Best Insurance Rates In Texas

In the vast state of Texas, the quest for the best insurance rates can be a challenging journey. With its diverse landscape and unique regulatory environment, finding the right insurance coverage at an affordable price requires a strategic approach. This article aims to guide you through the intricate world of insurance in Texas, providing an in-depth analysis and practical insights to help you secure the best rates for your needs.

Understanding the Insurance Landscape in Texas

Texas boasts a vibrant insurance market, characterized by a mix of local and national carriers competing for your business. The state’s unique regulations and laws, such as the Texas Insurance Code, significantly influence the pricing and availability of insurance products. Understanding these regulations is crucial to making informed decisions.

Regulatory Environment and Its Impact

Texas maintains a relatively competitive insurance market, allowing carriers to set their own rates within certain guidelines. This regulatory approach has led to varying pricing structures across the state. While it offers flexibility, it also demands a careful comparison of rates and coverage options.

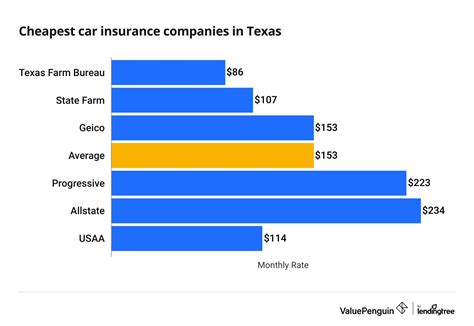

| Insurance Type | Average Premium in Texas |

|---|---|

| Auto Insurance | $1,500 annually |

| Homeowners' Insurance | $2,200 annually |

| Health Insurance (Individual Plan) | $450 monthly |

| Life Insurance (Term) | $300 annually for a healthy individual |

The table above provides a snapshot of average premiums for common insurance types in Texas. However, it's essential to note that these rates can vary significantly based on individual circumstances and the specific carrier.

Factors Influencing Insurance Rates in Texas

Several key factors play a significant role in determining insurance rates in Texas. Understanding these factors can help you tailor your insurance choices to your specific needs and potentially save money.

Demographics and Location

Texas’s diverse population and varying geographical regions can impact insurance rates. For instance, urban areas like Houston or Dallas might have higher auto insurance rates due to factors like increased traffic density and higher crime rates. On the other hand, rural areas might offer more affordable rates for homeowners’ insurance due to lower risk of natural disasters or property crimes.

Risk Assessment and Claims History

Insurance carriers carefully evaluate the risk associated with insuring an individual or property. Your claims history, credit score, and even your occupation can influence the rates you receive. A clean claims history and a good credit score are generally viewed favorably by insurers, potentially leading to lower rates.

Coverage and Deductibles

The level of coverage you choose and your preferred deductibles can significantly affect your insurance premiums. Higher coverage limits and lower deductibles often result in higher premiums. Conversely, opting for lower coverage and higher deductibles can reduce your monthly or annual payments.

Carrier-Specific Factors

Each insurance carrier operates with its own pricing structure and policies. Some carriers might offer discounts for bundling multiple policies, while others might specialize in certain types of insurance, providing more competitive rates for those specific products. Exploring these carrier-specific nuances can lead to significant savings.

Strategies to Secure the Best Insurance Rates in Texas

Navigating the Texas insurance landscape requires a strategic approach. Here are some practical tips to help you find the best rates and coverage options.

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Take the time to compare quotes from multiple carriers. Online insurance marketplaces and brokerages can provide a convenient way to gather multiple quotes quickly. Ensure you’re comparing similar coverage levels and deductibles to get an accurate comparison.

Bundle Your Policies

Many insurance carriers offer discounts when you bundle multiple policies with them. For instance, bundling your auto and homeowners’ insurance policies can result in significant savings. Consider whether you can consolidate your insurance needs with a single carrier to take advantage of these discounts.

Understand Your Coverage Options

Different insurance policies offer varying levels of coverage. It’s crucial to understand the specific terms and conditions of each policy you’re considering. Ensure you’re getting the coverage you need without paying for unnecessary add-ons. Educate yourself about the different types of coverage available and tailor your choices to your unique circumstances.

Improve Your Risk Profile

Insurance carriers assess your risk profile when determining your rates. Taking steps to improve your risk profile can lead to lower premiums. This might involve maintaining a clean driving record, improving your credit score, or even making home improvements to reduce the risk of property damage.

Explore Discounts and Special Programs

Insurance carriers often offer a range of discounts and special programs to attract and retain customers. These can include discounts for safe driving, loyalty rewards, or even discounts for specific occupations or affiliations. Stay informed about these opportunities and take advantage of them where applicable.

The Role of Insurance Agents and Brokers

Insurance agents and brokers can be valuable resources in your quest for the best insurance rates. They possess deep knowledge of the insurance market and can provide personalized advice based on your unique needs.

Independent Insurance Brokers

Independent insurance brokers work with multiple carriers, offering a wide range of insurance products. They can shop around on your behalf, leveraging their relationships with carriers to negotiate the best rates and coverage options. Their expertise can be particularly beneficial if you have complex insurance needs or if you’re looking for specialized coverage.

Captive Insurance Agents

Captive insurance agents represent a single insurance carrier. While they might not offer the same breadth of options as independent brokers, they possess in-depth knowledge of their carrier’s products and can provide tailored advice based on your specific needs. Captive agents can be a good choice if you’re seeking a strong relationship with a single carrier and value the convenience of having all your insurance needs met by one company.

Future Outlook and Emerging Trends

The insurance landscape in Texas is continually evolving, driven by technological advancements and changing consumer preferences. Keeping abreast of these trends can help you make informed decisions about your insurance needs.

Digitalization and Online Insurance Platforms

The rise of digital technology has transformed the insurance industry, making it more convenient and efficient for consumers to shop for insurance. Online insurance platforms and comparison websites have emerged as powerful tools, allowing consumers to quickly gather and compare quotes from multiple carriers. These platforms often provide additional insights and tools to help consumers make informed choices.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and data analytics to monitor driving behavior, is gaining traction in the insurance industry. Usage-based insurance programs offer personalized premiums based on an individual’s actual driving behavior, rather than relying solely on traditional risk factors. These programs can be particularly beneficial for safe drivers, offering the potential for significant savings.

Focus on Preventative Measures

Insurance carriers are increasingly recognizing the value of preventative measures in reducing claims. Many carriers now offer incentives and discounts for customers who take steps to reduce risks, such as installing home security systems or completing defensive driving courses. Embracing these preventative measures can not only enhance your safety but also lead to lower insurance premiums.

Tailored Insurance Solutions

The insurance industry is moving towards more personalized and tailored insurance solutions. Carriers are developing products that cater to specific consumer segments or lifestyles. This trend towards customization can lead to more efficient coverage and potentially lower premiums for consumers.

Conclusion

Securing the best insurance rates in Texas requires a thoughtful and strategic approach. By understanding the unique insurance landscape in the state, exploring your options, and leveraging the expertise of insurance professionals, you can find the right coverage at the most competitive rates. Remember, insurance is a long-term investment, and taking the time to make informed decisions can pay dividends in the form of lower premiums and comprehensive coverage.

How often should I review my insurance policies in Texas?

+It’s recommended to review your insurance policies annually or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for unnecessary premiums.

Can I negotiate my insurance rates in Texas?

+While insurance rates are largely predetermined by carriers, there are opportunities to negotiate. Working with an independent insurance broker can give you more leverage, as they can shop around for the best rates and negotiate on your behalf.

What factors can lead to an increase in my insurance premiums in Texas?

+Several factors can lead to premium increases, including a history of claims, changes in your credit score, or even demographic shifts in your area. Regularly reviewing your policies and staying informed about potential risk factors can help you anticipate and manage these increases.