Which Health Insurance Is Better

Navigating the complex world of health insurance can be daunting, especially when trying to determine which provider offers the best coverage and benefits. With numerous options available, it's essential to delve into the specifics to make an informed decision. This comprehensive guide aims to shed light on some of the leading health insurance providers and help you understand their unique offerings, so you can choose the plan that aligns with your healthcare needs and budget.

Understanding the Key Players in Health Insurance

The health insurance landscape is diverse, with various providers catering to different demographics and healthcare requirements. Let’s explore some of the top players and their distinct features:

Provider 1: A Pioneer in Comprehensive Care

Renowned for its extensive network of healthcare providers, Provider 1 offers a comprehensive range of benefits. Their plans are designed to cater to individuals, families, and businesses, ensuring a personalized approach to healthcare coverage. Key features include:

- A vast in-network provider list, spanning both primary care physicians and specialists, ensuring easy access to healthcare services.

- Flexible plan options tailored to different budgets, allowing individuals to choose the level of coverage they require.

- Comprehensive preventative care coverage, promoting early detection and management of health issues.

- Innovative digital health tools for managing healthcare expenses and accessing medical records conveniently.

- A strong focus on customer service, with dedicated support teams to assist with any queries or concerns.

| Plan Type | Premium Cost | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Basic | $250/month | $2,000 | $4,000 |

| Standard | $320/month | $1,500 | $3,000 |

| Premium | $450/month | $1,000 | $2,500 |

Provider 2: A Leader in Specialized Care

Provider 2 has established itself as a leader in providing specialized healthcare services. Their focus on specific medical conditions and treatments sets them apart, making them an ideal choice for individuals with unique healthcare needs.

- Specialized plans for chronic conditions like diabetes, heart disease, and mental health disorders, offering tailored coverage and support.

- Innovative treatment options not typically covered by other insurers, giving access to cutting-edge medical advancements.

- A dedicated case management team for complex cases, ensuring personalized attention and efficient care coordination.

- Discounts and incentives for wellness activities, encouraging a proactive approach to health management.

| Plan Type | Premium Cost | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Chronic Care | $350/month | $1,800 | $5,000 |

| Specialized Treatment | $500/month | $2,500 | $8,000 |

Provider 3: The Budget-Friendly Option

Provider 3 has gained popularity for its affordable health insurance plans, making healthcare more accessible to a wider range of individuals and families. Their focus on simplicity and value makes them an attractive choice for those on a budget.

- A basic plan with low premiums, ideal for those who rarely require medical attention but want coverage for emergencies.

- Discounted rates for families, making healthcare more affordable for households.

- A user-friendly online platform for managing claims and expenses, ensuring a smooth experience.

- A customer-centric approach, with a focus on providing clear and concise information about coverage and benefits.

| Plan Type | Premium Cost | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Basic | $180/month | $3,000 | $6,000 |

| Standard | $250/month | $2,500 | $5,000 |

Factors to Consider When Choosing Health Insurance

When evaluating health insurance options, it’s crucial to assess your specific needs and circumstances. Here are some key factors to keep in mind:

Healthcare Needs

Consider your current and potential future healthcare requirements. Do you have any pre-existing conditions or chronic illnesses that require specialized care? Are you planning for any major medical procedures or treatments in the near future? Understanding your healthcare needs will help you choose a plan that provides adequate coverage.

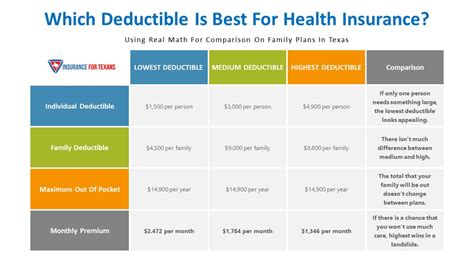

Cost and Budget

Health insurance premiums can vary significantly, and it’s essential to find a plan that fits within your budget. Evaluate the cost of premiums, deductibles, and out-of-pocket maximums to determine the overall affordability of a plan. Keep in mind that a lower premium may not always be the best option, as it could result in higher out-of-pocket costs if you require extensive medical care.

Network of Providers

A robust network of healthcare providers is crucial to ensure easy access to medical services. Research the provider’s network to verify that your preferred doctors and specialists are included. A larger network can provide more options for care, especially if you travel frequently or live in a remote area.

Coverage and Benefits

Different health insurance plans offer varying levels of coverage and benefits. Assess the plan’s coverage for essential services like doctor visits, hospital stays, prescription drugs, and preventative care. Additionally, consider any optional benefits that may be valuable to you, such as dental, vision, or mental health coverage.

Customer Service and Reputation

The quality of customer service can significantly impact your experience with a health insurance provider. Research the provider’s reputation for customer satisfaction, response times, and claim handling. A responsive and supportive customer service team can make a world of difference, especially during times of medical need.

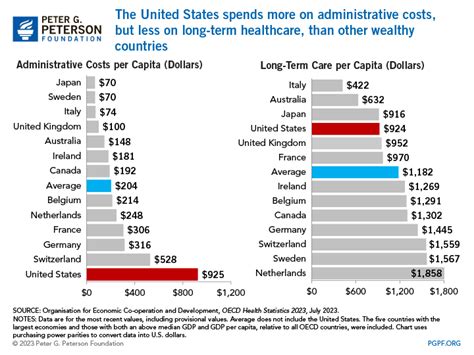

The Future of Health Insurance: Emerging Trends

The health insurance industry is evolving, with new trends and technologies shaping the way healthcare is delivered and accessed. Here’s a glimpse into the future of health insurance:

Telehealth and Digital Health

The rise of telehealth services has revolutionized the way healthcare is delivered, especially during the COVID-19 pandemic. Many insurers are now offering virtual care options, allowing individuals to access medical advice and treatment from the comfort of their homes. This trend is expected to continue, with insurers investing in digital health tools to enhance convenience and accessibility.

Value-Based Care Models

Value-based care models are gaining traction, focusing on the quality and outcomes of healthcare rather than the quantity of services provided. This shift encourages insurers to collaborate with healthcare providers to improve patient health and reduce costs. By rewarding providers for delivering efficient and effective care, these models aim to enhance overall healthcare quality.

Personalized Medicine

Advancements in genetic testing and precision medicine are paving the way for more personalized healthcare approaches. Insurers are increasingly exploring ways to incorporate genetic data into their coverage, offering tailored treatment plans based on an individual’s unique genetic makeup. This trend has the potential to revolutionize healthcare, improving treatment efficacy and patient outcomes.

Preventative Care and Wellness Programs

Insurers are recognizing the importance of preventative care and wellness programs in reducing long-term healthcare costs. Many are now offering incentives and discounts for individuals who engage in healthy lifestyle activities, such as regular exercise, healthy eating, and stress management. By promoting a culture of wellness, insurers aim to reduce the incidence of chronic diseases and improve overall population health.

Conclusion

Choosing the right health insurance provider is a crucial decision that impacts your access to healthcare and financial well-being. By understanding the unique offerings of different providers and considering your specific needs, you can make an informed choice. Remember to evaluate factors like healthcare needs, cost, provider network, coverage, and customer service to find a plan that provides comprehensive and affordable coverage. Stay informed about emerging trends in the industry to ensure you’re always up-to-date with the latest advancements in healthcare.

How do I know if a health insurance provider is reputable and trustworthy?

+

Researching a provider’s reputation is crucial. Look for online reviews, ratings, and customer testimonials to gauge their trustworthiness. Additionally, check if they are accredited by reputable organizations, such as the National Committee for Quality Assurance (NCQA). Government websites and consumer protection agencies can also provide valuable insights into a provider’s track record.

What happens if I have a pre-existing condition? Will I be able to find affordable health insurance?

+

Thanks to the Affordable Care Act, health insurers cannot deny coverage based on pre-existing conditions. However, the cost of your premium may be higher to reflect the additional risk. It’s essential to compare plans and shop around to find the most affordable option for your specific condition. Some states also offer high-risk pools, which can provide coverage at a more reasonable cost.

Can I switch health insurance providers if I’m not satisfied with my current plan?

+

Yes, you have the right to switch health insurance providers if you’re not happy with your current plan. However, it’s important to understand the enrollment periods and potential penalties for switching outside of these periods. Open Enrollment, which typically occurs annually, is the best time to make changes to your health insurance coverage without incurring additional fees.