State Farm Car Insurance Number

Welcome to a comprehensive guide on State Farm, one of the leading insurance providers in the United States. This article will delve into the world of State Farm car insurance, exploring its features, benefits, and the unique policies it offers to drivers across the nation. With a focus on delivering expert insights and real-world examples, we aim to provide an in-depth analysis that goes beyond the surface, ensuring you have all the information you need to make informed decisions about your automotive insurance.

The State Farm Advantage: A Trusted Name in Insurance

State Farm has built a reputation as a reliable and trusted insurance provider, offering a comprehensive range of services that cater to the diverse needs of its customers. When it comes to car insurance, State Farm stands out for its commitment to providing personalized coverage options, competitive pricing, and exceptional customer service.

One of the key advantages of choosing State Farm is its extensive network of local agents. Unlike many online-only insurance providers, State Farm understands the importance of face-to-face interactions. With a vast network of knowledgeable agents, State Farm ensures that customers receive personalized guidance and support throughout the insurance process.

Personalized Coverage Options

State Farm understands that every driver’s needs are unique. That’s why they offer a wide array of coverage options to tailor policies to individual requirements. Whether you’re looking for basic liability coverage, comprehensive collision protection, or specialized add-ons like rental car reimbursement or roadside assistance, State Farm has you covered.

For example, imagine you're a young driver just starting your automotive journey. State Farm's policies can provide comprehensive coverage for your vehicle, including collision and comprehensive protection, as well as additional benefits like accident forgiveness or discounts for good driving habits. On the other hand, if you're a seasoned driver with a spotless record, State Farm can offer competitive rates and customized policies that reward your safe driving history.

Competitive Pricing and Discounts

State Farm is known for its competitive pricing, ensuring that drivers receive excellent value for their insurance dollars. They offer a range of discounts to make insurance more affordable, including multi-policy discounts (for bundling car and home insurance), good student discounts, and safe driver discounts. Additionally, State Farm often runs promotional offers, providing further savings opportunities for new customers.

Let's take a look at some real-world examples of State Farm's pricing advantages. For instance, a married couple with two vehicles and a clean driving record might benefit from a multi-policy discount, resulting in significant savings on their annual insurance premiums. Similarly, a young adult who maintains a good academic record and opts for State Farm's good student discount could see a noticeable reduction in their insurance costs.

Exceptional Customer Service

State Farm prides itself on delivering exceptional customer service. With a dedicated team of agents and support staff, they ensure that customers receive prompt and personalized assistance whenever needed. Whether it’s answering policy questions, providing guidance during claims, or offering assistance in emergency situations, State Farm’s customer service representatives are there to help.

Consider the scenario of a driver involved in an accident. State Farm's customer service team steps in to guide the policyholder through the claims process, ensuring a smooth and stress-free experience. From coordinating repairs to providing rental car assistance, State Farm's agents work diligently to minimize the impact of the accident on the customer's daily life.

State Farm’s Car Insurance Policies: A Deep Dive

State Farm offers a comprehensive suite of car insurance policies, each designed to meet specific needs. Let’s explore some of the key policies and their features in more detail.

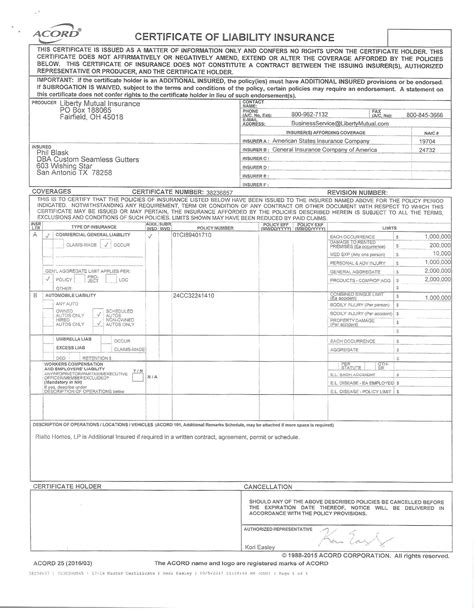

Liability Coverage

Liability coverage is a fundamental aspect of any car insurance policy. State Farm offers robust liability coverage to protect policyholders from financial losses arising from accidents they cause. This coverage includes both bodily injury liability and property damage liability, ensuring that you’re protected in the event of an at-fault accident.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties in an accident you cause. |

| Property Damage Liability | Pays for repairs or replacements of other people's property damaged in an accident you cause. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are essential for protecting your vehicle against a wide range of risks. State Farm’s policies offer comprehensive protection, covering damages resulting from collisions with other vehicles, as well as damages caused by non-collision events such as vandalism, theft, natural disasters, and animal collisions.

Uninsured/Underinsured Motorist Coverage

Driving on the roads can be unpredictable, and unfortunately, not all drivers carry adequate insurance. State Farm’s uninsured/underinsured motorist coverage steps in to protect you in such situations. This coverage provides financial protection if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Medical Payments Coverage

In the event of an accident, medical expenses can quickly mount. State Farm’s medical payments coverage, often referred to as “MedPay,” helps cover these costs. This coverage provides payment for medical expenses resulting from an accident, regardless of who was at fault. It can cover a wide range of medical services, including hospital stays, doctor visits, and even funeral expenses.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is another crucial aspect of State Farm’s car insurance policies. PIP coverage provides broader medical coverage than MedPay, including not only medical expenses but also lost wages and other related expenses. It ensures that policyholders receive the financial support they need to recover from injuries sustained in an accident.

The State Farm Difference: Going Beyond Insurance

State Farm doesn’t just provide insurance; they aim to be a trusted partner in their customers’ lives. Here are some unique features and services that set State Farm apart from other insurance providers.

Accident Forgiveness

State Farm understands that accidents happen, and they don’t believe in punishing policyholders for a single mistake. Their accident forgiveness program ensures that your rates won’t increase after your first at-fault accident, providing peace of mind and protection against unexpected rate hikes.

Roadside Assistance

State Farm offers roadside assistance as an add-on to their car insurance policies. This service provides 24⁄7 support for a wide range of roadside emergencies, including towing, battery jump-starts, flat tire changes, and even fuel delivery. With State Farm’s roadside assistance, you can rest assured that help is just a phone call away.

Usage-Based Insurance (UBI) Programs

State Farm is at the forefront of innovative insurance solutions, offering Usage-Based Insurance programs that reward safe driving habits. With UBI, policyholders can earn discounts by demonstrating responsible driving behaviors. State Farm’s programs, such as Drive Safe & Save and MileageWise, use telematics technology to track driving behavior and provide personalized feedback and incentives.

Digital Tools and Resources

State Farm recognizes the importance of technology in today’s world and has invested heavily in developing digital tools to enhance the customer experience. Their mobile app, for instance, provides policyholders with easy access to their insurance information, allows for quick claims reporting, and offers a range of useful features like digital ID cards and accident checklists.

Performance Analysis: State Farm’s Track Record

State Farm’s commitment to providing exceptional insurance services is backed by a strong track record of performance and customer satisfaction. Here’s a closer look at some key performance indicators.

Financial Strength and Stability

State Farm is one of the largest insurance providers in the United States, with a long history of financial stability and strength. Their solid financial position ensures that policyholders can rely on State Farm to be there when they need them most, providing the financial backing to honor their insurance commitments.

| Financial Rating | Rating Agency |

|---|---|

| A++ (Superior) | A.M. Best |

| AA (Very Strong) | Standard & Poor's |

Customer Satisfaction and Claims Handling

State Farm consistently ranks highly in customer satisfaction surveys, earning praise for its efficient and fair claims handling processes. Their dedicated claims teams work tirelessly to ensure that policyholders receive prompt and fair settlements, minimizing the stress and hassle associated with filing claims.

Community Involvement and Social Responsibility

Beyond its insurance services, State Farm is committed to making a positive impact in the communities it serves. The company actively supports various charitable initiatives and causes, demonstrating its social responsibility and dedication to making a difference.

The Future of State Farm Car Insurance

As the insurance landscape continues to evolve, State Farm remains at the forefront, embracing innovation and technology to enhance its services. Here’s a glimpse into the future of State Farm car insurance.

Continued Innovation and Digital Transformation

State Farm is committed to staying ahead of the curve, continuously investing in technology and digital solutions to improve the customer experience. Expect to see further enhancements to their digital platforms, providing even more convenient and efficient ways to manage insurance policies and interact with State Farm.

Expanding Coverage Options

State Farm understands the changing needs of its customers and is dedicated to expanding its coverage options to meet these evolving demands. Whether it’s offering more specialized add-ons, providing coverage for emerging technologies like autonomous vehicles, or developing new products to address unique risks, State Farm is poised to adapt and grow alongside its customers.

Enhanced Data Analytics and Personalization

Data analytics plays a crucial role in the insurance industry, and State Farm is leveraging this technology to provide even more personalized and tailored coverage. By analyzing customer data and driving behaviors, State Farm can offer more accurate pricing and customized policies that reflect individual risk profiles.

Conclusion: Choosing State Farm for Your Car Insurance Needs

In a competitive insurance market, State Farm stands out as a trusted and reliable provider. With its comprehensive range of car insurance policies, competitive pricing, exceptional customer service, and unique features like accident forgiveness and Usage-Based Insurance programs, State Farm offers a compelling package for drivers seeking peace of mind and financial protection.

As you consider your car insurance options, remember that State Farm is more than just an insurance company; it's a partner in your automotive journey. With a commitment to innovation, customer satisfaction, and community involvement, State Farm is well-positioned to meet your insurance needs, both now and in the future.

What is the State Farm Car Insurance Number for Customer Service?

+

The State Farm Car Insurance customer service number is 1-800-STATE-FARM (1-800-782-8332). This number provides 24⁄7 assistance for policyholders and prospective customers, offering guidance, answering questions, and providing support for various insurance needs.

Does State Farm Offer Discounts for Multiple Policies?

+

Yes, State Farm offers significant discounts for customers who bundle multiple policies, such as auto and home insurance. This multi-policy discount can result in substantial savings on your overall insurance premiums, making State Farm an attractive choice for those seeking comprehensive coverage.

How Does State Farm’s Usage-Based Insurance (UBI) Program Work?

+

State Farm’s UBI programs, such as Drive Safe & Save and MileageWise, use telematics technology to track driving behavior. Policyholders can earn discounts by demonstrating safe driving habits, with the programs providing personalized feedback and incentives to encourage responsible driving.