Dental Insurance For Individuals

Introduction:

Dental health is an essential aspect of overall well-being, yet many individuals find themselves navigating the complex world of dental insurance alone. This guide aims to demystify the process, offering a comprehensive understanding of dental insurance for individuals. By the end, you’ll have the knowledge to make informed decisions and take control of your oral health and financial planning.

In the realm of healthcare, dental insurance stands out as a unique and often misunderstood entity. Unlike traditional health insurance, which primarily covers medical procedures and hospitalizations, dental insurance focuses on preventive care, restorative treatments, and orthodontic services. This guide will delve into the intricacies of individual dental insurance, exploring its benefits, costs, and the various plans available to help you find the right coverage for your needs.

Understanding the Basics of Dental Insurance

What is Dental Insurance?

Dental insurance is a type of health coverage specifically designed to help individuals manage the costs of dental care. It provides financial assistance for a range of dental services, from routine check-ups and cleanings to more complex procedures like root canals and dental implants. By offering a pre-negotiated rate or reimbursement for these services, dental insurance makes dental care more accessible and affordable.

The Importance of Dental Insurance

Having dental insurance is crucial for maintaining good oral health. Regular dental visits and timely treatments can prevent minor issues from becoming major problems, saving individuals from potential pain, discomfort, and expensive procedures down the line. Additionally, dental insurance encourages individuals to prioritize their oral health, leading to better overall well-being and potentially reducing the risk of systemic health issues linked to poor oral hygiene.

How Dental Insurance Works

Dental insurance typically operates on a reimbursement or discount basis. When you visit a dentist, you pay for the services rendered, and then you can submit a claim to your insurance provider. Depending on your plan, you may receive a reimbursement for a portion of the cost or a discounted rate at the dentist’s office, reducing the financial burden of dental care.

Types of Dental Insurance Plans

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, offer the most flexibility in terms of dentist choice. With this type of plan, you can visit any licensed dentist and still receive coverage. The insurance company will reimburse you for a portion of the cost, usually based on a predetermined fee schedule. Indemnity plans often have higher premiums but provide more control over your dental care choices.

Preferred Provider Organization (PPO) Plans

PPO plans offer a balance between flexibility and cost savings. With a PPO plan, you have the freedom to choose any dentist, but you’ll save more by staying within the network of preferred providers. These plans typically have lower out-of-pocket costs and higher annual limits compared to indemnity plans. However, you may face additional fees or reduced coverage if you choose a dentist outside the network.

Dental Health Maintenance Organization (DHMO) Plans

DHMO plans, also known as managed care plans, are designed to provide cost-effective dental care. With this type of plan, you select a primary dentist from a network of providers, and all your dental care is coordinated through this dentist. DHMO plans often have the lowest premiums and copays but may have limited flexibility in dentist choice and a more restricted range of covered services.

Dental Discount Plans

Dental discount plans are not traditional insurance but rather a membership program that offers discounted rates on dental services. With these plans, you pay a monthly or annual fee and receive access to a network of dentists who agree to provide services at a reduced cost. While these plans can save you money, they typically don’t provide coverage for the full range of dental services, and you may still face high out-of-pocket costs for certain procedures.

Key Components of Dental Insurance Plans

Coverage Limits

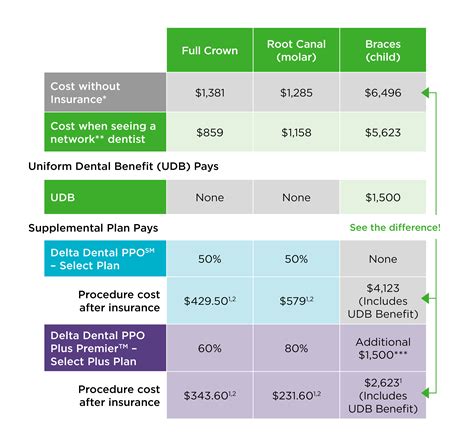

Dental insurance plans often have annual or lifetime maximums, which are the maximum amounts the insurance company will pay out for covered services. It’s essential to understand these limits, as exceeding them can result in significant out-of-pocket expenses. Some plans may also have separate maximums for different types of services, such as preventive care and major restorative work.

Waiting Periods

Many dental insurance plans have waiting periods before certain benefits become effective. This is especially common for major procedures like dental implants or orthodontics. Waiting periods can range from a few months to a year, so it’s crucial to review these details when choosing a plan to ensure you’re not caught off guard by unexpected delays in coverage.

Deductibles and Copays

Deductibles are the amounts you must pay out of pocket before your insurance coverage kicks in. Copays, on the other hand, are the fixed amounts you pay for covered services after meeting your deductible. Understanding these costs is vital, as they can significantly impact your overall dental expenses. Some plans may also have separate deductibles and copays for different types of services.

Choosing the Right Dental Insurance Plan

Assessing Your Needs

When selecting a dental insurance plan, start by evaluating your current dental health and future needs. Consider factors such as your age, existing dental conditions, and whether you have any specific dental treatments in mind. For instance, if you’re considering orthodontics, choose a plan that offers comprehensive orthodontic coverage.

Comparing Plans

Research and compare different dental insurance plans to find the best fit for your needs. Consider factors like premium costs, coverage limits, network providers, and any additional benefits or discounts offered. Online comparison tools and insurance brokers can be valuable resources to help you navigate the options and find the most suitable plan.

Understanding Network Providers

If you’re considering a PPO or DHMO plan, it’s crucial to review the network of providers. Ensure that your preferred dentist is included in the network, and if not, be prepared to either switch dentists or face additional costs. Also, research the reputation and quality of care provided by the network dentists to ensure you receive the best possible treatment.

Reading the Fine Print

Always carefully review the plan details and policy documents before making a decision. Pay attention to any exclusions or limitations, such as pre-existing condition clauses or restrictions on certain procedures. Understanding these nuances can prevent unexpected surprises and help you make an informed choice.

Maximizing Your Dental Insurance Benefits

Preventive Care

One of the most significant advantages of dental insurance is access to preventive care. Regular dental check-ups, cleanings, and X-rays can help detect and prevent oral health issues before they become costly problems. Make sure to take advantage of these covered services to maintain good oral health and potentially save on future dental expenses.

Understanding Coverage Levels

Dental insurance plans typically categorize services into different levels of coverage, often referred to as basic, major, and orthodontic. Basic coverage typically includes preventive services and minor restorative work, while major coverage includes more complex procedures like root canals and crowns. Orthodontic coverage is often a separate category, with its own set of benefits and limitations. Understanding these categories can help you manage your dental care and expenses more effectively.

Using In-Network Providers

If you have a PPO or DHMO plan, using in-network providers can result in significant cost savings. These providers have agreed to offer their services at discounted rates, so you’ll pay less out of pocket. Additionally, in-network providers are more likely to be familiar with your insurance plan’s policies and procedures, making the claims process smoother.

Exploring Additional Benefits

Some dental insurance plans offer additional benefits beyond basic coverage. These can include discounts on vision care, prescription drugs, or even fitness memberships. While these perks may not be the primary reason for choosing a plan, they can add value to your overall healthcare coverage and provide opportunities for further savings.

Conclusion: Empowering Your Dental Health Journey

In the world of individual dental insurance, knowledge is power. By understanding the different types of plans, coverage options, and key components, you can make informed decisions and take control of your oral health. Whether you’re selecting a plan for the first time or reevaluating your current coverage, this guide has provided the tools to navigate the complex landscape of dental insurance with confidence.

Remember, your dental health is an investment in your overall well-being, and with the right insurance plan, you can protect your smile and your wallet. So, take the time to research, compare, and choose wisely, and don’t hesitate to seek guidance from insurance professionals or dental providers if needed. Your journey to optimal oral health starts here.

FAQ:

How much does dental insurance cost for individuals?

+The cost of dental insurance for individuals varies widely depending on factors such as age, location, and the type of plan chosen. On average, monthly premiums for individual dental insurance range from 30 to 50, but this can increase or decrease based on the specific plan and coverage levels.

What is the difference between dental insurance and dental discount plans?

+Dental insurance provides coverage for dental services, with the insurance company reimbursing a portion of the cost or offering discounted rates through network providers. Dental discount plans, on the other hand, are membership programs that offer reduced rates on dental services without providing actual insurance coverage. Discount plans typically have lower monthly fees but may not cover the full range of dental services and may have higher out-of-pocket costs.

Can I use my dental insurance for emergency dental care?

+Most dental insurance plans cover emergency dental care, but it’s important to check the specific details of your plan. Some plans may require prior authorization for emergency treatments, while others may have separate coverage limits or deductibles for urgent care. It’s always a good idea to contact your insurance provider before seeking emergency dental services to understand your coverage and potential out-of-pocket costs.