Commerical Insurance

In the dynamic landscape of business, one of the most critical aspects of risk management is commercial insurance. It serves as a cornerstone for safeguarding businesses against an array of unforeseen events, ranging from property damage to liability claims. As such, it is imperative for businesses to comprehend the nuances of commercial insurance and how it can be tailored to meet their unique needs. This article aims to provide an in-depth exploration of commercial insurance, its various facets, and its significance in the business realm.

Understanding Commercial Insurance

Commercial insurance, also known as business insurance, is a specialized form of risk management designed to protect businesses from potential losses arising from various perils. It is a comprehensive coverage that caters to the diverse needs of different business entities, from sole proprietorships to large corporations. The primary objective of commercial insurance is to provide financial protection and support during times of crisis, allowing businesses to maintain their operations and minimize potential damages.

The scope of commercial insurance is vast and encompasses a multitude of coverage options. It can include property insurance, which safeguards a business's physical assets such as buildings, equipment, and inventory from damage or loss due to events like fire, theft, or natural disasters. Liability insurance, on the other hand, protects businesses from claims arising from accidents or injuries that occur on their premises or as a result of their operations. This type of insurance is particularly crucial for businesses that interact directly with the public.

Additionally, commercial insurance packages often include business interruption insurance, which provides coverage for lost income and ongoing expenses in the event that a business is forced to suspend operations due to a covered peril. Other coverage options might include workers' compensation insurance, which covers medical expenses and lost wages for employees injured on the job, and professional liability insurance, which protects businesses against claims of negligence or errors in their professional services.

Tailoring Commercial Insurance to Business Needs

The beauty of commercial insurance lies in its ability to be customized to the unique requirements of each business. Every business is distinct, with its own set of risks and challenges. Therefore, a one-size-fits-all approach to commercial insurance is often inadequate. Instead, businesses should work closely with insurance professionals to design a policy that aligns with their specific needs and potential risks.

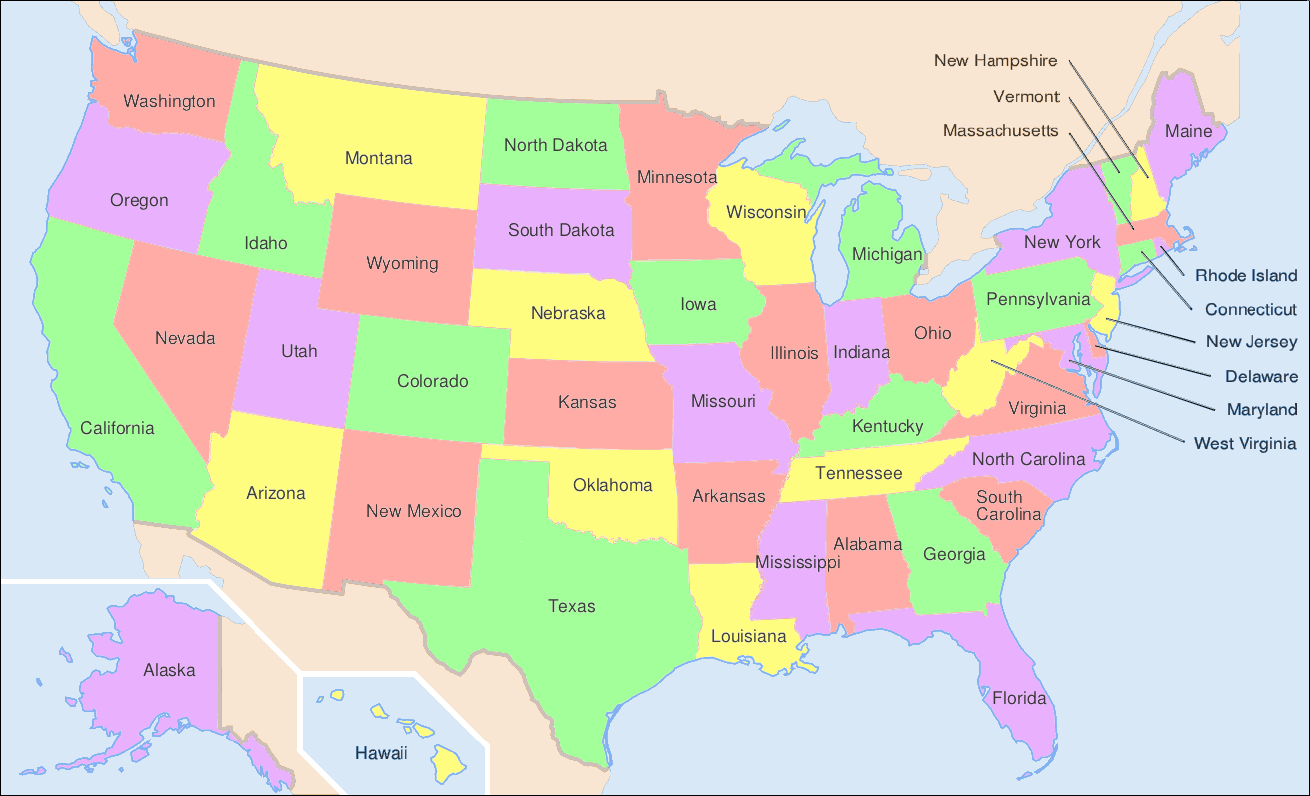

For instance, a business located in an area prone to natural disasters like hurricanes or floods would require different coverage than one situated in a more stable climate. Similarly, a business that relies heavily on specialized equipment or technology might need more robust property insurance to cover potential losses due to equipment malfunction or cyber attacks. By understanding these nuances, businesses can ensure they have the right level of coverage to protect their assets and operations.

Moreover, the size and nature of a business can also influence the type and extent of commercial insurance required. Large corporations with multiple departments and diverse operations may need a more complex insurance package that includes various coverage options. In contrast, smaller businesses might opt for a more streamlined package that focuses on their most significant risks, such as product liability insurance for businesses that manufacture or sell physical goods.

| Commercial Insurance Coverage | Description |

|---|---|

| Property Insurance | Protects physical assets from damage or loss. |

| Liability Insurance | Covers claims arising from accidents or injuries on business premises. |

| Business Interruption Insurance | Provides coverage for lost income and expenses during business suspension. |

| Workers' Compensation Insurance | Covers medical expenses and lost wages for injured employees. |

| Professional Liability Insurance | Protects against claims of negligence or errors in professional services. |

Risk Assessment and Commercial Insurance

A critical aspect of commercial insurance is risk assessment. This process involves a meticulous evaluation of a business’s operations, assets, and potential hazards to identify areas that could expose the business to financial loss. By conducting a thorough risk assessment, businesses can pinpoint their most significant risks and tailor their insurance coverage accordingly.

Risk assessment is not a one-time event but rather an ongoing process. As businesses evolve, so do their risks. New products, services, or operational changes can introduce new potential hazards that may not have been present before. Regular risk assessments allow businesses to stay abreast of these changes and adjust their insurance coverage as necessary.

For instance, a business that launches a new product line might face additional liability risks associated with the product's use or potential defects. By conducting a risk assessment, the business can identify these risks and ensure they have the appropriate liability insurance coverage in place. Similarly, a business that expands its operations to a new location may need to reassess its property insurance coverage to account for the new premises and any potential hazards unique to that location.

The Role of Insurance Brokers in Risk Assessment

Insurance brokers play a pivotal role in the risk assessment process. They are professionals who specialize in evaluating risks and recommending insurance solutions tailored to a business’s needs. By leveraging their expertise and industry knowledge, insurance brokers can provide valuable insights into a business’s potential risks and help design a comprehensive insurance package.

Insurance brokers often conduct on-site visits to understand a business's operations firsthand. They assess the business's physical assets, evaluate its safety measures, and analyze its potential exposure to various risks. Based on this assessment, they can recommend specific insurance coverages and policy limits that provide adequate protection. They may also suggest risk management strategies to help the business mitigate potential losses and reduce its overall risk profile.

For businesses, working with insurance brokers can be highly beneficial. Brokers act as advocates for their clients, negotiating with insurance companies to secure the best coverage at competitive rates. They can also provide ongoing support and guidance, helping businesses understand their policies and ensuring they remain adequately insured as their operations evolve.

Commercial Insurance and the Claims Process

When a business faces a covered loss, the claims process is critical to its financial recovery. Commercial insurance policies outline the steps a business must take to initiate and manage a claim. While the specifics may vary depending on the type of insurance and the circumstances of the loss, the general process involves reporting the claim, providing supporting documentation, and collaborating with the insurance company to reach a settlement.

Reporting a claim is typically the first step. This involves promptly notifying the insurance company about the loss and providing a detailed account of what happened. It is essential to be as accurate and thorough as possible during this stage, as it sets the foundation for the claim's processing. The insurance company will then assign a claims adjuster to investigate the incident and determine the extent of the loss.

The claims adjuster plays a crucial role in the process. They will review the policy, assess the damage or loss, and determine whether the claim is covered under the terms of the policy. They may request additional information or documentation to support the claim, such as police reports, repair estimates, or photographs of the damage. It is important for businesses to cooperate fully with the adjuster and provide all the necessary information to facilitate a smooth and timely claims process.

Once the claim is approved, the insurance company will provide a settlement, which may be in the form of a lump-sum payment or ongoing support to help the business recover. The settlement amount is typically based on the policy limits and the extent of the loss. In some cases, the insurance company may also provide resources or assistance to help the business mitigate further damages or prevent similar losses in the future.

Tips for a Smooth Claims Process

To ensure a smooth and efficient claims process, businesses should take certain steps. Firstly, it is crucial to have a clear understanding of the policy terms and conditions, including any exclusions or limitations. This knowledge will help businesses identify potential coverage gaps and take appropriate steps to address them.

Secondly, businesses should maintain thorough and accurate records. This includes documentation of assets, maintenance records, and any safety measures in place. Having these records readily available can expedite the claims process and provide a clear picture of the business's operations and potential risks.

Additionally, businesses should establish a systematic approach to reporting and managing claims. This could involve designating a specific person or department to handle claims and ensuring they are well-versed in the process. Regular training and updates on the claims process can help ensure that claims are handled promptly and efficiently.

Finally, businesses should foster open communication with their insurance providers. Building a positive relationship with the insurance company can facilitate a smoother claims process. Regular check-ins and updates can help keep the insurance company informed about the business's operations and any potential changes that may impact its risk profile.

Future Trends in Commercial Insurance

The landscape of commercial insurance is continually evolving, driven by technological advancements, changing business models, and evolving regulatory environments. As such, it is essential for businesses and insurance professionals to stay abreast of these trends to ensure they remain adequately protected and prepared for the future.

The Impact of Technology on Commercial Insurance

Technology is transforming the insurance industry, and its impact is particularly evident in commercial insurance. The rise of digital platforms and data analytics is revolutionizing the way insurance is sold, underwritten, and managed. Insurance companies are leveraging technology to enhance their risk assessment capabilities, streamline the claims process, and provide more personalized coverage options.

For instance, the use of data analytics allows insurance companies to gather and analyze vast amounts of data to identify patterns and trends in risk exposure. This enables them to offer more accurate and tailored insurance solutions. Additionally, digital platforms and mobile apps are making it easier for businesses to manage their insurance policies, file claims, and access real-time information about their coverage.

Furthermore, the integration of technology into insurance operations is fostering the development of new coverage options. Insurtech, a term used to describe the intersection of insurance and technology, is driving innovation in the industry. Examples include parametric insurance, which provides coverage based on the occurrence of specific events or triggers, and cyber insurance, which protects businesses from the growing threat of cyber attacks and data breaches.

The Role of Sustainability and Environmental Risks

Sustainability and environmental concerns are increasingly influencing the commercial insurance landscape. As businesses strive to reduce their environmental impact and adopt more sustainable practices, insurance companies are responding by offering coverage options that align with these efforts.

Insurance companies are developing products that address environmental risks, such as coverage for climate change-related events or policies that incentivize businesses to adopt sustainable practices. This not only helps businesses manage their environmental risks but also aligns with their sustainability goals and enhances their reputation as responsible corporate citizens.

Moreover, the growing focus on sustainability is prompting insurance companies to adopt more sustainable practices themselves. This includes integrating environmental, social, and governance (ESG) considerations into their investment strategies and business operations. By doing so, insurance companies are not only contributing to a more sustainable future but also demonstrating their commitment to responsible business practices.

The Importance of Cyber Security and Data Privacy

In today’s digital age, cyber security and data privacy have emerged as critical concerns for businesses of all sizes. The increasing reliance on technology and the growing volume of sensitive data stored digitally have made businesses more vulnerable to cyber attacks and data breaches.

As a result, cyber insurance has become an essential component of commercial insurance packages. This type of insurance provides coverage for losses resulting from cyber attacks, data breaches, and other digital threats. It can help businesses mitigate the financial impact of these incidents and provide resources to enhance their cyber security measures.

Furthermore, the rising importance of cyber security and data privacy is prompting insurance companies to collaborate more closely with businesses to understand their unique cyber risks. This collaborative approach allows insurance companies to offer more tailored coverage options and provide valuable insights and resources to help businesses strengthen their cyber security defenses.

Conclusion

Commercial insurance is a vital tool for businesses to manage their risks and protect their operations. By understanding the various coverage options, conducting thorough risk assessments, and working closely with insurance professionals, businesses can tailor their insurance policies to meet their unique needs. The claims process is a critical aspect of commercial insurance, and by staying informed and prepared, businesses can navigate it effectively.

As the business landscape continues to evolve, so too does the world of commercial insurance. Technology, sustainability, and cyber security are driving significant changes in the industry, and businesses must stay abreast of these trends to ensure they remain adequately protected. By embracing these changes and working with trusted insurance providers, businesses can mitigate risks and thrive in an increasingly complex and dynamic environment.

What is the average cost of commercial insurance for small businesses?

+

The cost of commercial insurance for small businesses can vary significantly depending on several factors, including the type of business, its location, the level of coverage required, and the insurer. On average, small businesses can expect to pay anywhere from a few hundred dollars to several thousand dollars per year for their commercial insurance policies. It’s essential to shop around and compare quotes from multiple insurers to find the best coverage at a competitive price.

How often should I review my commercial insurance policy?

+

It’s recommended to review your commercial insurance policy at least once a year, or whenever there are significant changes to your business operations, such as expanding to a new location, adding new products or services, or hiring additional employees. Regular policy reviews ensure that your coverage remains up-to-date and aligned with your business’s evolving needs.

What happens if I don’t have enough commercial insurance coverage when a loss occurs?

+

If you experience a covered loss and your commercial insurance coverage is insufficient, you may be left with significant out-of-pocket expenses. It’s crucial to regularly assess your coverage limits and ensure they adequately protect your business assets and operations. Working with an insurance professional can help you determine the appropriate coverage levels for your specific needs.