Commercial Car Insurance Quotes

For businesses that rely on vehicles for their operations, commercial car insurance is an essential aspect of their financial protection and risk management strategy. It safeguards businesses from potential losses arising from accidents, damage, or liability claims. Obtaining accurate and affordable commercial car insurance quotes is crucial for businesses to secure the coverage they need without straining their budgets.

In this comprehensive guide, we will delve into the world of commercial car insurance, exploring the factors that influence quotes, the process of obtaining them, and the strategies to ensure businesses receive the best coverage for their specific needs. By understanding these aspects, businesses can navigate the insurance market with confidence and make informed decisions to protect their assets and operations.

Understanding Commercial Car Insurance Quotes

Commercial car insurance quotes are tailored to the unique needs and risks associated with a business's vehicle fleet. Unlike personal auto insurance, which primarily covers private vehicles, commercial insurance caters to a wide range of vehicles used for business purposes, including trucks, vans, taxis, and delivery vehicles.

The quotes provided by insurance companies take into account various factors specific to the business, such as the type of vehicles, the nature of their use, the driving records of employees, and the overall risk profile of the business. This customized approach ensures that the insurance coverage and premiums reflect the actual risks faced by the business, rather than relying on generic rates.

Key Factors Influencing Commercial Car Insurance Quotes

- Vehicle Type and Usage: The type of vehicles in a business's fleet is a significant factor. Different vehicles have varying risk profiles, and their intended use also plays a role. For instance, a delivery van that frequently navigates urban areas may pose a higher risk than a truck primarily used for long-haul transportation.

- Business Operations and Size: The nature and scale of a business's operations influence insurance quotes. A business with a large fleet and extensive coverage needs will likely face different premiums compared to a smaller operation with fewer vehicles.

- Driver Records: The driving records of employees handling the vehicles are crucial. A history of accidents or traffic violations can lead to higher premiums, as insurance companies consider these factors when assessing risk.

- Coverage Options: The level of coverage desired by the business affects the quote. Comprehensive coverage, including liability, collision, and comprehensive protection, will typically result in higher premiums compared to basic liability-only coverage.

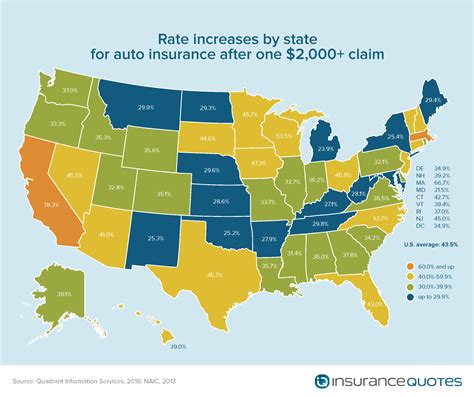

- Location and Risk Factors: The geographic location of the business and its vehicles is a significant factor. Areas with high crime rates or frequent natural disasters may carry higher insurance costs.

- Claims History: A business's past claims history can impact future quotes. Frequent claims may lead to higher premiums or even non-renewal of policies.

The Process of Obtaining Commercial Car Insurance Quotes

Securing commercial car insurance quotes involves a systematic process that allows businesses to compare options and make informed choices. Here's an overview of the typical steps involved:

1. Assessing Coverage Needs

The first step is to evaluate the specific coverage requirements of the business. This includes identifying the types of vehicles, their intended use, and the desired level of protection. A clear understanding of these needs is essential for obtaining accurate quotes.

2. Researching Insurance Providers

With a defined coverage framework, the next step is to research insurance providers that specialize in commercial auto insurance. It's important to consider both established companies and emerging insurers to get a comprehensive view of the market.

3. Requesting Quotes

Once a shortlist of insurance providers is established, the business can request quotes. This can be done through online quote forms, phone calls, or by visiting insurance agents or brokers. Providing detailed information about the business and its fleet is crucial to ensure accurate quotes.

4. Comparing Quotes and Coverage

After receiving quotes from multiple providers, the business should carefully compare the premiums, coverage limits, and any additional benefits or exclusions. It's essential to consider not only the cost but also the quality and suitability of the coverage.

5. Negotiating and Finalizing

In some cases, businesses may have the opportunity to negotiate with insurance providers, especially if they have a strong risk management program or a history of safe driving. Negotiation can lead to more favorable terms and premiums.

6. Regular Review and Updates

Commercial car insurance quotes should be reviewed periodically to ensure they remain competitive and aligned with the business's changing needs. Regular reviews help businesses stay informed about market trends and potential cost-saving opportunities.

Strategies for Securing the Best Commercial Car Insurance Quotes

Obtaining the best commercial car insurance quotes requires a strategic approach. Here are some key strategies businesses can employ to optimize their insurance coverage and costs:

1. Enhance Risk Management

Implementing robust risk management practices can significantly impact insurance quotes. This includes establishing comprehensive driver training programs, implementing strict vehicle maintenance protocols, and utilizing telematics or GPS tracking to monitor driver behavior and vehicle performance.

2. Explore Coverage Options

Businesses should thoroughly understand the different coverage options available and select the ones that best align with their needs. While basic liability coverage is essential, additional coverage for medical payments, uninsured motorists, and rental car reimbursement can provide valuable protection.

3. Bundle Policies

Bundling multiple insurance policies with the same provider can often result in discounts and more favorable terms. Businesses with diverse insurance needs, such as commercial property, liability, and auto insurance, can benefit from bundling these policies to streamline management and potentially reduce costs.

4. Maintain a Clean Claims History

A history of frequent or large claims can drive up insurance costs. Businesses should aim to maintain a clean claims record by implementing proactive measures to prevent accidents and addressing any potential risks promptly.

5. Utilize Technology

Technology can play a crucial role in securing better insurance quotes. Telematics devices, for instance, can provide real-time data on driver behavior, helping insurance companies assess risk more accurately. Additionally, online comparison tools and insurance marketplace platforms can make it easier for businesses to compare quotes and find the best deals.

Case Study: Optimizing Commercial Car Insurance Coverage

To illustrate the impact of these strategies, let's consider a case study involving a small delivery business, Express Deliveries, which operates a fleet of 10 vans in a metropolitan area. The business aims to optimize its commercial car insurance coverage while keeping costs under control.

By implementing a comprehensive driver training program and installing telematics devices in their vans, Express Deliveries was able to significantly improve its risk profile. The data collected through telematics helped identify areas where drivers could improve, leading to safer driving habits and a reduction in accidents.

Additionally, the business explored different coverage options and bundled its commercial auto insurance with its existing commercial property insurance policy, resulting in a 15% discount on premiums. By maintaining a clean claims history and utilizing technology to enhance risk management, Express Deliveries not only secured better insurance rates but also improved its overall operational efficiency.

The Future of Commercial Car Insurance Quotes

The insurance industry is undergoing significant transformations, and the landscape of commercial car insurance quotes is no exception. Emerging technologies and data analytics are reshaping the way insurance is priced and delivered.

1. Telematics and Data-Driven Pricing

Telematics devices are increasingly being used to collect real-time data on vehicle performance and driver behavior. This data-driven approach allows insurance companies to offer more accurate and personalized quotes, taking into account factors such as driving habits, vehicle usage patterns, and even road conditions.

2. Usage-Based Insurance (UBI)

Usage-Based Insurance is a concept that leverages telematics data to charge premiums based on actual vehicle usage. This model rewards safe driving and can lead to significant cost savings for businesses with low-risk driving habits.

3. Digital Insurance Platforms

The rise of digital insurance platforms and online marketplaces is making it easier for businesses to compare quotes and purchase insurance policies. These platforms often provide comprehensive information and tools to help businesses make informed decisions about their coverage needs.

4. Risk Mitigation Technologies

Advancements in technology are also leading to the development of risk mitigation solutions. For instance, advanced driver assistance systems (ADAS) and autonomous vehicle technologies can reduce the likelihood of accidents, ultimately lowering insurance costs for businesses.

FAQs

How often should I review my commercial car insurance quotes?

+

It is recommended to review your commercial car insurance quotes at least once a year, or whenever your business experiences significant changes, such as expanding your fleet or altering your operational scope.

Can I negotiate commercial car insurance quotes with providers?

+

Yes, negotiation is possible, especially if you have a strong risk management program or a history of safe driving. Many insurance providers are open to discussions and may offer more favorable terms or discounts.

What are the benefits of bundling multiple insurance policies with the same provider?

+

Bundling policies can lead to cost savings through discounts and streamlined management. It also ensures consistency in coverage and makes it easier to coordinate claims across different policies.

How do telematics devices impact commercial car insurance quotes?

+

Telematics devices provide real-time data on driver behavior and vehicle performance, allowing insurance companies to assess risk more accurately. This data-driven approach can lead to more personalized quotes and potentially lower premiums for businesses with safe driving records.

What is Usage-Based Insurance (UBI), and how does it work?

+

Usage-Based Insurance (UBI) is a model where insurance premiums are based on actual vehicle usage. It leverages telematics data to charge businesses according to their driving habits and mileage. UBI rewards safe driving and can result in significant cost savings for businesses with low-risk profiles.