Online Life Insurance Policy

In today's fast-paced world, where convenience and efficiency are paramount, the insurance industry has undergone a digital transformation, making it easier than ever to secure your future with an online life insurance policy. This innovative approach to protecting your loved ones offers numerous benefits, from the comfort of your home to the flexibility of choosing a plan that suits your unique needs. Let's delve into the world of online life insurance and explore how it can provide peace of mind in an increasingly digital age.

The Rise of Online Life Insurance: A Digital Evolution

The traditional method of acquiring life insurance often involved tedious paperwork, lengthy meetings with agents, and a significant time investment. However, with the advent of technology, the insurance landscape has evolved, introducing a more streamlined and accessible process through online platforms.

Online life insurance policies have gained popularity due to their simplicity and accessibility. Insurers now offer a range of tools and resources on their websites, allowing individuals to compare plans, calculate premiums, and apply for coverage without leaving their homes. This shift towards digital insurance not only saves time but also provides a level of convenience that resonates with the modern consumer.

Moreover, the online application process is designed to be user-friendly, guiding applicants through a series of questions to determine their eligibility and coverage needs. This streamlined approach eliminates the need for extensive medical examinations in many cases, making the process more efficient and less invasive.

The Benefits of Going Digital

Opting for an online life insurance policy brings several advantages to the table, catering to the diverse needs of today’s consumers.

- Convenience and Accessibility: The ability to apply for and manage your policy online eliminates geographical barriers. Whether you're in a remote area or simply prefer the comfort of your home, you can access insurance services with just a few clicks.

- Real-Time Comparison: Online platforms provide a comprehensive overview of various insurance plans, allowing you to compare features, coverage limits, and premiums instantly. This transparency empowers you to make informed decisions about your financial protection.

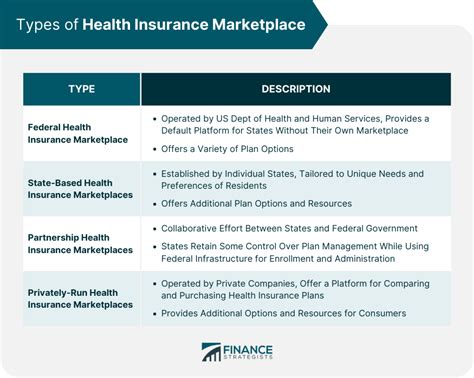

- Customizable Coverage: Online life insurance often offers a range of customizable options. From term life insurance to whole life policies, you can tailor your coverage to match your specific needs, ensuring you're not paying for features you don't require.

- Paperless Process: Say goodbye to piles of paperwork! Online insurance applications are digital, reducing the environmental impact and making the entire process more efficient and organized.

- Instant Quotes: By providing basic information, you can receive instant quotes, giving you a quick understanding of the financial commitment involved. This transparency helps you budget effectively for your insurance needs.

| Policy Type | Coverage Period | Average Premium |

|---|---|---|

| Term Life Insurance | 10-30 years | $20-$50/month |

| Whole Life Insurance | Lifetime | $100-$300/month |

| Universal Life Insurance | Flexible | $50-$200/month |

How Online Life Insurance Works: A Step-by-Step Guide

Securing an online life insurance policy is a straightforward process that can be completed at your own pace. Here’s a simplified breakdown of the steps involved:

Step 1: Research and Comparison

Begin by exploring reputable insurance websites. These platforms provide detailed information about different types of life insurance, including term life, whole life, and universal life insurance. Compare features, coverage limits, and premiums to find the plan that aligns with your financial goals and budget.

Step 2: Application Process

Once you’ve selected a suitable plan, you’ll be guided through an online application. This typically involves providing personal details, such as your name, date of birth, and contact information. You may also be asked about your health history and lifestyle choices, which help the insurer assess your risk profile.

Some online applications may require a simple medical exam or a blood test to confirm your health status. However, many insurers now offer accelerated underwriting, where advanced technology and data analysis are used to evaluate your application, potentially eliminating the need for traditional medical exams.

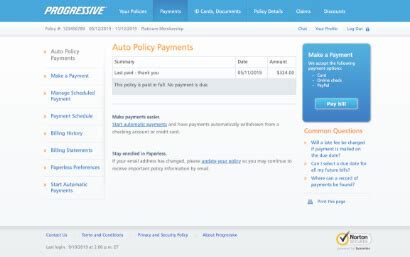

Step 3: Premium Calculation and Payment

Based on the information you provide, the insurer will calculate your premium. This is the amount you’ll pay regularly (usually monthly or annually) to maintain your coverage. Online platforms often provide instant quotes, allowing you to see the estimated cost of your policy upfront.

After reviewing the premium, you can proceed with the payment using secure online methods, such as credit/debit cards or digital wallets. Some insurers also offer flexible payment options, allowing you to spread the cost over several installments.

Step 4: Policy Issuance and Management

Once your application is approved and the premium is paid, you’ll receive your policy documents electronically. These documents outline the terms and conditions of your coverage, including the benefits, exclusions, and any specific conditions.

Online life insurance policies come with digital management tools. You can access your account online to make changes to your policy, update personal information, or even file claims in case of an unfortunate event. These platforms often provide real-time updates, ensuring you stay informed about your coverage status.

The Future of Online Life Insurance: Innovations and Opportunities

The digital transformation of the insurance industry is far from over. As technology continues to advance, we can expect online life insurance to become even more personalized, efficient, and accessible.

Enhanced Personalization

Artificial Intelligence (AI) and machine learning are set to revolutionize the way insurance policies are tailored to individual needs. These technologies can analyze vast amounts of data, including lifestyle choices, health metrics, and even genetic information, to offer highly personalized coverage options. This level of customization ensures that each policyholder receives the most suitable protection for their unique circumstances.

Streamlined Claims Process

Online insurance platforms are already simplifying the claims process, but future innovations promise even greater efficiency. With the integration of blockchain technology, for instance, claims can be verified and processed securely and quickly, reducing the time and paperwork involved. This ensures that beneficiaries receive their payouts promptly during times of need.

Inclusion and Accessibility

The digital nature of online life insurance opens up opportunities for greater financial inclusion. Individuals who may face challenges accessing traditional insurance due to geographical limitations or physical disabilities can now easily connect with insurers online. This inclusivity ensures that more people can secure their financial future and protect their loved ones effectively.

Digital Education and Awareness

Online platforms also provide a valuable space for insurance education. Insurers can utilize these platforms to raise awareness about the importance of life insurance and dispel common misconceptions. By offering educational resources, webinars, and interactive tools, insurers can empower individuals to make informed decisions about their financial protection.

Can I Get Life Insurance If I Have Pre-Existing Health Conditions?

+Absolutely! While pre-existing health conditions may impact the type of coverage and premium you receive, many insurers offer specialized plans for individuals with specific health needs. It's important to be transparent about your health status during the application process to ensure you get the most suitable coverage.

How Do I Choose the Right Coverage Amount for My Life Insurance Policy?

+Determining the right coverage amount involves considering your financial responsibilities, such as outstanding debts, mortgage payments, and the future educational expenses of your children. It's recommended to consult with a financial advisor or use online calculators provided by insurers to estimate the coverage you need to adequately protect your loved ones.

Are Online Life Insurance Policies Legitimate and Secure?

+Yes, reputable online life insurance providers are regulated and adhere to strict industry standards. Ensure that you choose a licensed insurer and verify their credentials before applying. Additionally, secure online payment methods and data encryption protocols protect your personal and financial information throughout the process.

As we navigate the digital age, online life insurance policies offer a convenient and efficient way to secure your financial future. With the power of technology, you can now protect your loved ones with just a few clicks, ensuring peace of mind for years to come.