Auto Insurance Deductible

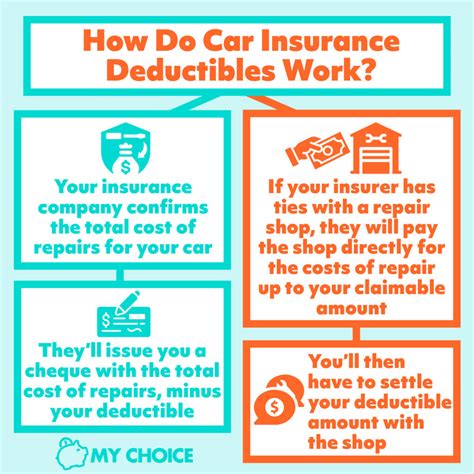

In the realm of auto insurance, understanding the concept of deductibles is crucial for any vehicle owner. A deductible is an agreed-upon amount that you, the policyholder, are responsible for paying out of pocket when filing a claim. It acts as a financial barrier, discouraging small claims and encouraging responsible driving practices. The auto insurance deductible you choose can significantly impact your premium and coverage, so it's essential to make an informed decision.

The Role of Deductibles in Auto Insurance

Deductibles serve as a risk-sharing mechanism between the insurance company and the policyholder. By agreeing to a higher deductible, you accept more financial responsibility in the event of a claim, which can result in lower premiums. Conversely, a lower deductible means you pay less out of pocket when filing a claim but may lead to higher insurance costs.

The choice of deductible depends on various factors, including your financial situation, driving history, and the value of your vehicle. It's a delicate balance, as a deductible that's too high could strain your finances in the event of an accident, while a low deductible might lead to higher overall insurance costs.

Types of Auto Insurance Deductibles

There are primarily two types of deductibles in auto insurance: compulsory and voluntary.

Compulsory Deductibles

Also known as mandatory deductibles, these are standard amounts set by insurance companies and are applicable to all policyholders. Compulsory deductibles are typically lower, ranging from $250 to $500, and are designed to cover minor accidents or claims. They are non-negotiable and are a standard part of most auto insurance policies.

Voluntary Deductibles

These are chosen by the policyholder and can be higher or lower than the compulsory deductible. Voluntary deductibles offer more flexibility, allowing you to customize your insurance coverage to fit your financial needs and risk tolerance. A higher voluntary deductible can lead to significant savings on your premium, while a lower one provides more financial protection in the event of a claim.

When selecting a voluntary deductible, it's essential to consider your driving habits and the potential financial impact of an accident. For instance, if you drive in an area with high accident rates or have a history of claims, a lower deductible might be more suitable. Conversely, if you have a clean driving record and want to save on premiums, a higher deductible could be a wise choice.

Factors Affecting Deductible Choice

Several factors influence the decision of choosing the right deductible for your auto insurance policy.

Financial Considerations

Your financial situation plays a pivotal role in determining the appropriate deductible. If you have sufficient savings or an emergency fund, you might consider a higher deductible to take advantage of lower premiums. However, if your financial resources are limited, a lower deductible might provide more peace of mind, as you won't have to worry about a large out-of-pocket expense in the event of an accident.

Vehicle Value and Age

The value and age of your vehicle are critical factors. If you drive an older vehicle with low market value, a higher deductible might be more suitable, as the potential claim amount is likely to be lower. Conversely, for a new or high-value vehicle, a lower deductible might be preferable to minimize the financial impact of repairs or replacements.

Driving Habits and Risk Assessment

Your driving habits and the level of risk you're comfortable with are significant considerations. If you drive frequently in high-risk areas or have a history of accidents or claims, a lower deductible could provide more financial protection. On the other hand, if you have a clean driving record and are confident in your driving skills, a higher deductible might be a strategic choice to save on insurance costs.

Impact of Deductible on Premium and Coverage

The deductible you choose has a direct impact on your auto insurance premium and coverage.

Premium Calculation

Insurance companies use various factors, including your deductible amount, to calculate your premium. Generally, a higher deductible leads to a lower premium, as you're accepting more financial responsibility in the event of a claim. Conversely, a lower deductible often results in a higher premium, as the insurance company assumes more financial risk.

Coverage and Claims Process

The deductible also affects your coverage and the claims process. When you file a claim, you'll first pay the agreed-upon deductible amount, and the insurance company will cover the remaining costs, up to your policy limits. It's important to note that if your claim amount is less than your deductible, you'll be responsible for the entire cost, and the insurance company won't provide any coverage.

For instance, if your vehicle sustains $1,500 in damages and your deductible is $1,000, you'll pay the full amount, and the insurance company won't be involved. However, if the damages exceed your deductible, you'll pay the deductible, and the insurance company will cover the remaining amount.

Tips for Choosing the Right Deductible

Selecting the appropriate deductible involves careful consideration of your financial situation, driving habits, and risk tolerance. Here are some tips to help you make an informed decision:

- Evaluate Your Financial Situation: Assess your savings and emergency funds. If you have sufficient financial resources, a higher deductible might be suitable. However, if your finances are tight, a lower deductible could provide more security.

- Consider Your Driving Habits: Think about your daily commute, the areas you drive in, and your driving record. If you're a safe driver with minimal accident risk, a higher deductible could be beneficial. Conversely, if you frequently drive in high-risk areas or have a history of accidents, a lower deductible might be preferable.

- Analyze Your Vehicle's Value: The value and age of your vehicle are crucial factors. For older vehicles with low market value, a higher deductible might make sense. For newer or high-value vehicles, a lower deductible could provide more financial protection.

- Shop Around and Compare: Different insurance companies may offer varying deductible options and premium rates. Compare quotes from multiple insurers to find the best combination of deductible and premium that suits your needs.

- Consider a High-Low Approach: Some policyholders choose a high deductible for comprehensive and collision coverage to save on premiums but opt for a lower deductible for liability coverage to ensure they're adequately protected in the event of an accident.

Common Misconceptions about Auto Insurance Deductibles

There are several misconceptions surrounding auto insurance deductibles that can lead to confusion and incorrect assumptions.

Misconception: A Higher Deductible Always Saves Money

While it's true that a higher deductible often results in lower premiums, this isn't always the case. The savings from a higher deductible might not always offset the financial risk you take on. It's essential to carefully calculate and consider your potential out-of-pocket expenses before choosing a higher deductible.

Misconception: Lower Deductibles Are Always Better

Choosing a lower deductible might provide more financial protection, but it also comes with a higher premium. Over time, the increased premium costs might outweigh the benefits of a lower deductible, especially if you don't file many claims.

Misconception: Deductibles Apply to All Types of Claims

This is not true. Deductibles typically apply to comprehensive and collision coverage, which cover damages to your vehicle. They don't usually apply to liability coverage, which protects you against claims made by others for bodily injury or property damage caused by your vehicle.

Real-Life Scenarios and Examples

Let's look at some real-life scenarios to better understand the impact of deductible choices.

Scenario 1: Safe Driver with Older Vehicle

John, a safe driver with an older vehicle, decides to choose a high deductible of $1,000. He reasons that his vehicle has a low market value, and he has sufficient savings to cover any potential out-of-pocket expenses. With the high deductible, John saves significantly on his annual premium, which allows him to allocate more funds towards other financial goals.

Scenario 2: Frequent Commuter with New Vehicle

Emily, who commutes daily in a busy urban area, chooses a lower deductible of $500. She understands the higher risk of accidents in her commute and wants to minimize her financial exposure. While her premium is slightly higher, she feels more secure knowing she won't have to pay a large amount out of pocket in the event of an accident.

Scenario 3: Young Driver with Limited Funds

Michael, a young driver with limited savings, opts for a moderate deductible of $750. He strikes a balance between saving on his premium and maintaining a manageable out-of-pocket expense in the event of an accident. This choice allows him to save some money on his insurance while still ensuring he can afford any necessary repairs.

Frequently Asked Questions (FAQ)

How does a deductible affect my insurance premium?

+A higher deductible often leads to a lower insurance premium, as you're accepting more financial responsibility. Conversely, a lower deductible can result in a higher premium, as the insurance company assumes more risk.

Are there any situations where I don't have to pay the deductible?

+Yes, deductibles typically don't apply to liability coverage, which covers claims made by others for bodily injury or property damage caused by your vehicle. In such cases, you won't be responsible for paying a deductible.

Can I change my deductible after purchasing my insurance policy?

+In most cases, yes. You can often adjust your deductible by contacting your insurance provider and requesting a change. However, it's important to note that changing your deductible may impact your premium, either increasing or decreasing it depending on the new deductible amount.

What happens if my claim amount is less than my deductible?

+If your claim amount is less than your deductible, you'll be responsible for the entire cost, and your insurance company won't provide any coverage. It's important to consider this when choosing your deductible to ensure you're comfortable with the potential out-of-pocket expense.

Understanding the role of deductibles in auto insurance is crucial for making informed decisions about your coverage. By carefully considering your financial situation, driving habits, and risk tolerance, you can choose a deductible that provides the right balance of financial protection and cost-effectiveness for your needs.