highly personalized insurance products. By leveraging customer insights and behavior patterns, insurers can develop tailored coverage options, pricing structures, and risk management strategies, ensuring that insurance meets the unique needs of each policyholder.

How do insurance networks impact the traditional insurance broker role?

+Insurance networks have the potential to both enhance and transform the role of insurance brokers. By leveraging the network's resources and tools, brokers can access a wider range of insurance products and services, enabling them to provide more comprehensive advice to their clients. Additionally, the efficient data exchange and collaboration within networks can streamline the brokerage process, making it more efficient and effective.

Are insurance networks only relevant for large insurers, or can smaller insurers benefit as well?

+Insurance networks offer advantages to insurers of all sizes. While larger insurers may have the resources to develop their own networks, smaller insurers can leverage existing networks to access a broader market, gain insights from data analytics, and collaborate with other industry players. This level playing field allows smaller insurers to compete more effectively and expand their reach.

What measures are in place to ensure data security and privacy within insurance networks?

+Insurance networks prioritize data security and privacy to maintain the trust of their participants and customers. Robust security protocols, encryption technologies, and access controls are implemented to protect sensitive data. Additionally, many networks adhere to industry-specific regulations and guidelines, such as GDPR in Europe, to ensure compliance and safeguard customer information.

Insurance networks represent a paradigm shift in the insurance industry, empowering insurers to deliver innovative, customer-centric services and transforming the overall insurance experience. As these networks continue to evolve and integrate cutting-edge technologies, they will play a pivotal role in shaping the future of insurance, driving efficiency, and meeting the evolving needs of policyholders.