State By State Car Insurance Rates

When it comes to car insurance, the cost can vary significantly depending on your location. State-by-state car insurance rates are influenced by a multitude of factors, including local regulations, the frequency of accidents, and the cost of living. Understanding these variations is crucial for drivers, as it directly impacts their insurance premiums. In this comprehensive guide, we delve into the intricacies of car insurance rates across different states, offering valuable insights and comparisons to help you navigate the complex world of automotive insurance.

A Comprehensive Breakdown of State-by-State Car Insurance Rates

The United States boasts a diverse landscape, and this diversity extends to the realm of car insurance. Rates can differ dramatically from one state to another, making it essential for drivers to grasp the unique insurance landscape of their region.

Regional Variations: Unraveling the Differences

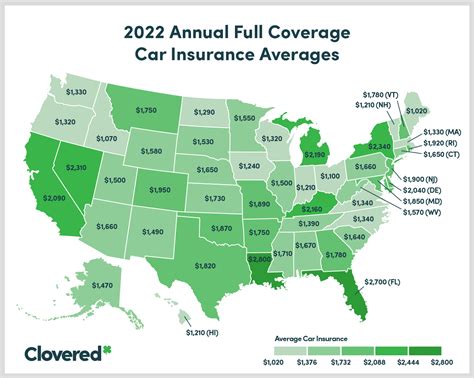

The cost of car insurance is not distributed evenly across the country. States in the Northeast and Midwest generally experience higher insurance rates due to a combination of factors. These regions often contend with severe weather conditions, such as blizzards and icy roads, which can lead to an increased number of accidents. Additionally, the cost of living and labor expenses tend to be higher in these areas, influencing the overall insurance rates.

In contrast, states like California, Texas, and Florida typically offer more competitive insurance rates. These states benefit from a milder climate, which reduces the likelihood of weather-related accidents. Moreover, the cost of living and repair expenses are often more affordable, contributing to lower insurance premiums.

The Impact of Local Regulations

Each state has its own set of regulations governing car insurance. These regulations can significantly influence the cost of insurance. For instance, states with no-fault insurance systems, such as Michigan and New York, generally have higher insurance rates. This is because no-fault systems require insurance companies to pay claims regardless of who is at fault in an accident, leading to increased administrative costs.

On the other hand, states with tort systems, like Texas and California, tend to have lower insurance rates. In these states, the at-fault driver is responsible for the damages, which can lead to fewer claims and, consequently, lower insurance costs.

| State | Average Annual Premium |

|---|---|

| Michigan | $2,680 |

| Rhode Island | $1,845 |

| Florida | $1,597 |

| Texas | $1,219 |

| California | $1,177 |

The Role of Accident Frequency

States with a higher frequency of accidents tend to have higher insurance rates. This is particularly evident in urban areas with dense populations and heavy traffic. Cities like Los Angeles, New York, and Chicago often experience a higher number of accidents, which can lead to increased insurance costs for drivers in these areas.

Conversely, states and regions with lower population densities and better driving conditions, such as Montana and Wyoming, typically have lower insurance rates. The reduced accident risk in these areas translates to lower insurance premiums for residents.

Insurance Coverage and Deductibles

The type of insurance coverage you choose and your deductible play a significant role in determining your insurance rates. States with mandatory liability coverage, which requires drivers to carry a minimum amount of insurance, may have slightly higher rates to accommodate this requirement. On the other hand, states that offer more flexible coverage options, like collision and comprehensive coverage, allow drivers to tailor their insurance to their needs and budget.

Your deductible, the amount you pay out of pocket before your insurance kicks in, is another critical factor. Choosing a higher deductible can lead to lower insurance premiums, as you are assuming more financial responsibility in the event of an accident. However, it's essential to strike a balance, as a higher deductible also means you'll pay more out of pocket if you do get into an accident.

Comparing Car Insurance Rates: A State-by-State Analysis

To provide a more detailed understanding of car insurance rates across the nation, let’s delve into a comparative analysis of select states.

California: A Balanced Approach

California strikes a balance between insurance regulations and competitive rates. The state’s tort system keeps insurance costs relatively low, and the mild climate reduces the risk of weather-related accidents. Additionally, California’s stringent driving laws contribute to a safer driving environment, further lowering insurance rates.

Despite these advantages, California's large population and dense urban areas, particularly in cities like Los Angeles and San Francisco, can lead to increased accident rates in certain regions. This localized factor can influence insurance rates, with some areas experiencing higher premiums than others within the state.

Texas: A Competitive Market

Texas is known for its competitive car insurance market. The state’s tort system and relatively low cost of living contribute to lower insurance rates. Additionally, Texas has a large number of insurance providers, fostering a competitive environment that benefits consumers.

However, Texas also has a high number of uninsured drivers, which can lead to increased insurance costs for those who do carry insurance. The state's efforts to address this issue, such as requiring proof of insurance for vehicle registration, aim to reduce the number of uninsured drivers on the road.

New York: Navigating High Costs

New York is notorious for its high car insurance rates. The state’s no-fault insurance system and dense urban areas, particularly New York City, contribute to these elevated costs. The high cost of living and labor expenses in the state also play a significant role.

Despite the challenges, New York has implemented measures to address these high insurance rates. The state's Department of Financial Services regularly reviews insurance rates and approves rate increases only when necessary. Additionally, New York offers various discounts and incentives to help drivers save on their insurance premiums.

Tips for Navigating State-by-State Car Insurance Rates

Understanding the variations in car insurance rates across states is just the first step. Here are some practical tips to help you navigate these differences and find the best insurance coverage for your needs:

- Research Local Insurance Providers: Each state has its own set of insurance providers. Take the time to research and compare the rates and services offered by local providers. This can help you find the best value for your insurance needs.

- Understand Your State's Regulations: Familiarize yourself with your state's insurance regulations. This knowledge will help you make informed decisions about your coverage and understand your rights and responsibilities as an insured driver.

- Consider Bundling Policies: Many insurance providers offer discounts when you bundle multiple policies, such as car insurance with homeowners or renters insurance. This can be a cost-effective way to save on your insurance premiums.

- Shop Around and Compare Quotes: Don't settle for the first insurance quote you receive. Obtain quotes from multiple providers to ensure you're getting the best rate for your specific situation. Online comparison tools can be particularly useful for this.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current circumstances. This includes considering changes in your driving habits, vehicle ownership, or even moving to a new state.

How do I find the best car insurance rates in my state?

+Researching local insurance providers and obtaining multiple quotes is essential. Compare rates, coverage options, and customer reviews to find the best fit for your needs. Additionally, understanding your state’s specific regulations can help you make informed decisions.

What factors influence car insurance rates the most?

+The primary factors include your driving history, the type of vehicle you drive, your age and gender, the coverage limits you choose, and your location. Local regulations, accident frequency, and the cost of living in your area also play significant roles.

Can I lower my car insurance rates by switching providers?

+Absolutely! Shopping around for insurance is a great way to potentially lower your rates. Different providers offer varying rates and discounts, so comparing quotes can lead to significant savings. Additionally, reviewing your coverage annually and adjusting it to your changing needs can also help reduce costs.